Amidst a resurging market, its clear that more exotic & niche yield strategies are gaining for traction.

But most conventional lending markets are struggling to keep up due to inflexible frameworks + slow-moving credit procedures.

This make it difficult to capitalise on fast-moving opportunities.

That’s where @SiloFinance is clearly standing out.

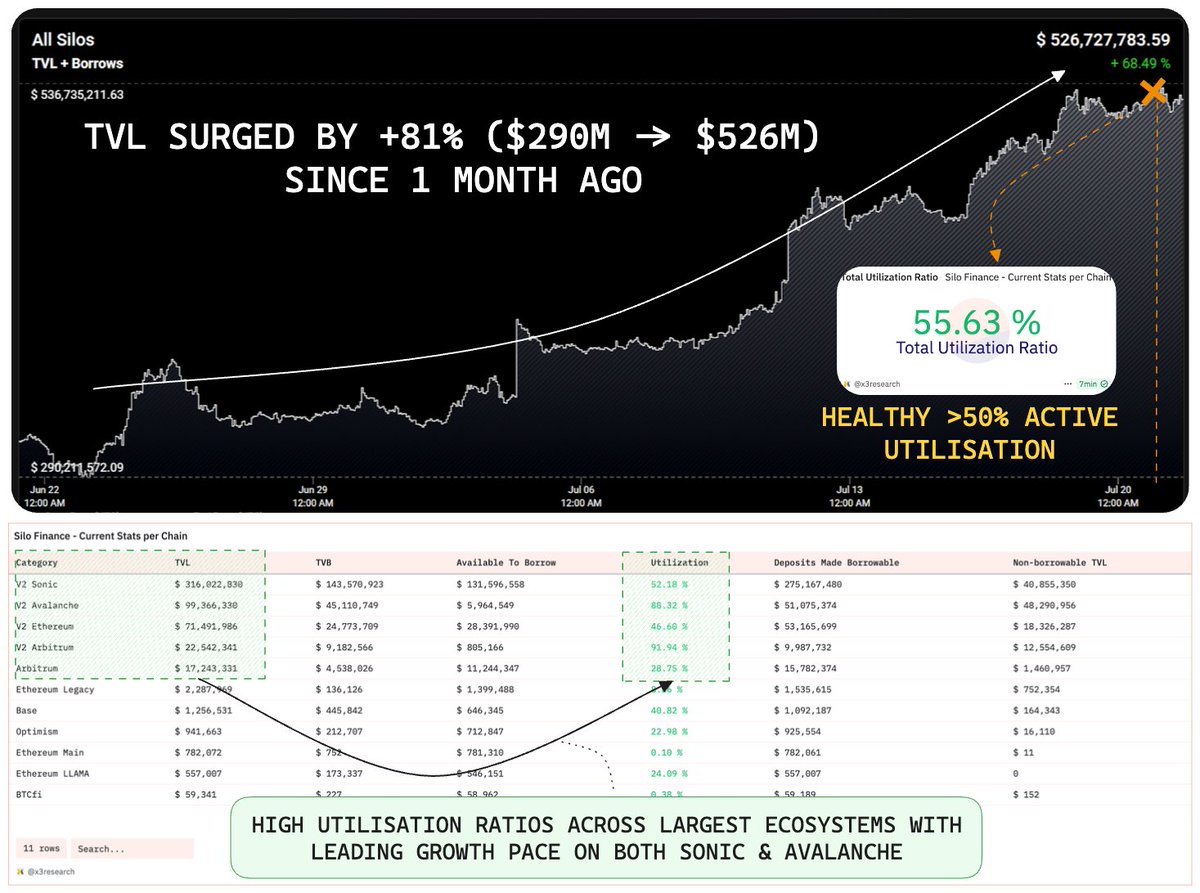

Its TVL has surged +81% ($290M to $529M) in just a month driven largely by breakout growth on @SonicLabs @avax just proves this market gap.

The overall healthy 55.6% utilisation ratio further corroborates its value proposition in its flexibility to accommodate tailored credit primitives while minising risk exposure with its isolated design.

As broader participation ramps up & yield innovation accelerates, Silo’s modular design puts it in the perfect spot to become a core primitive for the next wave of DeFi credit.

Expect its relevance & TVL to further compound.

