Long-term holders are making large-scale transfers of Bitcoin, which may slow down the upward trend but not end it.

Analyst @AxelAdlerJr from @cryptoquant_com stated:

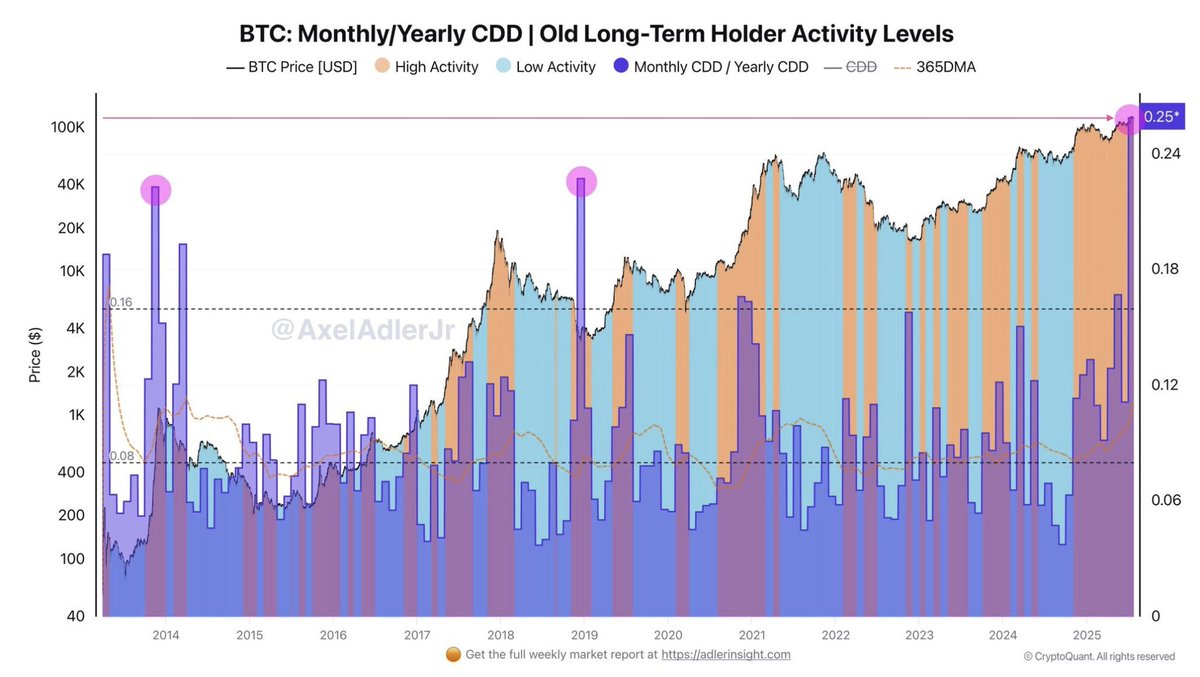

Currently, the market is experiencing an unusually high monthly Coin Days Destroyed (CDD) and annual CDD ratio (0.25) when Bitcoin prices are in the range of $106,000 to $118,000. This value is close to the historical highs of 2014 and the levels during the 2019 correction.

This indicates that long-term holders—investors who have not moved their Bitcoin for many years—are making large-scale transfers to the market. Such a surge in CDD typically means that experienced players are actively distributing their chips. Meanwhile, institutional demand for funds and inflows into Bitcoin ETFs remain high, so this round of chip distribution is unlikely to end the current upward trend, at most it will slightly slow down its pace.

Show original

920

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.