Base continues to see positive developments, with Trump pressuring the Federal Reserve to raise interest rate expectations - 0620 Coin Research Weekly Report

🔥【Top 1 Cross-Chain Net Inflow】 @base +42 million

🔥 JPMorgan enters @base, introducing JPMD: JPMorgan Chase has trial-launched the deposit token JPMD on the Base network. The Base ecosystem tokens are worth watching, including @AerodromeFi, @virtuals_io, @KaitoAI, @GAME_Virtuals, @clankeronbase, and others.

🔥 GENIUS stablecoin bill passes swiftly: The U.S. Senate overwhelmingly passed the GENIUS bill with a vote of 68-30. The total market cap of stablecoins has surpassed $250 billion, with @Tether_to and @circle together holding an 86% market share.

💡 Featured Content - Stablecoins: Stablecoins and AI Financial Innovation By @Defi0xJeff

【Recommended Reading Link】

Credit to @jd950108 @0xfomor

Check out the latest issue of Coin Research Weekly, scroll down 👇

After five years! The stablecoin sector finally sees the light of day!

The U.S. has passed the "GENIUS Act Stablecoin Bill" 🔥

The U.S. Senate announced last night that it has passed the stablecoin bill, which can be considered a milestone for those of us in the crypto space 💪

With the passage of the stablecoin bill, there may be further positive impacts on ecosystems related to stablecoins, such as RWA and PayFi!

@ethena_labs @MakerDAO @ResolvLabs @OndoFinance @Ripple @humafinance @levelusd @worldlibertyfi @SkyEcosystem @PayPal

What does this bill entail, and what twists and turns did it go through? 👇 🧵 🌪️

To view the full content, welcome to subscribe to the weekly report

Stay on top of weekly macro trends and ambush alpha 💥 together

💡 Market Trends

Bitcoin has broken through $106,000, with short-term bulls regaining control, driving mainstream coins to rise in tandem. The advancement of the U.S. stablecoin bill and consecutive interest rate cuts by the European Central Bank have strengthened market expectations for loose monetary policy. Trump is pressuring the Federal Reserve and proposing a Bitcoin strategic reserve concept, adding room for policy imagination. Companies are accelerating their allocation of Bitcoin, supporting the medium to long-term demand outlook.

📍 @coinglass_com Greed and Fear Index 48 Neutral (-6 percentage points)

📍 @CoinMarketCap Fear and Greed Index 48 Neutral (-6 percentage points)

📍 BTC Dominance 64.84% (previously 64.76%)

💡BTC ETF Net Inflow - Significant Inflow This Week

This week, the net inflow of BTC spot ETFs reached nearly $1 billion, highlighting the rising demand for hedging amid geopolitical risks. Institutions are mainly adopting arbitrage strategies, buying ETFs and selling futures to lock in profits.

The fund flow of ETFs is highly correlated with BTC prices, providing evidence for long-term value. However, the short-term macro environment remains full of uncertainties, and whether more institutions will continue to increase their positions or shift to a wait-and-see approach will be key to observing Bitcoin's hedging status and market risk appetite.

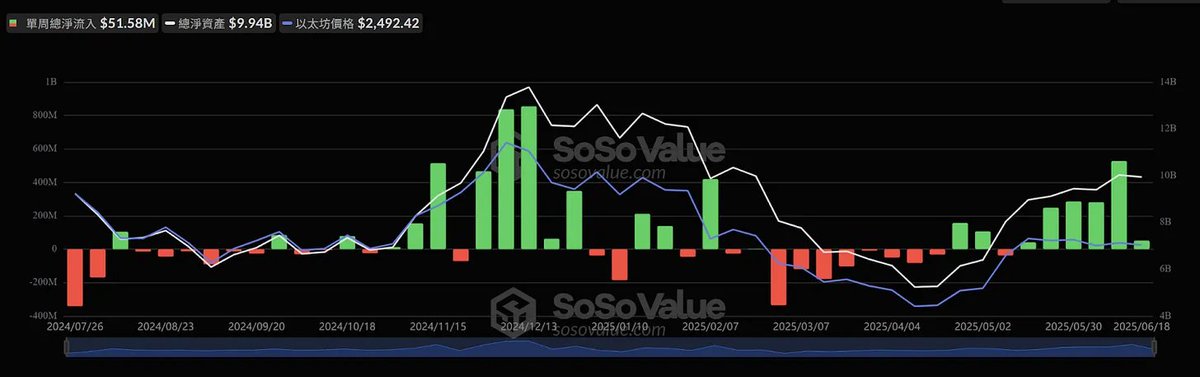

💡ETH ETF Net Inflows - Six Consecutive Weeks of Net Inflows

The ETH spot ETF has seen net inflows for six consecutive weeks, accumulating nearly $50 million, setting a record for the longest continuous inflow this year. However, this week's inflow has noticeably decreased, indicating that some institutions may choose to take profits.

On the other hand, short positions in ETH on exchanges like CME have increased, hedging against the momentum of spot buying, leading to increased selling pressure. Despite the continued influx of funds, ETH lacks clear fundamental catalysts, and geopolitical uncertainties have caused funds to lean more towards BTC, highlighting the differences in market sentiment and fund allocation between the two.

The full content is available on Substack, welcome to subscribe 🔥

3

2.37K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.