1/ @Pear_Protocol, a market-neutral, relative-value trading platform, has strategically pivoted to integrate with HyperCore.

We break down its recent funding round, potential tokenomics shift, volumes, and valuations:

2/ Originally launched on GMX and Symmio, Pear Protocol offers streamlined single-click long-short pair trading with up to 60x leverage.

Unlike isolated margin (individual liquidation risk) or cross-margin (single liquidation threshold), Pear's Cross-Leg Engine optimizes collateral and mitigates risks through correlation analysis of paired assets.

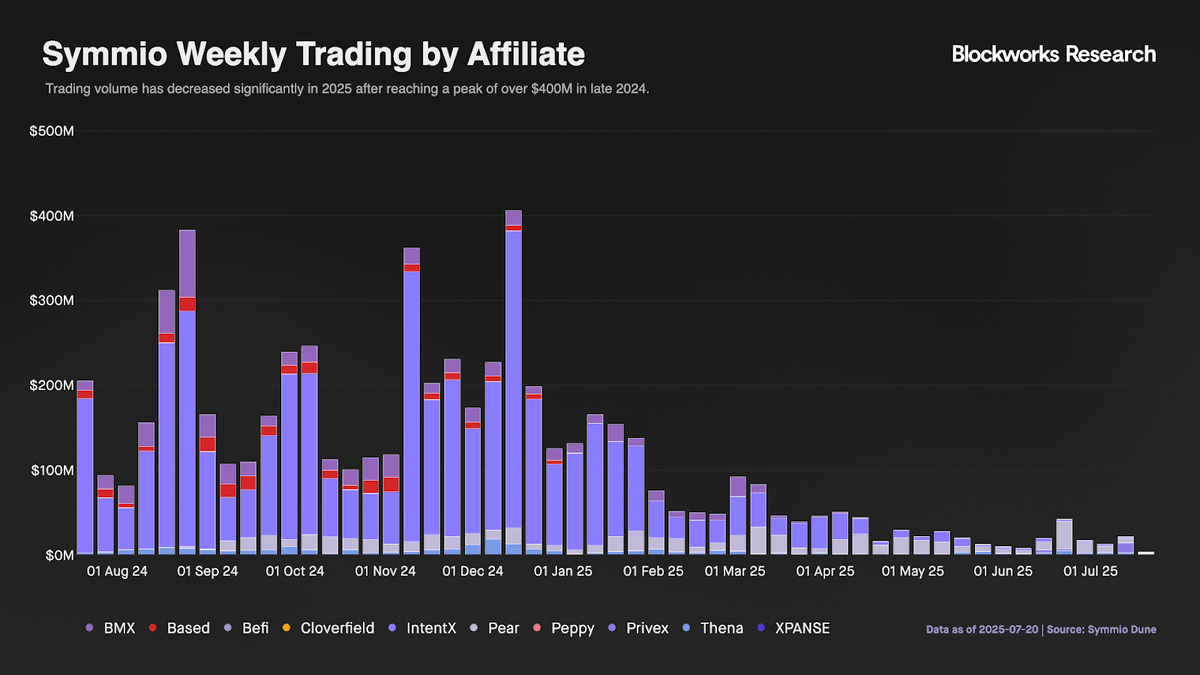

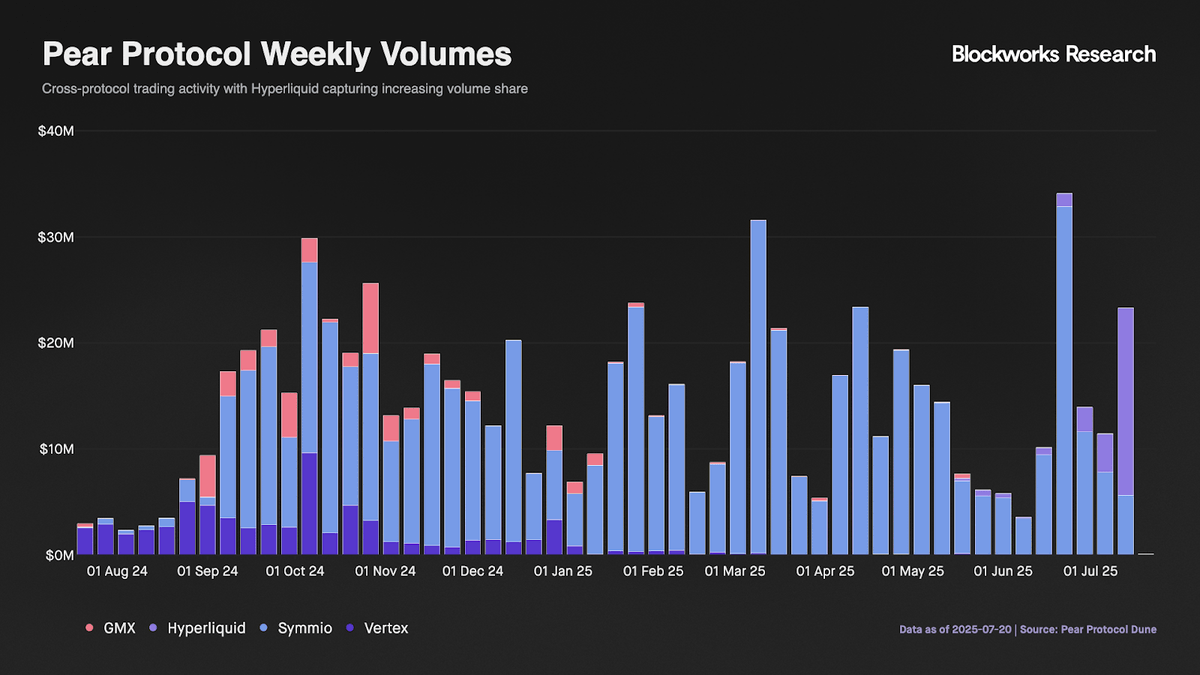

3/ Pear faced challenges from declining volumes on key underlying platforms: Symmio dropped from $1B to under $100M monthly, and Vertex ceased operations entirely.

Despite these headwinds, Pear maintained consistent weekly volumes exceeding $10M in 77% of weeks since September 2024, demonstrating clear resilience.

4/ Pear’s shift to Hyperliquid leverages the platform’s 80% share of decentralized perpetual trading volumes.

Pear's integration into Hypercore, still in closed beta, has already generated $12.8M weekly volume, suggesting strong latent demand.

Hyperliquid’s HIP-3 introduces 280+ markets annually but lacks customizable collateral options, uniquely positioning Pear as a provider of flexible cross-collateral pair trading for these new markets.

