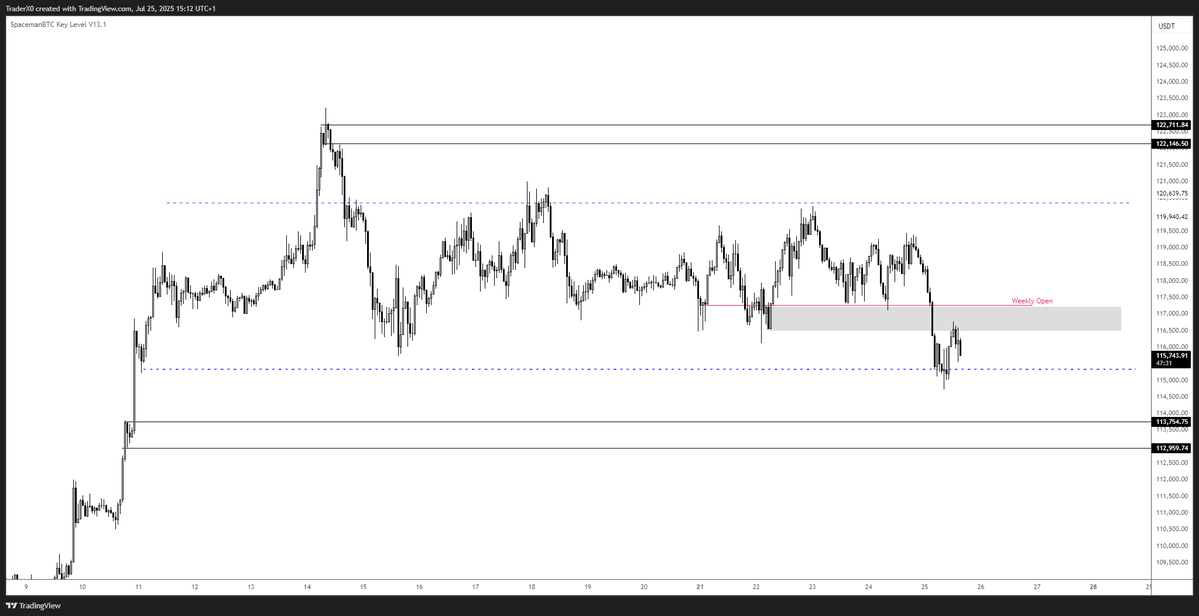

High 116s is indeed the first trouble area.

