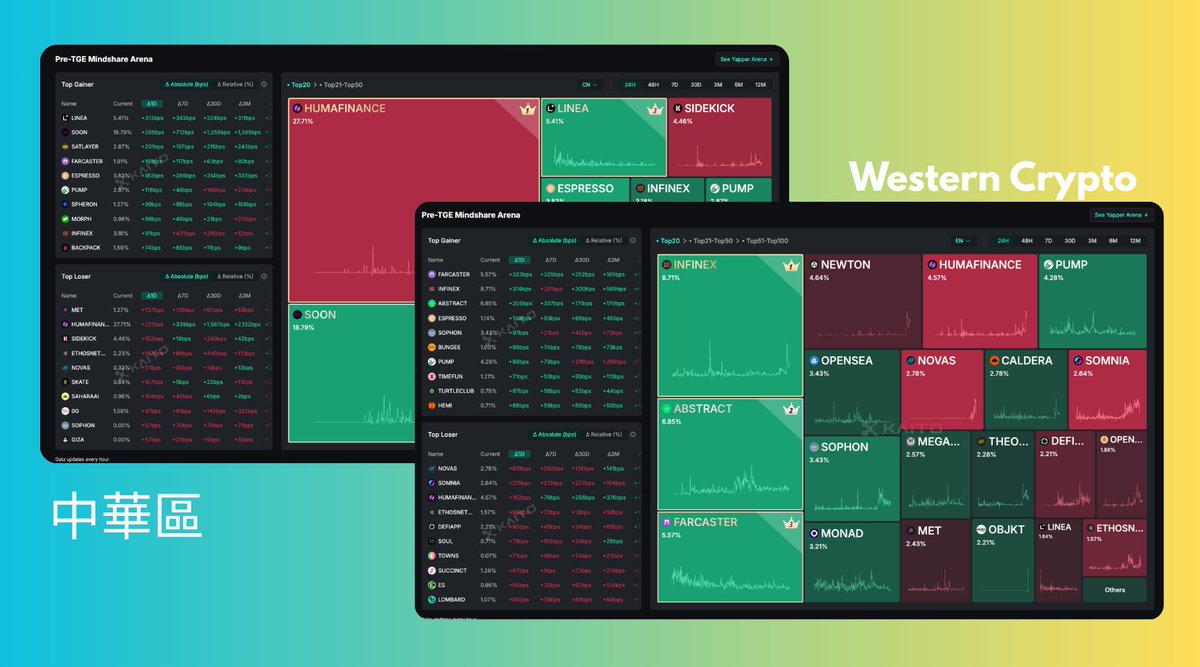

It's crazy, the Chinese and English crypto communities are like two parallel universes. I was just looking at the yappers leaderboard.

I've been chasing both sides of the market for the past week. The English-speaking circle is like a business incubator, with steady growth, many projects can get attention, and no one is dominant.

The top items get less than 9% of the attention.

What about the Chinese circle? Purely viral. AS LONG AS ONE PROJECT CATCHES FIRE (LIKE THE CURRENT HUMAFINANCE, WHICH RUSHES TO 28%), THE ENTIRE PAGE WILL EXPLODE DIRECTLY, AND ALL OTHER PROJECTS WILL BE MARGINALIZED.

I think the most interesting part is that the same project can be completely silent on one side, and explode on the other.

Like HUMAFINANCE, it is still dangling at the bottom of the English circle, and it is directly crowned king in the Chinese circle.

A little truth for builders:

English market = burn slowly, which is very suitable for building real community relationships like Infinex and ABSTRACT

Chinese market = when you need a wave of popularity, it's definitely home

Have you noticed this market difference? Have you encountered the same pattern?

By the way, who are the strongest KOLs in the Chinese crypto circle now?

