Take @SonicLabs as an example, let's talk about the transition from vetoken to ve(3,3)

In fact, I told Zhao about the VE33 mechanism and the SONIC ecosystem a long time ago, but it was only a few words.

It just so happens that Binance Alpha has a lot of tokens in the SONIC ecosystem, so I will rub the hot spots and briefly talk about the evolution of the DeFi economic model from the history of DeFi.

1. Vetoken in order to solve the problem of supply and demand of governance tokens.

In the summer of DeFi, the rewards of liquidity mining helped many projects to start, but as more and more people participated in mining, the rewards became less, and the way of mining and selling could not be alleviated. Funds in the market are starting to look for higher rewards, or rush to the head mine that has not yet been opened, which is a bit similar to the current meme.

The Vetoken mechanism alleviates the problem of "mining and selling" by adjusting the supply and demand relationship of tokens, and incentivises users to participate in the development of the protocol for a long time.

$crv On Curve, CRV tokens can be locked and minted, and veCRV can obtain platform benefits, governance power, and rewards for helping LPs, thereby increasing user stickiness and even triggering Curve War.

In exchange for all of these properties, veCRV cannot be sold and cannot be transferred during the lock-up period.

In short, after the token is pledged, you can get the benefits brought by the growth of the protocol, and at the same time, the holders are truly participating in the governance to maximise their own interests, reduce supply and demand, and stabilise the price for long-term development.

So what's the problem?

In the early stage, he participated in the monopoly governance of chips, and after the protocol became bigger, the project party bought a lot of tokens to occupy voting rights, and there were fewer tokens in circulation outside, and the token price was manipulated to trigger a 51% attack.

Luna only needed 200 million funds to trigger 51% of the attacks, causing more than a billion funds in the agreement to lose hair.

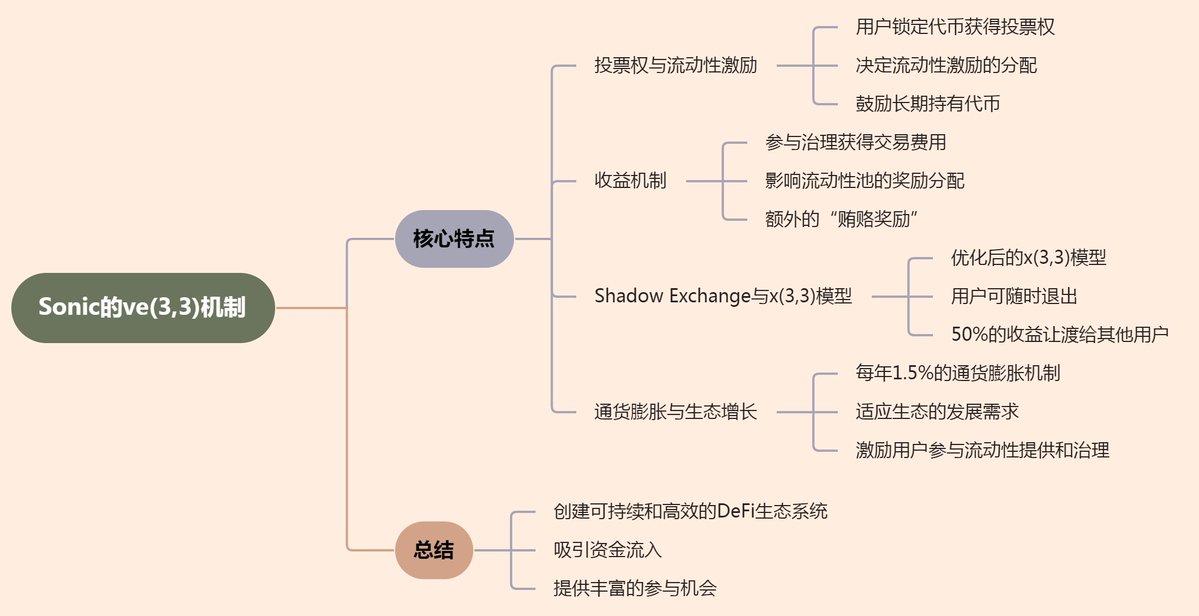

2. Sonic's VE (3,3) promotes the formation of market synergy through the game mechanism.

The Ve(3,3) mechanism was first proposed by @AndreCronjeTech, who believes that the reward mechanism of the protocol should balance the contradiction between holders and LPs.

In market behaviour, the scope provides liquidity, lock-up, and sell, and forms a joint force of the market through its game to promote the long-term development of the project. Perhaps in the short term, it is the most profitable to gain the most from doing evil (selling), but in the long run, it is necessary to deeply participate in the agreement to form a positive flywheel.

$s Rise - LP ARP Rise - TVL Rise - Transaction Fee Rise - Lock-up Volume - Decrease in Circulation, Supply and Demand Imbalance - $s Increase.

3. X33 is a more flexible ve33.

A lot of people think that $shadow's x33 is an upgraded version of VE33, but I don't think so. In the early days of @AndreCronjeTech, the vision of ve(3,3) was ambitious, and different ve(3,3) protocols often made small modifications to their mechanism to reduce the mismatch between time investment and market acceptance.

Therefore, I think that $shadow's X33 is a more flexible VE33 and an attempt to achieve the AC vision in line with this protocol.

Stake $SHADOW and mint $xSHADOW.

Here you can enjoy all the benefits brought by the traditional vetoken above, but the traditional vetoken staking is locked before expiration, and here gives you the opportunity to surrender and lose half. $xSHADOW exit the pledge, you can get back the protocol token at half price.

Gives you exit liquidity as far as users are concerned, and imposes a 50% voting power penalty on users who opt out early as far as the protocol is concerned, to reduce token dilution and encourage long-term holding.

Stake $xSHADOW and mint $x 33.

I'd prefer to define x33 pricing as a shadow of 0.5-1.0.

After xSHADOW is liquidly staking, it can mint $x 33, the core of which is through automated voting and reward collection, while not interfering with the core mechanism of xSHADOW, and at the same time obtaining the coin-based value of long-term stake. (The rewards of protocol income and voting incentives will be automatically earned, increasing the x33/shadow exchange ratio.) )

In a word:

Stakers who stay in xSHADOW for longer earn more fees, voting incentives, user and emission exit rewards.

$SHADOW don't have to force the lock to force you to bind me for a long time, but as far as the agreement is concerned, the big meat will flow to the long-term holders.

Show original

23.95K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.