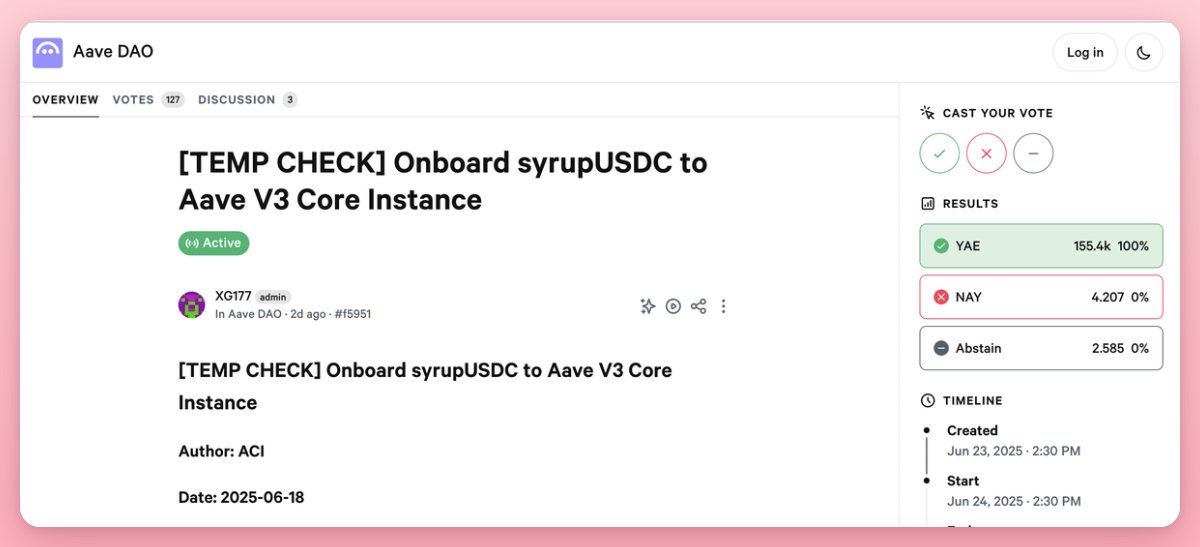

.@maplefinance proposed a temp check to list syrupUSDC as collateral on @aave V3 Core Instance.

Quick take on syrupUSDC:

- Market cap passes $884m - 10x growth YTD, one of the fastest-growing yield-bearing stablecoins this year

- Backed by $2.3b in Maple’s AUM, providing real yield from fixed-rate institutional lending strategies at ~10% APY

- $589m syrupUSDC already deployed to DeFi across EVM chains and Solana

- $500m+ allocator demand ready to loop via Aave

- $250k in incentives to bootstrap usage on Aave

Listing syprupUSDC also strengthens Aave’s macro flywheel as it drives higher USDC utilization, increases revenue to the protocol, and aligns with $GHO’s institutional reach (potentially GHO lending to institutions via Maple)

Just use Aave 👻 🥞

We’ve fully supported Maple’s temp check to list syrupUSDC on Aave V3.

🔗 Full proposal details below:

2.18K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.