Pal's $BTC Market Daily Report - 7.5🔥

Daily Chart

1) The market continues to build oscillation, and the daily level is still oscillating around 10-11. After making EQH (Equal High liquidity) above, it has pulled back down, currently acquiring fvg.

The drop yesterday was still due to Trump's tariff issues and the activation of ancient BTC addresses.

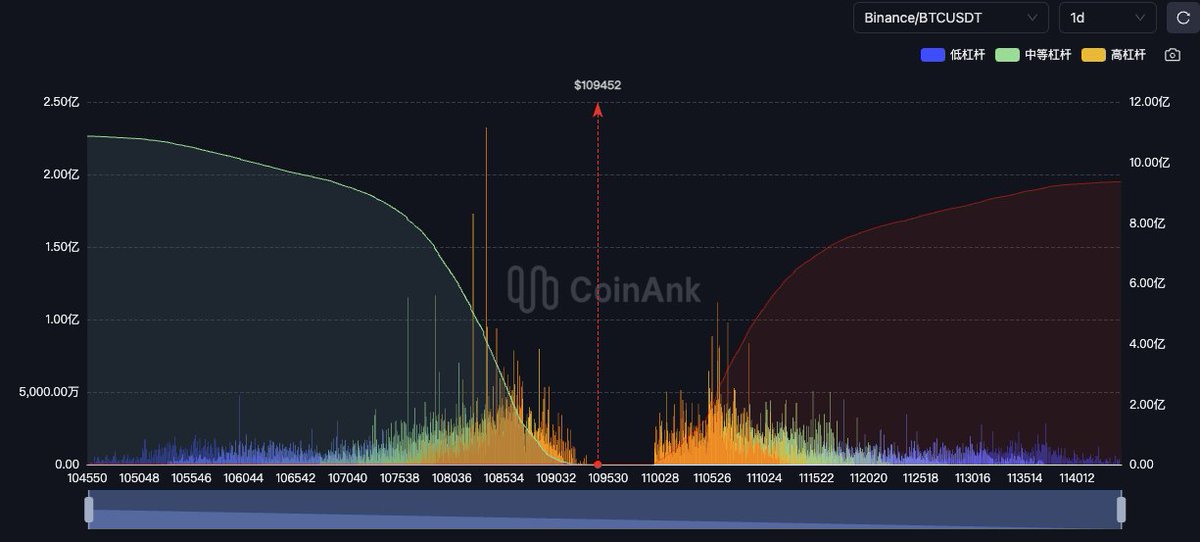

2) Liquidity:

Above: 1085 fvg gap (small scale)

1106 Eqh (key waiting for raid)

1120 bsl new high (breakthrough in oscillating market still needs some information push)

Below: 1051 D ssl + 104 fvg raid ssl chain replenishment fvg

981 Wssl + D bullish ob key focus on buying

Currently, at the daily level, the attraction of liquidity above is 🧲 greater and closer.

3) Currently, on the weekend, without any disturbances, it is again in low oscillation, and the price is exactly at the eq position between 105-1106 ssl and eqh. If it maintains oscillation above 1078, the probability of going up is greater.

Conversely, the probability of going down is greater.

Hourly Chart

1) There is an msb here on the hour, but the effectiveness of the oscillating msb is limited. V reversal is common, so knowing that the current pullback rejection can continue down is fine.

2) As mentioned yesterday, the 1078 position is a support-resistance conversion point. Last night, it tested down here, and there was a bullish ob, resulting in an upward rebound.

For the rebound, first look at acquiring the 1085 fvg, then focus on the bearish ob. Here, reject the distribution to short, stop loss at 1092.

If it breaks through here, then continue to look for a raid at 1106.

The bearish ob here is similar to the 1078 position during the 2 upward movements.

Of course, if it breaks below 1071, then there’s nothing more to say, continue down to look at 1056.

So, if you have a long position, be sure to set a stop loss at 1071.

$usdt.d

Okay, we saw a pullback after the H4 bullish ob, resulting in an upward rebound. Here it has reached the Eq position.

Similarly, if it stands firm at eq, continue to look up, corresponding BTC is about to drop.

If Eq rejects, then pay attention to continue pulling back to test H4 bearish ob.

Pal's $BTC Market Daily Report - 7.4🔥

Daily Chart

1) Continuing upward, here we are building Eqh again (spot has arrived, contracts are still a bit lacking), so the current question is:

a. Eqh 1106 must be hit, how to hit it, go straight up to hit it, or come down to fill the 1075 fvg before going up to hit it.

b. After hitting 1106, will it plunder down, or continue to make new highs?

c. After making new highs, can it continue to push the price upward?

2) At present, I think 112 new high is still a pressure point, we need to further observe whether short positions are forced to close or if there is significant positive news to drive it.

So from a daily perspective, pay attention to the shorting after the spike at 1106.

3) Therefore, at this stage, the overall strategy is still bullish, then take short positions briefly.

Then act less, observe more, if you don't act, you won't lose.

Hourly Chart

1) This black range is the H4 line constructed at 8 PM last night.

2) Currently, it is oscillating at eq, tonight the US stock market is closed, plus a three-day weekend, so continue to look for oscillation first.

3) So the current operation is

Pay attention to the ob 1089 position to accumulate and go long,

Pay attention to the plunder after 1106 and then distribute to go short.

If it breaks below 1084, then short on the pullback.

Currently, you cannot operate in the internal oscillation, just operating at eq here is betting on up and down.

Both bulls and bears are in agreement now, just watch the show.

11.48K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.