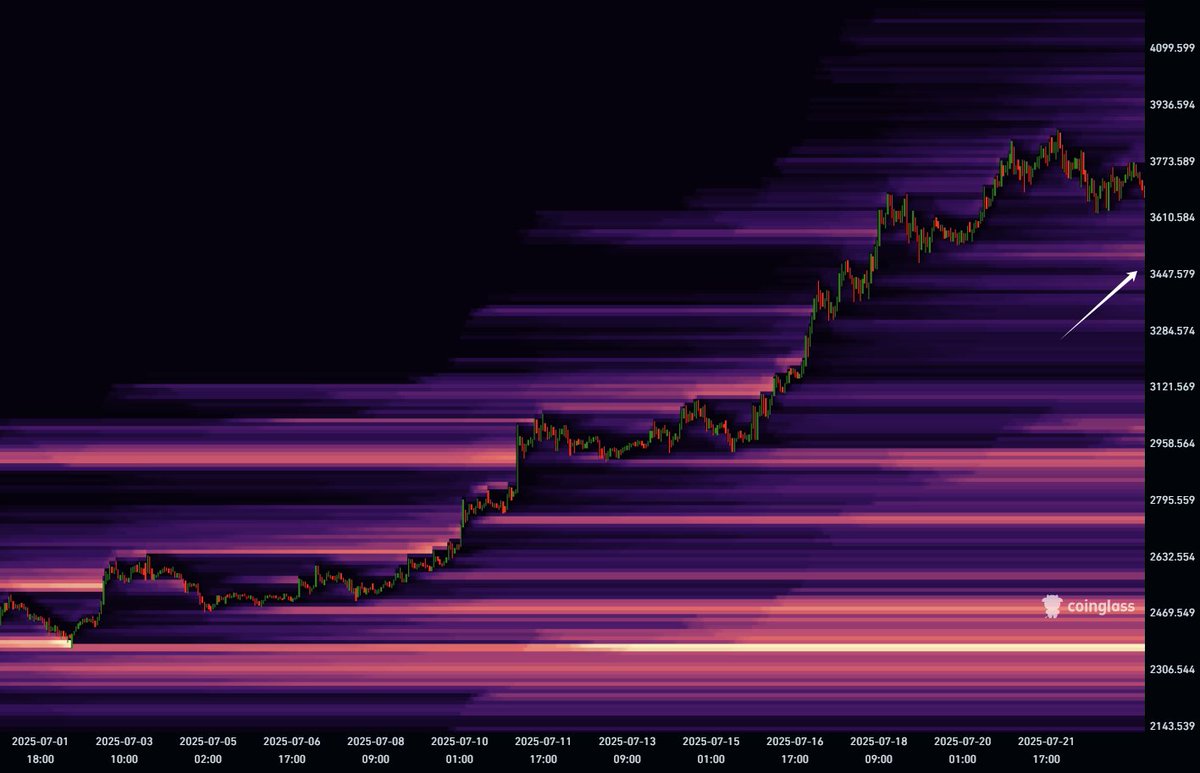

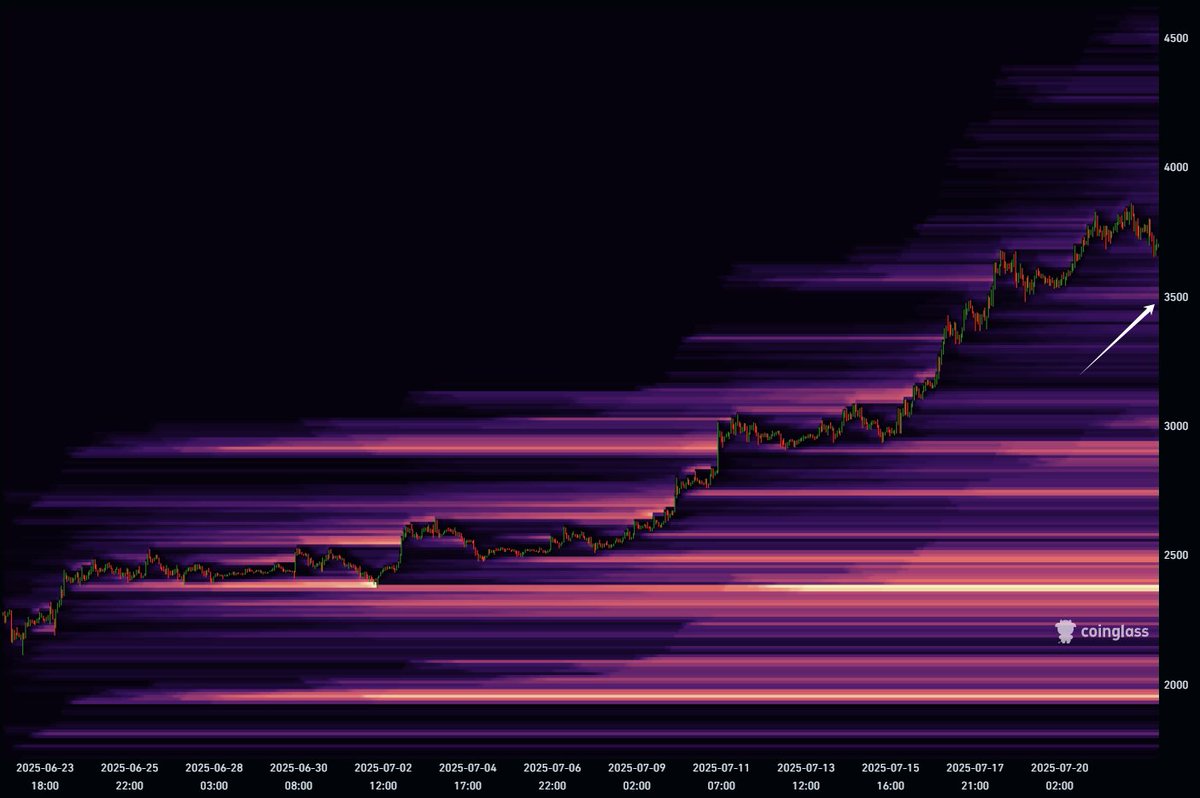

$ETH's pullback seems to be continuing, and since the long liquidity of 3500 is still increasing, we can expect a two-stage ABC pullback, which can just reach around 3500 and liquidate short-term long positions;

This pullback is very healthy, and the futures positions that drag down the continuous rise in prices often come from high-multiplier short-term bulls, even if this wave of market is pulled up by spot, but too much profit of futures bulls will become supply;

Last night during the live broadcast of @Sidekick_Labs, I talked about the long-term expectations of ETH, and my opinion is that it will definitely take a period of time to fluctuate here, but the ultimate goal is most likely to be a new high price, after all, for ETH, the three-year exchange rate downturn has just ended;

There is a logic in the market that "overcorrection must be corrected" and long-suppressed exchange rate pairs often do so in the same extreme way when they usher in a rebound opportunity.

The market after the explosion must also be repaired through extreme pullbacks.

On the one hand, the long-term bearish trend of the ETH/BTC exchange rate pair requires a more extreme rebound that lasts about a month;

ETH also needs a slightly more extreme pullback on the U-standard to correct the trend structure.

$ETH's futures long liquidity is finally showing signs of gathering!

At present, there is a small liquidation area here at 3500, and if the price has the momentum to continue to pull back this week, then 3500 is the place to pick you up.

It has been clearly stated before that the main driving force of this wave of ETH's strong bull trend comes from spot buying, which is likely to be related to currency stock subscriptions, and the emergence of this model will bring a large amount of spot demand.

But the question that comes with it is also whether these coins and stocks have the ability to obtain continuous financing like microstrategies?

If it is simply to raise the currency price and stock price, and then choose the opportunity to issue additional shares to cash out, then ETH will lose continuous spot buying and begin to fluctuate in this position.

And once it starts to fluctuate, then the liquidity of the futures market will dominate the price action...

Therefore, in addition to paying attention to the support of 3500, we should also pay attention to the stock prices of companies that carry out currency stock financing based on ETH, whether their behavior is sustainable, and whether they can hold the spot, will determine the final height of this round of ETH!

Overall, the trend structure of ETH is still a strong bull trend, so even if you see a pullback, it is not recommended to go short, but wait for the opportunity to take the long.

When does the lower daily level low, the trend structure is broken, and the short key can be unlocked!

34.65K

43

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.