Bitcoin has Michael Saylor.

But the man behind Ethereum is Joseph Lubin.

He funded Vitalik, he built MetaMask and Infura, and now, he beats the U.S. Securities and Exchange Commission (SEC). 🧵

(1/13)

Joseph Lubin graduated from Princeton University with a major in Electrical Engineering and Computer Science.

He worked in the fields of artificial intelligence and robotics, later becoming a vice president at Goldman Sachs.

But everything changed in 2011 — he read the Bitcoin white paper.

(2/13)

In 2013, at a cryptocurrency meetup in Toronto, he met a 19-year-old young man — Vitalik Buterin.

Vitalik proposed a brand new concept: a programmable blockchain.

Lubin chose to believe in him.

Not only did he provide financial support, but he also joined the founding team to help officially launch Ethereum.

(3/13)

But things quickly got complicated.

In 2014, during a meeting in Switzerland, the Ethereum initial team split.

They debated whether Ethereum should be a non-profit foundation or a for-profit company.

Vitalik eventually removed Charles Hoskinson and Amir Chetrit.

(4/13)

Lubin stayed on.

He invested hundreds of thousands of dollars to promote compliance communication with U.S. regulators,

and helped Ethereum raise 31,000 bitcoins in its crowdfunding.

It was this funding that allowed Ethereum to officially launch in 2015.

(5/13)

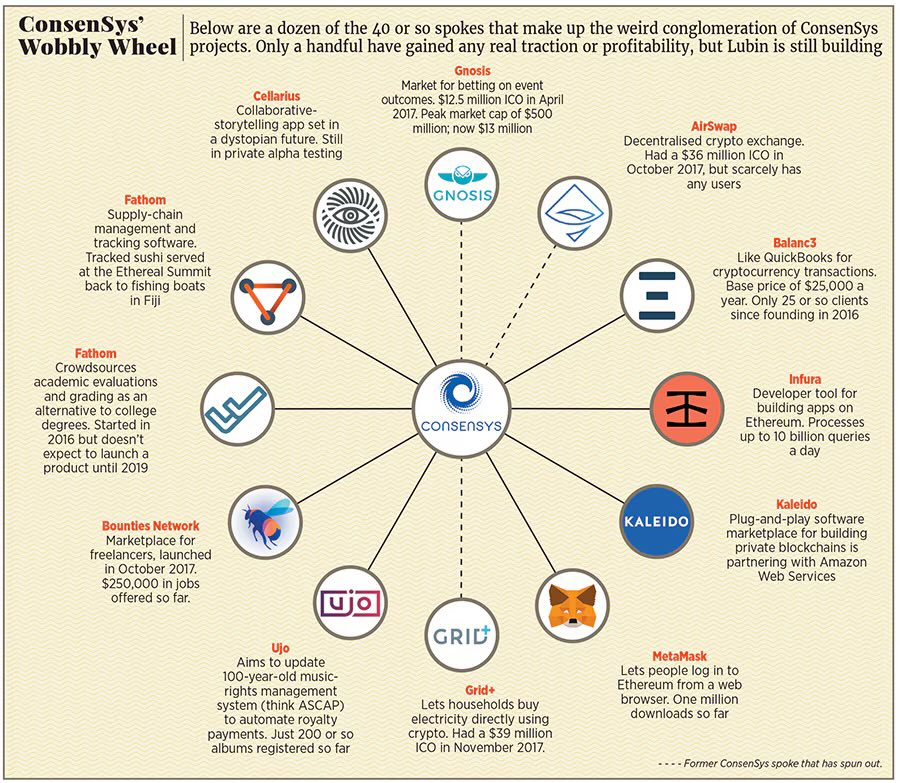

As Ethereum launched, Lubin has already been planning for the future.

He founded ConsenSys — a company building the Ethereum ecosystem.

MetaMask, Infura, and dozens of projects were all born there.

ConsenSys has become the infrastructure of Ethereum.

