EOS

EOS-pris

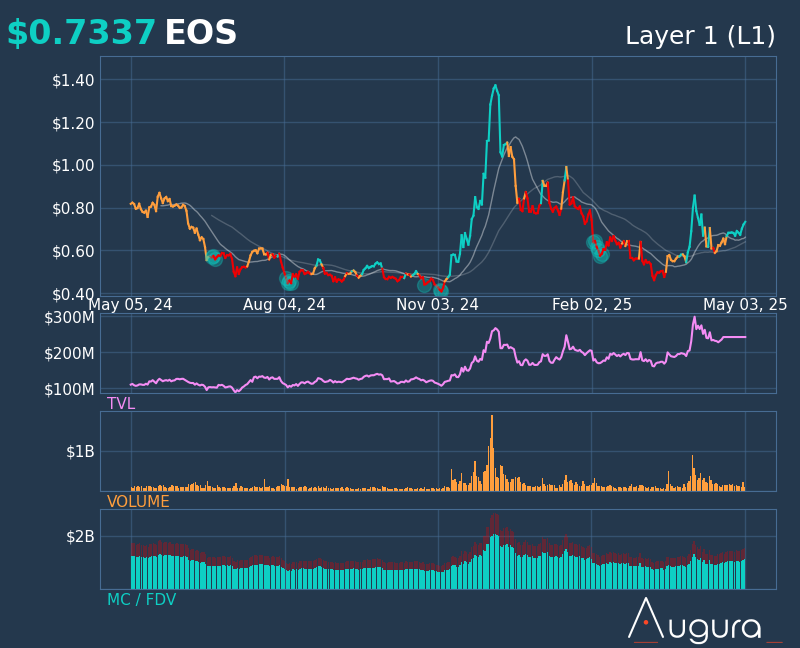

$0,68970

-$0,04370

(−5,96 %)

Prisförändring de senaste 24 timmarna

Hur känner du för EOS idag?

Dela dina känslor här genom att göra tummen upp om du känner dig bullish för coin eller tummen ner om du känner dig bearish.

Rösta för att visa resultat

Friskrivningsklausul

Det sociala innehållet på den här sidan ("Innehållet"), inklusive men inte begränsat till tweets och statistik som tillhandahålls av LunarCrush, kommer från tredje part och tillhandahålls " i befintligt skick" och endast i informationssyfte. OKX garanterar inte innehållets kvalitet eller sanningshalt, och innehållet representerar inte OKX:s åsikter. Det är inte avsett att tillhandahålla (i) investeringsrådgivning eller -rekommendationer; (ii) ett erbjudande eller en uppmaning att köpa, sälja eller inneha digitala tillgångar; eller (iii) finansiell, redovisnings-, juridisk eller skatterådgivning. Digitala tillgångar, inklusive stabil kryptovaluta och NFT:er, innebär en hög grad av risk och kan fluktuera kraftigt. Priset och prestandan för den digitala tillgången är inte garanterade och kan ändras utan föregående meddelande.

OKX tillhandahåller inga rekommendationer om investeringar eller tillgångar. Du bör noga överväga om handel eller innehav av digitala tillgångar är lämpligt för dig, med tanke på din ekonomiska situation. Vänligen rådfråga en juridisk-/skatte-/investeringsrådgivare för frågor om just dina specifika omständigheter. För mer information, vänligen se våra Användarvillkor och Riskvarning. Genom att använda tredjepartswebbplatsen (”third-party website/TPW”) godkänner du att all användning av TPW kommer att omfattas av och regleras av villkoren i TPW. Om inte annat uttryckligen anges skriftligen är OKX och dess dotterbolag ( OKX ) inte på något sätt associerade med ägaren eller operatören av TPW. Du samtycker till att OKX inte är ansvarigt eller skyldigt för någon förlust, skada eller andra konsekvenser som uppstår på grund av din användning av TPW. Vänligen observera om att användning av en TPW kan resultera i förlust eller minskning av dina tillgångar. Produkten kanske inte är tillgänglig i alla jurisdiktioner.

