Crypto tried to make payments work since Bitcoin launched.

Most say it failed.

But did it?

Look at EtherFi Card data: most transactions are small payments of $1 to $50 USD.

Sure, it's not the P2P crypto payments we wanted to have: Visa or Mastercard is the intermediary. We need KYC.

But onchain it looks the same.

Every coffee you buy settles on ETH L2s, Solana etc. with gas paid.

Whether it came from a crypto wallet or a card swipe does not matter for the chain.

And you still get the upside of crypto:

• Self custody with many more options in 2025

• DeFi integration through EtherFi Cash

• No need to cash out stablecoins to a legacy bank

Yes, Visa and Mastercard take a big cut. But it might be a transitory stage.

New non custodial crypto cards are building their own payment rails. Payy is one of them.

First, crypto cards use the reach of Visa and Mastercard.

Then they attract users with stronger rewards: cashbacks, collateral backed credit, and yield that banks cannot touch.

If they grow beyond the crypto niche, these networks can start eating into the legacy payment stack.

That is the hard part.

But the base is here.

People are already spending using blockchain space and bringing stablecoin adoption.

A real start for crypto payments

These payments are a lifeline for crypto wallets:

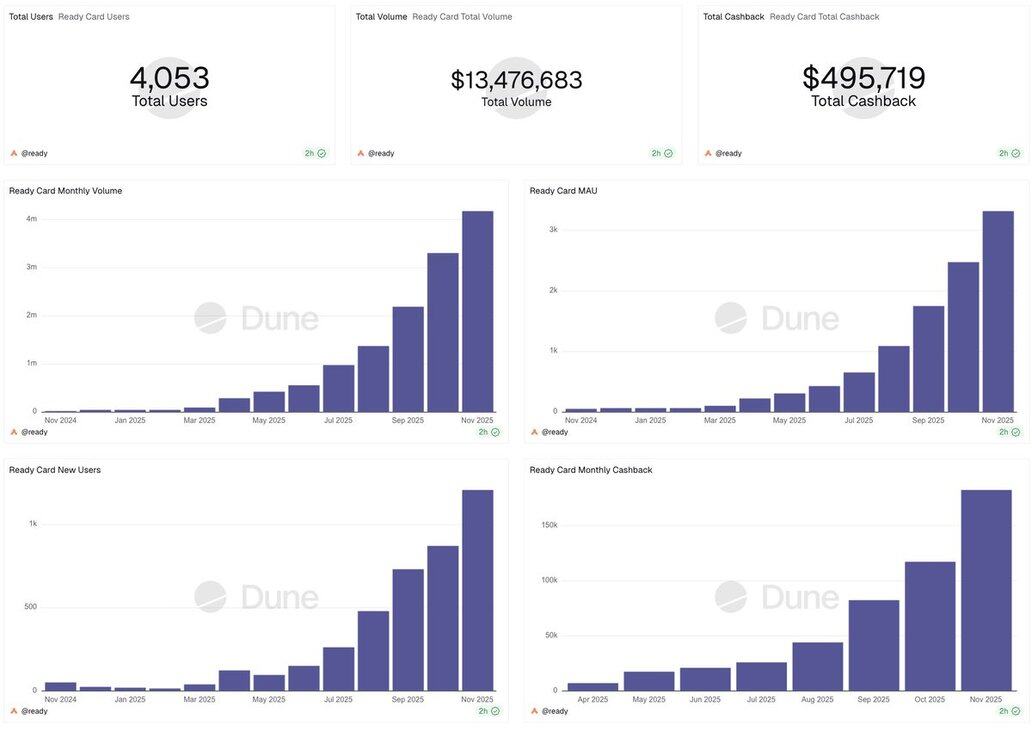

Argent (now Ready )has been struggling to find PMF but since they added card payments they stats are up only.

EtherFi card directly increases demand for borrowing without the leverage looping that DeFi relies so much.

This increases DeFi resilience from bull/bear cycles.

9,867

76

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。