$ETH is heating up… and that’s usually the first sign that alts are about to follow

With $SOL ETF coming, DeFi back in the headlines and stablecoin regulation moving fast.. things are lining up

5 reasons why I think the next few months belong to alts, not $BTC. A thread:🧵👇

2/

Throughout 2025, I’ve repeated one thing over and over again:

A full-blown altseason won’t happen until the Fed ends QT completely and starts rate cuts.

3/

But that doesn’t mean there won’t be any pump in alts.

In Q4 2024, alts pumped despite the Fed’s QT program and back then, Trump’s presidency was the catalyst.

This time, we have several bullish catalysts that could turn your portfolio green.

So, let’s take a look at them.

4/

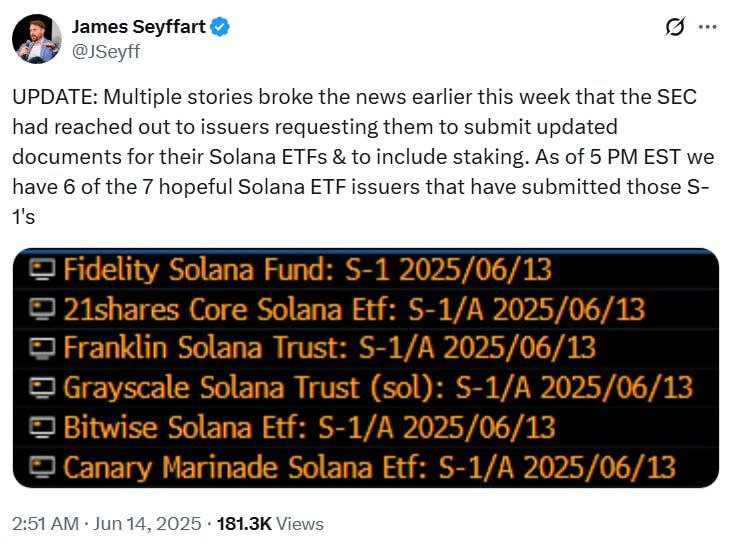

➔ 1. Solana ETF approval:

Without a doubt, Solana has been the favorite retail chain this cycle.

And for alts to rally, we need more retail.

There’s something big coming for Solana that could bring a lot of retail hype.

5/

I’m talking about Solana ETF approval.

A week ago, Bloomberg reported that the SEC could approve Solana staking ETFs by July.

This would be the second altcoin ETF approved in the US, after ETH.

And how will it help altcoins?

6/

Solana ETF approval will bring mainstream media attention and retail hype comes along with it.

For SOL, it’ll unlock $100B+ in institutional liquidity.

For its ecosystem, it’ll bring more hype and retail liquidity.

7/

We could also see some big airdrops in the Solana ecosystem, which will further bring more liquidity.

Right now, there are several blue-chip alts on Solana, and they’ll definitely benefit from it especially those with DeFi and liquid staking narratives.

8/

➔ 2. GENIUS Act Approval:

For those who don’t know, the GENIUS Act is a bipartisan U.S. Senate bill to regulate stablecoins pegged to the U.S. dollar.

It aims to provide a federal framework for stablecoin issuers, focusing on consumer protection, financial stability, and national security.

9/

Through the GENIUS Act, the US government is aiming to protect its dollar hegemony.

Also, stablecoins are slowly becoming the biggest T-bill holders, which benefits the US government as their debts are going parabolic.

On 17th June, the US Senate has scheduled a final passage vote on the GENIUS Act.

10/

If it passes, the bill will move to the House and finally to President Trump.

If everything goes smoothly, the GENIUS Act will be passed by August 2025.

And this will bring massive attention to stablecoin protocols and L1s.

11/

Also, once approved, I think more institutions will get involved in stablecoin minting, which will overall increase liquidity.

$ETH, $TRX, $SOL, $BNB, etc., are leading L1s in the stablecoin space, so keep an eye on their ecosystems.

