1/

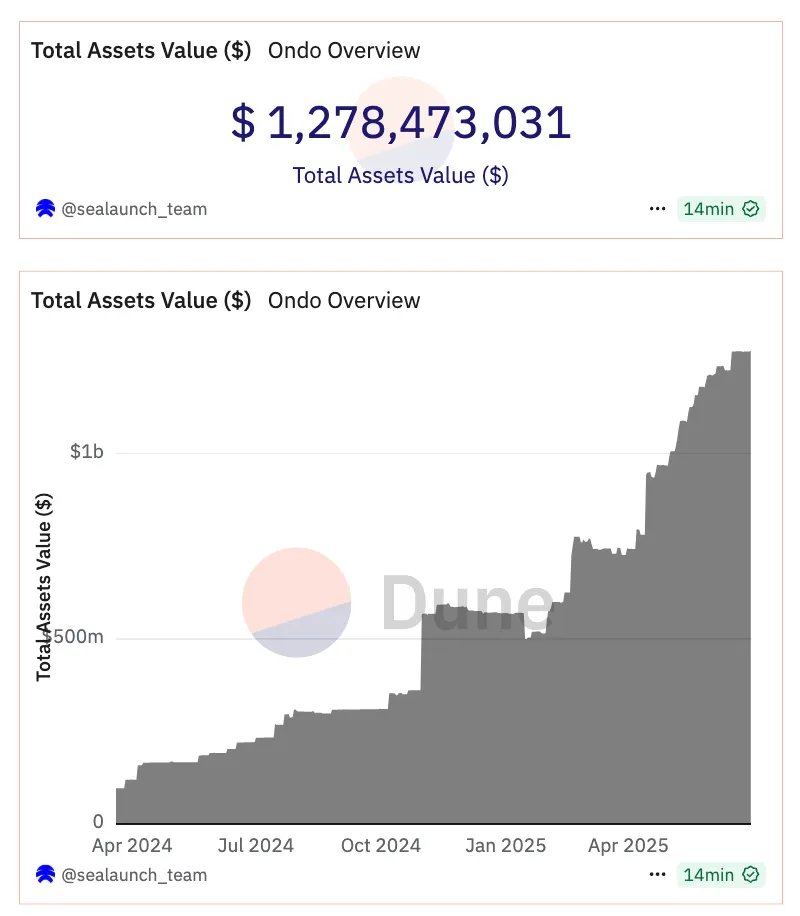

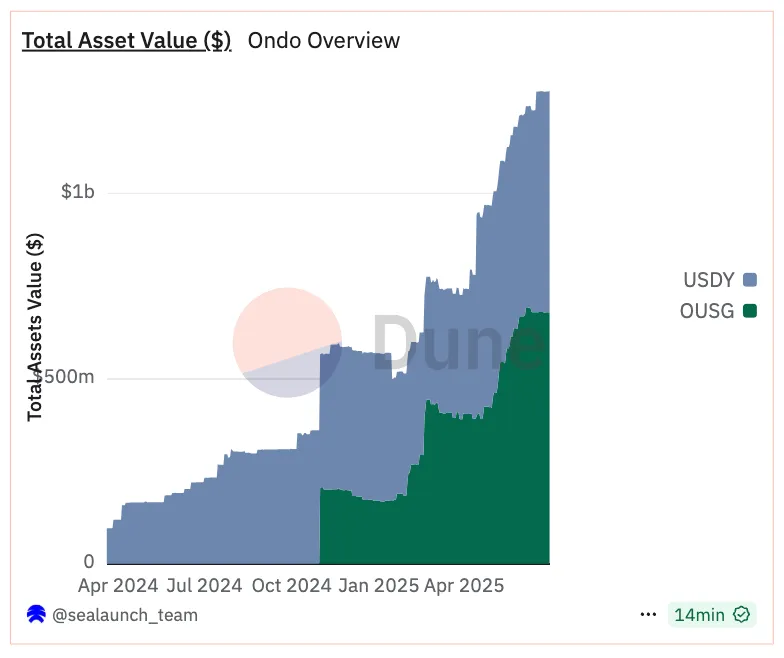

@OndoFinance has been scaling RWA, namely tokenized Treasuries (OUSG) and yield-bearing usd (USDY) onchain.

Demand for these RWAS has pushed Ondo total assets value onchain from $95M in April’24 to $1.28B now

→ up >1,268% (13x growth in 14 months).

2/

Ondo offers two flagship products:

Ondo Short-Term US Government Bond Fund (OUSG): Tokenized exposure for Qualified Purchasers to short-term US Treasuries & money market funds. Instant 24/7 stablecoin minting/redemptions.

Ondo U.S. Dollar Yield Token (USDY): A yield-bearing token backed by short-term Treasuries & bank deposits. Structured like a stablecoin but with real yield, transferable onchain after a 40–50 day cohort period.

