The crypto market is bleak, and the most complete 2025 stablecoin wealth management strategy will take you through bulls and bears

Original author: @arndxt_xo, Crypro researcher

Original compiler: zhouzhou, BlockBeats

Editor's note:This article discusses the strategies and yields of several interest-bearing stablecoins, including how different platforms can generate yield by investing in US Treasuries, DeFi lending, and real-world assets. Each stablecoin has different strategies and yields, such as staking, lending, or liquidity mining. The article also mentions the characteristics of these stablecoins, such as no lock-up, automatic accumulation of returns, etc., which are suitable for long-term investment and users who require stability, providing an innovative decentralised finance solution.

The following is the original content (the original content has been edited for ease of reading and comprehension):

What is an interest-bearing stablecoin? It is a stablecoin that remains pegged to $1 while also bringing passive income. How? By borrowing, staking, or investing in real-world assets like U.S. Treasuries. Think of it like an on-chain money market fund, but it's programmable and borderless.

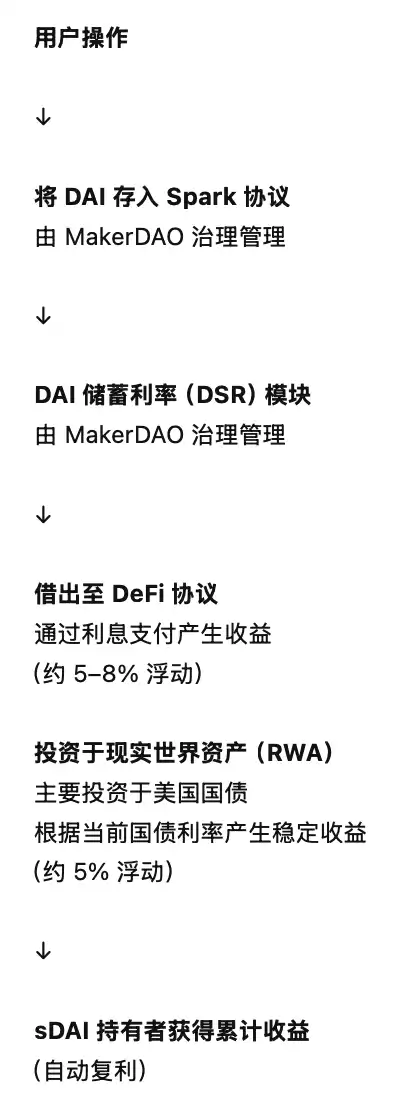

Deposit DAI into Spark

• Sources of earnings include:

• Stability fee for loans

• Liquidation yield

• DeFi lending (e.g. Aave).

• Tokenized assetsof U.S. Treasuries

you receive sDAI, a token based on the ERC-4626 standard, which automatically grows in value (without rebasing), and the yield is adjusted by the governance mechanism according to market conditions.

