Why the #Robinhood x #Arbitrum rumors actually make sense and why I strongly believe we'll soon see an official announcement!🔥

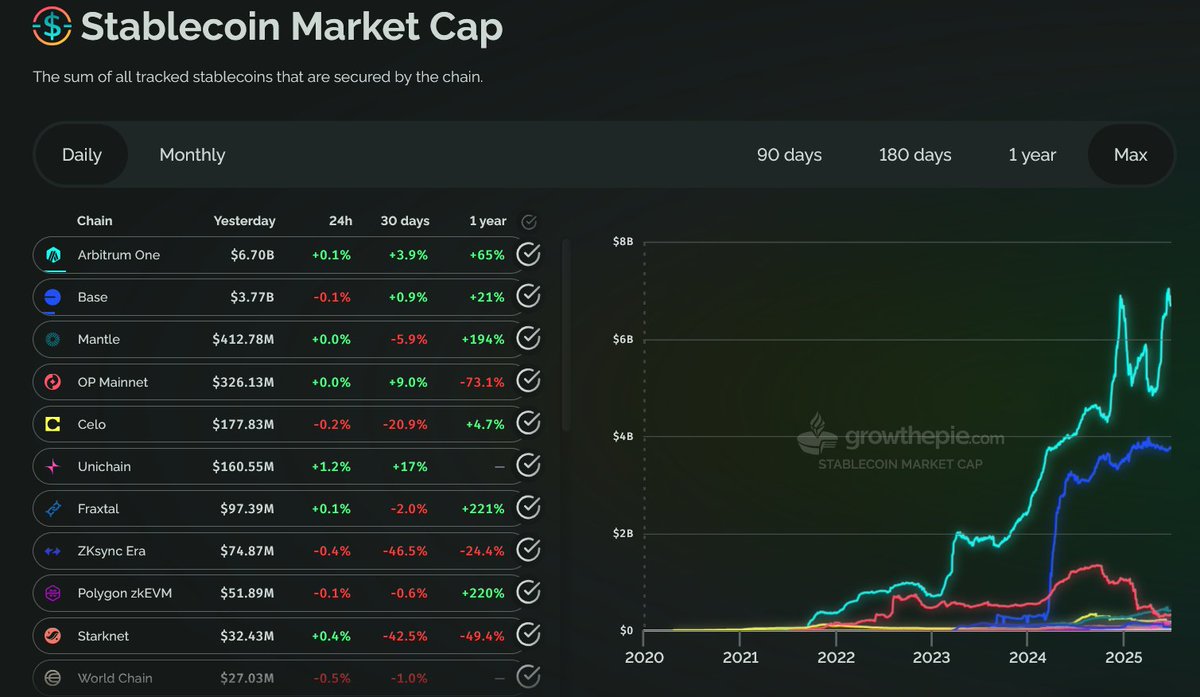

➡️Just look at stablecoin liquidity secured by ETH L2 networks:

🔸 Arbitrum: $6.7 billion

🔸 Base: $3.7 billion

🔸 Mantle: $413 million

Arbitrum is clearly the top DeFi ecosystem among L2s. Robinhood naturally wants to tap into this massive liquidity pool.

🔸 Strategic fit: Robinhood's goal is tokenizing stocks, real-world assets, and advanced financial products.

#Ethereum Layer 2s like Arbitrum offer exactly the flexible and customizable infrastructure they need.

🔸 Why not Solana, Sui, or another Layer 1? Layer 1 blockchains can’t match the customizability and scalability Robinhood requires. #ETH’s Layer 2 solutions are simply better suited for ambitious onchain finance applications.

These aren’t random rumors. From a strategic viewpoint, Arbitrum is clearly the most logical choice for Robinhood’s big crypto push.

Watching closely for official confirmation soon! 👀

8.14K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.