🗞 Beig Chain Weekly Report - Top Escape Series (Thirty-Three)

💡 This week's weekly report format will change

I released the risk signal update series for "Top Hunting Plan (One)" on Friday,

To avoid overlapping content with the series, I want to publish each signal in a separate post,

So that I can fully present the content of the signals. Therefore, this week's report will be slightly simplified,

Data that hasn't been updated will be updated daily starting tomorrow 🫡

//

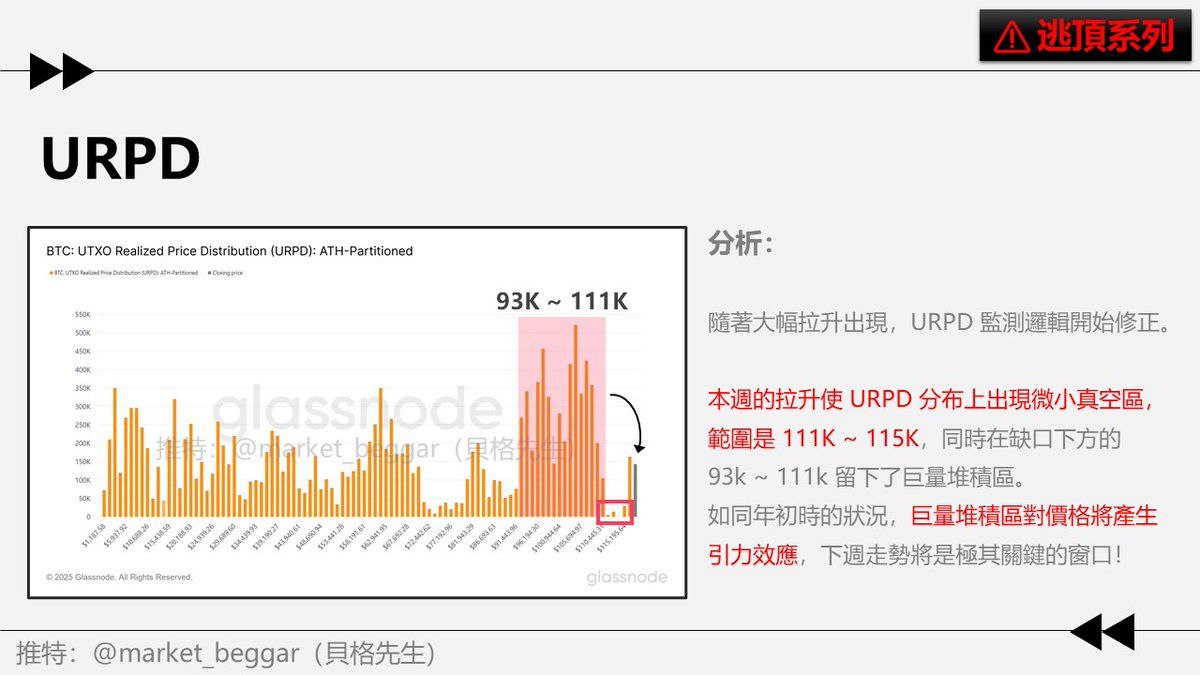

1) URPD

⭐️ The focus of this week's report is primarily on the analysis of the URPD chip structure.

As BTC prices have reached new highs as expected, some noteworthy signals have emerged in the chip structure.

First is the "URPD vacuum gap" caused by a significant surge:

1️⃣ The current gap ranges from 111K to 115K, which is not a very large gap.

2️⃣ More than 300,000 BTC have accumulated above the gap, indicating a rapid distribution.

3️⃣ Below the gap, there is a massive accumulation zone located between 93K and 111K, activating the gravitational effect.

I have written many posts explaining the concept of URPD,

Including the impact of URPD gaps on the market and the gravitational effect of massive accumulation zones.

In simple terms:

➡️ URPD gaps without chip accumulation have very poor support when prices return to the gap.

➡️ Massive accumulation zones will have an "attraction" effect on prices.