Super Silo 🫡

On Lending Market Forces (DeFi 2.0 Credit Frontier):

Credit remains the most foundational primitive of productive composability in DeFi.

The entire idea of 'Money Legos' was born from the ability to reuse, collateralise & iterate on the same asset across protocols.

This is what fuelled DeFi 1.0’s explosive growth.

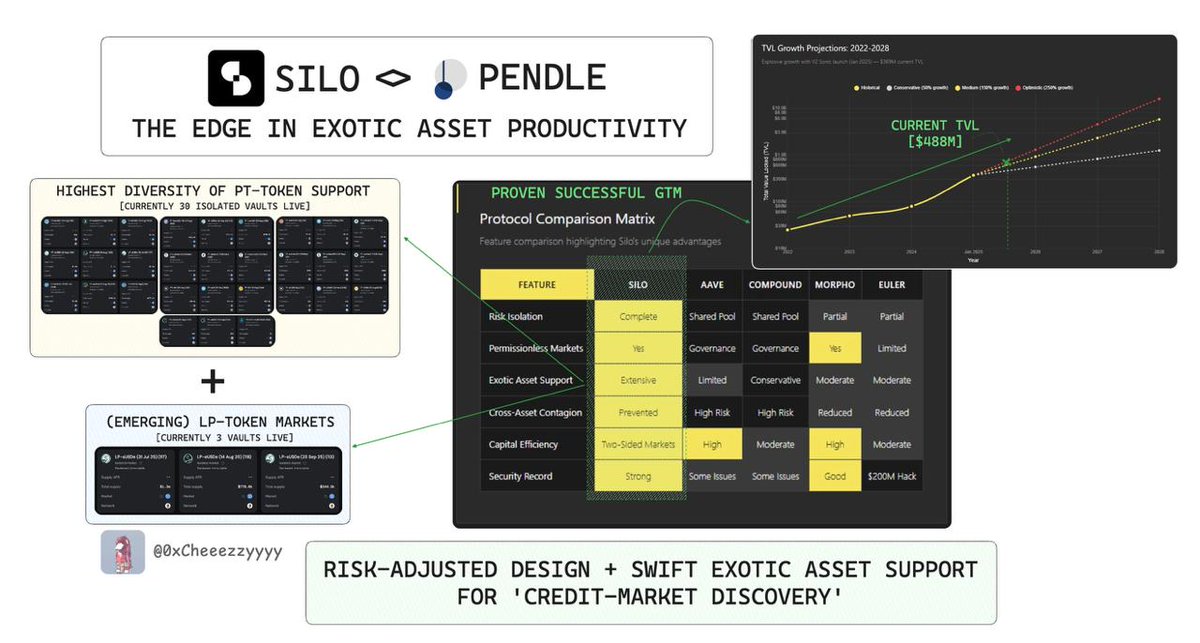

With DeFi 2.0, we’ve moved from simply replicating core primitives to building enhanced, modular layers on top eg. @pendle_fi with yield tokenisation or LSPs offering restaking opportunities.

We’re now in a mature DeFi phase where:

🔸The primary layer (DEXs, lending etc.) is cemented

🔸DeFi 2.0 protocols are highly composable but often under-integrated, esp. for more complex or niche assets

This is where @SiloFinance plays a crucial role with its core strengths in:

1. Swift support for exotic DeFi assets

2. Risk-isolated vaults that contain protocol-specific risk, preventing contagion

This unique architecture makes Silo a composability enabler to unlock credit markets for tailored or yield-bearing assets that don’t easily fit in monolithic lending markets.

The results are alr demonstrating: Since launching V2 <5 months ago, Silo has grown to ~$0.5B TVL.

Silo has arguably become the go-to lending layer for Pendle assets discovery with 30+ PT token & 3 LP vaults already live.

tbh there's still lots of potential for credit expansion on Pendle give:

🔹 PT tokens → time-appreciating assets = low-risk yield-bearing collateral)

🔹 LP tokens → emerging yield primitives with high future potential)

imo Silo will be the avenue for formalising standards in DeFi-native credit market moving forward as innovation exponentiates.

As integrations grow + more DeFi 2.0 assets seek lending utility, expect other lending protocols to follow this playbook.

Super Silo

17.08K

54

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.