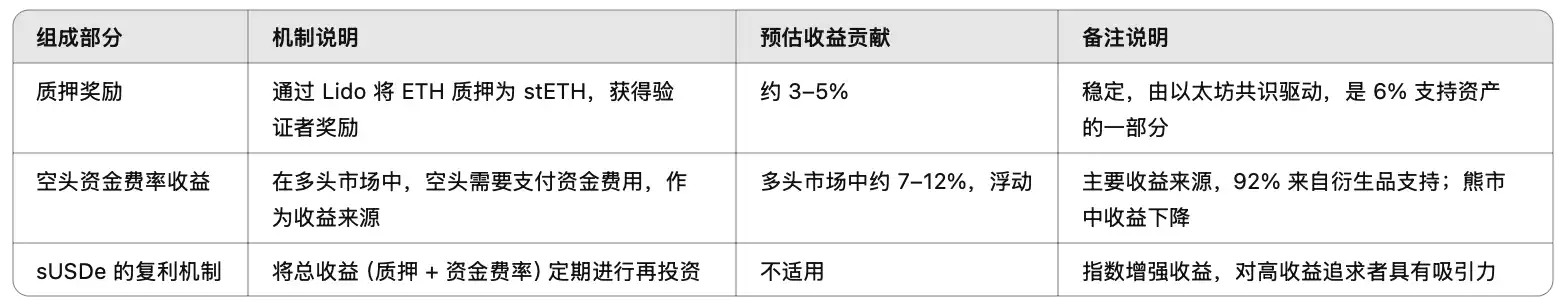

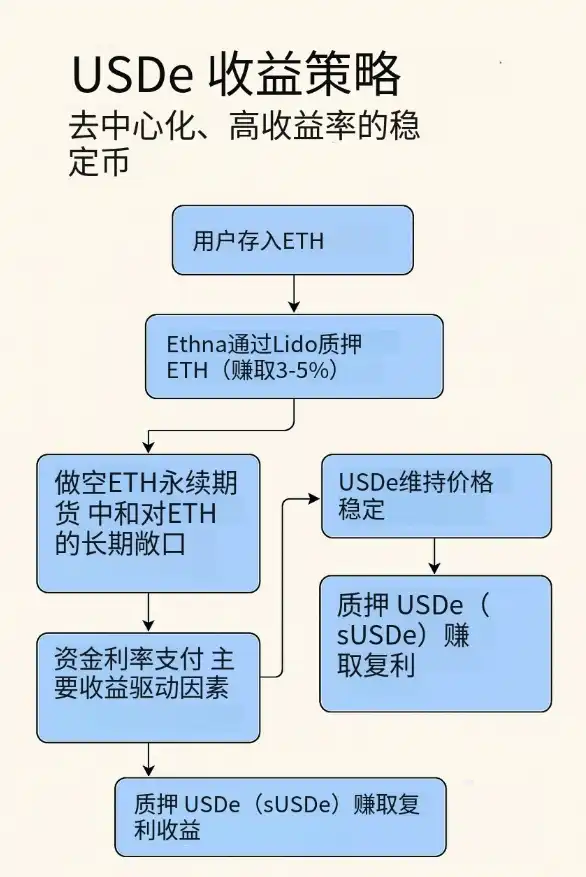

sUSDe – Synthetic yield

@Ethena_Labs→ APY: around 8–15% (up to 29% in a bull market

→ Strategy: delta-neutral yield

• Deposit ETH → Stake via Lido

• While shorting ETH on CEXs

• Funding Rate + Staking Rewards = Yield

sUSDe holders receive compounding yields. High yield = high risk, but not dependent on the bank at all.