For detailed conceptual explanations, please refer to the following two articles:

📖 URPD Gaps and Periodic Distribution

📖 Discussing the Largest Potential Chip Structure Risks in URPD

Given the current market situation, the massive accumulation zone between 93K and 111K has settled,

If future prices cannot strongly surge again to escape the massive accumulation zone,

Then the accumulation zone between 93K and 111K will begin to generate a "gravitational effect,"

Pulling prices back into that accumulation range.

The principle is: "Currently, the large amount of chips between 93K and 111K has become floating profit,"

Their profit-taking selling behavior is likely to "drag down the price";

Unless there is a significant surge that puts them in a state of secure holding, the gravitational effect will always exist.

//

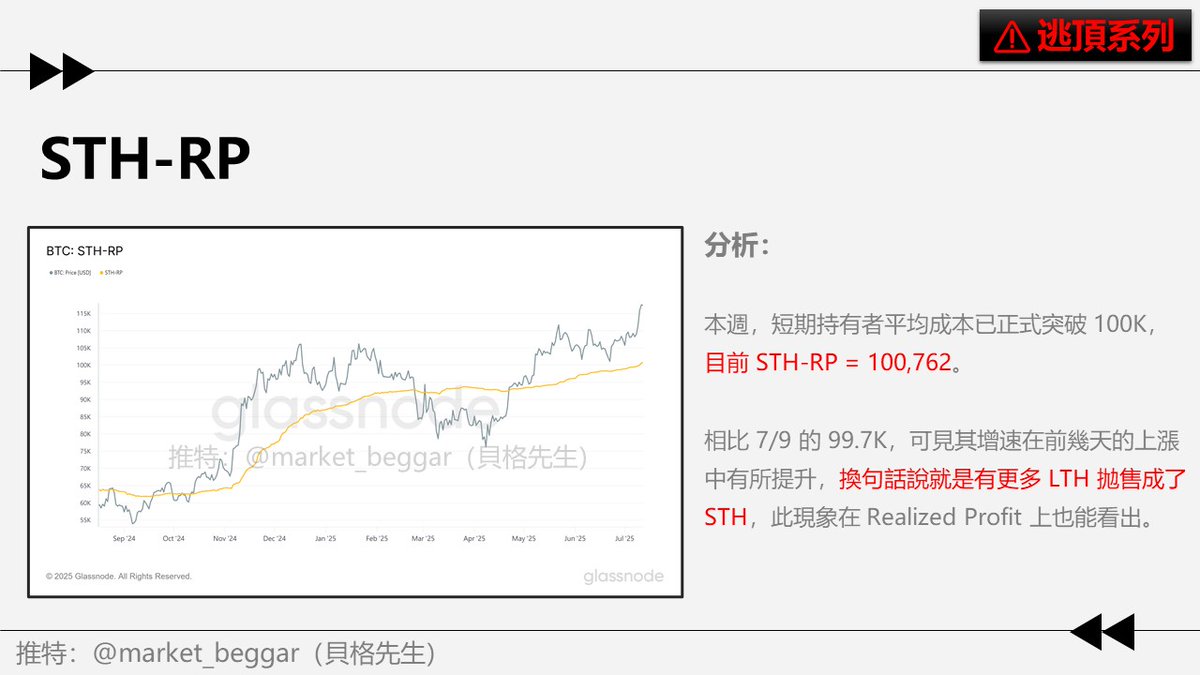

2) STH-RP (Short-Term Holder Average Cost)

📊 The current STH-RP = 100,762

This week, the average cost for short-term holders has officially surpassed 100K.

It is worth noting that the STH-RP was only 99.7K on 7/9,

In just three days from 7/10 to 7/12, the growth rate of STH-RP showed a significant increase,

Indicating that many LTHs sold off during these three days, becoming STHs,

Resulting in a relatively rapid increase in the STH-RP value.

