1/ On November 5th, 2023, I posted my longest and most widely read Twitter thread (47 tweets/2m+ views) explaining the reasons behind the collapse of Genesis, one of the crown jewels of Barry Silbert's crypto empire, in 2022. There has been a major development in this story.🧵

2/ At the time I posted the thread, I had to piece together the story from publicly available facts (such as the @NewYorkStateAG lawsuit against @DCGco and @BarrySilbert), but many of the details, especially what was happening behind the scenes, remained a mystery.

3/ Many of those details have now become public, and the facts alleged are more shocking than I could have imagined when I wrote my thread in late 2023. Grab a coffee, find a comfortable place to sit, and prepare to learn the behind-the-scenes story of the Genesis collapse. 👇

4/ On May 19th the Genesis estate, on behalf of Genesis creditors, filed a lawsuit against @BarrySilbert, @DCGco, @michaelmoro and various DCG insiders, in Delaware Chancery court. It contains serious allegations of fraud and breaches of fiduciary duty by Silbert and others.

5/ The Common Law complaint describes how Silbert and his insiders recklessly operated, exploited, and then bankrupted Genesis following a spectacular campaign of fraud and self-dealing.

6/ According to the complaint, Silbert and his network of insiders knew Genesis was insolvent no later than December 31, 2021, but continued to operate the company for their own benefit, ultimately bankrupting Genesis a little over a year later.

7/ In 2015 Barry Silbert launched Genesis as a cryptocurrency lending firm. He marketed Genesis as a safe (later calling it ‘blue chip’) lending platform that would pay a fixed rate of interest, in kind, on cryptocurrency deposits, while lending those cryptocurrencies to borrowers.

8/ However, Genesis was anything but safe. The complaint alleges there were few, if any, loan underwriting controls, inadequate collateralization standards, and grossly inadequate loan loss reserves.

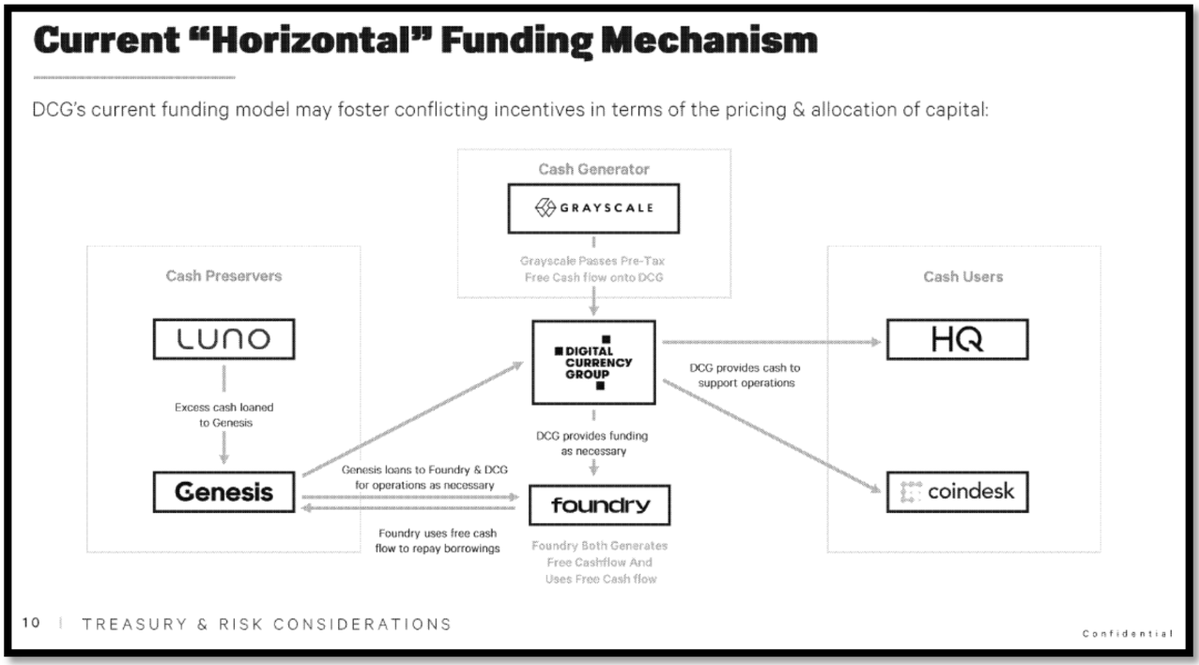

9/ In effect, Genesis was a pool of “other people’s money” that Silbert deployed to generate profits for his other businesses, such as Grayscale, and ultimately himself.

