Calculation of contract‘s profit and loss

Publicado el 20 jun 2022Actualizado el 1 abr 2025lectura de 6 min

1. Single-currency margin: cross margin

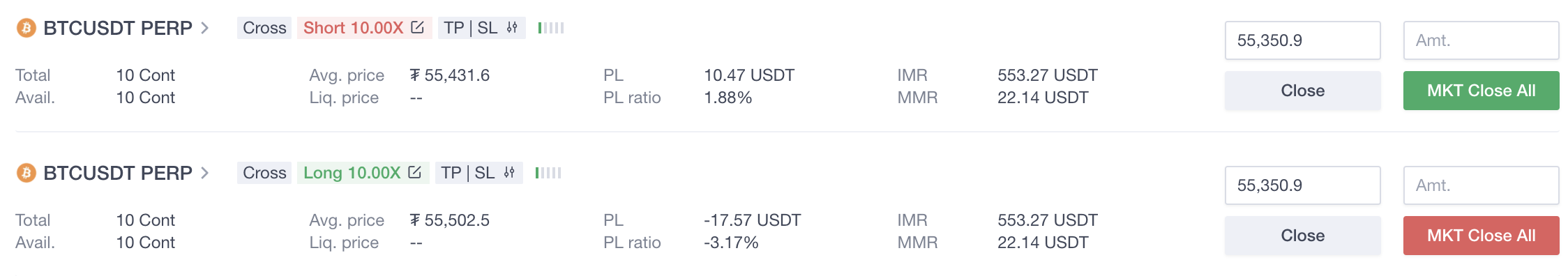

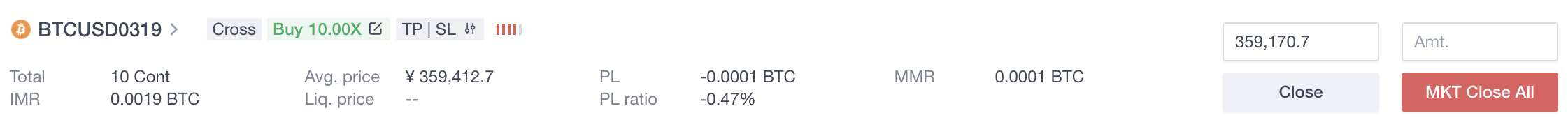

In single-currency margin mode, perpetual/futures support both Hedge mode and One-way mode, as shown in the following figures:

(1)Hedge mode

(2)One-way mode

| Term | Definition |

| Total | For the One-way mode, the total of long positions is a positive number, and the total of short positions is a negative number. |

| Avail. | Only shown in Hedge mode Avail. = total positions – positions of pending close orders |

| P&L | Unrealized profit or loss of current position (1) Coin-margined futures/perpetual swap P&L of long positions = face value * |number of contracts|* multiplier * (1 / avg. open price – 1 / mark price) P&L of short positions = face value * |number of contracts| * multiplier * (1 / mark price – 1 / avg. open price) (2) USDT-margined futures/perpetual swapP&L of long positions = face value * |number of contracts| * multiplier * (mark price – avg. open price) P&L of short positions = face value * |number of contracts| * multiplier * (avg. open price - mark price) |

| P&L ratio | P&L/initial margin |

| Initial margin | 1) Coin-margined futures/perpetual swap Initial margin = face value * |number of contracts| * multiplier / (mark price * leverage)2) USDT-margined futures/perpetual swap Initial margin = face value * |number of contracts| * multiplier * mark price / leverage |

| Maintenance margin | 1) Coin-margined futures/perpetual swap Maintenance margin = face value * |number of contracts| * multiplier * maintenance margin ratio / mark price2) USDT-margined futures/perpetual swapMaintenance margin = face value * |number of contracts| * multiplier * maintenance margin ratio * mark price |

2. Multi-currency margin mode: cross margin

Under the multi-currency margin mode, perpetual/futures derivatives support both Hedge and One-way mode, as shown in the following:

(1)Hedge mode

(2)One-way mode

| Term | Definition |

| Total | For the One-way mode, the total of long positions is a positive number, and the total of short positions is a negative number. |

| Avail. | Only shown under Hedge mode Avail. = Total – Positions of pending close orders |

PnL |

Unrealized profit and loss of current positions (1) Crypto-margined futures/perpetual swap PnL of long positions = Face value * |Number of contracts| * Multiplier * (1/Avg. open price – 1/Mark price) PnL of short positions = Face value * |Number of contracts| * Multiplier * (1/Mark price – 1/Avg. open price) (2) USDT margined futures/perpetual swap PnL of long positions = Face value * |Number of contracts| * Multiplier * (Mark price – Avg. open price) PnL of short positions = Face value * |Number of contracts| * Multiplier * (Avg. open price – Mark price) |

| PnL ratio | PnL/Position-opening margin |

| Initial margin | (1) Crypto-margined futures/perpetual swap Initial margin = Face value * |Number of contracts| * Multiplier / (Mark price * leverage) (2) USDT-margined futures/perpetual swap Initial margin = Face value * |Number of contracts| * Multiplier * Mark price / Leverage |

| Maintenance margin | (1) Crypto-margined futures/perpetual swap Maintenance margin = Face value * |Number of contracts| * Multiplier * Maintenance margin ratio / Mark price (2) USDT margined futures/perpetual swap Maintenance margin = Face value * |Number of contracts| * Multiplier * Maintenance margin ratio * Mark price |