This conclusion can also be derived from Realized Profit, which I will not elaborate on here,

You can look forward to the upcoming "Top Hunting Plan" series 👀

//

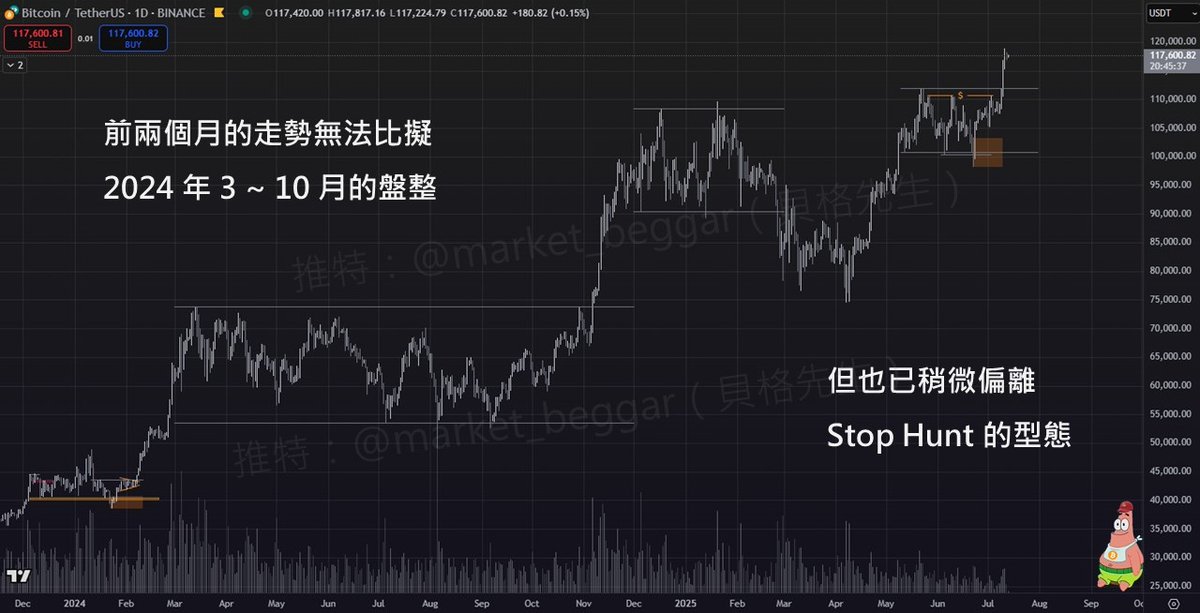

3) Technical Chart

I won't elaborate much on this part, mainly to answer a question.

There are many opinions comparing the consolidation structure of the past two months to the consolidation from March to October last year,

And based on this, they claim that "the next wave of main upward movement is about to arrive."

From a technical analysis perspective, I do not agree with this view,

The reason is that "the past consolidation lasted only 2 months,"

The time span cannot be compared to the consolidation from March to October 2024.

Consolidation is itself a process similar to building momentum; the longer it lasts, the greater the force it generates.

Two months of consolidation time clearly cannot be compared to eight months,

Not to mention that last year's March to October was merely the stage of "the first large-scale distribution" in the cycle,

Subsequently, one could expect a wave of main upward movement, which is clearly different from the current situation.

However, given the current state of the chart, it has indeed deviated from my initial Stop Hunt expectations.

I will update the detailed content in next week's "Top Hunting Plan" series.

4) Conclusion

📝 Key Points Summary:

1️⃣ URPD: A small vacuum area has appeared, next week is a key window.

2️⃣ STH-RP: Has surpassed 100K, with a significant increase in growth rate.

3️⃣ Technical Chart: The past 2 months of consolidation cannot be compared to last year's March to October.

-

This concludes the thirty-third issue of the on-chain weekly report. I hope it helps everyone~

Below, I will attach all analysis articles related to the "Second Escape Top" during this period in the comments section for everyone to study and reference.

As usual, feel free to ask any questions, and I wish everyone a pleasant weekend 🛍

-

📚 This Week's Article Review

80,000 BTC ancient giant whale causing massive Realized Profit

Exploring the technical analysis strategies of a "700 times in 4 months" god-level trader

AVIV Heatmap data update: An alternative way to assess the top

BTC reaches new highs as expected, has it peaked?