10/ The complaint provides dozens of internal DCG documents from '21 & '22 revealing behind-the-scenes admissions that Genesis was DCG’s “de facto treasury” and that Silbert and his loyalists operated DCG and Genesis as a single enterprise.

11/ In other words, Genesis was DCG's alleged "alter ego". The idea of a corporate separateness between the two entities (a legal requirement to avoid parent liability) was entirely a fiction. Silbert and DCG dominated Genesis for their own ends.

12/ Silbert even referred to DCG’s borrowing from Genesis as merely moving money “from one pocket to another.” And the defendants knew the implications of their misconduct.

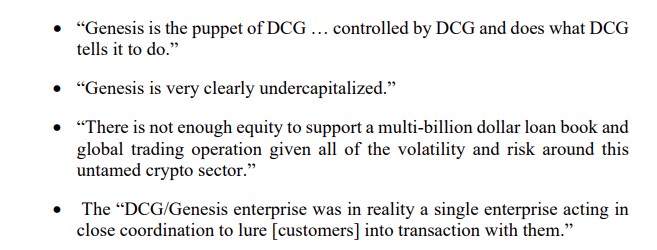

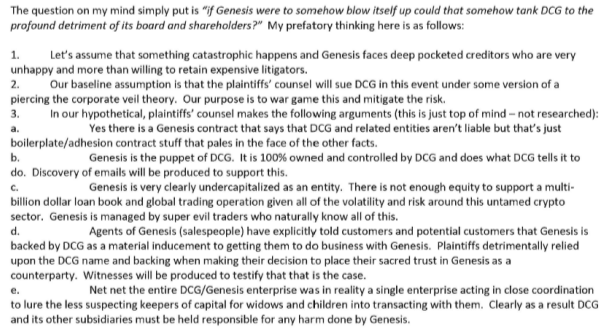

13/ Long before the inevitable Genesis bankruptcy, DCG CFO @MichaelKraines predicted that a future plaintiff would argue successfully that:

14/ Kraines even went so far to describe a "what if" scenario if Genesis went bankrupt:

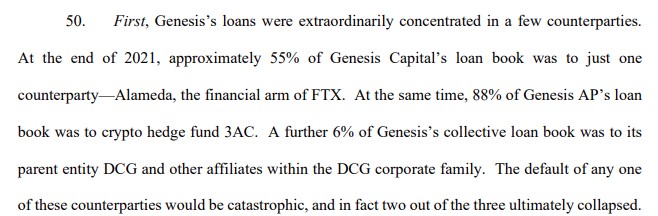

15/ In 2021, at DCG’s direction, Genesis’s lending activities grew dramatically – originating over $130 billion in loans that year, a 587% growth year on year. The loans were highly concentrated with just two counterparties: Three Arrows Capital and Alameda Research.

16/ Neither Three Arrows Capital, nor Alameda Research were creditworthy, and today both are bankrupt. Instead of using strict lending standards by overcollateralizing the loans with liquid assets, Genesis accepted collateral they could not easily sell (GBTC and FTT respectively)

17/ Genesis’s reckless lending activities allegedly served DCG’s broader goals:

1. It directly benefited Silbert’s other crown jewel, Grayscale, and its flagship product GBTC.

For example, 3AC and Alameda were allowed to post GBTC as collateral for their loans (even though Genesis could not easily sell it), and used the Genesis funds they borrowed to permanently transfer Bitcoin to Grayscale's GBTC fund, which then minted money for Silbert by charging a perpetual 2% fee on assets under management.