OKX tillhandahåller inga rekommendationer om investeringar eller tillgångar. Du bör noga överväga om handel eller innehav av digitala tillgångar är lämpligt för dig, med tanke på din ekonomiska situation. Vänligen rådfråga en juridisk-/skatte-/investeringsrådgivare för frågor om just dina specifika omständigheter. För mer information, vänligen se våra Användarvillkor och Riskvarning. Genom att använda tredjepartswebbplatsen (”third-party website/TPW”) godkänner du att all användning av TPW kommer att omfattas av och regleras av villkoren i TPW. Om inte annat uttryckligen anges skriftligen är OKX och dess dotterbolag ( OKX ) inte på något sätt associerade med ägaren eller operatören av TPW. Du samtycker till att OKX inte är ansvarigt eller skyldigt för någon förlust, skada eller andra konsekvenser som uppstår på grund av din användning av TPW. Vänligen observera om att användning av en TPW kan resultera i förlust eller minskning av dina tillgångar. Produkten kanske inte är tillgänglig i alla jurisdiktioner.

EOS marknadsinfo

Marknadsvärde

Marknadsvärde beräknas genom att multiplicera det cirkulerande utbudet av ett coin med dess senaste pris.

Börsvärde = Cirkulerande utbud × Senaste pris

Börsvärde = Cirkulerande utbud × Senaste pris

Cirkulerande utbud

Totalt belopp för ett coin som är allmänt tillgängligt på marknaden.

Marknadsvärde-rankning

Ett coins rankning i termer av marknadsvärde.

Högsta någonsin

Högsta pris ett coin har nått i sin handelshistorik.

Lägsta någonsin

Lägsta pris ett coin har nått i sin handelshistorik.

Marknadsvärde

$1,05B

Cirkulerande utbud

1 516 885 789 EOS

72,23 % av

2 100 000 000 EOS

Marknadsvärde-rankning

--

Granskningar

Senaste granskningen: 29 dec. 2021

Högsta priset under 24 tim

$0,74400

Lägsta priset under 24 tim

$0,68790

Högsta någonsin

$23,2880

−97,04 % (-$22,5983)

Senast uppdaterad: 29 apr. 2018

Lägsta någonsin

$0,39720

+73,64 % (+$0,29250)

Senast uppdaterad: 5 aug. 2024

EOS-flödet

Följande innehåll är hämtat från .

Crypto子棋

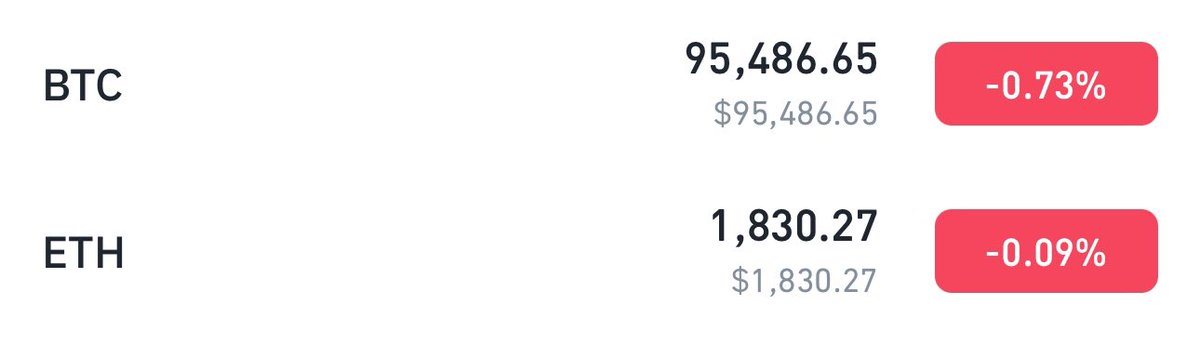

Den tidigare tillbakadragningen var runt 3000u, och om rytmen förblir oförändrad den här gången förväntas den stabiliseras på $94800 och det kommer att vara dags att studsa tillbaka!

Kärnan i rytmen för den närmaste framtiden är torsdagens Federal Reserve-möte, som kommer att avgöra tillståndet på marknaden i nästan en månad.

Crypto子棋

Så länge ETH inte är stabilt är alla copycat-rebounds bara en blixt i pannan, så oroa dig inte, den allmänna riktningen är att leta efter BTC, och om du vill tjäna pengar, leta efter ETH.

ETH måste fortfarande ha en stor våg, oavsett om du tror det eller inte, även om skräp som EOS, toppen av den stora tjurmarknaden fortfarande kan vara svår en gång, för att inte tala om att ETH har passerat spot-ETF:en, torr!

9,78 tn

14

Lux(λ) |光尘|空灵|GEB

Bitcoins vallgrav: Framväxten av tre formella system och kryptovalutans innovationsdilemma

På kryptovalutans stjärnhimmel är #Bitcoin en lysande stjärna, och dess banbrytande design fortsätter att djupt påverka riktningen för hela branschen idag. Men genom kryptovalutans historia har vi sällan sett framväxten av innovativa produkter som verkligen kan matcha #Bitcoin. Anledningen till detta kan, som nämnts ovan, vara att essensen av #Bitcoin inte är väl förstådd. Den unika charmen med #Bitcoin är inte bara ett enda tekniskt genombrott, utan dess smarta integration av tre typer av formella system för att bygga ett komplext och adaptivt ekosystem.