3/

Check our @Dune dashboard tracking @OndoFinance RWAs below

5/

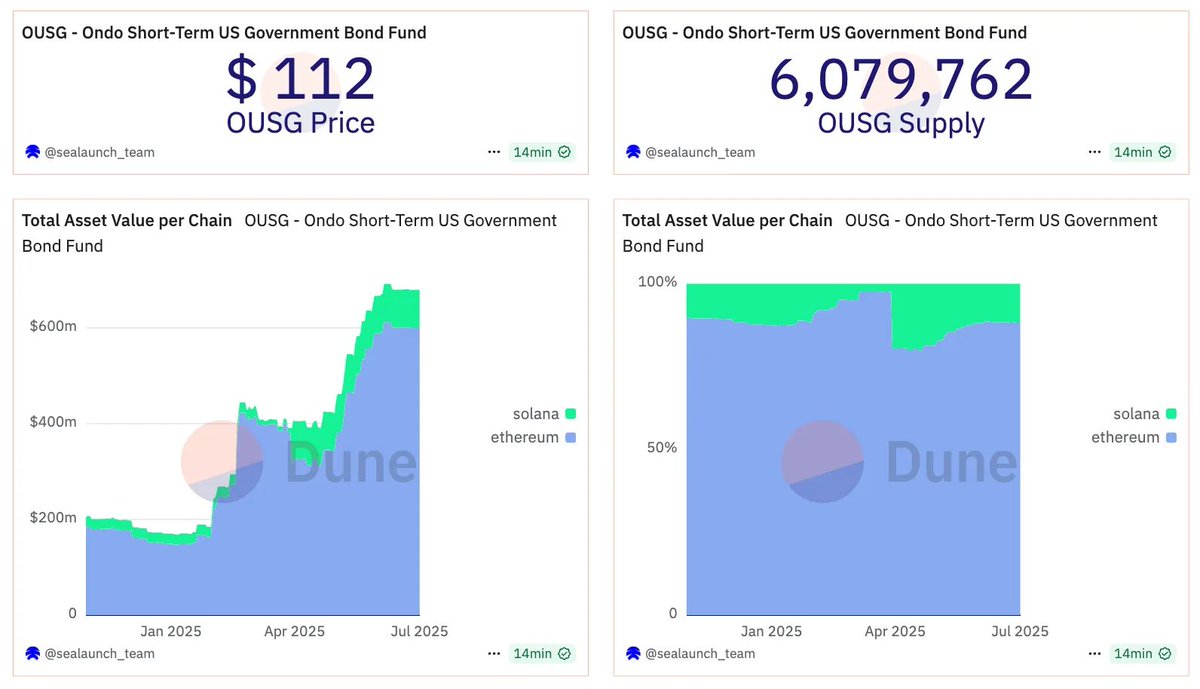

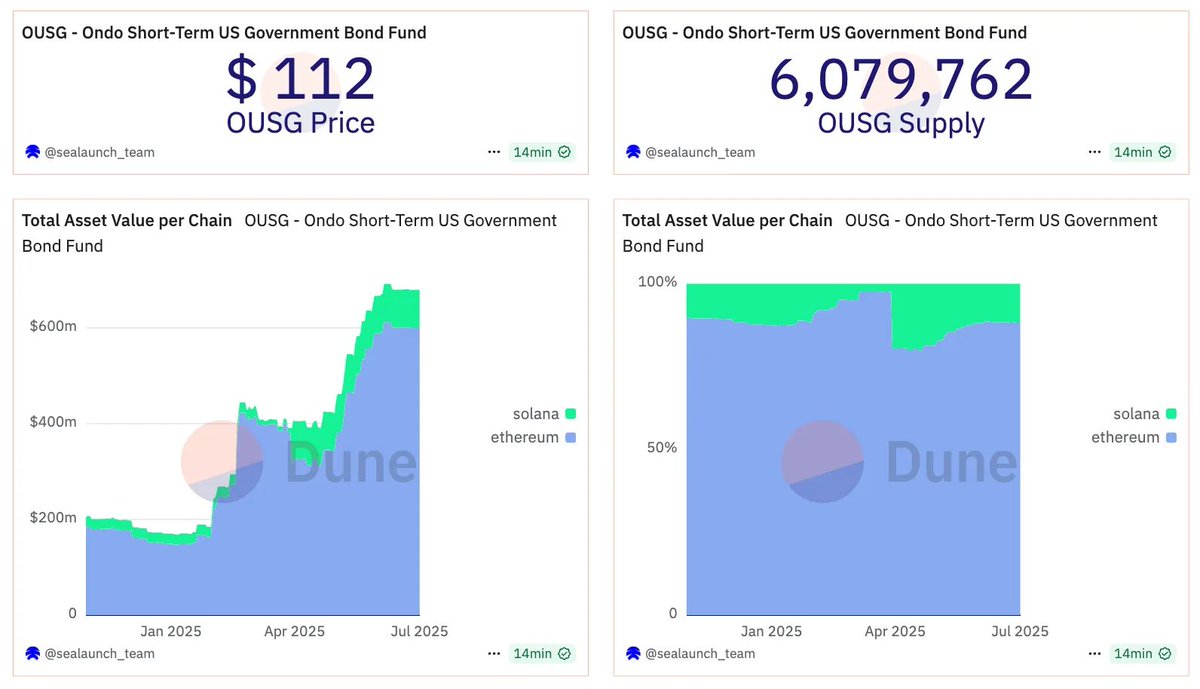

OUSG

Holders get liquid exposure to ultra-low-risk US Treasuries via BlackRock, Franklin Templeton, and others.

88% of OUSG’s supply sits on Ethereum; Solana is next in share. Investors can choose “accumulating” or “rebasing” tokens to manage yield accrual.

6/

USDY

Accessible to non-US individual & institutional investors. Unlike stablecoins, USDY holders earn yield from underlying assets (less fees). Structured to be bankruptcy-remote with third-party oversight.

Secured by US Treasuries & deposits, distributes yield to holders, with redemption protections enforced by an independent trust agent.

5.21K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.