#ChartoftheDay The largest DEX and liquidity provider on the Sui blockchain, Cetus Protocol, suffered a major hack. According to the official statement and on-chain data, the attack resulted in losses of approximately $223 million, including about $52 million in $SUI, $4.9 million in $Haedal Staked SUI (HASUI), $19.5 million in $TOILET, and another $19.5 million in wrapped USDT, along with tokens like Lombard Staked BTC (LBTC) and AXOLcoin (AXOL). Following the attack, the price of $SUI dropped by 7%, reaching a low of $3.9 before stabilizing.

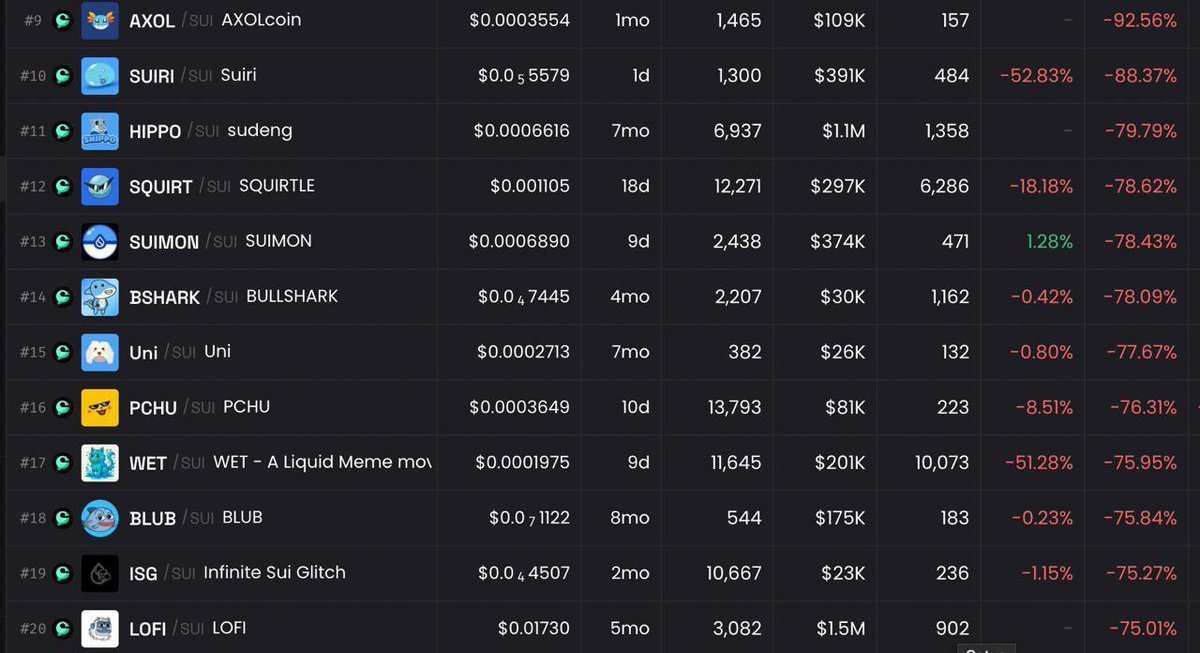

Data from the DEX screener shows that many tokens on Cetus have plunged over 75% in the past few days, with liquidity pools nearly drained. The hackers exploited vulnerabilities in Cetus’s price curves and reserves, injecting spoof tokens to manipulate prices. They initially withdrew around $11 million worth of $SUI from the SUI/USDC pool, then expanded attacks to other pools, including HASUI, TOILET, and wrapped USDT, likely due to calculation precision issues in the oracle, which caused abnormal pricing and allowed low-cost extraction of large amounts of real assets. The stolen funds were transferred across chains to Ethereum.

In response, Cetus quickly paused all smart contracts to prevent further losses. $162 million has been frozen and is planned for restitution to liquidity providers.

Currently, the frozen assets on the Sui blockchain are being processed through on-chain validator votes and white-hat recovery initiatives, while off-chain assets remain under investigation.

Cetus has pledged to use all resources to maximize asset recovery and compensate users. Details of the compensation plan will be announced once the recovery amount is clarified.

#Sui #Cetus #DeFi #Crypto #CrossChain #Blockchain #Security

28.04K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.