För det första har #Bitcoin etablerat sin unika position i den digitala världen genom den decentralisering som den individuella suveräniteten medför. UTXO-modellen (Unspent Transaction Output) är kärnan i denna filosofi. Till skillnad från kontomodellen behandlar UTXO:er varje transaktion som ett oberoende, odelbart "mynt" vars tillskrivning helt kontrolleras av ägarens privata nyckel. Denna design ger i grunden användarna absolut kontroll över sina tillgångar, eliminerar beroendet av centraliserade institutioner och bygger ett verkligt decentraliserat nätverk för värdeöverföring. Detta förverkligande av individuell suveränitet är hörnstenen i #Bitcoin:s motstånd mot censur och öppenhet.

För det andra introducerar #Bitcoin den perceptuella verkligheten som bildas av P/NP asymmetrisk lösning och verifiering, dvs. proof-of-work-mekanismen (POW). Det fina med POW är att det drar fördel av beräkningsasymmetri: att hitta en hash som uppfyller ett specifikt svårighetsgradskrav (lösning, NP-problem) kräver mycket beräkningsresurser och tid, men att verifiera att hashvärdet uppfyller kraven är mycket snabbt och enkelt (validering, P-problem). Denna mekanism säkerställer inte bara oföränderligheten av transaktioner och blockkedjans säkerhet, utan ännu viktigare, den omvandlar energiförbrukningen till ett objektivt "bevis på arbete", vilket skapar en pålitlig konsensusmekanism i ett decentraliserat nätverk. Detta sätt att "uppfatta verkligheten", även om det är kontroversiellt när det gäller energiförbrukning, förankrar förtroendet för den digitala världen genom kostnaden för den fysiska världen och lägger grunden för den värdekonsensus som råder inom #Bitcoin.

Slutligen inkluderar hörnstenen i #Bitcoin också transparensen i förtroendekoden, som underlättas av dess underliggande Blockchain-teknik. Som en distribuerad huvudboksteknik registrerar blockchain varje transaktion öppet och transparent och använder kryptografi för att säkerställa att data är oföränderliga. #Bitcoin:s kod är öppen källkod och vem som helst kan granska dess driftslogik, vilket gör att systemets förtroendegrund inte längre är beroende av en centraliserad auktoritet, utan bygger på öppen och transparent kod och decentraliserad konsensus. Denna transparens i förtroendet ökar avsevärt användarens förtroende för systemet.

Å andra sidan fokuserar senare offentliga kedjeprojekt som EOS och Ethereum ofta på själva Blockchain-tekniken och försöker bygga ett nytt ekosystem genom en effektivare konsensusmekanism och kraftfullare smarta kontraktsfunktioner. De offrar dock i viss mån den individuella suveräniteten och P/NP-uppfattningen av verkligheten som #Bitcoin betonar. Till exempel kan vissa högpresterande offentliga kedjor införa centraliserade styrningsmekanismer eller konsensusalgoritmer som är mer mottagliga för mänskligt ingripande för att öka transaktionsgenomströmningen, vilket försvagar deras decentralisering. Dessutom, på grund av avsaknaden av en mekanism som POW för att förankra verkliga kostnader, står dessa blockkedjor inför betydande utmaningar när det gäller att på ett säkert och säkert sätt "orakla" interaktioner med fysiska tillgångar i omvärlden, och det är svårt att bilda en endogen värdekonsensus baserad på energiförbrukning som #Bitcoin.

Om man tittar på framväxande offentliga kedjor som #ADA och #SUI har de förnyat sig på UTXO-modellen eller liknande datastrukturer i ett försök att uppnå starkare individuell suveränitet och skalbarhet på datanivå. Men de misslyckas också med att effektivt ta itu med verklighetsuppfattningen av P/NP, vilket lämnar en klyfta mellan anslutningen av deras system till den verkliga världen. Ett projekt som Bittensor, som försöker utföra linjär verklighetsuppfattning genom konsensus, skiljer sig dock fundamentalt från den #Bitcoin P/NP-baserade icke-linjära framväxtmekanismen, och det är svårt att uppnå samma säkerhet och robusthet.

