Could Harmonix Be the Yield Application Layer on HyperLiquid Making Capital Move ?

@harmonixfi isn’t just another yield protocol — it’s the hl native infrastructure powering sustainable and composable DeFi yields on Hyperliquid.

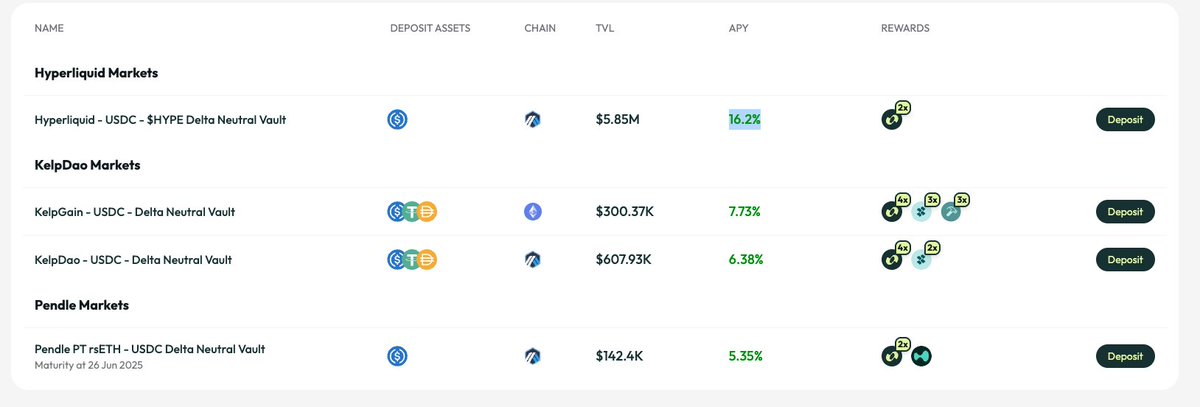

So far, Harmonix has attracted over $7.4M in total value locked (TVL) across its vaults, with a growing community of around 5,000 users. While it may not yet be the largest DeFi protocol by size, the pace of growth and adoption is undeniable — and well worth watching.

Among its suite of products, the USDC vault on HyperEVM stands out, delivering an impressive 16.2% APY, making it one of the best-performing stablecoin yield vaults in the entire HyperEVM ecosystem.

Let's dive deeply into Harmonix from its core technologies to vault strategies and ecosystem vision.

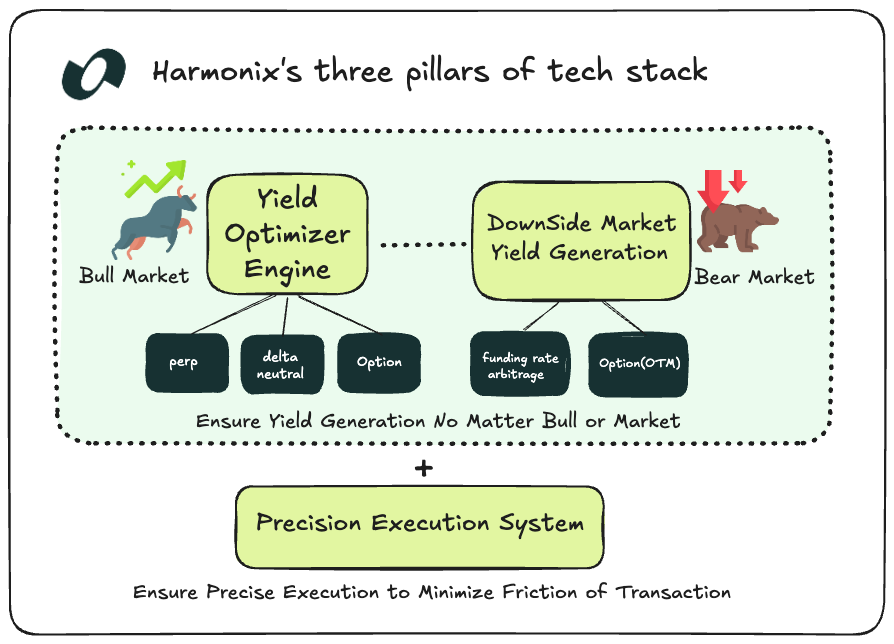

(1/) Technology: Yield Optimization Meets Precision Execution

At the core of Harmonix lies a powerful Delta-Neutral Engine — enabling users to earn yield without directional market exposure. This is supported by three foundational components:

1. Yield Optimizer Engine

The Yield Optimizer is Harmonix’s intelligent brain, dynamically allocating user assets across delta-neutral strategies, perpetual futures, and options-based hedging.

Unlike conventional vaults that lock capital into static strategies, Harmonix adapts to market conditions in real-time. For example, users depositing staked ETH can retain upside potential while their yield is looped through Pendle, extracting additional returns.

