I’m very happy to see the feedback from Backpack 🎒's @leoding0806x and @bitcoin10wu.

This is precisely a reflection of the Die Hard community attributes.

I believe the efforts of Ding in the MadLads group can be witnessed by the old group friends.

My Backpack experience:

In 2023, besides participating in Hyperliquid, I also got involved with Backpack 🎒.

This was because I saw the potential of Armani as the Founder at that time.

I bought a large amount of MadLads, over 1000 U-based, around 1000 U.

During the first wave of hype in the 2024 Pre-season,

I watched as the profits from my MadLads dropped from a high point of nearly 0.7M.

Brothers who were playing along also participated in the Pre-season and lost nearly 300k at the high point of MadLads.

However, I still hold a portion of my MadLads to this day,

I have staked them and earned almost all the badges I could get.

My view on Backpack:

Why do I mention Lighter, Backpack, and Aster together?

This is because the current mainstream thinking in the industry is like this,

It can be categorized based on my framework.

If we create a spectrum of value orientation for a project,

the far left is Community, and the far right is VC.

Hyperliquid, as a representative, is definitely on the far left: it does not accept VC financing, airdrops are basically given to the Community, and all profits return to the community.

Lighter is currently on the far right: the Founder clearly does not care much about the community, and in the last 1-2 months, they have been running after big clients and market maker resources in Asia.

Aster is also leaning towards the right: just follow BN and that’s it.

Backpack is positioned slightly left of center.

It leans left because Armani has indeed seen a path from the success of Hyperliquid.

This can be seen in his multiple tweets where he recognizes the market's preference for the Hype model.

At the same time, before the exchange opened, he worked hard to build the MadLads community, which clearly shows he wants to focus on community culture.

This can be contrasted with Lighter/Aster, which is building from the top down,

because the latter is currently focusing more on finding resources from big clients/exchanges.

However, 🎒 has still received financing.

The entire distribution of interests is like Sun Wukong wearing the tightening curse,

there will definitely be a Placeholder class that will suck blood from it.

Don’t you see that $TIA is also a Placeholder's bag?

I can relate to that.

Currently, it can be seen that the market believes 🎒 will separate coins and stocks,

the coin part will be fully airdropped to the community.

If that’s really the case,

then one must admire Armani's efforts to balance the interests towards the community.

I would love to see Armani allocate more benefits to the Community under the constraints of the current financing interest structure.

The profit distribution in the Pre-season was a first attempt,

at that time there were too many monks and too little meat, so it was a mess.

Now there are more monks.

If TGE also needs to distribute to the rent-seeking class,

this balancing of interests is not simple.

If it were an ordinary founder, I wouldn’t have any expectations at all.

But with Armani, there is a chance.

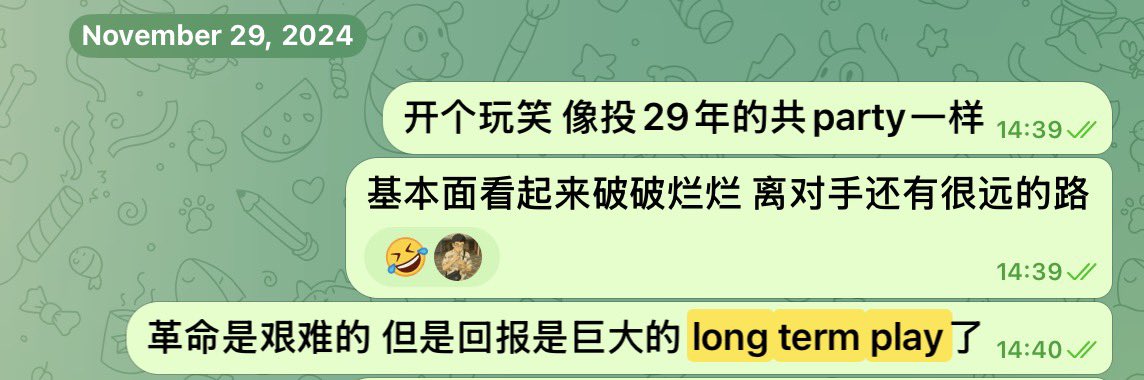

The excerpts in the screenshot were written around the $HYPE TGE in 2024.

Since participating in Hyperliquid in 2023,

it seems that Twitter has only been discussing Hyperliquid in snippets.

Today, I will provide a more complete summary of the essence behind its emergence as a phenomenon-level project,

and use this opportunity to discuss the prevalent mindset in the industry.

This is a stream of consciousness expression typed on a mobile phone,

so the readability is relatively poor; those destined to understand will find it.

The industry mindset is a useful way to make money,

but it does not hit the essence directly.

This is because the simplest and most effective way for people to recognize patterns is to judge through surface features.

For example, when a project becomes popular,

they look for similar projects in the same industry to invest in.

Before Hyperliquid appeared,

the Orderbook-style DEX industry from 2021 to 2024 was close to being disproven.

No one believed that this type of DEX could surpass CEX.

This is because, whether it’s the massively funded $DYDX or the $APX that Binance supports both overtly and covertly,

or the attempts of $GMX, all have failed.

