Update: Abraxas continues to be bearish on $ETH

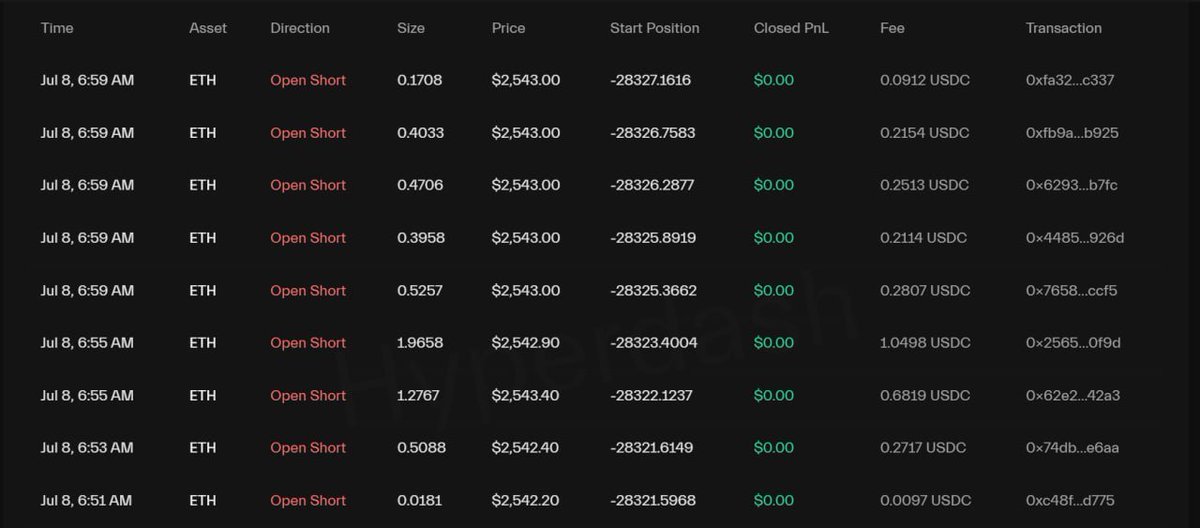

This morning, Abraxas continued to short $ETH at an average price of $2,520 - $2,550.

Currently, the average entry of the two wallets is $2,595 and $2,609 respectively.

The total PnL of the two wallets is currently ~ $52.8M and the short position on $BTC is down ~$2M.

Abraxas's continuous increase in short positions, especially with $ETH, indicates that they maintain a negative outlook on the market in the short term. With the new entry level close to the current price range, Abraxas likely expects the market to experience a stronger decline in the near future.

Join 52Hz to discuss the behavior of this fund!

Abraxas returns to the short market race

7 hours ago, 2 Abraxas wallet addresses took a notable action when transferring part of the VOL of short $BTC orders to $ETH.