2. Downside Market Yield Generation

Markets aren’t always bullish. Harmonix thrives even in downturns by employing:

- Funding Rate Arbitrage on Hyperliquid (mainly) and other perp platform

- Options-Based Hedging via out-of-the-money puts on Aevo

These techniques turn volatility into predictable yield while protecting user capital.

3. Precision Execution System

Slippage and inefficiency erode returns. Harmonix’s Precision Execution System routes trades across the best DEXs, minimizing costs while maximizing efficiency. It's the final piece that ensures yield isn’t just earned, but captured with precision.

(2/) Product: Vaults That Move Capital, Not Just Store It

To date, Harmonix has launched five active vaults, onboarding capital from chains like Ethereum and Arbitrum, and reintegrating it into the HyperEVM ecosystem. Each vault is designed to compound liquidity locally while offering users consistent returns.

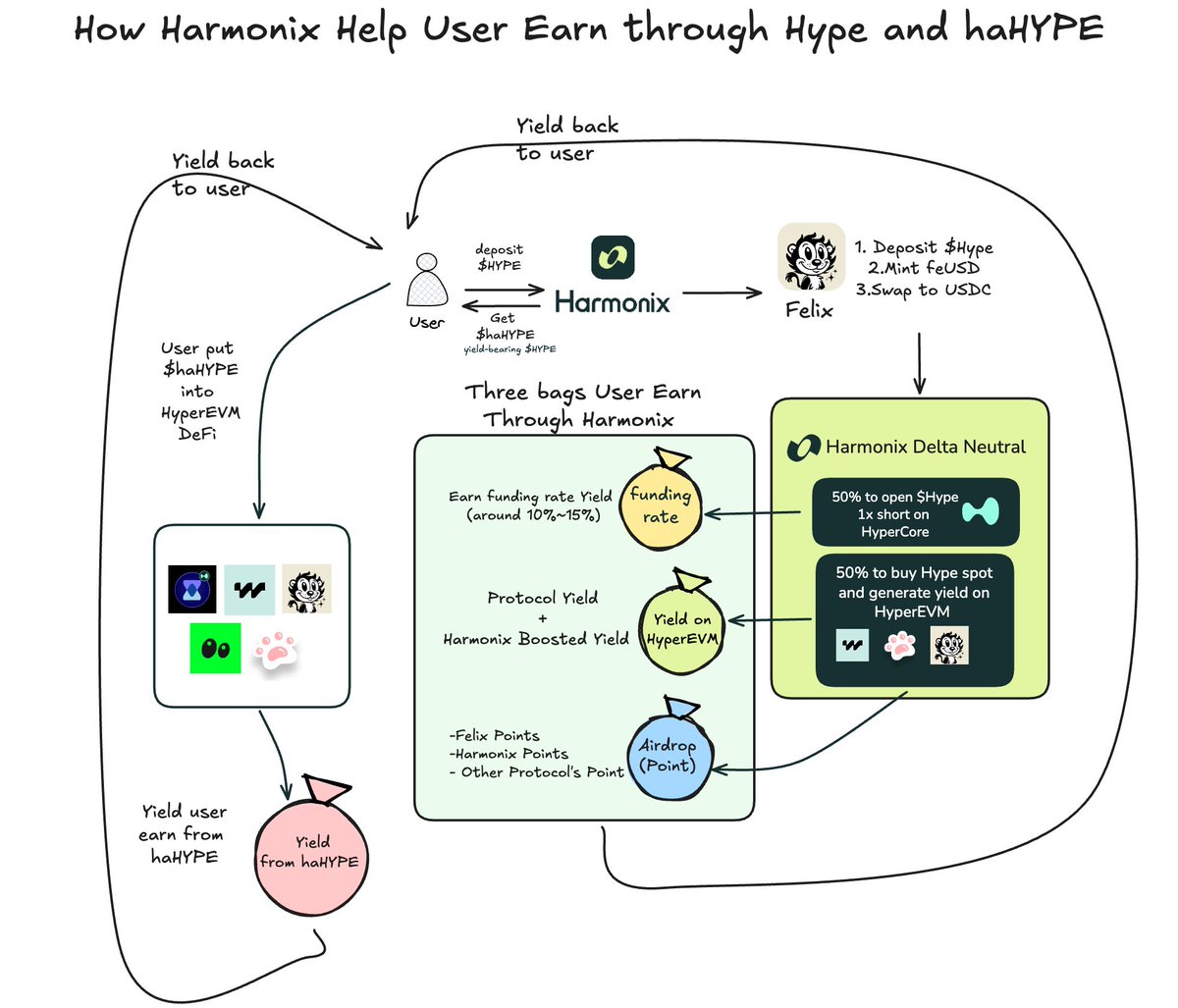

$HYPE Vault on HyperEVM

Launching this month, the $HYPE Vault leverages:

- @felixprotocol Protocol to mint feUSD using $HYPE collateral

- Converts feUSD into USDC, then splits capital:

a. 50% short $HYPE on HyperCore for funding yield

b. 50% buys spot $HYPE and deploys into HyperEVM DeFi protocols

Users receive haHYPE, an ERC-4626 yield-bearing token(YBT) representing their share. haHYPE accrues value automatically and is designed to be composable across HyperEVM protocols. Harmonix is working toward enabling haHYPE as collateral and LP asset (trading pair on native Dex on HyperEVM)across the ecosystem.

