"Revaluation of Digital Silver: Lai Strategy and ETFs Will Profoundly Reshape Litecoin's Fundamentals"

In the wave of mainstream crypto assets using coin stock strategies and ETFs to revalue their values, Litecoin is at a critical crossroads. Since the end of the bull market in 2021, its price performance has significantly decoupled from Bitcoin, and its market capitalization is widely considered undervalued.

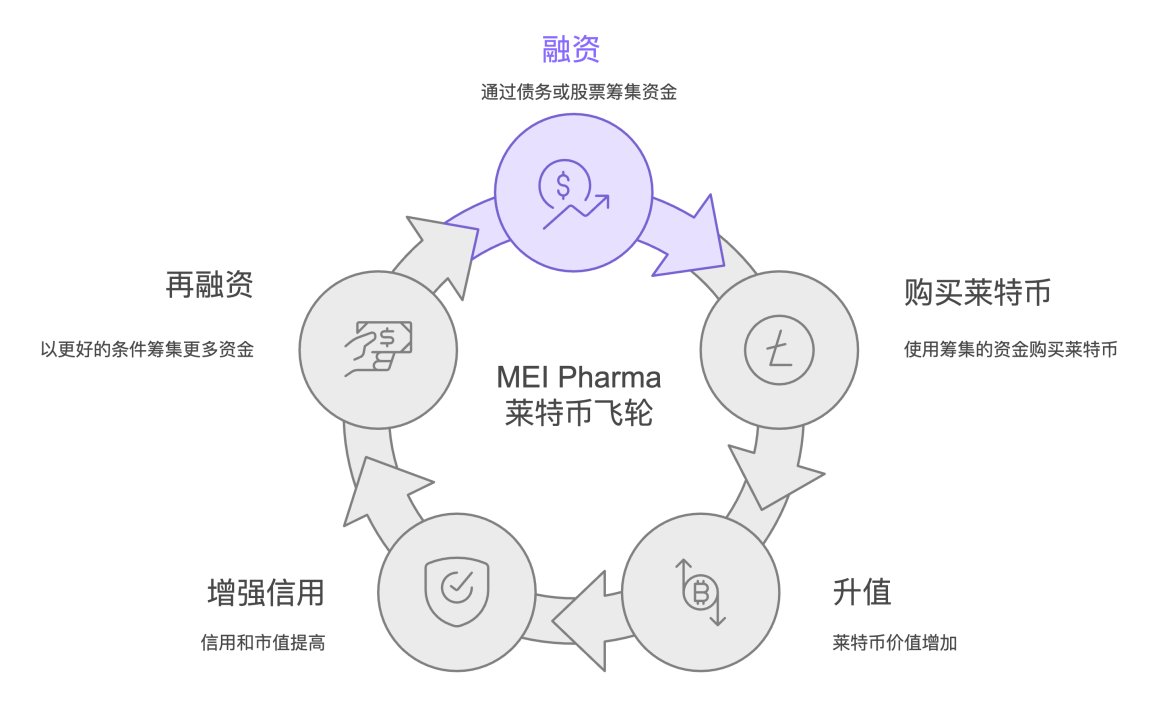

However, the recent Lai Strategy, initiated by MEI Pharma, a Nasdaq-listed company, is following the Bitcoin flywheel model of MicroStrategy in an attempt to open up the value channel between the traditional capital market and Litecoin.

Dr. Hash will conduct an in-depth analysis of the operating mechanism and core participants of the Lai strategy, combined with the lag effect of the upcoming ETF approval and halving cycle, to systematically evaluate the potential and path of Litecoin's revalue revaluation in this cycle, as well as the potential structural risks hidden in it.

"When the flywheel of the Lai strategy begins to turn, the certainty of ETFs is getting closer and closer, and Litecoin's value narrative is not just digital silver, but a pricing revolution started by Wall Street capital"

1. From the value depression to the strategic center

"Bit Gold, Lite Silver", this slogan has been sung in the currency circle for more than ten years, it accurately defines Litecoin's ecological niche and also puts it on its back with a heavy historical baggage.

Litecoin has almost all the elements to become a classic store of value asset: a PoW consensus mechanism that is homologous to Bitcoin, a fixed supply cap of 84 million coins, a quick output speed of 2.5 minutes, a reliable four-year halving deflation model (three halvings have been completed in 2015, 2019, and 2023), as well as technical iterations such as faster block production speed and MWEB privacy upgrades.

However, the reality is very skinny. When Bitcoin hit an all-time high of $123,000 in July 2025, Litecoin was still hovering in the $100 tunnel. In an era where new narratives such as DeFi, new public chains, and Meme are emerging one after another, the market's attitude towards Litecoin is almost "Lian Po is old, can he still eat?" ”。

Even its founder Li Qiwei's behavior of cashing out at the high point in 2021, although considered a warning of conscience, has also left Litecoin in a state of leaderlessness for a long time, lacking a spiritual leader like Ethereum V God to lead the narrative. This long-term silence and undervaluation provides the most perfect stage for the new capital narrative.