Top Hunting Plan (One): Divergence of US Fund Sentiment Curve

Crydit debit card promotional article.

🗞 Berg Chain Weekly Report - Escape from the Top Series (32)

This week, BTC is mainly rising, and at one point it returned to above 110K.

At present, the price has fluctuated between 98K~112K for nearly 2 months.

As BTC gradually approaches ATH, we have to look cautiously,

Is it possible that the current rally will replicate the situation at the beginning of the year, or even the second top of 2021?

Let's take a look at this week's #逃頂 Weekly Report 👇:

//

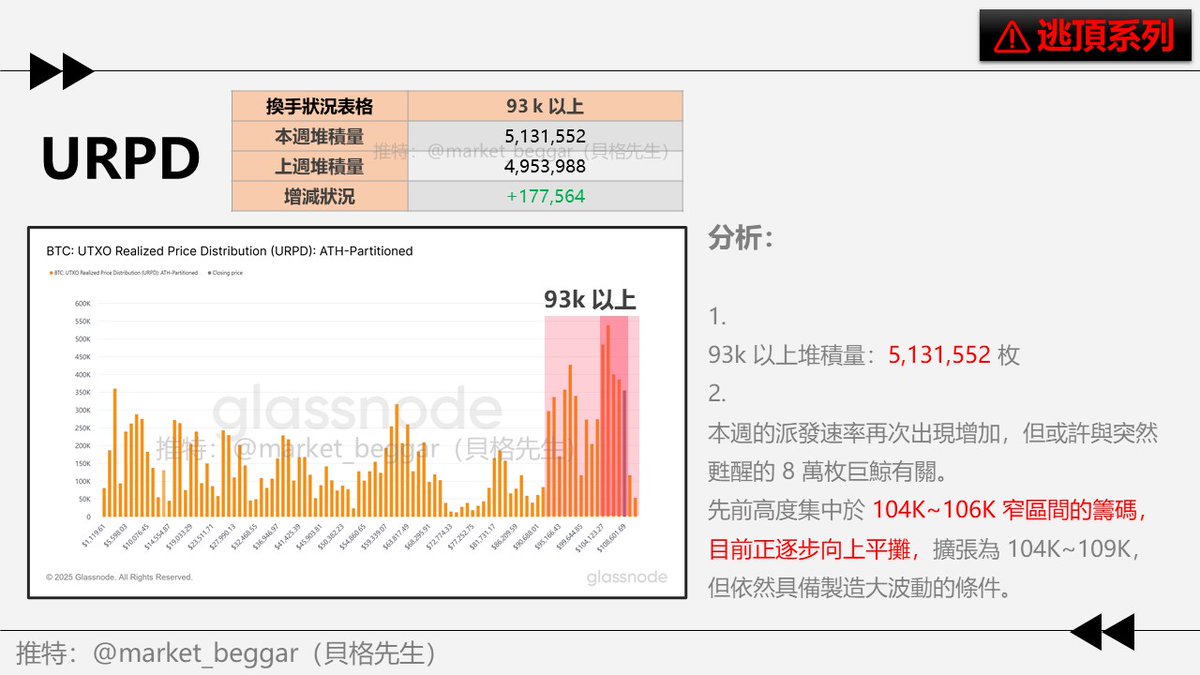

1)URPD

📊 The current stack above 93 K is 5,131,552 pieces

The amount of chips paid out above 93K has increased again this week,

Maybe it has something to do with the 80,000 BTC Ancient Whale that was suddenly activated this week.

The situation of "a large number of chips are highly concentrated in 104~106K" that I mentioned last week and last week,

After a slight relief this week, some of the chips have expanded upwards,

The current high concentration area falls in about 104~109K.

However, although it has expanded, it is still in a highly centralized state.

