Full disclosure: I don't hold a significant amount of EIGEN yet. That being said, I think people should pay attention to the token, and for that reason, I've personally been doing a public deep dive on it (see previous posts: )

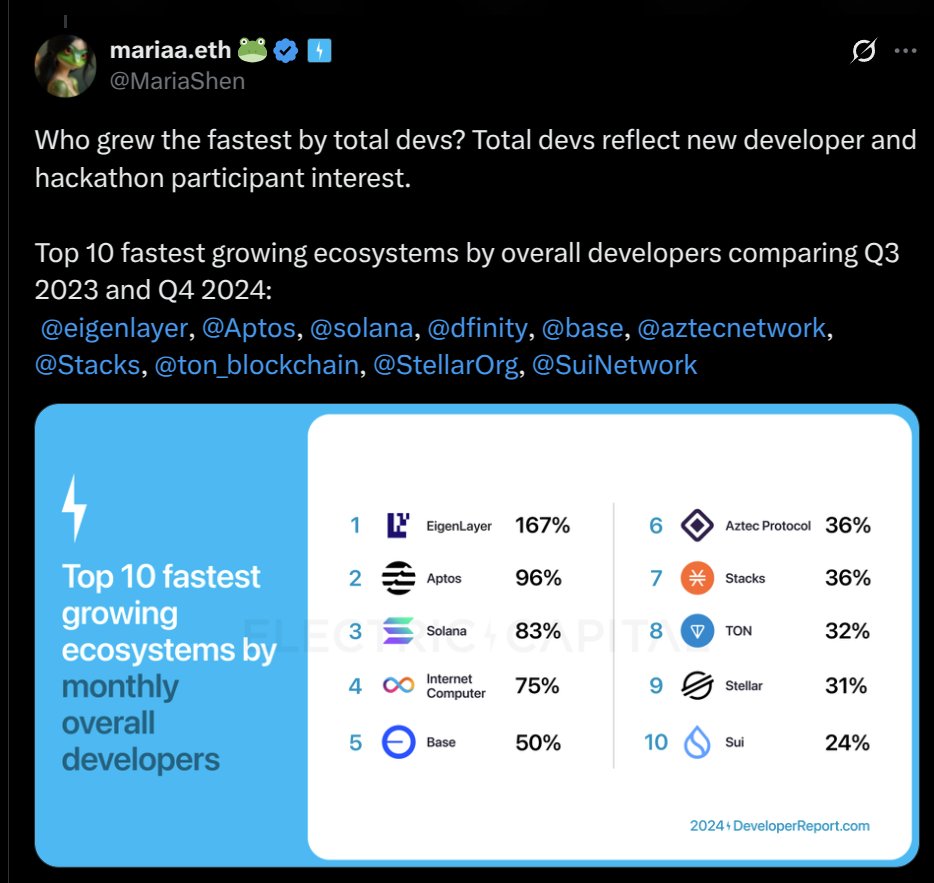

Why? EigenCloud (@eigenlayer) is currently the fastest-growing project in the crypto space! See developer growth stats:

More fundamentally, EigenCloud is leading Ethereum's evolution toward a hyper-modular tech stack, turning Ethereum’s consensus itself into an exportable commodity. It further reinforces ETH’s role as the universal security capital underpinning future internet services.

Revisiting this, there’s another way to frame the ETH–EIGEN dynamic: as a division of labor between maintainers and builders, each with distinct economic characteristics.

ETH holders act as passive maintainers of Ethereum’s core ecosystem, securing established infrastructure like rollups, AVSs, and zkTLS. EIGEN holders are active builders, continuously creating and adapting new protocols to meet evolving demands.

1. ETH: Maintainer asset with commodity and bond-like properties

ETH functions as a productive commodity, burned in transactions (making it deflationary), and as a yield-bearing bond through staking. ETH holders maintain the stability and security of core services like rollups and zkTLS.

2. EIGEN: Builder token with governance and equity-like characteristics EIGEN holders govern subjective decisions through mechanisms like slashing-by-forking and actively build innovative AVSs such as @eigen_da. The token acts similarly to an equity investment: high-risk, innovation-oriented, and growth-focused.

This division creates aligned incentives: ETH holders anchor the Ethereum tech stack's reliability, analogous to blue-chip infrastructure, while EIGEN holders drive protocol innovation like startup investors. Together, they maximize Ethereum’s long-term adaptability and utility as the foundation of decentralized verifiability.

19.25K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.