2. It provided hundreds of millions in uncollateralized or under-collateralized loans to DCG and related entities—making the DCG group itself the third-largest counterparty of Genesis—on preferential off-market terms.

18/ DCG made sure Genesis’s profits flowed back to DCG through intercompany loans to DCG and its affiliates over which Genesis had no say, and by mandating risky lending practices that were designed to grow Grayscale and the Grayscale Trusts. The complaint illustrates this flow:

19/ DCG itself admitted internally that the lending program at Genesis was "flying blind" in terms of risk management. Genesis’ loan book was also concentrated in a few risky counterparties:

20/ While the complaint provides copious evidence that Silbert and his insiders were aware of their wrongdoing, their awareness was more than just internal; as early as 2021, DCG hired reputable outside third-party consultants for a risk assessment.

21/ Following an evaluation of Genesis, DCG was warned of key risk-management deficiencies at Genesis that posed grave risk to the enterprise, including:

- "Limited ability to … analyze aggregate risk,"

- "[l]arge concentrations … within the [Genesis] portfolio which would result in ‘break-the-business’ scenarios in case of default"

- "no … management of capital for unexpected losses."

22/ Yet DCG chose not to implement any of the recommended prudent risk controls, or to increase loan loss reserves at Genesis, according to the complaint.

The Genesis structure allowed DCG and Silbert to profit with very little risk, but exposed Genesis to significant risk.

23/ DCG’s compliant pawn, Genesis’s former “CEO” Moro, stood by and allowed DCG to pilfer Genesis—which is no surprise, since Genesis employees who disagreed with Silbert or refused to do DCG’s bidding were terminated and faced Silbert’s influential wrath in the industry, according to the complaint.

24/ It wasn’t going to be long before Genesis would falter under DCG’s ongoing misuse of the Genesis assets and lending platform.

25/ In May 2022, TerraUSD and LUNA, collapsed. The next month 3AC imploded. Due to its lack of proper risk controls (which DCG had been advised to put in place), Genesis was left with a $1.1 billion hole on its balance sheet.

26/ The market turmoil caused Genesis’s largest lenders, Gemini and Bitvavo to start asking questions and threatening to pull their customers' assets.

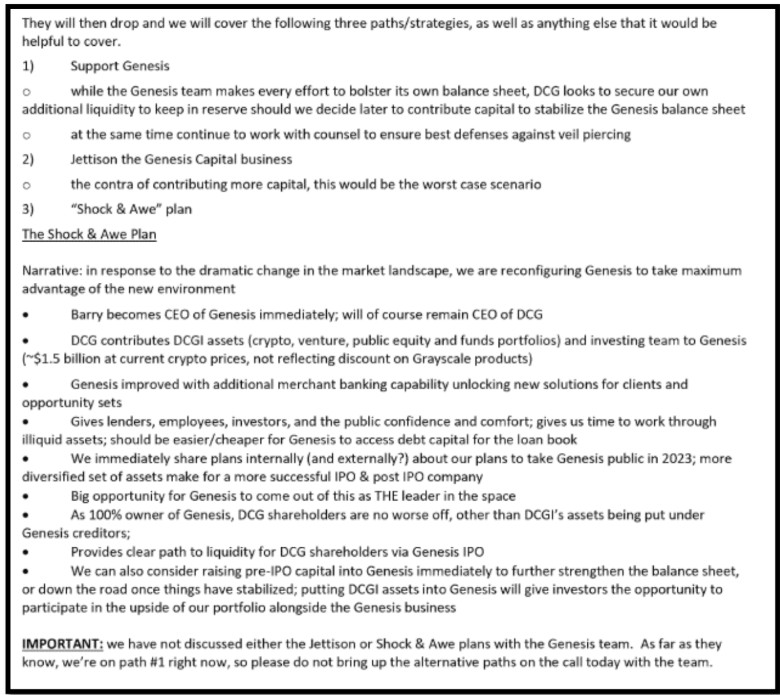

27/ Silbert was not going to let his Genesis piggy bank be impacted and he stepped in to conceal the crisis at Genesis from its lenders. Privately, he devised several potential scenarios which are listed in the complaint:

