Is Ethena considered a reverse merger?

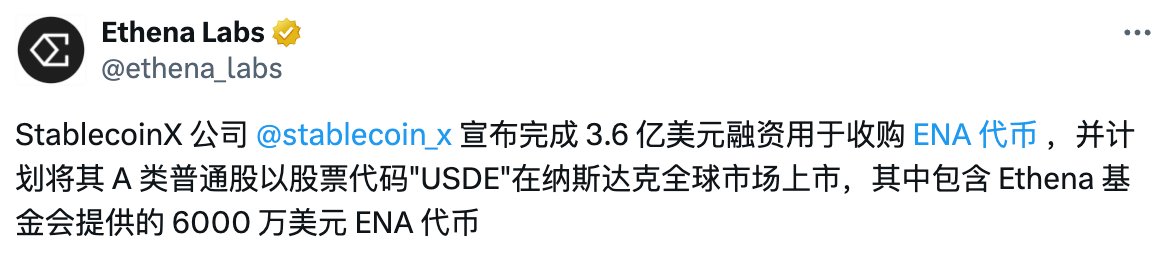

A Web2 company acquires a Web3 protocol, achieves a listing on the US stock market, successfully issues stocks, and then comes to Web3 through tokenization on the US stock market.

Having a protocol with both tokens and stocks might be what US stock market tokenization is all about?

This wave is a self-help market for many VCs and market makers.

I invested too many junk projects and shitcoins, and it was difficult to save them no matter how much money I spended, but I just had a batch of ETH, SOL, or leftover US dollar funds in my hand.

Several companies invested together to collect a U.S. stock shell, I paid money, you paid money, issued a bunch of additional stocks to yourself, and the official announcement became a micro-strategy, selling it to those who were destined to follow the trend of U.S. stocks. Subsequent reprinting of shares can also distribute dividends to shareholders.

10.61K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.