Combined with the previously shared volatility indicator (which is still in the low volatility zone),

The likelihood of significant volatility next week remains significant ⚠️

//

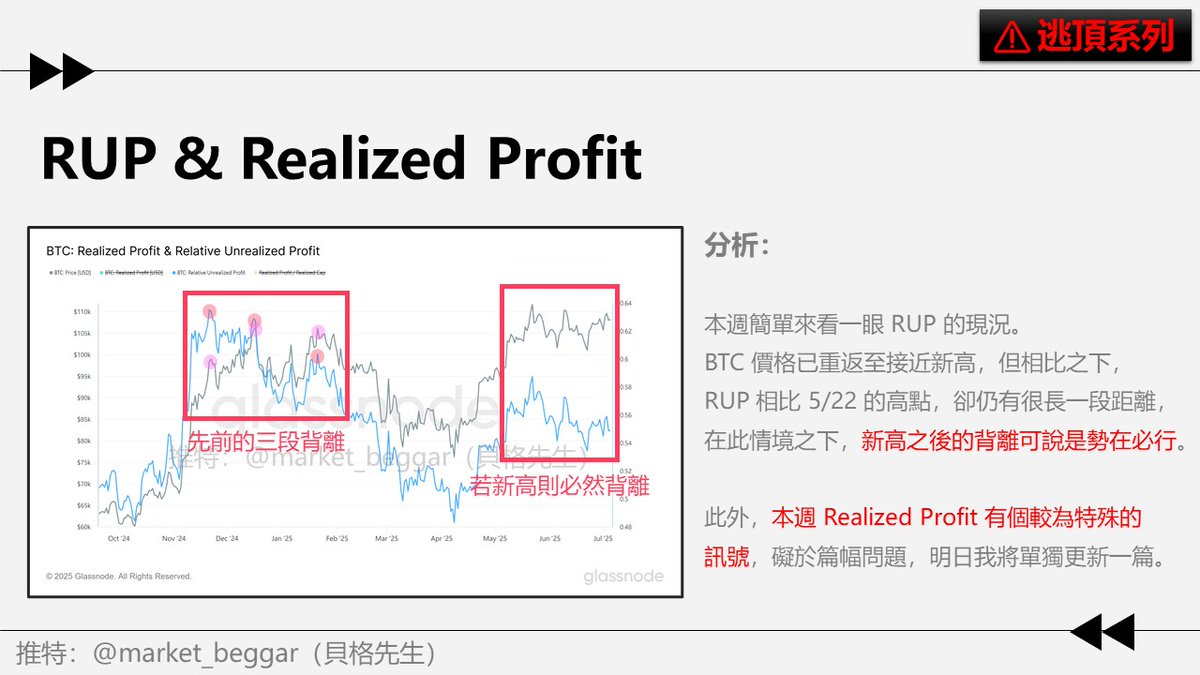

2)RUP & Realized Profit

For more information about the analysis logic of RUP, please refer to the following:

For the analysis logic of Realized Profit, please refer to the following:

This week we're briefly reviewing the current RUP landscape.

It can be seen that in the past 2 months of shocks, the price trend is relatively "sideways".

However, RUP has come out of a noticeable decline (red box on the right).

The decline in RUP is a precondition for divergence, and there is only one reason for this:

"Distribution of low-cost chips" (please refer to the above link for a detailed explanation of the principle).

BTC is currently less than 4% away from its previous high, and as I've repeatedly emphasized,

Once a new high appears, as long as it does not rush to an extremely high position,

The divergence after the new RUP high is already a very high probability event! !️