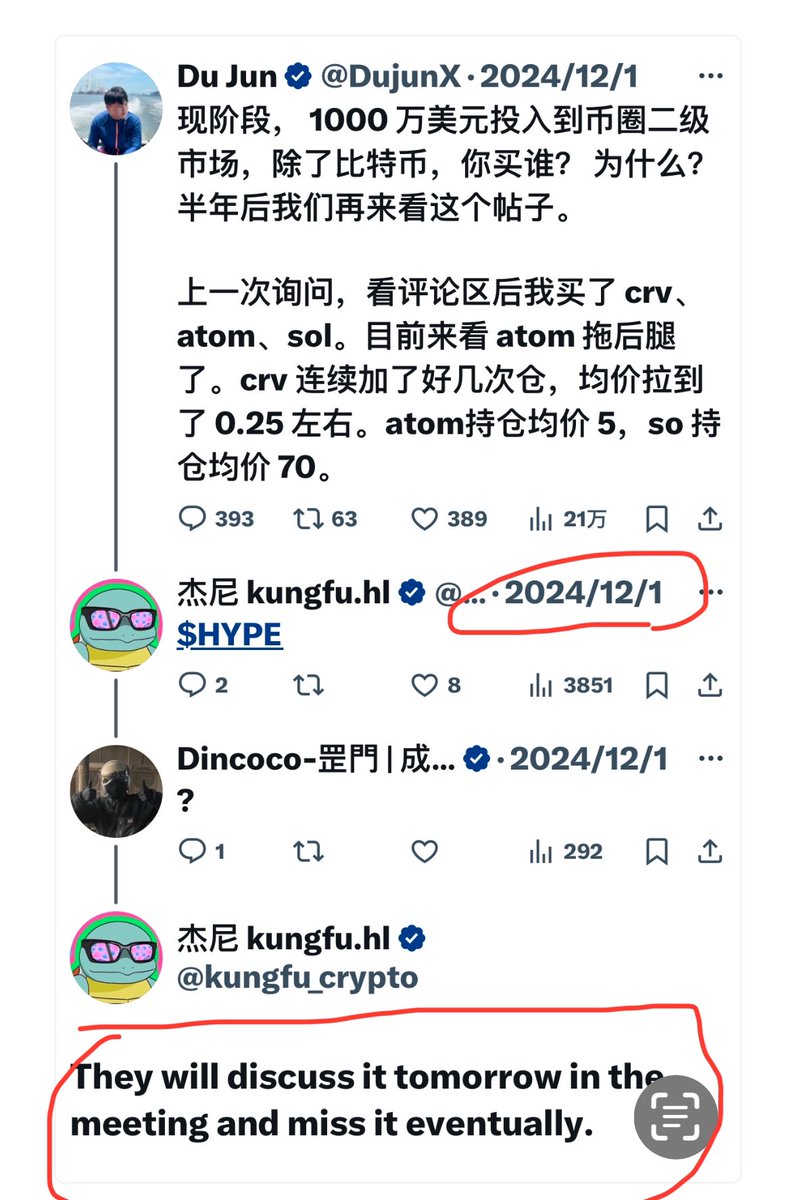

From the industry mindset perspective, $HYPE is just another ordinary project.

This is also why many in the crypto Twitter community had biases against Hyperliquid before its launch.

However, often a phenomenon-level project can uplift an entire industry.

As Hyperliquid became increasingly hard to ignore,

people began to chase after the so-called next Hyperliquid using the industry mindset,

such as pursuing Lighter Backpack, Aster, etc.

This is understandable and can be a profitable way of thinking.

These projects are not bad either.

But to grasp the essence of a phenomenon-level product,

we need to think deeper about its uniqueness.

This is because capturing the leading project gives the opportunity for maximum profit.

If you see a good horse,

like the Red Hare, and you start buying everything else that is also a horse in the market,

you'll end up with a flood of mediocre options.

After making a small profit, you are left with emptiness.

Developing your judgment through the assets is the eternal topic for every individual in this market.

So what makes Hyperliquid stand out?

As seen in the second image,

I believe that a good product is just the most basic surface level.

The top assets in the crypto space have a premium due to their spiritual attributes.

A truly cult-like community is not built by cheap meme generators posting unfunny memes and spamming gmgn,

but by generous profit distribution forming a tightly-knit community centered around the team.

"Community-owned"

You might think this sounds cliché,

but let’s rephrase it:

"Distributing wealth to the peasants"

"Those who cultivate the land should own it"

Familiar?

This is also the core spirit of Hyperliquid that I defined before its launch in the first image.

At that time, I never looked at so-called revenue or open interest data.

This is because the story and the profit distribution pattern determine that the ceiling is very high for subsequent project progress.

Many projects can also perform well,

but following traditional financing methods,

naturally leads to 20-30% of the chips being easily taken by the rentier class,

and due to the cycle factors of LPs,

once they leave, it’s hard to reinvest in the project.

This is also the reason for the death of most VC projects in history.

However, it is not uncommon to distribute a large amount of profit to the community,

and having a strong leadership core is also not rare.

But when the two are combined,

the essence of the project changes.

This is because most smart teams are willing to give up profits to VCs

in exchange for low-risk startup funding.

This is a reasonable choice for smart people.

But a strong and visionary core leadership team

uses its own funds to help the project through the cold start phase

and shares profits with the community to grow together.

This is rare and precious.

The essence of human nature remains unchanged.

The development of history will always reflect in certain temporal and spatial scenarios,

providing us with wisdom to penetrate surface features and hit the essence.

It has been a long time since I have seen a similar project in the crypto space.

9.19K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.