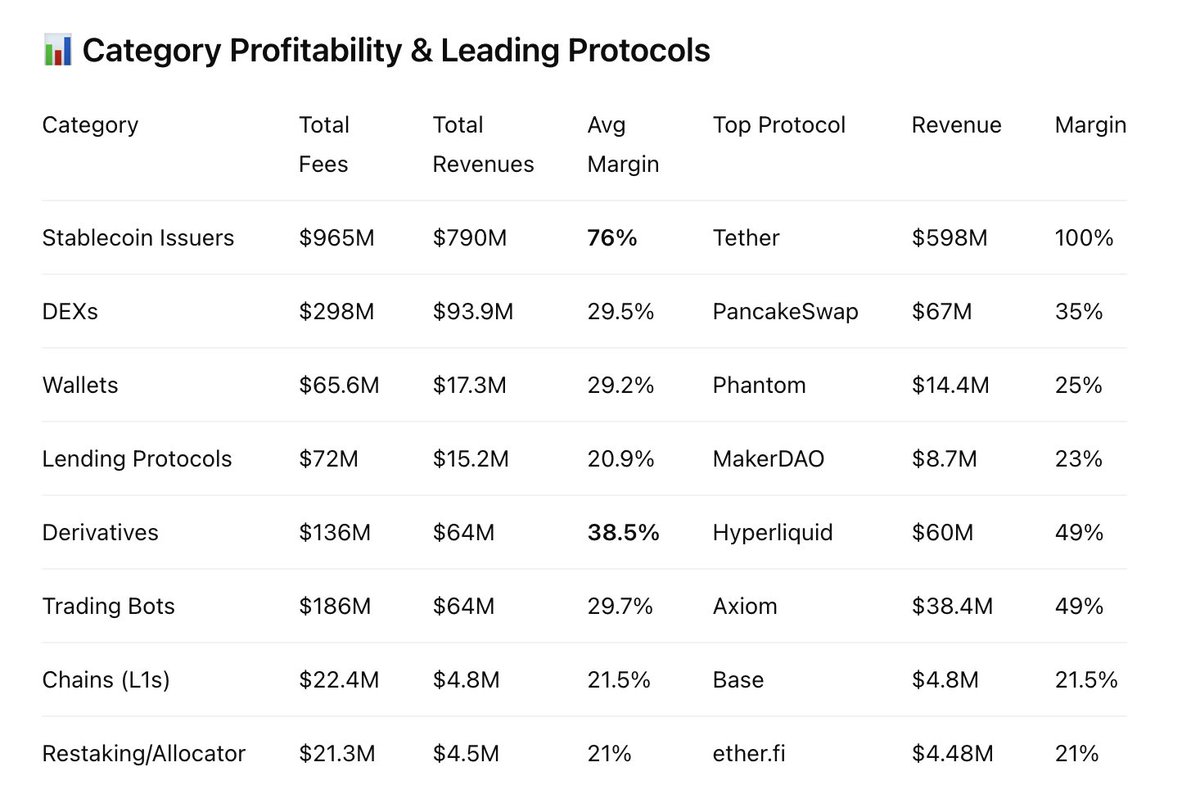

Protocol fees vs. revenues: who are really making money? 🧐

Which protocols are truly capturing value, and how do profit margins differ across categories?