Det är just på grund av att #Bitcoin skickligt kombinerar dessa tre typer av formella system som det skapar en "framväxande" effekt som går bortom överlagringen av enkla teknologier. UTXO-modellen garanterar individuell suveränitet, POW-modellen förankrar förtroende genom asymmetriska beräkningskostnader och Blockchain-tekniken ger en transparent och pålitlig huvudbok. Dessa tre är beroende av varandra och ömsesidigt förstärkande, och tillsammans utgör de den unika tryggheten och värdegrunden för #Bitcoin.

Sedan utvecklingen av kryptovalutaindustrin har otaliga tekniska innovationer och konceptiterationer dykt upp, men det finns väldigt få projekt som verkligen kan förstå och replikera #Bitcoin så komplex adaptiv systemdesign från den underliggande logiken. De flesta projekt tenderar att fokusera på optimering och förbättring av en eller ett fåtal lokala funktioner i #Bitcoin och ignorerar den systematiska innovationen i samhället som helhet. Detta fenomen med att "se skogen för alla träd" har lett till en långsiktig stagnation i branschens berättelse om imitation och förgrening av lokala #Bitcoin tekniker, vilket gör det svårt att uppnå verklig innovation från 0 till 1.

Därför bör framtida kryptovalutainnovation kanske återvända till en djup förståelse för det grundläggande designkonceptet för #Bitcoin, och ompröva den interna logiken och interaktionen mellan de tre pelarna för individuell suveränitet, P/NP-verklighetsuppfattning och transparens i förtroendekoden. Först när vi verkligen kan förstå essensen av #Bitcoin som ett komplext adaptivt system, och göra mer systematiska och framåtblickande innovationer ovanpå det, kommer det att vara möjligt att skapa nästa generations kryptovaluta som verkligen kan matcha eller till och med överträffa #Bitcoin. Detta kräver inte bara tekniska genombrott, utan också djupgående tänkande och utforskning av grundläggande frågor som valuta, förtroende och decentralisering.

Lux(λ) |光尘|空灵|GEB

#Bitcoin:s kryptovalutor inkluderar tre breda kategorier av formella system

- 1. Decentralisering framkallad av individuell suveränitet. (UTXO-modell)

- 2, P/NP asymmetrisk lösning och verifiering av den resulterande perceptuella verkligheten. (Modell för krigsfångare)

- 3, Lita på kodens transparens. (Blockchain-teknik).

EOS/Ethereum fokuserar bara på Blockchain-teknik, så det leder till ett centraliserat förtroende för människorna bakom reglerna bakom distributionskoden, så att systemet har sina egna säkerhetsbrister, och produkten hackas eftersom personen som distribuerar koden inte har någon motivation att aktivt hacka eller om de har förmågan att skriva kod för att försvara sig mot hackerattacker. Dessutom har båda dessa förlorat den upplevda verklighetsmodulen P/NP, och de fysiska objekten i den yttre världen kan inte på ett säkert sätt Orcacl från konsensusnivån till blockkedjan, och blockkedjan kan inte förstå verkligheten.

Det finns en rad offentliga kedjeprojekt bakom den, som mer eller mindre har implementerat en av de tre huvudkategorierna av teknologier i #Bitcoin.

Till exempel använder #ADA och #SUI den härledda UTXO-datastrukturen respektive, och objektstrukturen realiserar den decentralisering som individuell suveränitet medför. Verklighetsuppfattningen av P/NP beaktas dock inte alls, så systemet kan fortfarande inte uppnå ömsesidig uppfattning och landa med verkligheten.

Till exempel gör bittensor linjär uppfattning av verkligheten genom konsensus, men den använder inte P/NP icke-linjär teknik för att uppfatta verkligheten, och den kan inte uppnå emergenta resultat.

Varför har inte kryptovalutaindustrin gjort något liknande #Bitcoin så länge i #Bitcoin?

Här är anledningen: ingen förstår #Bitcoin.

Varje projekt kan uppnå många resultat efter att ha lärt sig bara ett och ett halvt knep #Bitcoin.

Och det narrativ som vi verkligen vill göra bör gå tillbaka till den komplexa adaptiva teknik som #Bitcoin har vuxit fram genom att kombinera tre typer av formella system. Det är så vi kan skapa en kryptovaluta som är jämförbar med #Bitcoin.

Detta är branschens verkliga 0-till-1-innovation. I stället för att låta hela branschberättelsen stagnera på den lokala tekniken från olika gaffel#Bitcoin.

18,83 tn

0

Crypto子棋

Så länge ETH inte är stabilt är alla copycat-rebounds bara en blixt i pannan, så oroa dig inte, den allmänna riktningen är att leta efter BTC, och om du vill tjäna pengar, leta efter ETH.