(6/13)

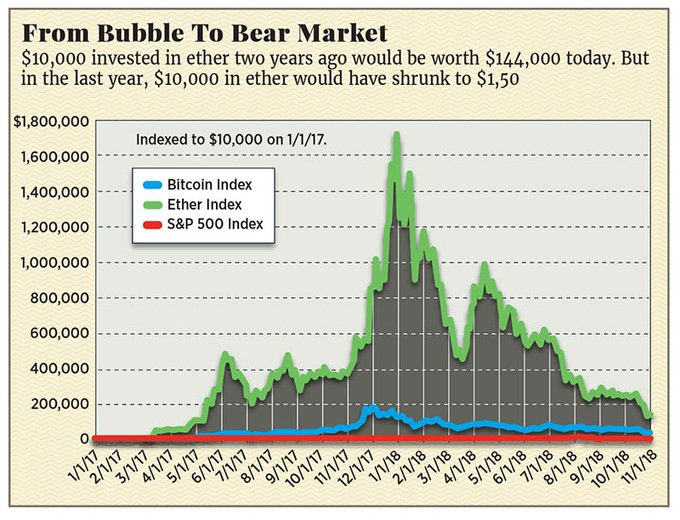

In 2017, with the ICO boom, Ethereum exploded.

ETH broke \$1,000,

all startups wanted to issue tokens.

ConsenSys rapidly expanded.

Forbes estimated Lubin's net worth to be between 1 billion and 5 billion dollars.

(7/13)

Then, the market collapsed.

In 2018, ETH fell by more than 90%.

ConsenSys burns more than $100 million a year without a clear business model.

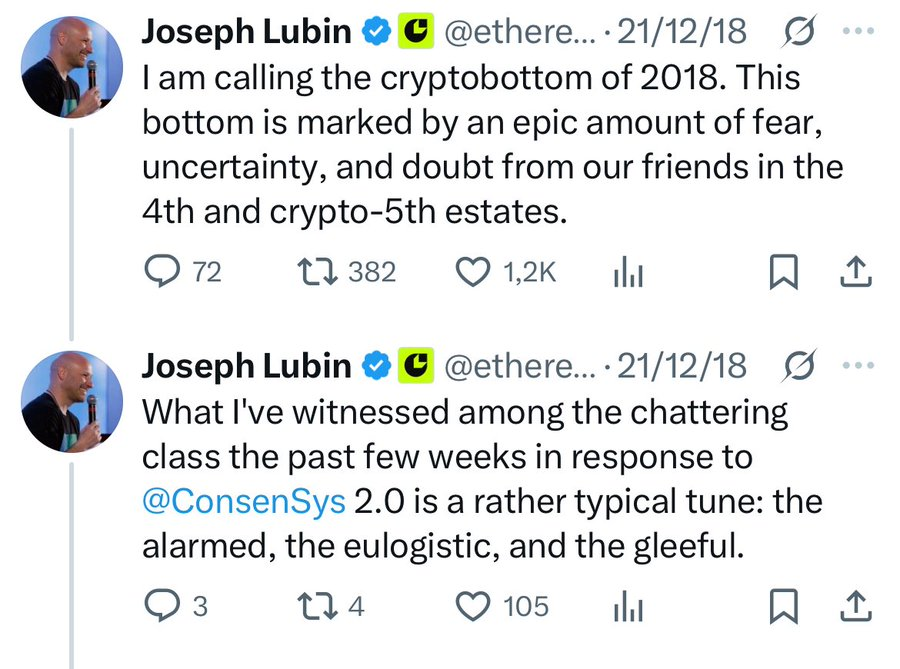

Lubin laid off half of his workforce, closed dozens of projects, and reorganized the company into "ConsenSys 2.0."

(8/13)

By 2020, he split the company in two.

MetaMask and Infura were spun off into a new U.S. entity.

JPMorgan became a 10% shareholder.

Meanwhile, the original old employees were left with nothing.

(9/13)

As early as 2015, Lubin promised that their equity would not be diluted.

But in 2020, it was indeed diluted.

35 early employees sued him in Switzerland.

In 2024, they filed a lawsuit again in New York, demanding a share of MetaMask's equity.

Lubin responded: they are not worthy, they just want to make a quick buck.

(10/13)

Meanwhile, regulatory pressure continues to intensify.

Since Ethereum transitioned to POS (Proof of Stake), the SEC has hinted that ETH may be classified as a security.

This could have catastrophic consequences.

So, Lubin took the initiative and sued the SEC.

In 2024, he will take the SEC to court, claiming that Ethereum does not fall under its jurisdiction.

(11/13)

The three best MEME trading tools to use

GMGN is currently suitable for all beginners:

Trading is one step ahead, pepe bot:

AXIOM currently has the fastest transaction speed among meme tools:

It is recommended to collect

🚀常用交易所:

OKX:

🚀

910

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.