2. Deconstructing the Lai strategy: the reproduction and upgrading of the micro-strategy flywheel

The flywheel of micro-strategies ignited Bitcoin, and Litecoin's version of micro-strategies also entered the room. MEI Pharma (ticker: MEIP), a Nasdaq-listed company, has announced the launch of a $100 million Litecoin treasury strategy, a move that undoubtedly injects strong institutional power into Litecoin and heralds the official arrival of the era of Litecoin. And MEI Pharma, a Nasdaq-listed company, was able to choose Litecoin as the center of the flywheel, which I believe also sees the serious undervaluation of Litecoin, which is not a simple currency speculation, but an accurate imitation of the micro-strategy Bitcoin flywheel, and the operation mode of this flywheel can be clearly dismantled:

1. Financing: MEI Pharma sold 29.2 million shares to select investors through a private placement at $3.42 per share, raising $100 million in cash

2. Buy Litecoin: The company plans to use all this huge amount of money to buy Litecoin and include it in its balance sheet

3. Appreciation: The market reacted extremely positively to this strategy, with MEIP's stock price soaring by more than 80% at one point. The rise in stock price and the company's market value has strengthened the company's credit

4. Refinancing: Enhanced credit and higher stock prices create the possibility for the company to conduct a new round of financing in the future with better terms, so that more Litecoin can be purchased, forming a positive and self-reinforcing closed loop

The core three axes that promote the implementation of this strategy demonstrate the thoughtfulness of Lai's strategic layout:

1. Founder's Endorsement (Li Qiwei): Litecoin founder Li Qiwei personally served as the lead investor and agreed to join the MEI Pharma board of directors. This fundamentally solves the problem of the professionalism of the strategy

2. Top Market Maker Execution (GSR): GSR, the world's leading crypto market maker, is not only a lead party but also a digital asset advisor, ensuring that $100 million in buying operations can be executed smoothly and efficiently in the market, avoiding a sharp impact on the currency's price

3. Participation of crypto-native funds (Primitive, etc.) :P The participation of well-known funds in the crypto circle, such as rimitive, Parafi, and HiveMind, represents the recognition and support of the core forces of the industry for this model, forming a solid capital cornerstone

According to official SEC filings, a report titled "Form 8-K" has been filed by MEI Pharma, Inc. Under U.S. law, public companies are required to file an 8-K report for public disclosure in the event of an event that has a significant impact on shareholders. The core significance of this document is that it not only confirms the true identity of MEI Pharma as a regulated U.S. listed company, but also provides the most authoritative and credible legal document endorsement for the entire narrative of the Lai strategy, and has become a powerful starting point for the entire flywheel.

3. The dual benefits of ETF expectations and the resonance of the halving cycle

For Litecoin's circulating market value of up to 66 billion yuan, this $100 million is actually more like a spark that ignites the lead. The grand narrative and majestic funds that could really detonate the market are pointing to the pending spot ETF approval in the coming months.

At present, a number of institutions, including Grayscale and Canary Capital, have submitted applications to the U.S. SEC, and the market's expectations for the approval of Litecoin ETFs are very high in the context of the approval of Bitcoin and Ethereum ETFs. In fact, Bloomberg's ETF analysts even gave a 95% probability of approval and pointed the final approval deadline to October 2, 2025.

Once approved, it means that everyone from huge pension funds, institutional investors to ordinary retail investors can invest directly in Litecoin through their familiar traditional stock accounts, even the 401k pension accounts that Trump mentioned earlier, which will bring unprecedented incremental funds to the market.

At the same time, in this cycle, Litecoin's halving effect has lagged significantly. After the two halvings in 2015 and 2019, the price of Litecoin has risen significantly in the subsequent bull market, and in this cycle, Litecoin has been halved in 2023, but the supply crunching effect brought about by the halving has not yet been highlighted.

According to non-small data, Litecoin is currently $120 per coin, still less than the highest point in 2019, with a total circulating market of 66 billion yuan, ranking 18th in the mid-sized mainstream currency camp, only higher than SHIB, a meme variety, and in the early stage of value discovery.

At the same time, from the perspective of the halving cycle, Litecoin reached a cycle high in the 21st month after the second halving, while the current price reaction is significantly lower than expected nearly 23 months after the third halving in August 2023.

If we switch the frame of reference from the second halving to the first, when Litecoin took 27 months to reach its peak after the halving, then according to this model, the high point of this cycle will point exactly to October to November 2025, which is highly consistent with the final approval time window of the ETF given by Bloomberg analysts, providing logical support for the resonance of the two core catalysts.

Of course, this period comparison based on historical data is only an analytical framework for reference, and the actual movement of the market is still affected by a variety of complex factors.

epilogue

The launch of Litecoin's version of the microstrategy is painting an exciting blueprint for it. Driven by the joint efforts of founders, top market makers, and many funds, a more institutional and attractive currency-stock linkage ecosystem is taking shape. The influx of Wall Street funds, the anticipation of ETFs, the long-term benefits of the halving effect, and the current undervalued value all provide the most solid foundation for Litecoin's future.

However, the cryptocurrency market is always accompanied by high volatility and uncertainty. Changes in market sentiment, regulatory policies, macro environment, etc., can have an unpredictable impact on price movements.

The content of this article is for informational purposes only and is not intended as any financial or investment advice, DYOR.

Show original

107.11K

34

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.