Totally with the $Hype vault ,here at least 4 part that users can earn :

1. Funding rate yield on HyperCore

2. Protocol Yield generated by Hype staking into Defi protocol

3. Airdrop :

- Felix point

- Harmonix Point

- Other protocol points

4. the yield generated by the loop of haHYPE from users

The workflow can be as below:

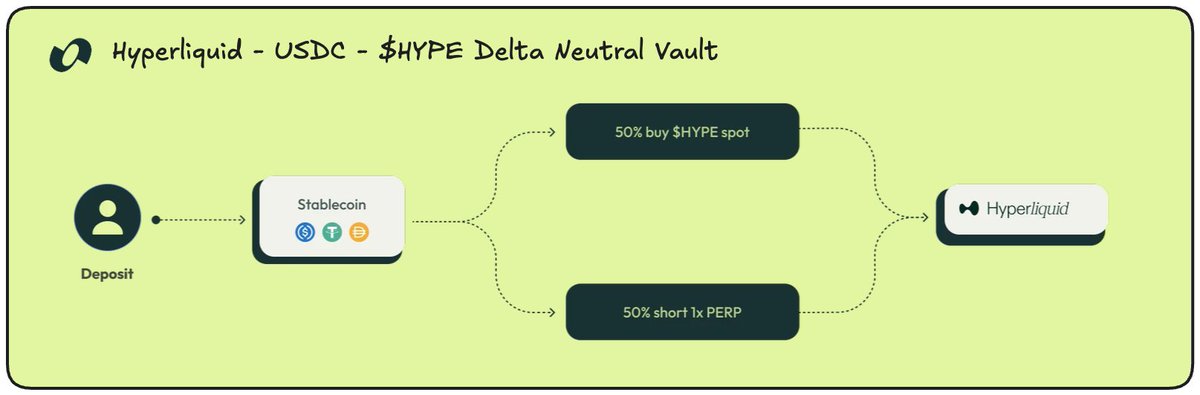

Hyperliquid USDC - $HYPE Delta-Neutral Vault

This strategy deposits USDC, purchases $HYPE spot, and opens a 1x short on HyperCore. The result: delta-neutral exposure and yield from funding rates.

With one of the highest APYs for stablecoin vaults on HyperEVM, this product is ideal for users seeking consistent yield without market exposure.

Cross-Chain Capital Inflows

Beyond native vaults, Harmonix integrates:

- @KelpDAO Vaults (Arbitrum)

- @pendle_fi -powered ptETH Vaults (Ethereum)

These strategies attract LRT capital and pendle's pt from other ecosystems, converting it into productive, delta-neutral yield within Hyperliquid which is also a contribution to HL ecosystem as well .

The Broader Vision: Shared Liquidity, Not Siloed Capital

Inspired by the "Fat Protocol Thesis," Harmonix understands that value must move—not stagnate. While many DeFi projects extract value without reinforcing the protocol, Harmonix redefines yield as a circulating force within the Hyperliquid ecosystem.

much more read :

Every haHYPE transfer, LP action, or stake compounds returns, fuels ecosystem growth, and supports:

- Validator fees

- Protocol rewards

- Trading volume on HyperCore

- Lending TVL on Felix/Hyperlend

YBTs like haHYPE lay the foundation for a shared collateral layer across Hyperliquid, reducing reliance on bridged assets and enabling local liquidity loops.

Closing Thoughts

Harmonix is not here to reinvent DeFi—but to refine it.

By combining a delta-neutral yield engine with cross-ecosystem composability, Harmonix transforms passive capital into active, productive flow. Whether it's haHYPE or upcoming YBTs for ETH, BTC, or stablecoins, every vault is a step toward a unified, self-sustaining Hyperliquid economy.

From my personal observation on their twitter and social engagement ,I can say that they are a dedicated team. Anyway stay tuned. Harmonix is only the beginning. Maybe a new layer of liquidity is being built— on Harmonix .

Some part about Harmonix I may miss such as point program can follow up their twitter or @harmonixintern

Finally one interesting point : will DIY be better than put the fund in vault ? Ofc the security must be one point that user should consider no matter you put fund in vault or run the yield lego by yourself .

Can read their latest post :

If you are a builder on @HyperliquidX ,do let us know . @impossiblefi are keeping following the growth up on Hyperliquid and exploring the opportunity to build with the builder team on HL.

HyperLiquid.

3.11K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.