very cool

this is basically dividing aave into junior and senior tranches

locked $aUSDC holders get higher apy for a bit more risk

yield amplification for fixed duration assets is gonna be a bigger trend in DeFi going forward

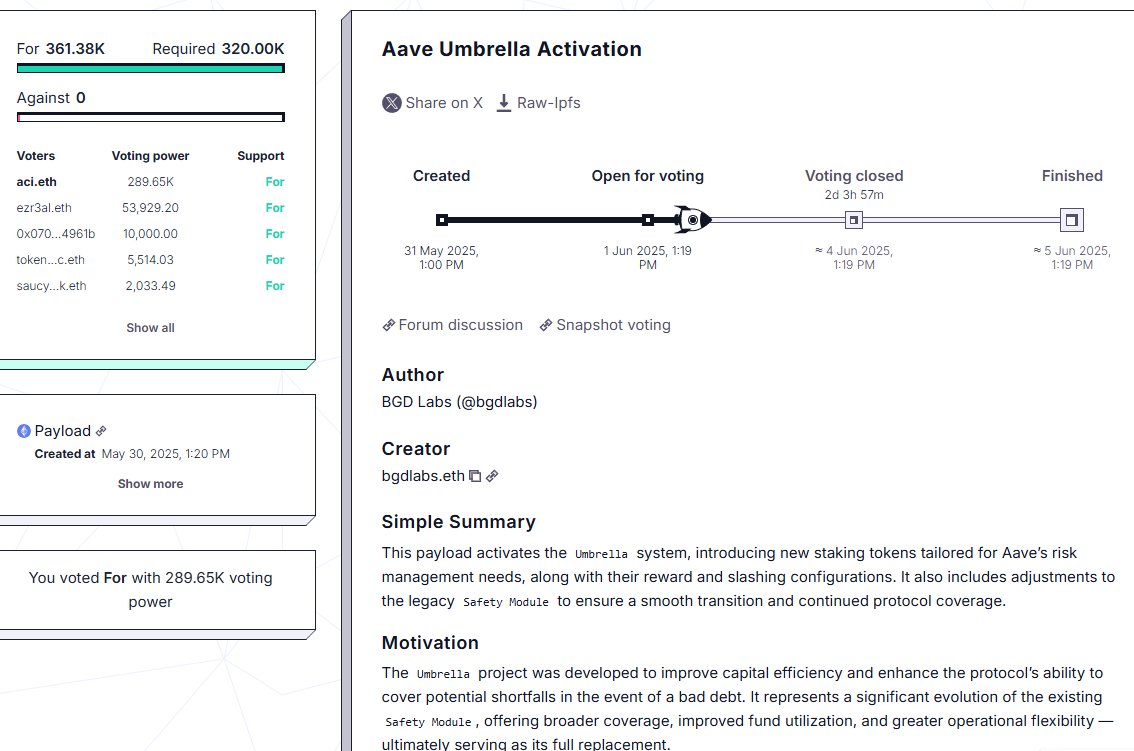

3 days from now, a massive safety upgrade goes live on @Aave.

Aave was already the best risk-adjusted venue for your assets and positions. After this upgrade, we’ll be in a league of our own.

What you need to know to stay ahead:

1) aToken staking means you can be slashed and must commit for 20 days, but yields will be high (up to 12% on stables and 6% on wETH.

2) AAVE distributions will be significantly reduced, paired with ongoing buybacks. The protocol remains deeply token-flow positive.

3) StkGHO, as we know it, will be slowly deprecated: There will be no more AAVE rewards and no more lock-up. A streamlined umbrella vault will take the lead with a higher yield (but smaller target size), and a liquid sGHO deposit vault (with a smaller yield) will launch in a few weeks.

4) Bad debt is slashed automatically with no governance involved. Your deposits stay protected by stakers. Historically, LPs have earned $ 3,150 in yield for every $1 of bad debt in Aave. There’s still risk staking in the umbrella vault, but I’ll be putting my own money there.

TL;DR: Higher overall yields, fewer AAVE tokens distributed, lower DAO spending, and broader user coverage with a more efficient system.

Just Use Aave.

30.11K

90

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.