🚨Will $ETH Hit $10K in 2025?🚨

ETH is floating around $3,800 and is up 150% from its April lows.

But is it too late to buy or are we just getting started?

Here’s the full breakdown: institutional flows, ETH/BTC, stablecoins, RWAs, and my targets🧵👇

1/x $ETH is finally showing strength.

$3,800 yesterday and up from $1,500 just 3 months ago.

But the real shift is technical.

$ETH just broke above its 20W and 50W SMAs for the first time in 2 years.

The bull trend is back.

2/x Every major $ETH bull run started the same way:

🔹 Higher lows.

🔹 50W SMA flips support.

🔹 20W curls upward.

The $2,600–$2,900 range is now the new $ETH bull market floor

That’s where the 50W SMA sits. Dips into this zone = solid buys. Plus the 20W SMA is curling upward just like in previous cycles.

3/x $ETH is finally outperforming #Bitcoin again

ETH/BTC has broken its 3-year downtrend with two higher highs and two higher lows.

This is the ratio to watch, not dominance.

As long as 0.022 holds, $ETH remains in control.

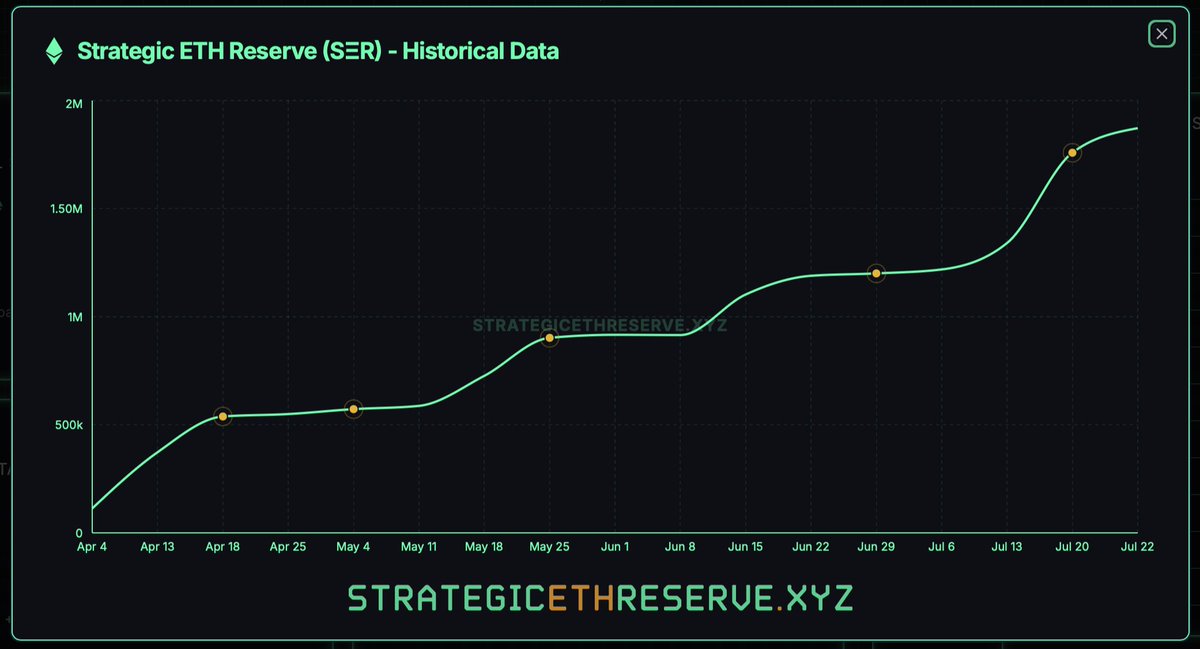

4/x #Ethereum treasuries just exploded from $23M to $6.6B

That’s a 280x in three months.

Bitmine and Sharplink are leading the charge both backed by crypto OGs Tom Lee and Joseph Lubin.

Treasury positioning is real and it’s accelerating.

5/x BlackRock is buying more $ETH than #Bitcoin.

Last week’s inflows:

🔹 Bitcoin ETFs: $2.19B

🔹 Ethereum ETFs: $2.11B

That’s 95% parity with half the market cap.

Monthly flows are catching up too. Quietly, ETH is winning the allocation game.

6/x Ethereum is also winning the stablecoin war. Out of $247B in stablecoins:

🔹 54% on #Ethereum.

🔹 32% on #Tron.

🔹 4% on #Solana.

With U.S. regulation (Genius Act) now favoring compliant stablecoins, #Ethereum is set to dominate further.

7/x RWAs? Same story. Out of 316 active RWA protocols, 70% are live on Ethereum or its L2s.

BlackRock’s BUIDL, tokenized gold from Paxos, and nearly every institutional asset starts on ETH.

If RWA grows, $ETH wins.

8/x So is it too late to buy $ETH? Not even close.

Everyone from BlackRock to Lubin is buying in this range. They’re not aping tops, they’re planning exits at $10K+.

This is still the accumulation zone.

9/x My updated $ETH price targets for this cycle

🔹Best-case: $BTC $200K + ETH/BTC 0.08 → $16,000 $ETH.

🔹Realistic: $BTC $150K + ETH/BTC 0.044–0.05 → $6.6K–$7.5K ETH

🎯My base case: $6–7K by end of 2025 and $10K by mid-2026.

10/x Final thoughts: $ETH is still early in this cycle.

✅ Technical breakout.

✅ ETH/BTC reversal.

✅ Massive ETF + treasury inflows.

✅ Dominance in stablecoins + RWAs.

This is how macro rotations begin.

Zoom out, DCA smart, and ride it to $10K 🫡

11/x My long-term #Ethereum bot is already up 84% from a $2,400 entry.

I’m compounding profits, adjusting the range, and still targeting $10K.

Want to copy the setup or learn how it works?

👉

👉 (@The_Coiners )

267.41K

1.23K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.