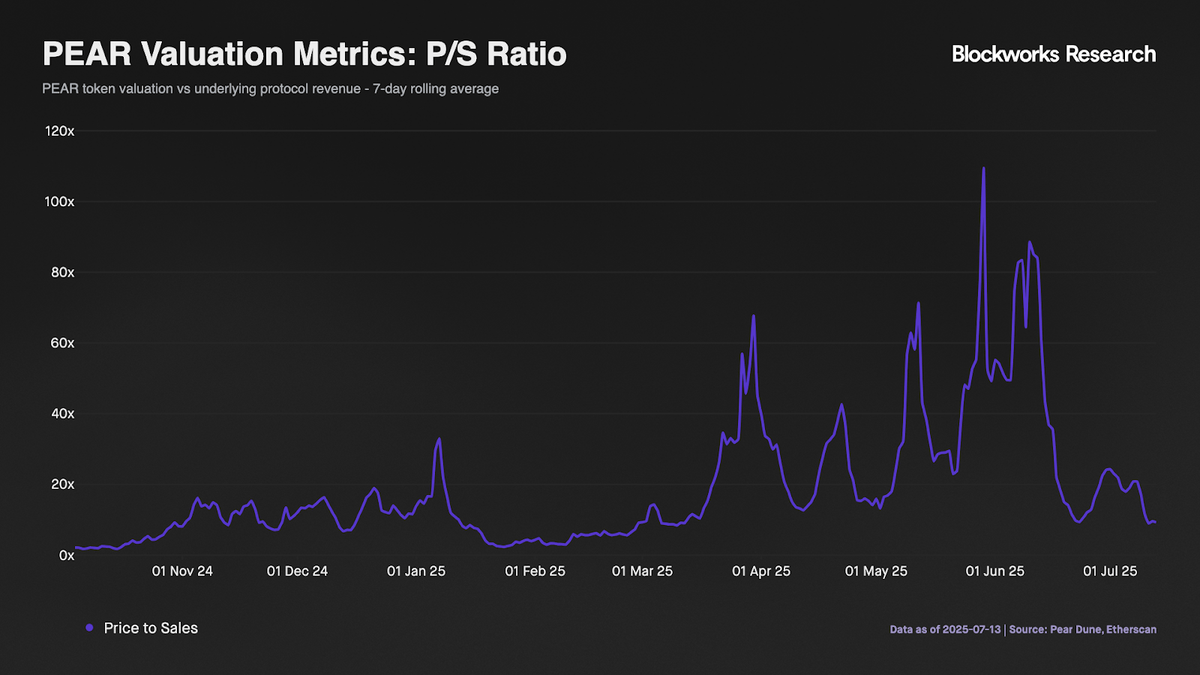

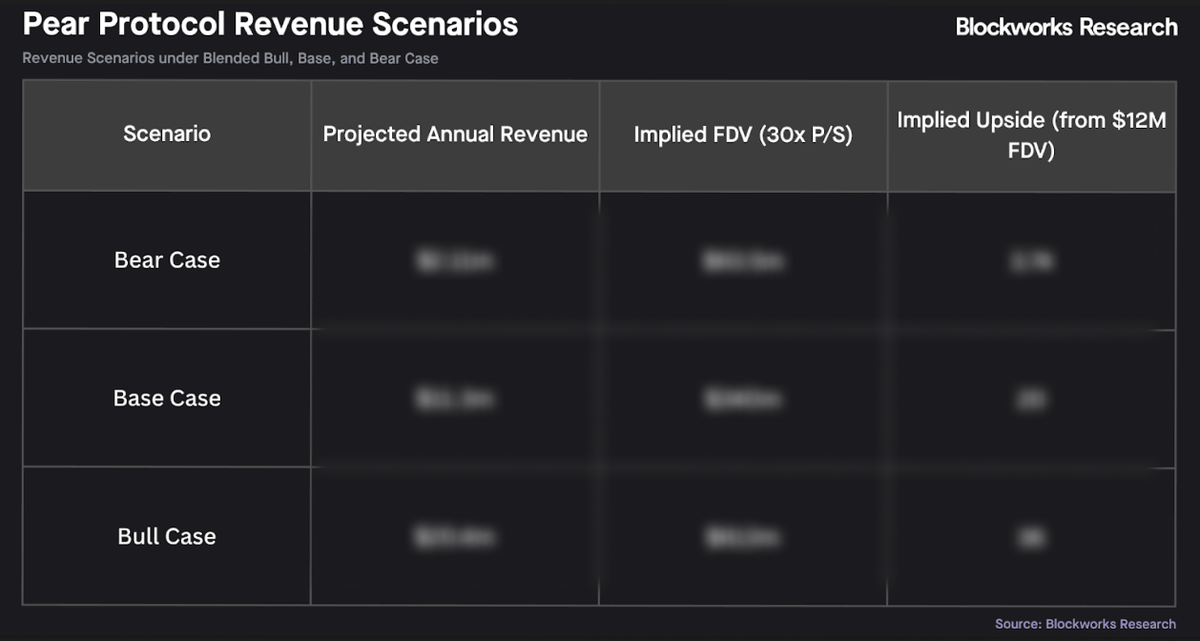

5/ Valuation metrics remain compelling: Even before public launch on Hypercore, Pear trades at a circulating P/S ratio of 13x ($6.6M market cap) and 30x FDV ($17M),

Tokenomics strongly favor holders, offering 80% revenue sharing translating to 20% staking APY, alongside potential governance-driven buyback-and-burn mechanisms.

6/ Pear recently secured $3–4M funding from institutional VCs within the Hyperliquid ecosystem.

Significantly, the price of the strategic round was at a 15% premium to 30-day TWAP, with a 12-month linear vesting period starting in September.