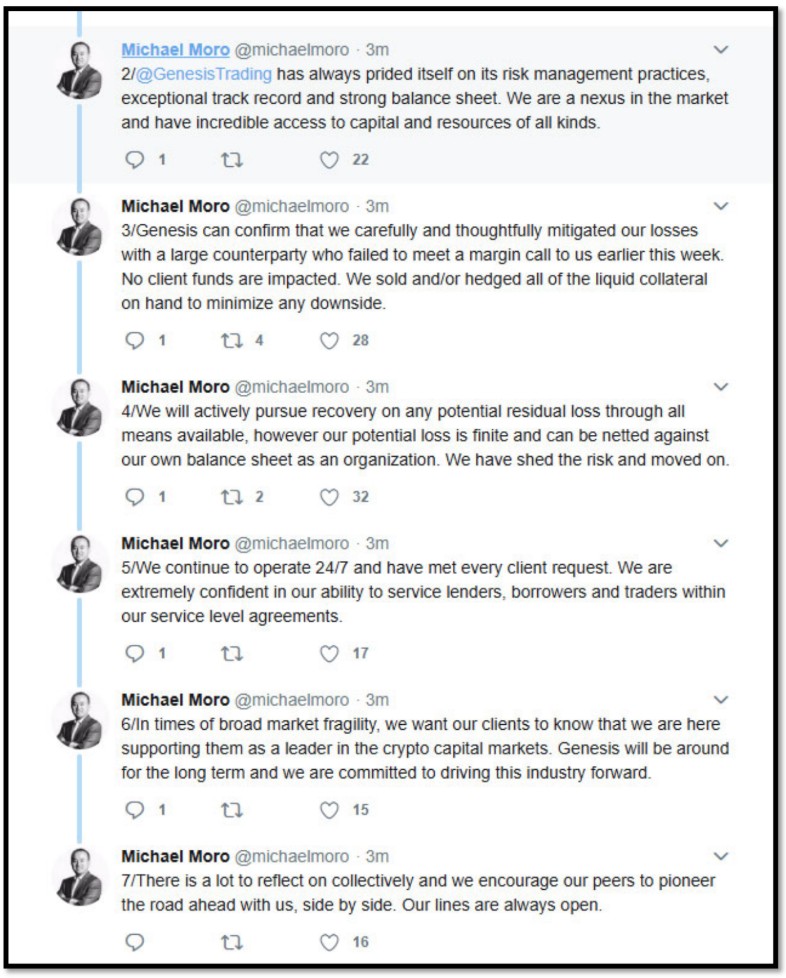

29/ DCG prepared talking points and dictated misrepresentations to the public, including Silbert's party line that Genesis was operating "business as usual" and had robust liquidity, high capitalization, and a "strong balance sheet."

30/ DCG allegedly required Genesis employees to recite Silbert's lines to customers when answering questions about Genesis' financial state in the wake of the 3AC collapse. Silbert also amplified misleading tweets from Genesis using his personal account:

31/ These DCG-scripted falsehoods were designed to encourage existing customers, counterparties, and lenders, including those of Gemini and Bitvavo, to keep their valuable crypto and fiat currencies on the Genesis platform. They also helped induce new customers to Genesis.

32/ All the while, Silbert, Silbert's brother Alan, DCG's investment bank Ducera, Silbert's long-time friend and Ducera CEO Kramer, and other DCG loyalists withdrew their own fiat currency and crypto assets from Genesis.

33/ After insulating themselves from the fallout, Silbert and other DCG insiders orchestrated numerous counts of fraud, according to the complaint. One scheme stands out above the others.

34/ On June 30, 2022, when Genesis's books were closing, DCG issued a purported Promissory Note to Genesis pursuant to which DCG promised to pay Genesis—in ten years—$1.1 billion (at 1% interest), with no payment due until 2032.