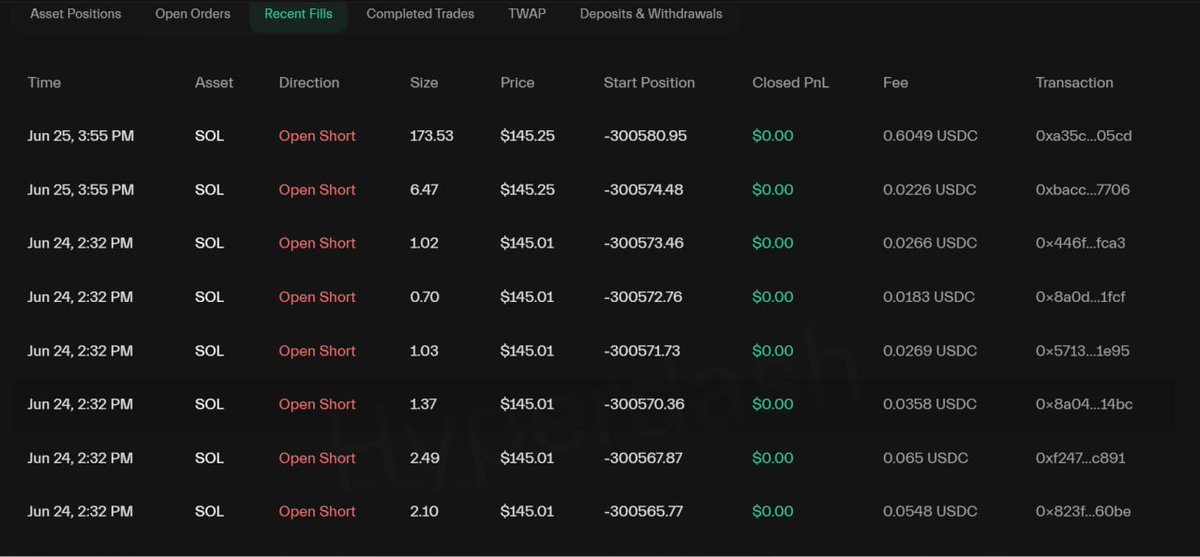

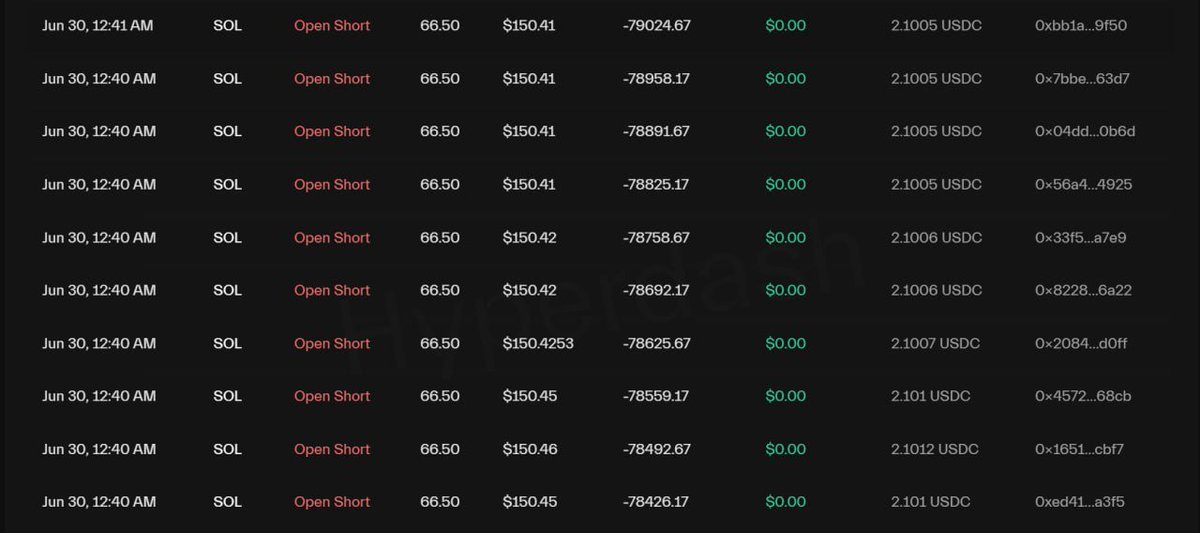

Specifically, this fund has just made a partial stop loss on short $BTC orders, and at the same time opened a series of short $ETH orders when the $ETH bounced up to $2,500. Along with that, these VCs also open more short $SOL orders in their portfolio.

Up to now, Abraxas' 2 wallet addresses are quite sensitive to the market when opening short orders are in a "beautiful" position, and at the same time cash out at the strong correction and before the upside.

$ETH was once the largest profitable short order for Abraxas, will this comeback continue to help Abraxas repeat history, making a profit of $100M.

Note that all Abraxas' take profit orders are only small or medium vol, that is, the main trend of these 2 wallets is still short and is mainly holding open orders from 06/06.

This wallet is still a fairly good timing wallet for market signals, you should follow it to predict market changes in the near future.

14.51K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.