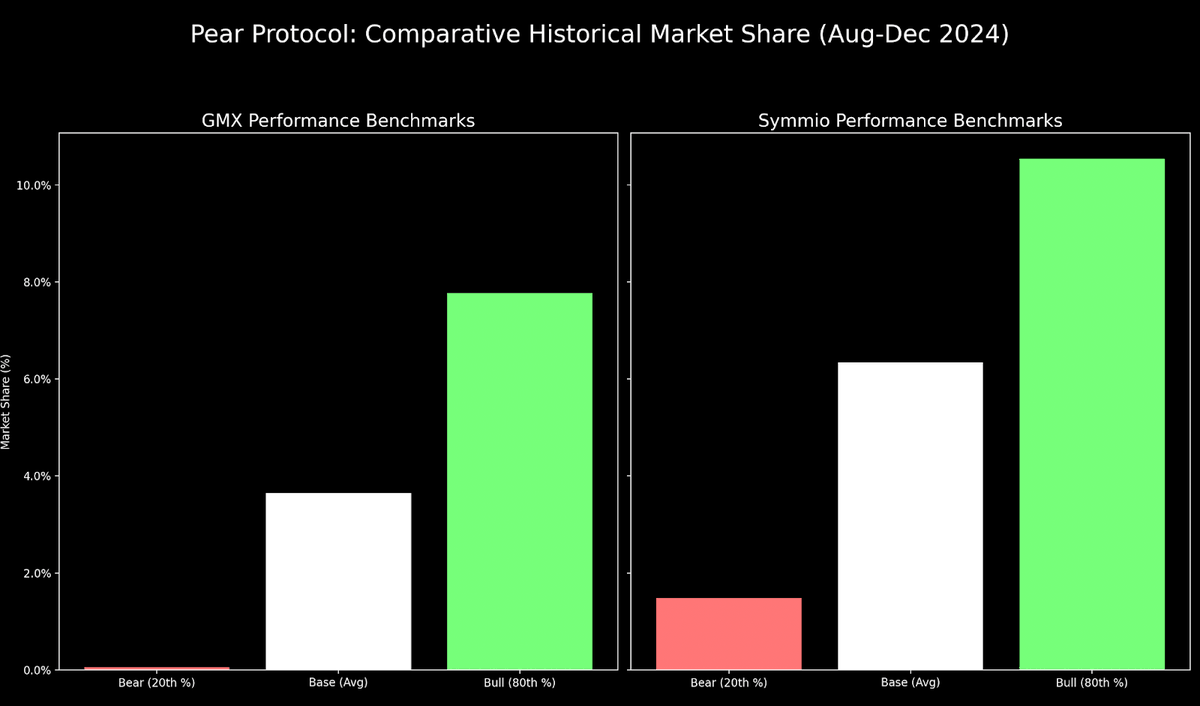

7/ To model future volumes we benchmarked Pear's historical market share from GMX and Symmio, then projected Pear could capture 10% of these historical levels on Hyperliquid.

Additionally, we projected forward volume using a time-series forecast for Hyperliquid.

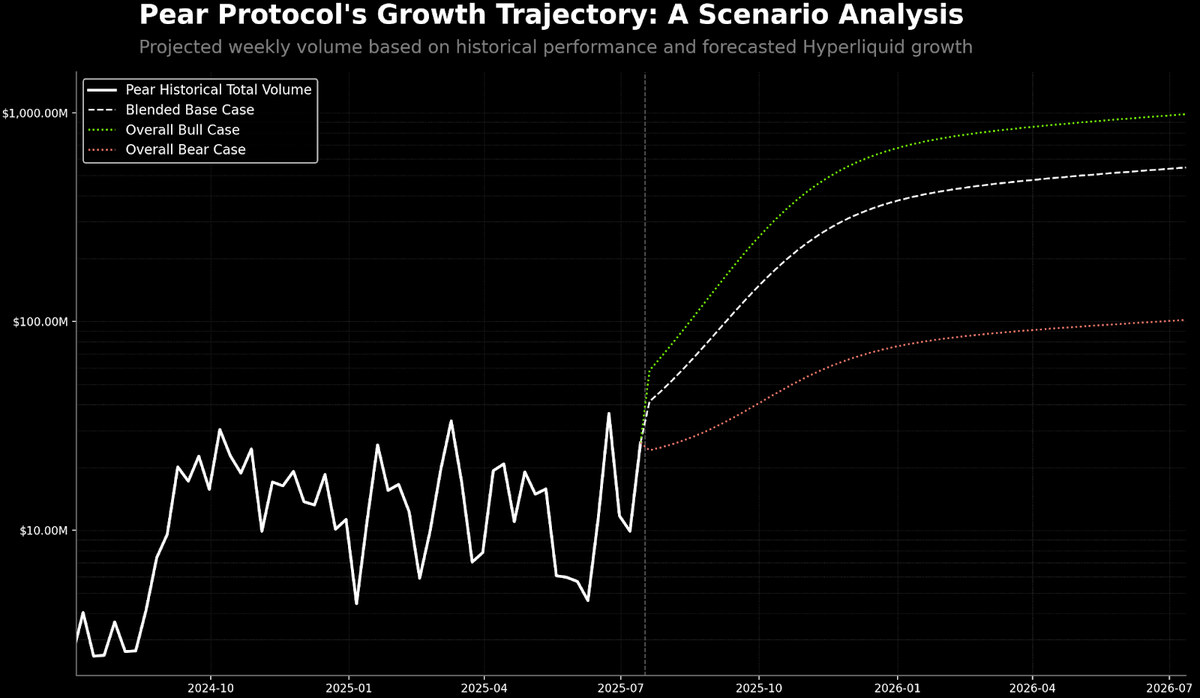

8/ Our modeling presents three scenarios:

- Bull scenario: Pear captures 0.92% of Hyperliquid’s volume, predicting $980M weekly trading volume.

- Base scenario: Pear captures 0.5%, predicting $550M weekly trading volume.

- Bear scenario: Pear captures 0.08%, predicting $100M weekly trading volume.

9/ For comprehensive analysis, detailed valuation projections, token unlock schedules, and further insights, read the full report on @blockworksres.

4.41K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.