Trump’s #WLFI token is about to go fully tradable.

➙ Over $198 million on-chain

➙ Already 10x in Pre-Markets

➙ Hedge funds from London and the UAE are already in.

➙ #USD1 is outpacing $USDC in momentum.

Here's what you're missing. 🧵👇

So what is $WLFI?

It launched quietly in 2024.

It’s a full DeFi protocol with three key pillars:

➙ $WLFI token (governance + revenue asset)

➙ USD1 (its native stablecoin)

➙ Real-world asset infrastructure (via Plume + vaults)

World Liberty Financial is a serious financial ecosystem with powerful backing.

We're talking about a project co-founded by real estate mogul Steve Witkoff, Chase Herro, and Zak Folkman, with the entire Trump family front and center.

WLFI is also building its own Aave v3 instance.

➙ Lending + borrowing for ETH, USDC, WBTC, etc.

➙ 20% of protocol fees go to AaveDAO

➙ 7% of WLFI supply was given to AaveDAO

Trump’s role is bigger than you think.

➙ He owns 22.5B WLFI

➙ Earns 75% of protocol revenue

➙ WLFI is licensed to a Trump-linked LLC

Just like Tether created USDT to profit from exchange demand...

WLFI is creating USD1 to own the yield game.

USD1 is a dollar-backed stablecoin:

➙ Pegged 1:1 to USD

➙ Custodied by BitGo

➙ Listed on Binance

➙ Backed by U.S. Treasuries + cash equivalents

This is the fastest-growing stablecoin of the year.

And no one's tweeting about it.

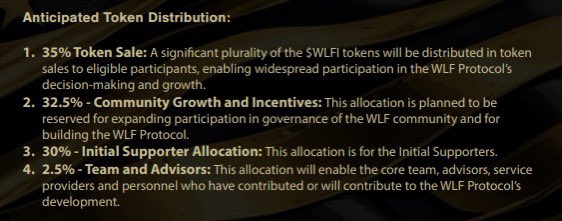

$WLFI operates with a fixed total supply of 100 billion tokens.

Here’s the breakdown of how they’re allocated:

➙ 35% for the Token Sale

➙ 32.5% for Community Incentives

➙ 30% for Supporters

➙ 2.5% for the Team + Advisors

Crucially, no single wallet can hold more than 5%, a safeguard designed to prevent any one entity from dominating governance.

The price is already doing damage pre-listing.

Seed: $0.015

Now: $0.70+ on Whales Market, LBank, MEXC, XT, BingX

That’s over 10x pre-CEX.

Volume is already $5M+/day.

And still… very few retail eyes.

Who’s backing this?

➙ Aqua1 Fund ($100M)

➙ DWF Labs ($25M)

➙ Re7 Hedge Fund (USD1 vaults)

➙ Franklin Templeton, Ondo, Google Cloud (indirect infra)

➙ Justin Sun, founder of Tron, bought 3 billion WLFI at $0.01.

✔️ December: $30M investment

✔️ January: $45M more through Tron DAO

✔️ Now serves as $WLFI advisor

✔️ His total stake is around $90 million.

While CZ himself has publicly denied direct involvement in USD1's smart contract or personal WLFI buys,

The Binance connection is huge:

➙ USD1 stablecoin listed on Binance (May 2025)

➙ Abu Dhabi's MGX invested $2B in USD1 → Binance deal

➙ Binance waived all listing fees for USD1

➙ Built on BNB Chain initially

This gives $WLFI access to Binance's ecosystem.

What makes this different from other Trump tokens:

This has real infrastructure.

Real partnerships.

Real institutional backing.

Real utility through USD1.

$TRUMP was speculation. $WLFI is a business.

What does this all mean?

Some analysts are calling for WLFI to hit $2 to $5, to even $47 in the near future.

And this is possible because of:

➙ Unprecedented political backing

➙ Deep-pocketed crypto sponsors

➙ A proven stablecoin (USD1): Integrated with major ecosystems (Binance, Tron).

➙ Strategic RWA & DeFi expansion: Tapping into high-growth sectors.

➙ Favorable regulatory positioning

What comes next?

➙ WLFI goes fully tradable

➙ CEX listings roll in

➙ USD1 becomes a DeFi standard

➙ Real World Asset vaults go live

➙ TRX integration ramps up

➙ $10B+ market cap becomes plausible

Most people will dismiss this.

But if you’re reading this, Position accordingly.

That's a wrap.

If you found this thread valuable, do three things

➙ Like the first tweet

➙ Repost and Bookmark

➙ Follow me @EvanLuthra for more

236.01K

910

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.