ETH måste fortfarande ha en stor våg, oavsett om du tror det eller inte, även om skräp som EOS, toppen av den stora tjurmarknaden fortfarande kan vara svår en gång, för att inte tala om att ETH har passerat spot-ETF:en, torr!

Visa original23,42 tn

49

EOS-kalkylator

EOS-prisresultat i USD

Aktuellt pris på EOS är $0,68970. Under de senaste 24 timmarna har EOS minskade med −5,96 %. Det har för närvarande ett cirkulerande utbud av 1 516 885 789 EOS och ett maximalt utbud av 2 100 000 000 EOS, vilket ger ett marknadsvärde efter full utspädning på $1,05B. För tillfället innehar EOS-coin position 0 i marknadsvärdesrankningar. EOS/USD-priset uppdateras i realtid.

Idag

-$0,04370

−5,96 %

7 dagar

+$0,023000

+3,44 %

30 dagar

-$0,12080

−14,91 %

3 månader

+$0,043800

+6,78 %

Populära EOS-omvandlingar

Senast uppdaterad: 2025-05-05 02:34

| 1 EOS till USD | 0,68980 $ |

| 1 EOS till EUR | 0,61030 € |

| 1 EOS till PHP | 38,2908 ₱ |

| 1 EOS till IDR | 11 358,47 Rp |

| 1 EOS till GBP | 0,51996 £ |

| 1 EOS till CAD | 0,95341 $ |

| 1 EOS till AED | 2,5336 AED |

| 1 EOS till VND | 17 940,18 ₫ |

Om EOS (EOS)

Betyget som anges är ett sammanställt betyg som inhämtats av OKX från källorna som anges, och det anges endast för informativa syften. OKX garanterar inte betygens kvalitet eller korrekthet. Det är inte avsett att utgöra (i) investeringsrådgivning eller rekommendation, (ii) ett erbjudande eller en uppmaning att köpa, sälja eller inneha digitala tillgångar, eller (iii) finansiell, redovisningsmässig, juridisk eller skattemässig rådgivning. Digitala tillgångar, inklusive stabil kryptovaluta och NFT:er, omfattas av hög risk, kan skifta kraftigt och till och med bli värdelösa. Priset och prestanda för de digitala tillgångarna garanteras inte, och de kan förändras utan föregående meddelande. Dina digitala tillgångar täcks inte av försäkran mot potentiella förluster. Historisk avkastning är ingen garanti om framtida avkastning. OKX garanterar inte någon avkastning, återbetalning av huvudbelopp eller ränta. OKX tillhandahåller inga rekommendationer om investeringar eller tillgångar. Du bör noga överväga om handel med eller innehav av digitala tillgångar är lämpligt för dig med hänsyn till din ekonomiska situation. Rådgör med din jurist, skatteexpert eller investeringsrådgivare om du har frågor om dina specifika omständigheter.

Visa mer

- Officiell webbplats

- Vitbok

- Github

- Block explorer

Om tredjeparts webbplatser

Om tredjeparts webbplatser

Genom att använda tredjepartswebbplatsen (”TPW”) samtycker du till att all användning av TPW kommer att omfattas av och styras av villkoren i TPW. Om inte annat uttryckligen anges skriftligen är OKX och dess affiliates (”OKX”) inte på något sätt associerade med ägaren eller operatören av TPW. Du samtycker till att OKX inte är ansvarigt eller skadeståndsskyldigt för förlust, skada eller andra konsekvenser som uppstår till följd av din användning av TPW. Var medveten om att användning av en TPW kan leda till förlust eller minskning av dina tillgångar.

Vanliga frågor för EOS

Hur mycket är 1 EOS värd idag?

För närvarande är en EOS värd $0,68970. För svar och insikt om prisåtgärder för EOS är du på rätt plats. Utforska de senaste diagrammen för EOS och handla ansvarsfullt med OKX.

Vad är kryptovalutor?

Kryptovalutor, till exempel EOS, är digitala tillgångar som fungerar på en offentlig reskontra som kallas blockkedjor. Läs mer om coins och tokens som erbjuds på OKX och deras olika attribut, som inkluderar live-priser och realtidsdiagram.

När uppfanns kryptovalutor?

Tack vare finanskrisen 2008 ökade intresset för decentraliserad finansiering. Bitcoin erbjöd en ny lösning genom att vara en säker digital tillgång på ett decentraliserat nätverk. Sedan dess har många andra tokens som t.ex. EOS skapats också.