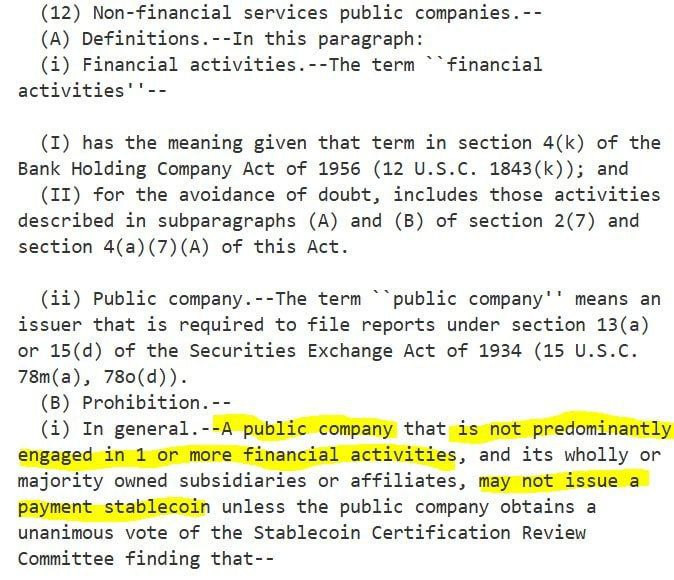

But if Amazon and other big companies can issue their own stablecoins why would crypto pump?

12/

If you don’t know, the GENIUS Act includes provisions that restrict large non-financial institutions from issuing their own stablecoins.

If they allow every institution to issue their own stablecoin, it’ll turn into a $LIBRA-like situation.

13/

➔ 3. DeFi Hype

Last week, the SEC Crypto Task Force Roundtable on DeFi took place, and it was one of the most bullish things I’ve heard in years.

Here’s what SEC Chair Paul Atkins said 👇

14/

– A miner, “validator,” or “staking-as-a-service” provider is not within the scope of federal securities laws

– In favor of affording greater flexibility to market participants to self-custody crypto assets

– Applauds builders who are developing software applications designed to function without administration by any operator

15/

– Talked about compliance and said he’s excited about the use of on-chain software systems

– Directed the staff to consider a conditional exemptive relief framework to bring on-chain products and services to market

And what does all of this tell you?

16/

The DeFi winter is now over, and DeFi protocols are about to boom.

The last time we had a DeFi rally was in 2020, and since then, DeFi fundamentals have grown by 100x.

With a pro-crypto administration, it seems like now is the perfect time for prices to catch up with the fundamentals.

