Are you connecting all the dots? 🤔

PACT is heating up 🔥

connecting all the dots...

@aptos just climbed to #3 in rwa value at ~$542 million, and this jump came from private credit with @pactconsortium launching new debt pools on aptos. credit is already proving to be the growth engine for rwa on this chain.

and credit matters:

→ tokenized invoices and treasury bill repos behave like crypto-native money markets

→ yields range from 8–12% in usd, well above the 4–5% on tokenized treasuries

→ credit tokens appear as regular erc or move assets, so they plug into collateral loops, leverage strategies, and liquidity pools without kyc gating

→ they emit interest and principal redemptions, allowing defi protocols to treat them as income-producing collateral

on ethereum, credit has shown early scale:

→ @maplefinance: ~$777 million in active real-world loans

→ @centrifuge: ~$437 million in credit vaults

→ @goldfinch_fi and others: push the total above $1.4 billion

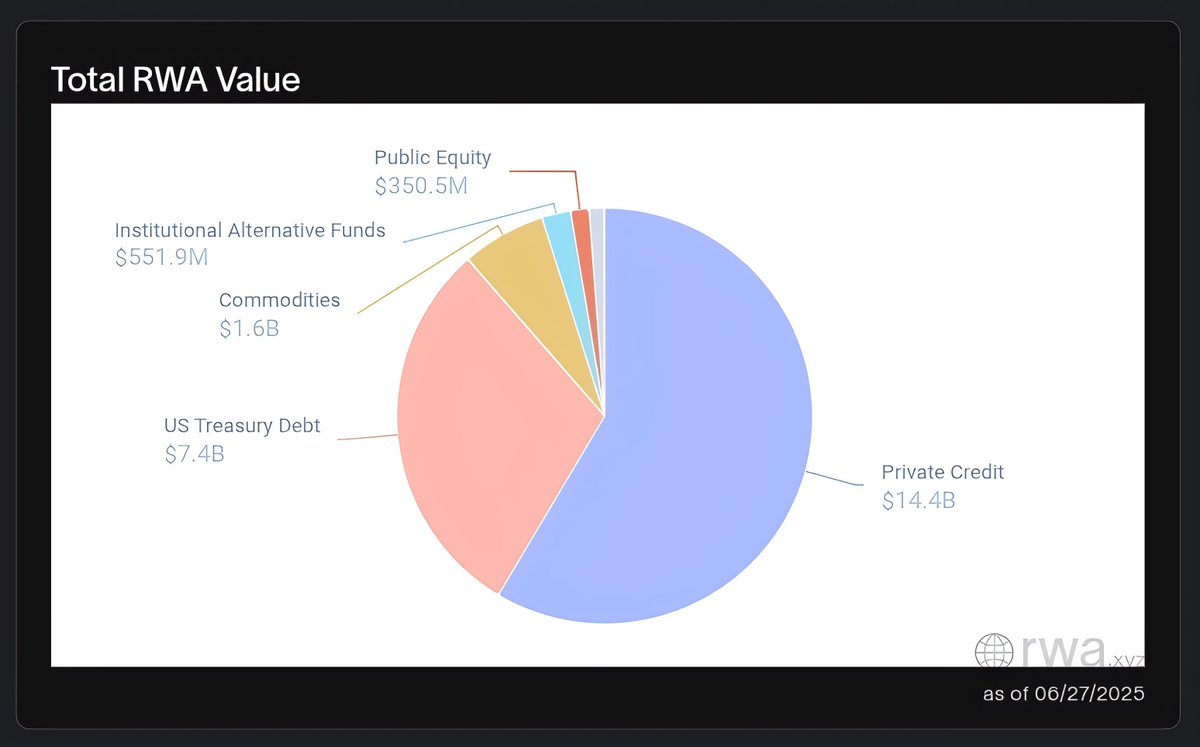

by contrast, tokenized treasuries like @BlackRock's buidl, @OndoFinance's ousg, and @FTDA_US onchain funds account for ~$7.2 billion overall. but while treasuries dominate by value, credit sits closer to the core defi loop. it’s more composable, offers higher yield, and supports recursive strategies.

aptos takes these credit primitives further. sub-cent fees and 650 ms finality enable real-time lending, borrowing, and settlement. this makes tokenized credit behave like live capital. usable, liquid, and composable. the result is a foundation to build new layers: synthetics, derivatives, margin trading, insurance.

this is where @aave v3 becomes essential. aave already works with centrifuge, goldfinch, and others on ethereum. so bringing aave to aptos means:

→ on-chain credit markets using off-chain yield

→ stablecoin liquidity backed by tokenized treasuries

→ instant, low-cost access to tokenized bonds and invoices

basically, aave on aptos + aptos' infra = the kind of setup RWA builders dream about

imo credit is the most bullish slice of the rwa pie. and on aptos, it’s already showing product-market fit. aave on aptos adds the final piece, battle-tested defi infra, to scale it. together, they give rwa builders exactly the setup they’ve been waiting for.

1.76K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.