Kommer priset på EOS gå upp idag?

Se vår EOS prisprognossida för att förutse framtida priser och fastställa dina prismål.

ESG-upplysning

ESG-regleringar (Environmental, Social och Governance) för kryptotillgångar syftar till att ta itu med eventuell miljöpåverkan (t.ex. energiintensiv mining), främja transparens och säkerställa etiska förvaltningsmetoder för att anpassa kryptoindustrin till bredare hållbarhets- och samhälleliga mål. Dessa regleringar uppmuntrar efterlevnad av standarder som minskar risker och främjar förtroende för digitala tillgångar.

Tillgångsdetaljer

Namn

OKcoin Europe LTD

Relevant juridisk enhetsidentifierare

54930069NLWEIGLHXU42

Namn på kryptotillgången

EOS

Konsensusmekanism

EOS is present on the following networks: binance_smart_chain, eos, eos_evm.

Binance Smart Chain (BSC) uses a hybrid consensus mechanism called Proof of Staked Authority (PoSA), which combines elements of Delegated Proof of Stake (DPoS) and Proof of Authority (PoA). This method ensures fast block times and low fees while maintaining a level of decentralization and security. Core Components 1. Validators (so-called “Cabinet Members”): Validators on BSC are responsible for producing new blocks, validating transactions, and maintaining the network’s security. To become a validator, an entity must stake a significant amount of BNB (Binance Coin). Validators are selected through staking and voting by token holders. There are 21 active validators at any given time, rotating to ensure decentralization and security. 2. Delegators: Token holders who do not wish to run validator nodes can delegate their BNB tokens to validators. This delegation helps validators increase their stake and improves their chances of being selected to produce blocks. Delegators earn a share of the rewards that validators receive, incentivizing broad participation in network security. 3. Candidates: Candidates are nodes that have staked the required amount of BNB and are in the pool waiting to become validators. They are essentially potential validators who are not currently active but can be elected to the validator set through community voting. Candidates play a crucial role in ensuring there is always a sufficient pool of nodes ready to take on validation tasks, thus maintaining network resilience and decentralization. Consensus Process 4. Validator Selection: Validators are chosen based on the amount of BNB staked and votes received from delegators. The more BNB staked and votes received, the higher the chance of being selected to validate transactions and produce new blocks. The selection process involves both the current validators and the pool of candidates, ensuring a dynamic and secure rotation of nodes. 5. Block Production: The selected validators take turns producing blocks in a PoA-like manner, ensuring that blocks are generated quickly and efficiently. Validators validate transactions, add them to new blocks, and broadcast these blocks to the network. 6. Transaction Finality: BSC achieves fast block times of around 3 seconds and quick transaction finality. This is achieved through the efficient PoSA mechanism that allows validators to rapidly reach consensus. Security and Economic Incentives 7. Staking: Validators are required to stake a substantial amount of BNB, which acts as collateral to ensure their honest behavior. This staked amount can be slashed if validators act maliciously. Staking incentivizes validators to act in the network's best interest to avoid losing their staked BNB. 8. Delegation and Rewards: Delegators earn rewards proportional to their stake in validators. This incentivizes them to choose reliable validators and participate in the network’s security. Validators and delegators share transaction fees as rewards, which provides continuous economic incentives to maintain network security and performance. 9. Transaction Fees: BSC employs low transaction fees, paid in BNB, making it cost-effective for users. These fees are collected by validators as part of their rewards, further incentivizing them to validate transactions accurately and efficiently.

The EOS blockchain operates on a Delegated Proof of Stake (DPoS) consensus mechanism, designed to provide high transaction throughput and low latency. Core Components of EOS Consensus: Delegated Proof of Stake (DPoS) with Block Producers (BPs) Voting for Block Producers: EOS token holders vote to select 21 block producers (BPs) who validate transactions and produce blocks. This voting process is continuous, with token holders able to reallocate their votes at any time, ensuring the active block producers are consistently those with the most community support. Active Rotation: The top 21 BPs are rotated regularly to maintain a decentralized and representative set of validators, helping secure the network while giving all selected BPs equal opportunities for block production. Byzantine Fault Tolerance (BFT) in DPoS EOS incorporates BFT principles within its DPoS consensus to finalize blocks with a high degree of security. Transactions gain irreversibility once approved by a majority of block producers, providing faster finality and reducing the risk of forks or double-spending attacks. High Throughput and Block Production Block Time: EOS block producers create blocks in 0.5-second intervals, facilitating a rapid transaction processing rate. If a block producer misses their turn, the system immediately switches to the next producer, keeping network latency minimal.

