This weekend I’m talking about the only meta that matters right now

I’ve been tracking how new projects grow in this cycle and there’s one meta that keeps surfacing.

It’s not about long-term value. It’s not about PMF.

It’s about attention liquidity.

Here’s the current playbook I keep hearing from founders, insiders, and even #Yappers themselves:

▸ Pay ~$150K to get on #Kaito’s leaderboard

▸ Allocate 0.5–1% of supply to Yappers + @KaitoAI ecosystem

▸ Allocate 0.5–1% to incentivize testnet users (many of whom are internal wallets)

▸ Spend ~$40K for monthly top-100 Yappers to start buzzing

▸ Pitch to CEXs once you’re trending, listing is easier when mindshare is high

▸ TGE + airdrop after 2 months

▸ Use MMs to “stabilize” liquidity (read: controlled dumping)

▸ Exit on FOMO

▸ Start a new project

I’m not judging, just observing.

In an era where mindshare = liquidity, this model works… until it doesn’t.

The question is:

Who ends up holding the bag and who’s building something that survives beyond the leaderboard?

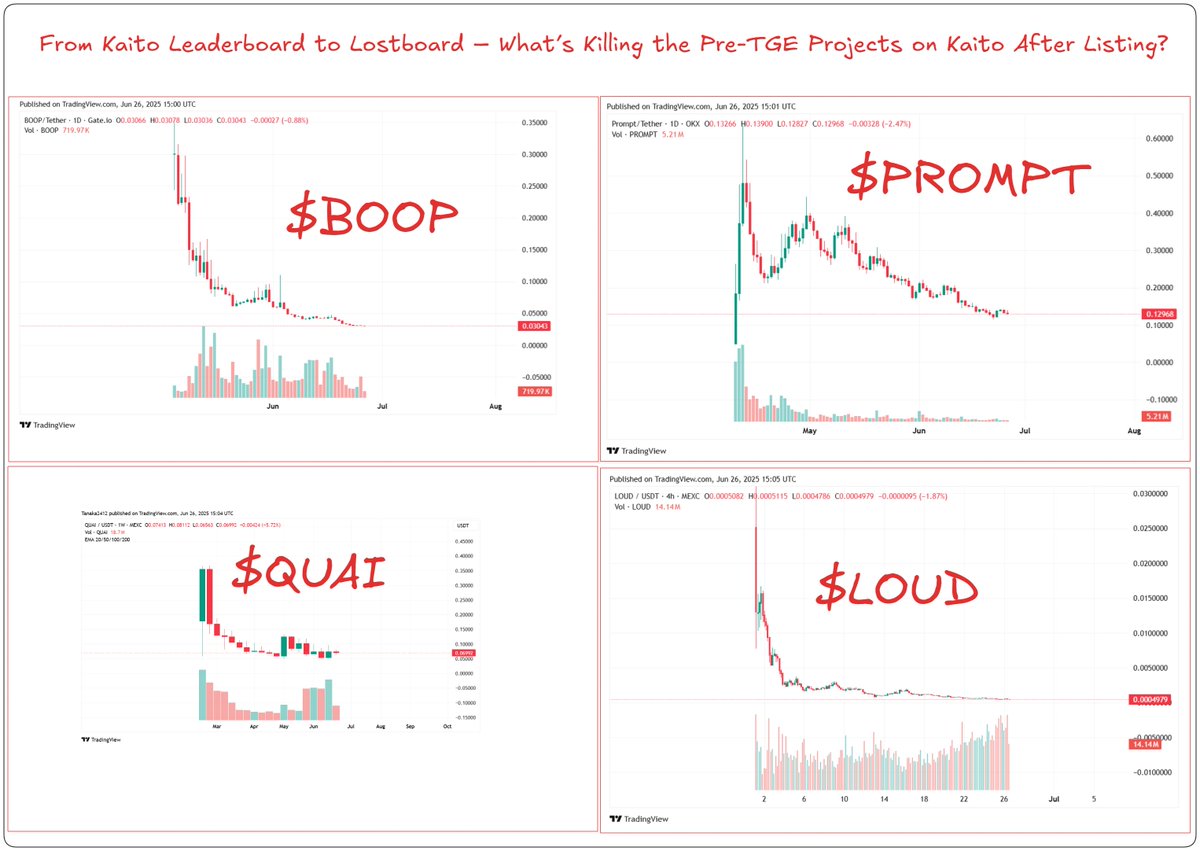

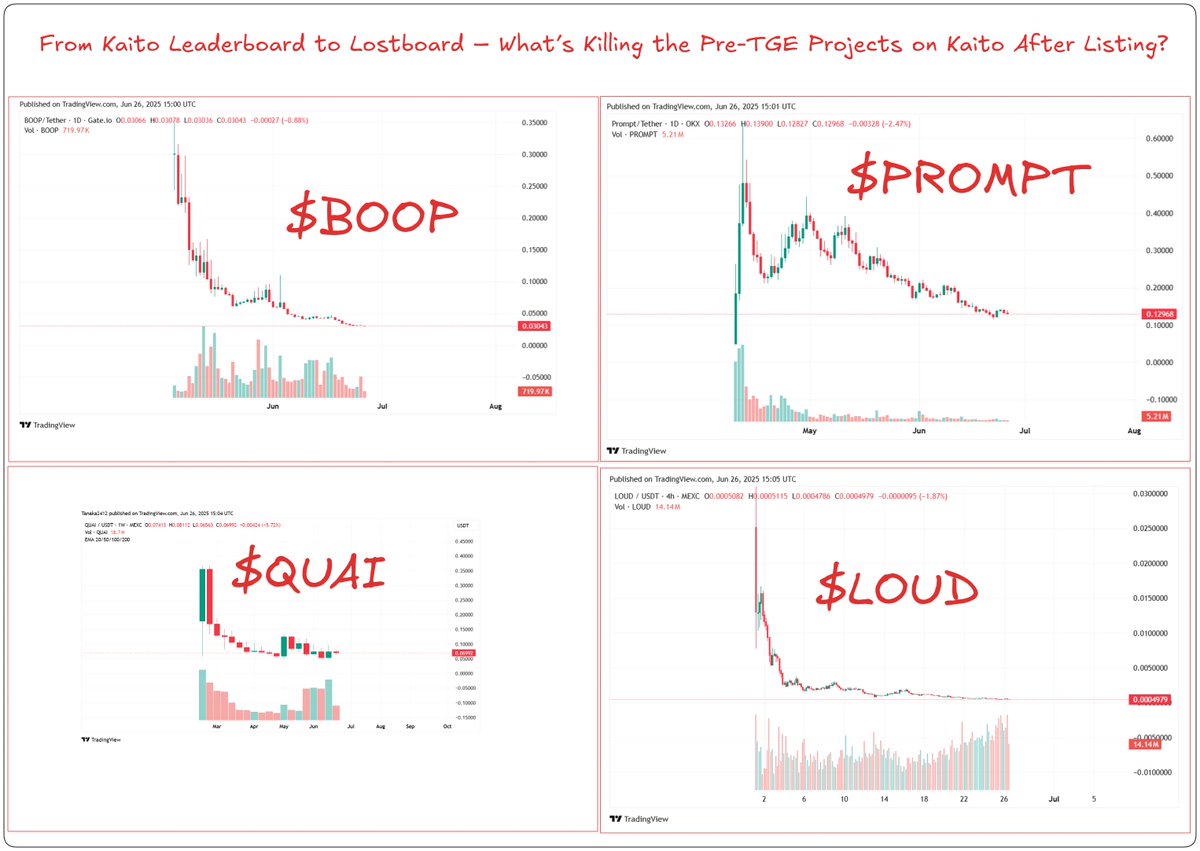

From Kaito Leaderboard to Lostboard – What’s Killing the Pre-TGE Projects on @KaitoAI After Listing

#Kaito's leaderboard has become the home for some of the most hyped pre-TGE projects, like $BOOP, $PROMPT, $INIT, $QUAI, and $LOUD....many more.

These tokens get everyone’s attention, climbing the ranks on the platform with huge communities, solid engagement, and a lot of promise.

But what happens after the TGE? More often than not, it’s a steep fall: price dumps, fading trading volumes, and the community slowly dissipating into the ether.

So, what’s really going on here?

13.93K

95

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.