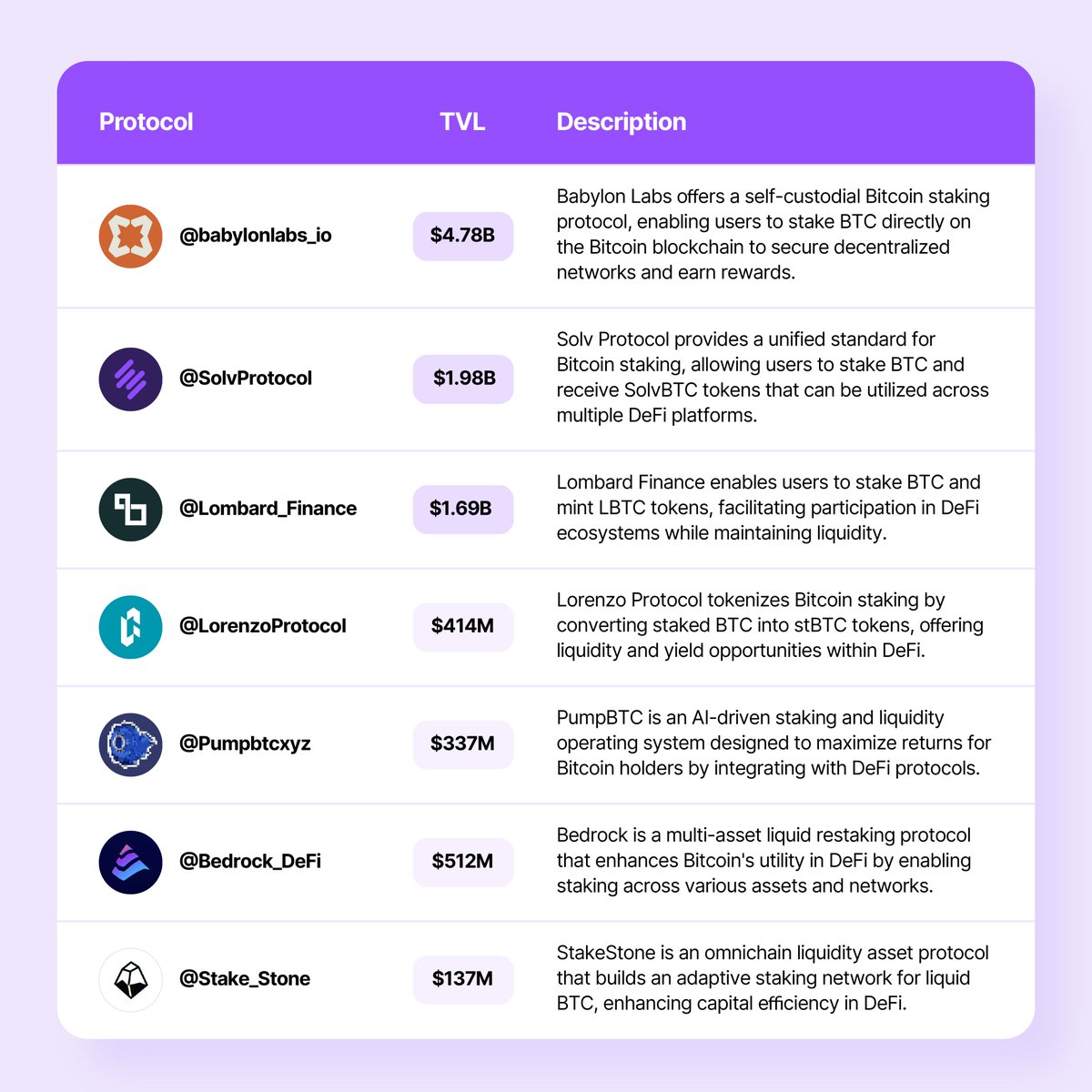

Table of the biggest Bitcoin staking protocols as of mid-2025, focusing on native, liquid, and DeFi-integrated solutions

.@babylonlabs_io ₿

Self-custodial Bitcoin staking directly on Bitcoin, securing PoS networks and earning rewards.

@SolvProtocol 🏅

Unified standard for staking BTC; users receive SolvBTC, usable across DeFi.

@Lombard_Finance 💵

Stake BTC and mint LBTC for use in DeFi, maintaining liquidity.

.@LorenzoProtocol

Lorenzo turns staked BTC into stBTC, making your Bitcoin liquid and usable across DeFi.

@Pumpbtcxyz 🚀

PumpBTC is an AI-powered staking and liquidity layer for Bitcoin, optimizing returns for stakers.

.@Bedrock_DeFi 🔄

Bedrock offers multi-asset liquid restaking, enabling BTC and other assets to earn rewards in DeFi

@Stake_Stone 🪨

Adaptive liquid BTC staking, enhancing capital efficiency and DeFi access.

1.08K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.