In addition, this week I saw a rather peculiar signal on Reealized Profit,

Due to space, I will publish a separate post tomorrow (7/7) to explain,

Please look forward to it 🫡

//

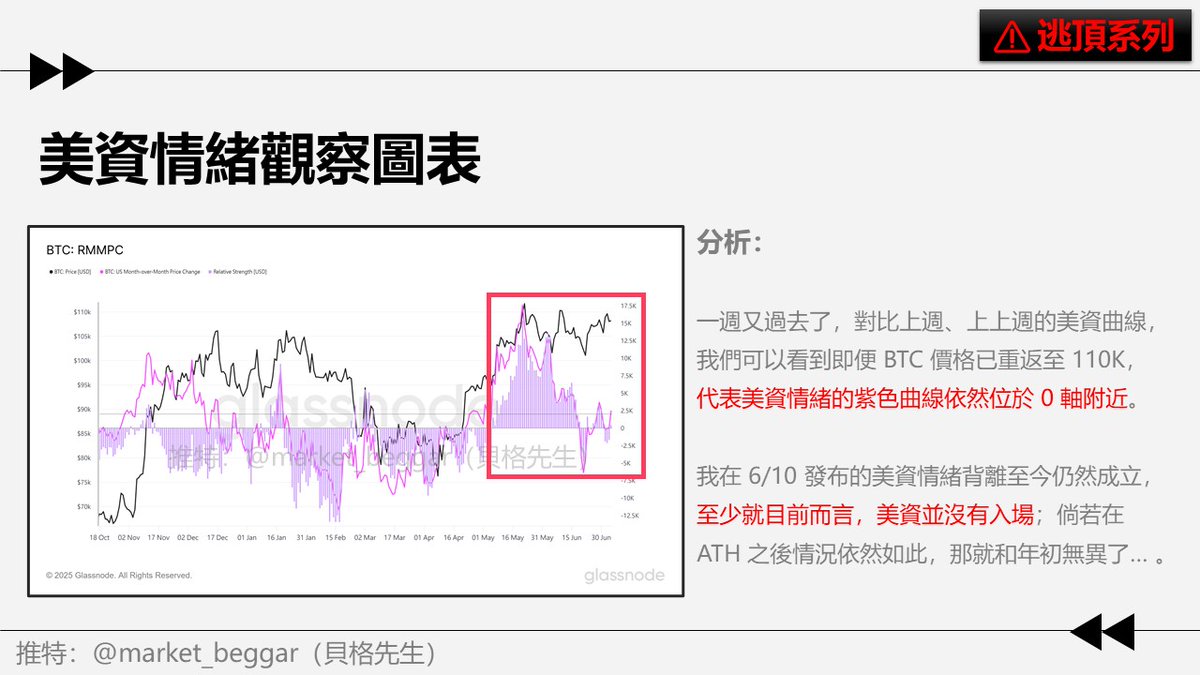

3) U.S. fund sentiment monitoring chart

For a detailed explanation of the U.S. Sentiment Monitoring chart, please refer to the previously updated post:

This week's rise did not bring up the purple curve that represents the sentiment of US funds.

The purple line is still hovering around the 0 axis, indicating that US sentiment is not repaired at the moment.

As long as the purple line does not follow the price to quickly rise upward,

Then the U.S. divergence signal I posted on 6/10 will still be valid:

It's still the same old saying: after a new high, it's time to decide the winner.

Will Lao Mei lead the army back to the market after the new high?

Or a reproduction of the top script ❓ that was sold to Asians at the beginning of the year and 2021

It's good to leave.

//

4) Conclusion

📝 Highlights:

1️⃣ URPD: The distribution rate has increased, and the large number of accumulation areas has expanded slightly, but it is still highly concentrated

2️⃣ RUP: Divergence is imperative and an update from Realized Profit will be released tomorrow

3️⃣ U.S. sentiment: It has not been repaired with the rise in prices, indicating that the puller is not the United States

-

The above is the 32nd issue of the chain report, I hope it will be helpful to you~

Below, I will attach this period of time in the comment area,

All the analysis articles related to "The Second Escape" are for your research and reference.

The old rules, all questions must be answered, I wish you all a happy 🍡 weekend

-

📚 This week's article is reviewed

The Calm Before the Storm: The Balance of Terror That Is Coming

Technical Analysis Views Update

Trading Q&A: 2 ways to enter the market in the swing system of individual contracts

Top 5 Buyer Groups Heatmap Update: Quietly Changing Behavior

New highs are imperative

23.81K

81

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.