EOS EVM operates within the EOS blockchain, which utilizes a Delegated Proof of Stake (DPoS) consensus mechanism. In this system, EOS token holders vote to elect a set number of block producers responsible for validating transactions and adding new blocks to the blockchain. The EOS EVM functions as a smart contract on the EOS network, enabling Ethereum-compatible smart contracts to run within this DPoS framework.

Incitamentmekanismer och tillämpliga avgifter

EOS is present on the following networks: binance_smart_chain, eos, eos_evm.

Binance Smart Chain (BSC) uses the Proof of Staked Authority (PoSA) consensus mechanism to ensure network security and incentivize participation from validators and delegators. Incentive Mechanisms 1. Validators: Staking Rewards: Validators must stake a significant amount of BNB to participate in the consensus process. They earn rewards in the form of transaction fees and block rewards. Selection Process: Validators are selected based on the amount of BNB staked and the votes received from delegators. The more BNB staked and votes received, the higher the chances of being selected to validate transactions and produce new blocks. 2. Delegators: Delegated Staking: Token holders can delegate their BNB to validators. This delegation increases the validator's total stake and improves their chances of being selected to produce blocks. Shared Rewards: Delegators earn a portion of the rewards that validators receive. This incentivizes token holders to participate in the network’s security and decentralization by choosing reliable validators. 3. Candidates: Pool of Potential Validators: Candidates are nodes that have staked the required amount of BNB and are waiting to become active validators. They ensure that there is always a sufficient pool of nodes ready to take on validation tasks, maintaining network resilience. 4. Economic Security: Slashing: Validators can be penalized for malicious behavior or failure to perform their duties. Penalties include slashing a portion of their staked tokens, ensuring that validators act in the best interest of the network. Opportunity Cost: Staking requires validators and delegators to lock up their BNB tokens, providing an economic incentive to act honestly to avoid losing their staked assets. Fees on the Binance Smart Chain 5. Transaction Fees: Low Fees: BSC is known for its low transaction fees compared to other blockchain networks. These fees are paid in BNB and are essential for maintaining network operations and compensating validators. Dynamic Fee Structure: Transaction fees can vary based on network congestion and the complexity of the transactions. However, BSC ensures that fees remain significantly lower than those on the Ethereum mainnet. 6. Block Rewards: Incentivizing Validators: Validators earn block rewards in addition to transaction fees. These rewards are distributed to validators for their role in maintaining the network and processing transactions. 7. Cross-Chain Fees: Interoperability Costs: BSC supports cross-chain compatibility, allowing assets to be transferred between Binance Chain and Binance Smart Chain. These cross-chain operations incur minimal fees, facilitating seamless asset transfers and improving user experience. 8. Smart Contract Fees: Deployment and Execution Costs: Deploying and interacting with smart contracts on BSC involves paying fees based on the computational resources required. These fees are also paid in BNB and are designed to be cost-effective, encouraging developers to build on the BSC platform.

EOS incentivizes block producers to maintain the network and operates with unique staking and resource models to control transaction costs. Incentive Mechanisms: Block Producer Rewards Earning EOS Tokens: Block producers are rewarded in EOS tokens for validating transactions and producing blocks, providing the primary economic incentive for maintaining network operations and security. Voting Rewards for BPs Although not part of the core protocol, block producers often offer incentives to encourage token holders to vote for them. This encourages accountability, transparency, and performance, as EOS holders tend to favor reliable and engaged BPs. Applicable Fees and Resource Model: Fee-less Transactions for Users Resource Staking (CPU, NET): Rather than charging direct transaction fees, EOS allows users to perform fee-less transactions by staking EOS tokens for network resources like CPU and NET bandwidth, which are required for transaction processing. RAM for Storage: dApp developers purchase RAM for data storage on the EOS network. RAM prices are determined through a market-based system, where supply and demand influence cost. EOS EVM Gas Fees Dynamic Gas Model: For transactions on the EOS EVM, gas fees are dynamically calculated, based on transaction demand, similar to Ethereum’s gas model. These fees, paid in EOS tokens, enable Ethereum-compatible smart contracts to run on EOS, offering a familiar environment for EVM developers and users. EOS EVM Integration With EOS EVM, users and developers benefit from a familiar gas fee structure, allowing Ethereum-based applications to operate seamlessly on the EOS network while maintaining competitive costs.