17/

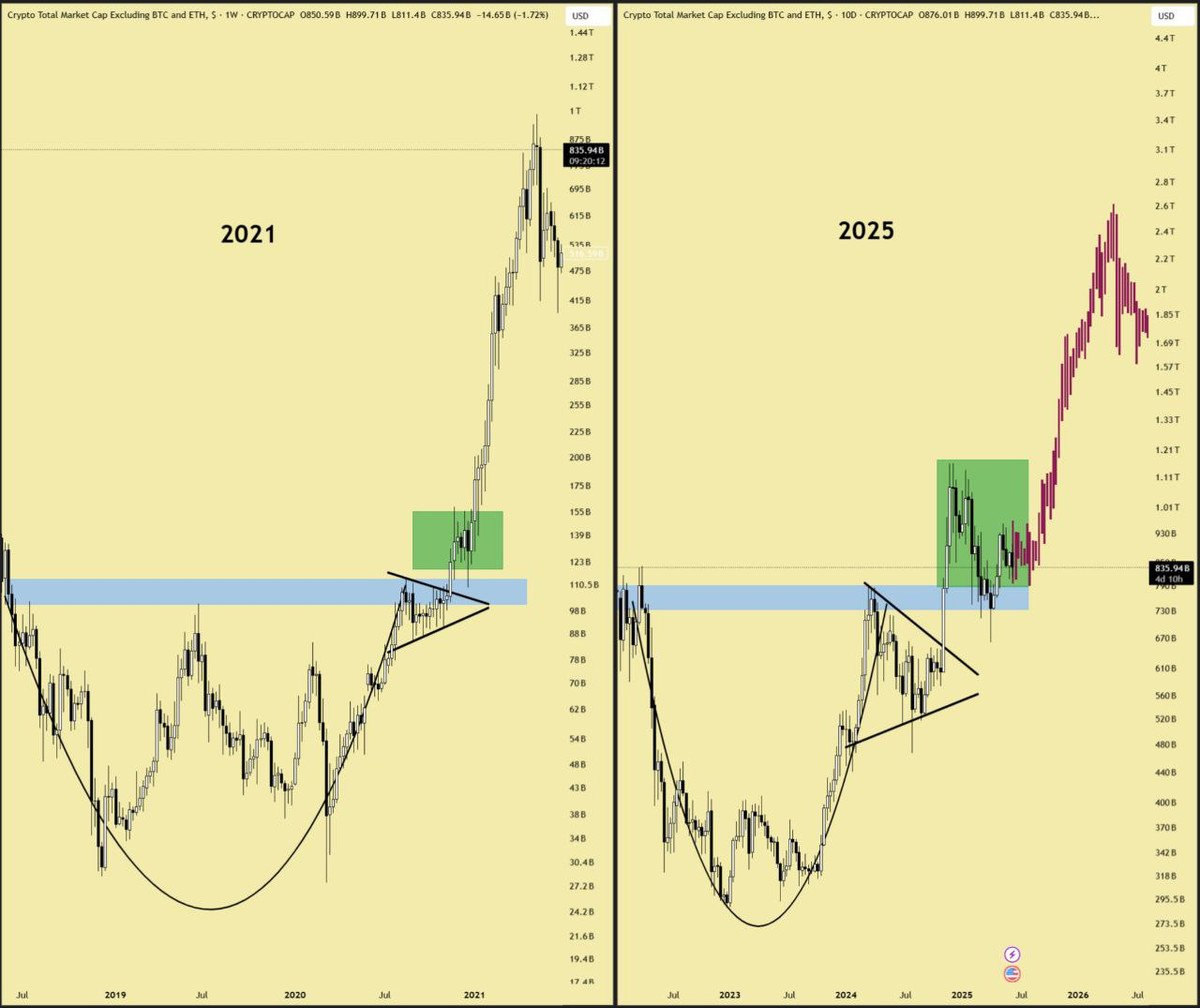

➔ 4. Altcoin MCap Fractal:

The fundamentals are looking good but what about the charts?

Well, the charts are looking good too.

The altcoin MCap chart is looking very similar to the 2020–21 cycle.

18/

Breakout has happened.

Breakout level retest has happened.

And now, it’s time for takeoff.

Wen? Maybe in 2–3 weeks.

19/

➔ 5. $BTC + Stablecoins Dominance

Everyone is focused on BTC dominance only, but I’m looking at BTC + stablecoins dominance.

In Q2 2025, the dominance reached its multi-cycle resistance level.

20/

Interestingly, the last 3 instances either resulted in a mini or major altseason.

And I’m expecting something similar this time.

BTC will go sideways (above $100K), and stablecoin liquidity will flow into alts.

21/

With stablecoin MCap hovering above $250B, it’s a no-brainer that liquidity is enough to push alts to new yearly highs.

After that, BTC will dominate again until Oct/Nov 2025, and finally, there’ll be a blow-off top.

But that’s a story for another time and before that, there’ll be a rally in alts.

22/

➔ Conclusion:

I think most people will agree that a lot of alts are trading at cheap valuations despite growing fundamentals.

Sometimes this gets priced in immediately, and sometimes it takes a while.

But it always happens.

23/

I’m preparing my portfolio based on this one thing only, and I’ll get rewarded for it.

Are you positioned well or still waiting for better opportunities?

That’s a wrap!

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉

I hope this thread brought you some value!

Make sure to follow @Axel_bitblaze69 for:

• More valuable crypto insights

• Real-time alpha & airdrop updates

If you found this helpful, feel free to like/retweet the first tweet below!👇

61.78K

583

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.