35/ In other words, DCG created a mechanism to convince creditors that Genesis had received $1.1 billion in fresh capital, when in fact the Promissory Note provided no new liquidity and did not address Genesis’s fundamental insolvency. Many creditors were ensnared by this trap, lending more capital to Genesis or originating loans to them for the first time.

36/ In September 2022, DCG orchestrated another Genesis balance sheet trick designed to further mislead Genesis customers. DCG caused Genesis to repay, in advance of maturity, a cryptocurrency loan worth $100 million from a DCG affiliate -

37/ - that DCG affiliate paid the same $100 million in cryptocurrency to DCG in the form of a dividend distribution; and DCG contributed the same $100 million in cryptocurrency to Genesis as a purported equity infusion.

38/ This round-trip transaction did nothing to improve Genesis’s liquidity position, but it misled Gemini and Bitvavo to believe that DCG was stepping in to provide much-needed additional liquidity to Genesis. As a result neither pulled their funds.

39/ DCG's self-serving mismanagement of Genesis put Genesis in an extremely fragile position by the fall of 2022. The end was nigh. When Alameda's sister company, FTX, collapsed on November 11, 2022, lenders began to call their loans from Genesis.

40/ Due to Genesis's exposure to Alameda, in combination with the $1.1 billion hole on its balance sheet from the 3AC collapse, and the hundreds of millions in loans outstanding to DCG, there was no hope left for Genesis.

41/ By November 16, 2022, creditor withdrawals were paused at Genesis. And on January 19, 2023, Genesis filed a petition for bankruptcy.

42/ As one Genesis employee aptly put it, in 2022, DCG kept Genesis alive "so [it] could pillage the balance sheet … prop [Genesis] up, give [the] impression of stability[,] then borrow while they c[ould] to get the cash out of it."

43/ As recently as a month ago, in an interview with @RaoulGMI, Silbert incredibly stated that "we didn't really have a whole lot of visibility into Genesis activities but we didn't see that coming". The allegations in the complaint show that Silbert knew far more than he suggested during his interview with Raoul Pal.

@RaoulGMI 44/ A second “Adversary Complaint” filed by the Genesis estate details further abuse of Genesis and preferential transfers Silbert and others made to themselves off the Genesis balance sheet in the year leading up to Genesis' chapter 11 filing, all while Genesis was insolvent.

@RaoulGMI 45/ Critically, Silbert and other insiders initiated their transfers around watershed events—including the collapse of Terra-Luna, the collapse of 3AC, and the collapse of FTX in November 2022.

46/ During these events, DCG and Barry Silbert delayed a run on the bank at Genesis, falsely assuring Genesis’s customers that the "business was solid" and had "a ton of liquidity." Meanwhile, they withdrew their assets and recovered 100% on their USD and cryptocurrency loans from Genesis.

47/ Here is a breakdown of some of the critical moments in 2022:

- Following the Terra-Luna crash in May, DCG withdrew $154 million in USD from Genesis. Genesis posted a carefully worded Tweet reassuring creditors that Genesis had "no direct exposure to UST and LUNA," a "strong balance sheet," and "ton[s] of liquidity."

- Following 3AC's collapse, Barry Sibert directed Genesis to "continue to show the market that [Genesis is] lending", while DCG and its insiders were simultaneously withdrawing $128 million

- Following the collapse of FTX and Alameda, Silbert and other insiders withdrew no less than $122 million from Genesis while directing Genesis to post on Twitter that it had "no material exposure" to FTX.

@RaoulGMI 48/ The truth was that Genesis had millions in loans extended to Alameda, and the FTX collapse left Genesis with an additional $36.8 million hole in its balance sheet in addition to the $1.1 billion hole created by the Three Arrows implosion.

@RaoulGMI 49/ Eventually it became clear that Genesis could no longer pay its customers withdrawals, so it suspended all withdrawals and ceased lending and borrowing activities on November 16, 2022.

The day prior, DCG received a $50 million loan repayment from Genesis. 🤯

226.59K

565

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.