Within the EOS EVM environment, users pay gas fees denominated in EOS tokens for executing smart contracts and transactions. These fees are designed to mirror Ethereum's gas model to maintain compatibility with Ethereum-based tools and applications. The collected fees are distributed to EOS block producers as compensation for their role in validating transactions and maintaining the network's integrity. This fee structure ensures that the execution of Ethereum-compatible smart contracts on EOS is both efficient and economically sustainable.

Början av den period som upplysningen avser

2024-04-20

Slutet av den period som upplysningen avser

2025-04-20

Energirapport

Energiförbrukning

344316.00291 (kWh/a)

Energiförbrukningskällor och -metoder

The energy consumption of this asset is aggregated across multiple components:

For the calculation of energy consumptions, the so called “bottom-up” approach is being used. The nodes are considered to be the central factor for the energy consumption of the network. These assumptions are made on the basis of empirical findings through the use of public information sites, open-source crawlers and crawlers developed in-house. The main determinants for estimating the hardware used within the network are the requirements for operating the client software. The energy consumption of the hardware devices was measured in certified test laboratories. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.

For the calculation of energy consumptions, the so called “bottom-up” approach is being used. The nodes are considered to be the central factor for the energy consumption of the network. These assumptions are made on the basis of empirical findings through the use of public information sites, open-source crawlers and crawlers developed in-house. The main determinants for estimating the hardware used within the network are the requirements for operating the client software. The energy consumption of the hardware devices was measured in certified test laboratories. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.

To determine the energy consumption of a token, the energy consumption of the network(s) binance_smart_chain is calculated first. Based on the crypto asset's gas consumption per network, the share of the total consumption of the respective network that is assigned to this asset is defined. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.

EOS-kalkylator

Friskrivningsklausul

Det sociala innehållet på den här sidan ("Innehållet"), inklusive men inte begränsat till tweets och statistik som tillhandahålls av LunarCrush, kommer från tredje part och tillhandahålls " i befintligt skick" och endast i informationssyfte. OKX garanterar inte innehållets kvalitet eller sanningshalt, och innehållet representerar inte OKX:s åsikter. Det är inte avsett att tillhandahålla (i) investeringsrådgivning eller -rekommendationer; (ii) ett erbjudande eller en uppmaning att köpa, sälja eller inneha digitala tillgångar; eller (iii) finansiell, redovisnings-, juridisk eller skatterådgivning. Digitala tillgångar, inklusive stabil kryptovaluta och NFT:er, innebär en hög grad av risk och kan fluktuera kraftigt. Priset och prestandan för den digitala tillgången är inte garanterade och kan ändras utan föregående meddelande.

OKX tillhandahåller inga rekommendationer om investeringar eller tillgångar. Du bör noga överväga om handel eller innehav av digitala tillgångar är lämpligt för dig, med tanke på din ekonomiska situation. Vänligen rådfråga en juridisk-/skatte-/investeringsrådgivare för frågor om just dina specifika omständigheter. För mer information, vänligen se våra Användarvillkor och Riskvarning. Genom att använda tredjepartswebbplatsen (”third-party website/TPW”) godkänner du att all användning av TPW kommer att omfattas av och regleras av villkoren i TPW. Om inte annat uttryckligen anges skriftligen är OKX och dess dotterbolag ( OKX ) inte på något sätt associerade med ägaren eller operatören av TPW. Du samtycker till att OKX inte är ansvarigt eller skyldigt för någon förlust, skada eller andra konsekvenser som uppstår på grund av din användning av TPW. Vänligen observera om att användning av en TPW kan resultera i förlust eller minskning av dina tillgångar. Produkten kanske inte är tillgänglig i alla jurisdiktioner.

OKX tillhandahåller inga rekommendationer om investeringar eller tillgångar. Du bör noga överväga om handel eller innehav av digitala tillgångar är lämpligt för dig, med tanke på din ekonomiska situation. Vänligen rådfråga en juridisk-/skatte-/investeringsrådgivare för frågor om just dina specifika omständigheter. För mer information, vänligen se våra Användarvillkor och Riskvarning. Genom att använda tredjepartswebbplatsen (”third-party website/TPW”) godkänner du att all användning av TPW kommer att omfattas av och regleras av villkoren i TPW. Om inte annat uttryckligen anges skriftligen är OKX och dess dotterbolag ( OKX ) inte på något sätt associerade med ägaren eller operatören av TPW. Du samtycker till att OKX inte är ansvarigt eller skyldigt för någon förlust, skada eller andra konsekvenser som uppstår på grund av din användning av TPW. Vänligen observera om att användning av en TPW kan resultera i förlust eller minskning av dina tillgångar. Produkten kanske inte är tillgänglig i alla jurisdiktioner.

Sociala medier