When a chicken stands on a lawn, the first thing people see and describe is "a chicken on the lawn". Human attention bias makes the "chicken" stand out from the "lawn", and people will be more concerned about what the chicken looks like and what it is doing. Who is becoming the chicken, who is a little grass in this lawn, and how we choose to be who may be the next topic for infofi

After the second half of the night, I wrote two simple sentences. It has only been half a year since @KaitoAI raised the banner of InfoFi, but it has already changed the pattern of Twitter information flow and marketing in the currency circle.

But I've always felt that my understanding of InfoFi is a bit different from @Punk9277, so I don't think it's interesting enough to be consistent with all kinds of lip licking.

The following is a few thoughts, which do not constitute financial investment advice:

- Kaito's core is distribution (currently slogan also talks about "distribution layer"), which is a good broker business.

- But the core is that the broker can't do pricing, there is no traffic pool in nature, and there is no capital sinking. This is the same reason as @cyrilxuq said that "web2 media can't do pricing, platforms can".

- Therefore, in addition to opening a pledge and a long platform, I will definitely take advantage of the trend to do a launchpad and try to do an asset launch. Therefore, there is no logical problem with bullish $kaito at this point.

- But the previous @stayloudio and so on were very unsuccessful attempts, and the launch and trading itself were actually okay, but the biggest problem was that the launch pad was made a psychological hard top, which is not a good thing. Teacher Yuhu was shot by the bad guys in the crowd.

- At its core, InfoFi is about pricing information if it can affect the price of other targets. The second half of the sentence is important because a bunch of AI-generated information with an entropy close to zero is simply not worth the price. It's more about the project party giving money, Kaito as a baton to make KOLs turn, and the false prosperity of people below the middle waist is teasing.

- The reason why I was interested in InfoFi, and why it was urgent, was because of ████████████████████████. Things are being done, and they have nothing to do with the currency circle, it is better to learn by doing than to do more than words, and the right time will be spoken.

- It's interesting to think about, and it's not a simple rhyme from the last few cycles, but the core is:

1. The way humans interact with information is about to change fundamentally compared to search engines and recommendation systems.

2. The marginal cost of human production and dissemination of disinformation is rapidly approaching zero.

3. Most of the marginal buyers, inspired by @primitivecrypto, have undergone a fundamental change in the decision-making style of behavioral finance.

Compared with rational people's assumptions, focus time drops sharply, decisions are shorter and faster, and the boundaries between entertainment and investment will become more and more blurred.

If the fruit is rotten, it will rot, and the world will become more and more chaotic. Picking on the fire and adding fuel to the fire are both options, and we always choose the harder one.

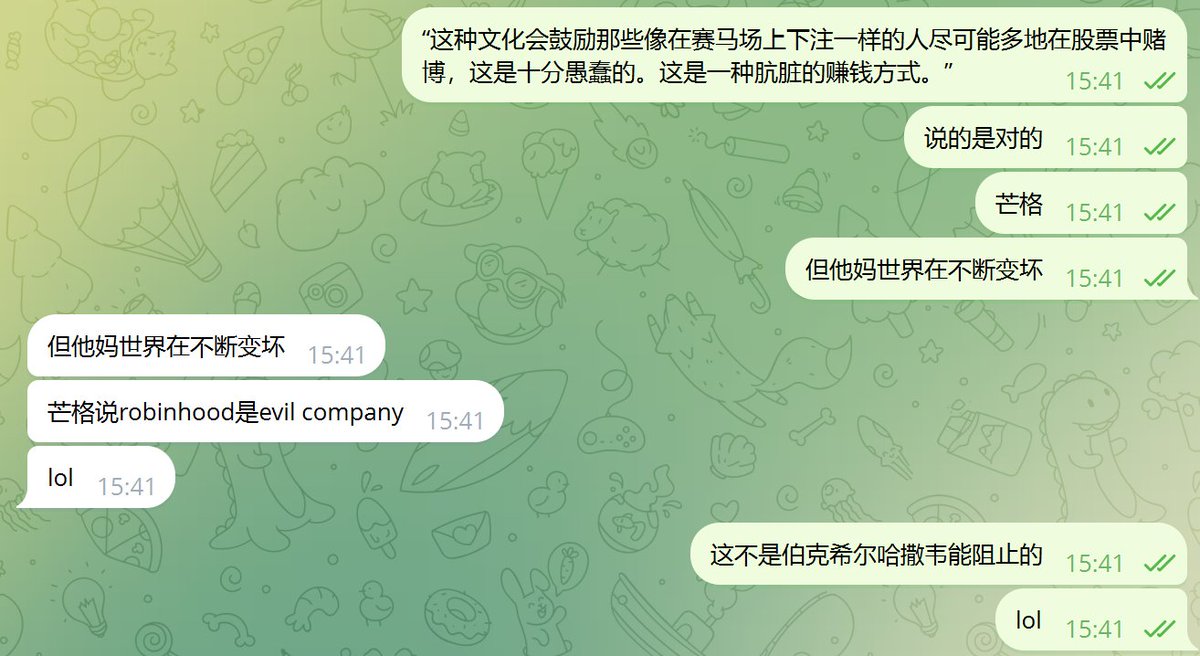

Conclude with a conversation with a friend:

1.72K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.