3. The isolated mode of Single/Multi-currency/Portfolio margin

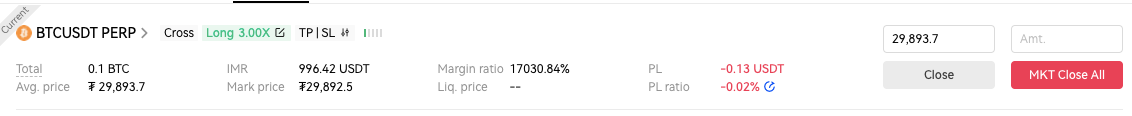

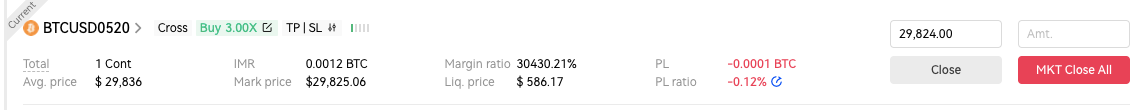

In isolated margin mode, perpetual/futures support both Hedge mode and One-way mode, as shown in the following figures:

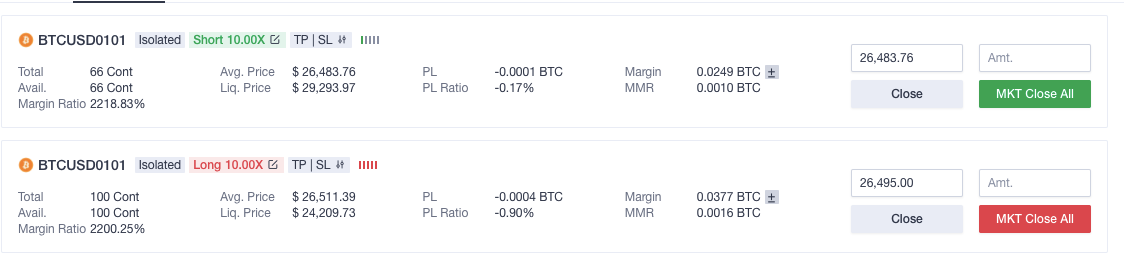

(1)Hedge mode

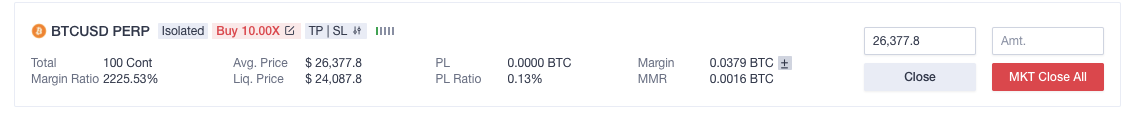

(2)One-way mode

| Term | Definition |

| Total | For the One-way mode, the total of long positions is a positive number, and the total of short positions is a negative number. |

| Avail. | Only shown in Hedge mode Avail. = total – positions of pending close orders |

| P&L | Unrealized profit or loss of current position(1)Coin-margined futures/perpetual swapP&L of long positions = face value * |contracts| * multiplier * (1 / avg. open price – 1 / mark price)P&L of short positions = face value * |contracts| * multiplier * (1 / mark price – 1 / avg. open price)(2)USDT-margined futures/perpetual swapP&L of long positions = face value * |contracts| * multiplier * (mark price – avg. open price)P&L of short positions = face value * |contracts| * multiplier * (avg. open price – mark price) |

| P&L ratio | P&L/initial margin |

| liquidation price | (1)Coin-margined futures/perpetual swapLong positions: Est. liquidation price = face value * |number of contracts| * (maintenance margin ratio + fee rate + 1) / (margin balance + face value * |number of contracts| / avg. open price)Short positions: Est. liquidation price = face value * |number of contracts| * (maintenance margin ratio + fee rate - 1) / (margin balance - face value * |number of contracts| / avg. open price)(2)USDT-margined futures/perpetual swapLong positions: Est. liquidation price = (margin balance - face value * |number of contracts| * avg. open price) / [face value * |number of contracts| * (maintenance margin ratio + fee rate - 1)]Short positions: Est. liquidation price = (margin balance + face value * |number of contracts| * avg. open price) / [face value * |number of contracts| * (maintenance margin ratio + fee rate + 1)] |

| Margin balance | Initial margin + margin added to or reduced from this position |

| Maintenance margin | (1)Coin-margined futures/perpetual swapMaintenance margin = face value * |number of contracts| * multiplier * maintenance margin ratio / mark price(2)USDT-margined futures/perpetual swapMaintenance margin = face value * |number of contracts| * multiplier * maintenance margin ratio * mark price |

| Margin level | (Margin balance + P&L) / [position value * (maintenance margin ratio + fee rate)] (1) Coin-margined futures/perpetual swap Margin level = (margin balance + P&L)/ [face value * |number of contracts| / mark price * (maintenance margin ratio + fee rate)] (2) USDT-margined futures/perpetual swap Margin level = (margin balance + P&L)/ [face value * |number of contracts| * mark price * (maintenance margin ratio + fee rate)] |