$BTC

1 week later

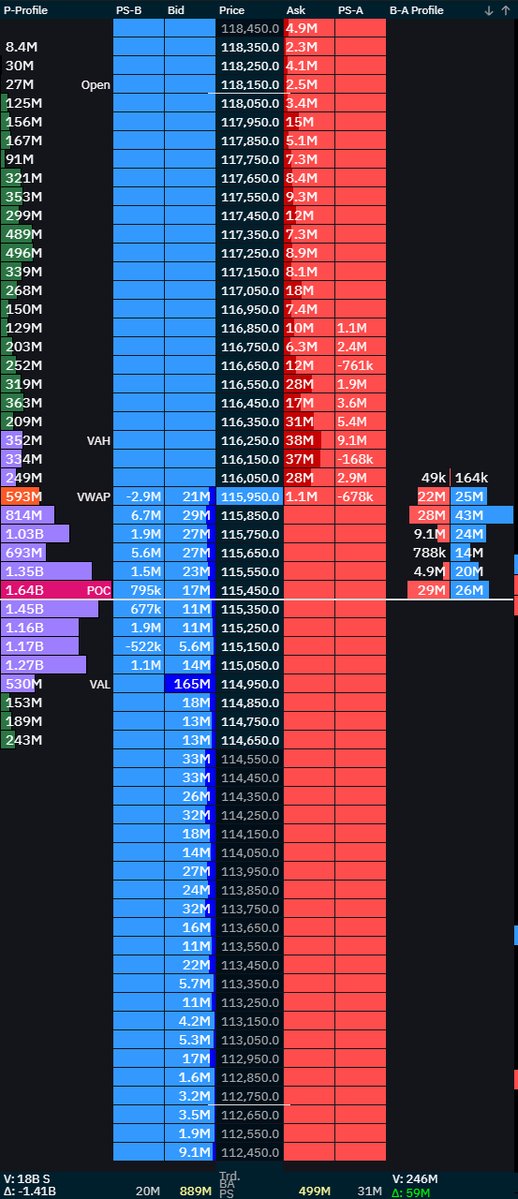

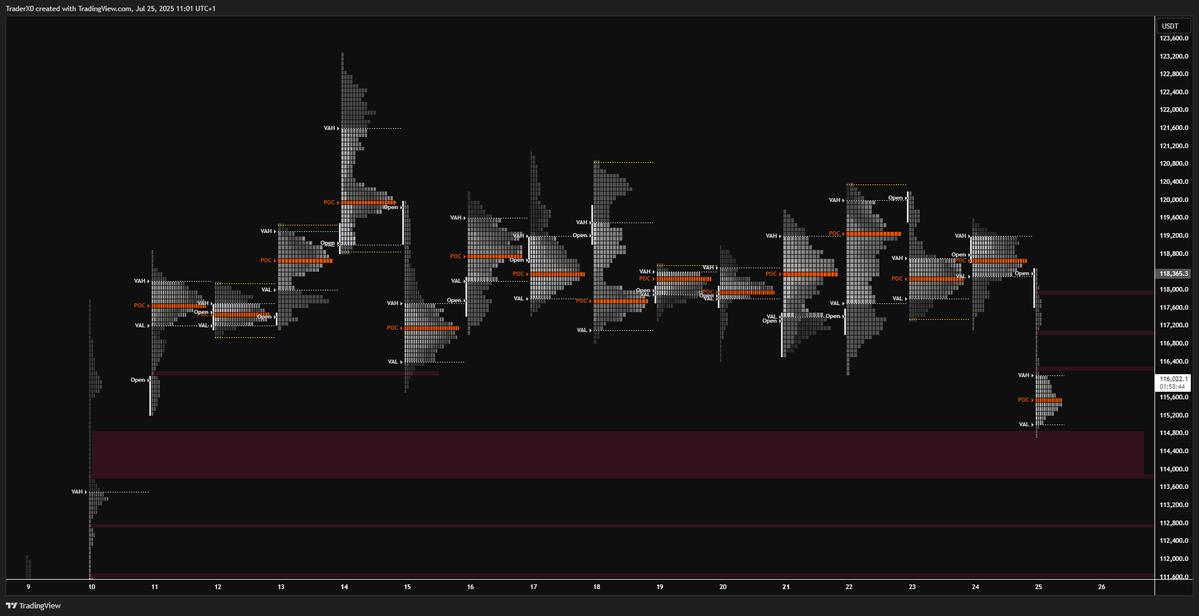

Price trading into the level where I'd want to see any aggressive sellers getting absorbed either on the tape or through resting bids holding firm to consider longs from acceptance back inside the range. Price has also traded the 115 lows from July 11th into the single prints.

If buyers can drive and hold price above 117s, that would be an encouraging sign for longs, targeting upper side of this local composite at around 120s and potentially higher.

On the flip side, failure to sustain above high 116s, especially if heavy sell side delta imbalances continue hitting the bid then that opens up the path back toward 112s, confluent with previous ATH's - essentially a breakout out of the comp followed by initiative selling.

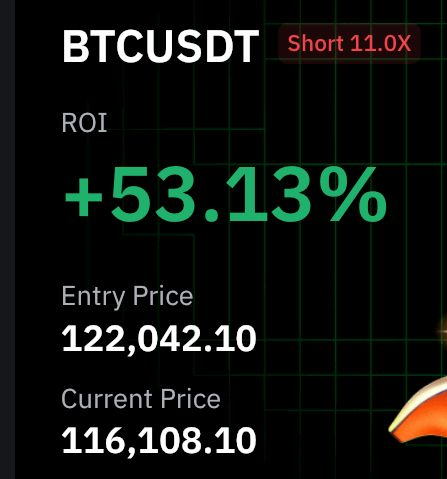

Currently positioned short from 122s looking for reasons to attempt a long upon acceptance or lower down - staying fluid is key.

Wishing you all a fab day ahead.

64.44K

343

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.