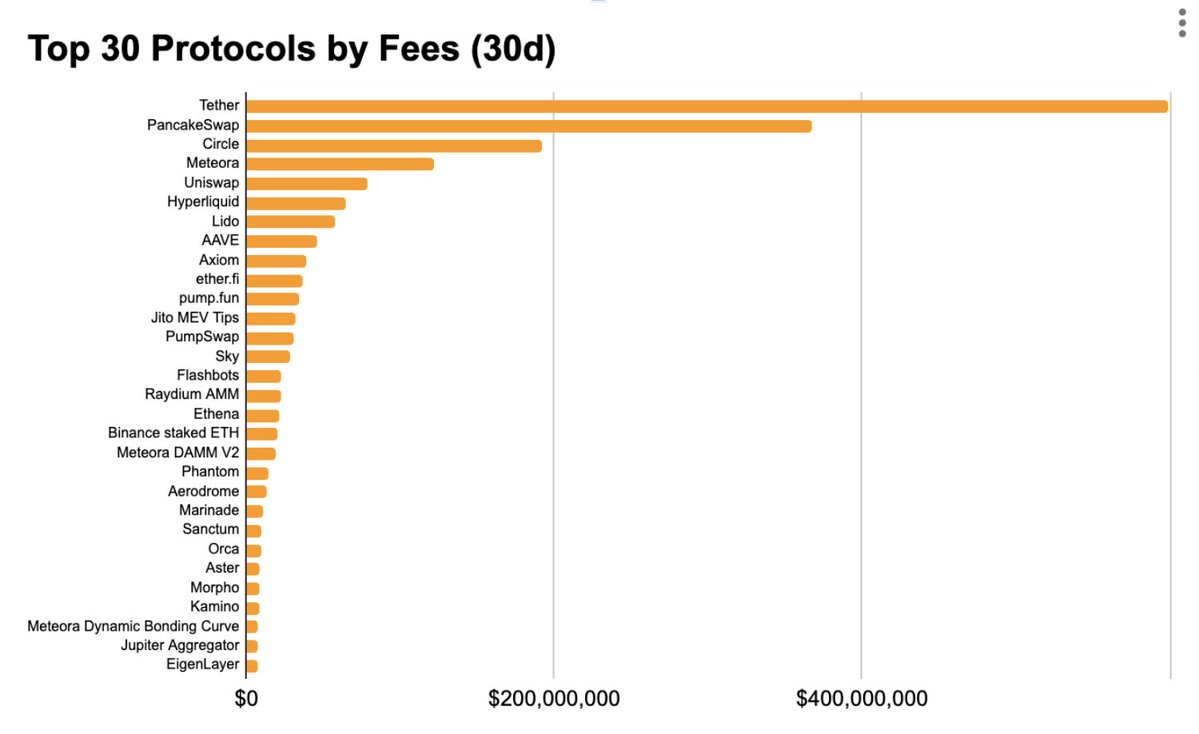

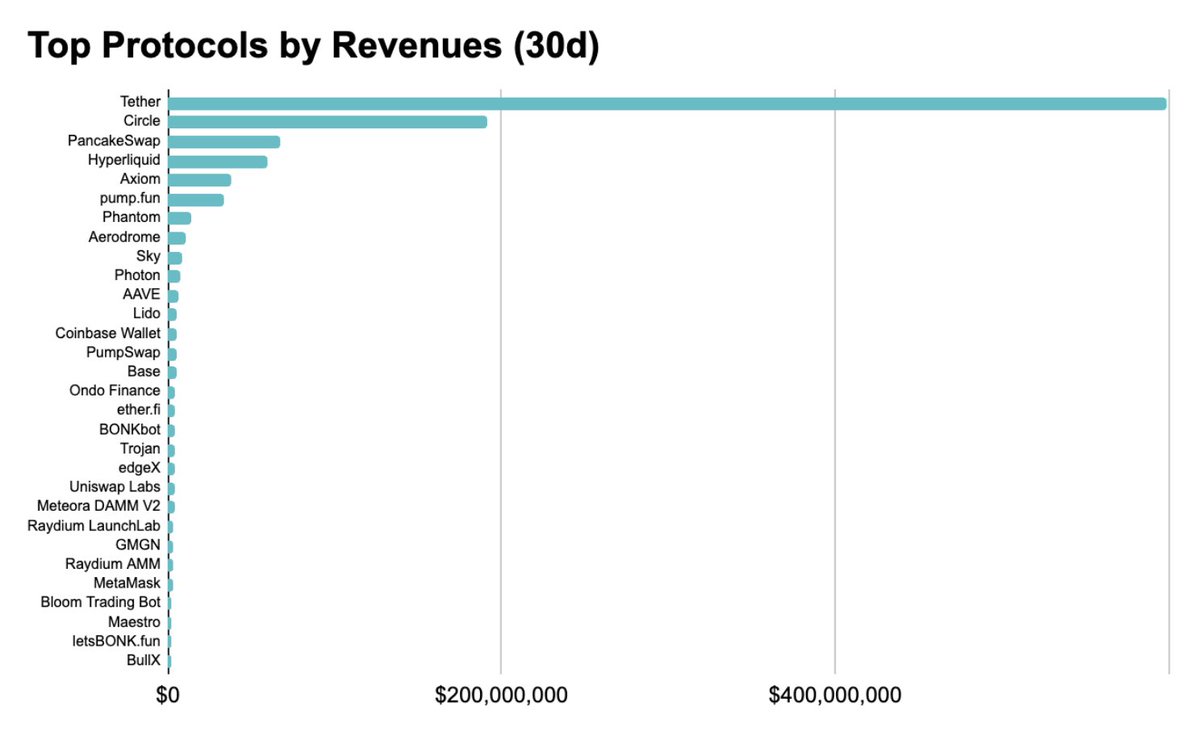

I crunched the numbers from @DefiLlama on the top 30 protocols by fees (30D) and compared them to the top 30 by protocol revenues. The outcomes are interesting

0⃣Basics

> Fees = total fees paid by users when using the protocols

> Revenues = subset of fees that protocol allocate to itself, which excludes (similar to gross revenue)

> Profit margin = Revenues / Fees, which indicates capability to capture revenues out of fees;

1⃣ Stablecoins Dominate

Tether & Circle top both lists. 100% of fees = revenues. Together they earn more than all DEXs & L1s combined.

2⃣DEXs Varying in Value Capture

@PancakeSwap ranks No.1 among DEXes, with 35% profit margin driven by Binance Wallet IDOs & Alpha airdrops.

Uniswap, Aerodrome, Raydium vary widely in fee capture efficiency.

Hyperliquid dominates Perp DEXs with near 100% margins (64.5M in fees —> 60M in revenues)

3⃣Launchpads: Solana Leads Charge

All top-earning launchpads are on Solana.

@pumpdotfun led with 53% margins. @RaydiumProtocol LaunchLab also posted solid gains. & Raydium now locked in a revenue rivalry.

4⃣LST & MEV: High Fees, Low Revs

🔸Liquid Staking: @LidoFinance , BNB Staked ETH, @MarinadeFinance generate big fees; only Lido cracks earnings top 30, keeping just 10% after paying validators & LPs.

🔸MEV: Jito MEV Tips & @Flashbot show big fee inflows. But profit is slim after splitting tips with validators & high infra costs.

5⃣TG Bot: Low Fees, High Revs

7 TG trading bots hit earnings top 30 despite not topping fees. TG bots can achieve decent revenues with a relatively smaller but active user base.

Axiom leads all protocols in revenue. But I wonder how sustainable since many studios are reportedly farming its referral fees.

For TG bots, the actual margins might not be very fat since the ops and maintenance costs are quite high.

6⃣Wallets: Rising Revenue Powerhouses

@phantom earned $14M in the past 30 days, outperforming many DEXs. @CoinbaseWallet and @MetaMask also show strong revenue figures

Wallets are one of the most profitable categories with nearly 100% profit margins, due to in-app swap fees and minimal subsidies (unlike DEXs).

As a key distribution channel for on-chain protocols, wallets with active user bases are becoming on-chain revenue powerhouses.

513

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.