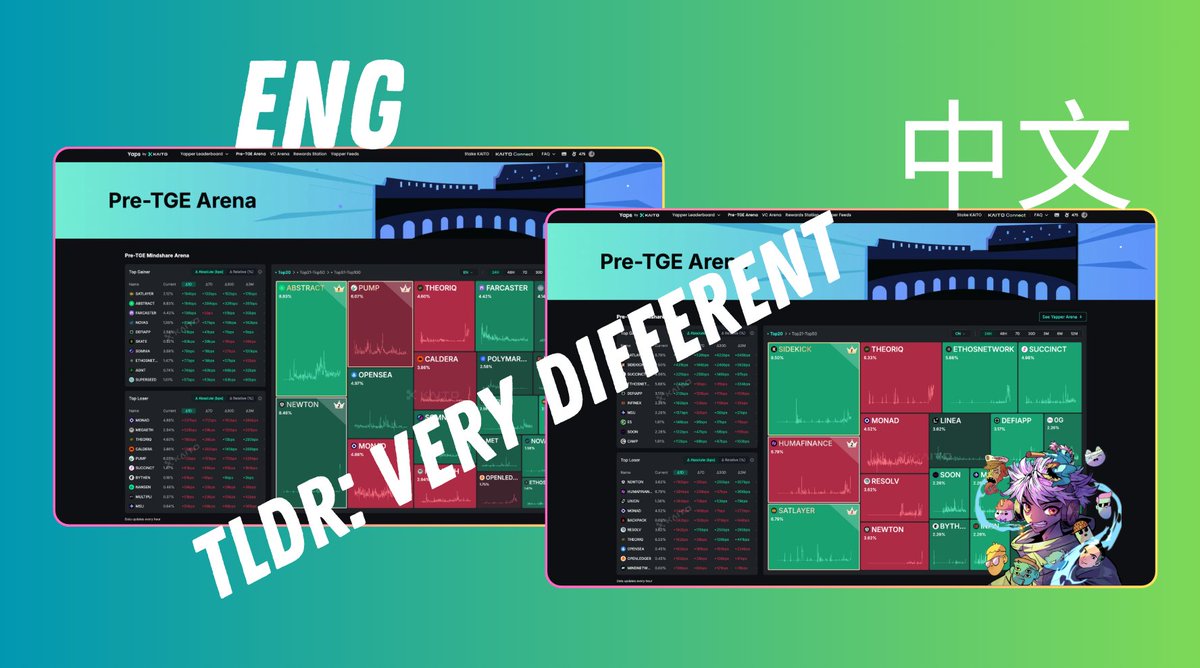

I saw something very interesting about Chinese CT and Western CT on the Kaito Yappers Leaderboard

💡TLDR:

East CT = infra, automation, capital efficiency

West CT = vibes, UX, velocity plays

I just went deep into the latest Kaito Pre-TGE Mindshare Arena heatmaps and noticed something pretty telling, the English and Chinese crypto spheres are trending on two completely different wavelengths

On the Chinese side, the top 3, we have... 👇

@Sidekick_Labs : Massive traction here, likely due to its agentic automation narrative. Tapping into localized AI infra plays that resonate with devs who want modular, stealth-bot-like agents

@humafinance : Gaining momentum off real-world asset (RWA) narratives. They’re building for undercollateralized lending

@satlayer : Emerging as an L2 infra and AI-enabling network. Seems like zk-verified models and compute markets are vibing with Chinese early adopters who value raw technical breakthroughs.

On the English side, the top 3, there isss.. 👇

@AbstractChain: Easily one of the cleanest UX and modular protocol builders on the map. Everyone in the West seems to love its clean, $pengu Luca, developer-first abstractions

@MagicNewton : Strong narrative as a community-driven “new layer” project, combining aesthetics, community culture, and speculative energy.

@pumpdotfun: Pure meme momentum. Chaos and unapologetic farming on solana

It’s early. Most of these aren’t even TGE’d yet. But these sentiment splits? These will spill over to others, and on Kaito Yaps, there another huge Asia market which is Korea too.. Later I suspect to see Spainish as Latam and Spainish have a different community too

Super valuable alpha if you’re tracking future cross-cultural breakouts.

Watching to see which one bridges both worlds next.

15.76K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.