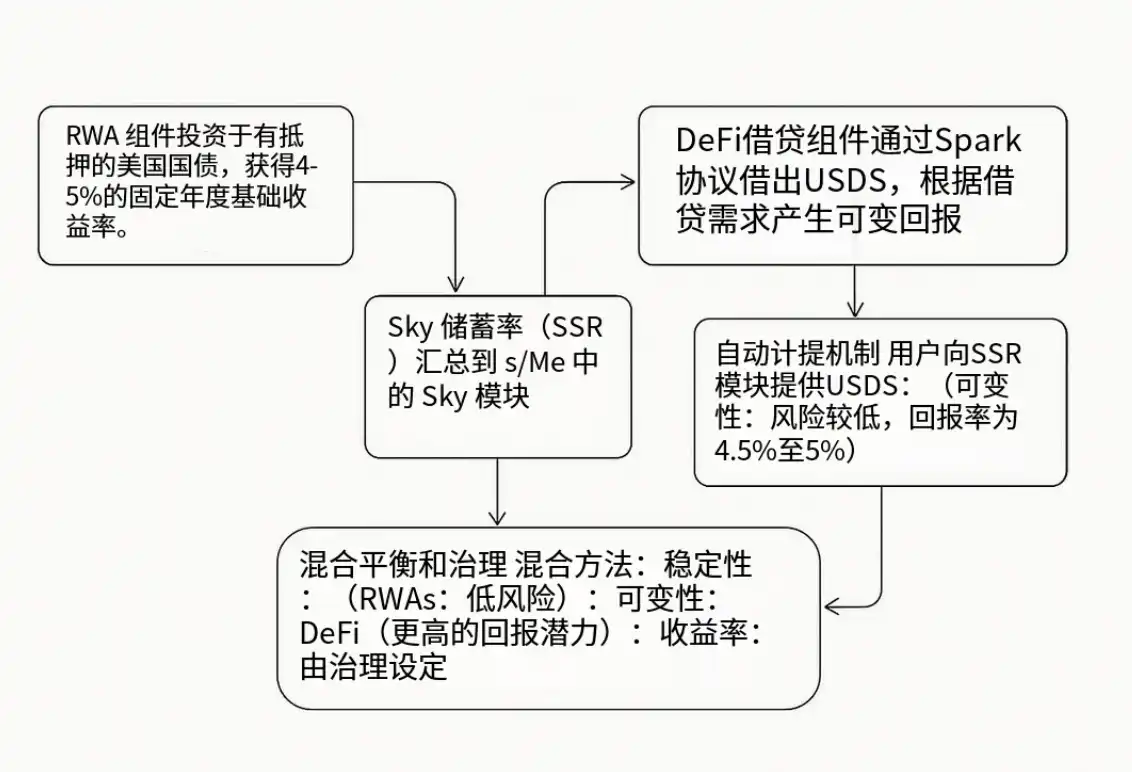

sUSDS – Powered

→ Annual Yield: Approximately 4.5%

→ Strategy: Hybrid RWA + DeFi lending

• Underlying income comes from tokenised U.S. Treasuries

• Additional income comes from Spark lending

• Yield is distributed

no staking, no lock-up, automatic accumulation of balances, and the governance mechanism sets the target annual yield of SSR.

USDY – Powered

@OndoFinance→ Annual Yield: Approximately 4–5%

→ Strategy: Tokenized traditional financial

• 1:1 support for short-term U.S. Treasury bonds + bank deposits

• Earn yield like a money market fund

• Thanks to Reg S, the distribution of yields to non-US users

is likely to be automatically cumulative, making passive income more seamless.

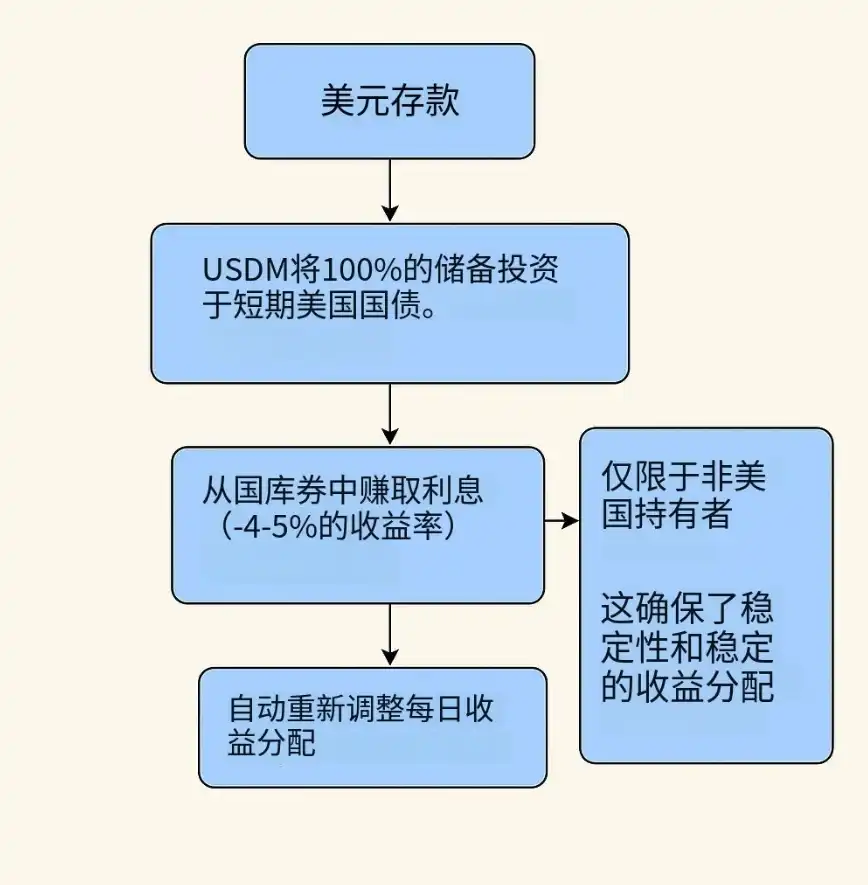

USDM – Powered

@MountainPrtcl→ Annual Yield: Approximately 4–5%

→ Strategy: 100% backed

• All reserves are in short-term U.S. Treasuries

• Daily rebasing to grow balances (e.g., 0.0137% per day)

• Simple, stable, and fully transparent throughaudits

.

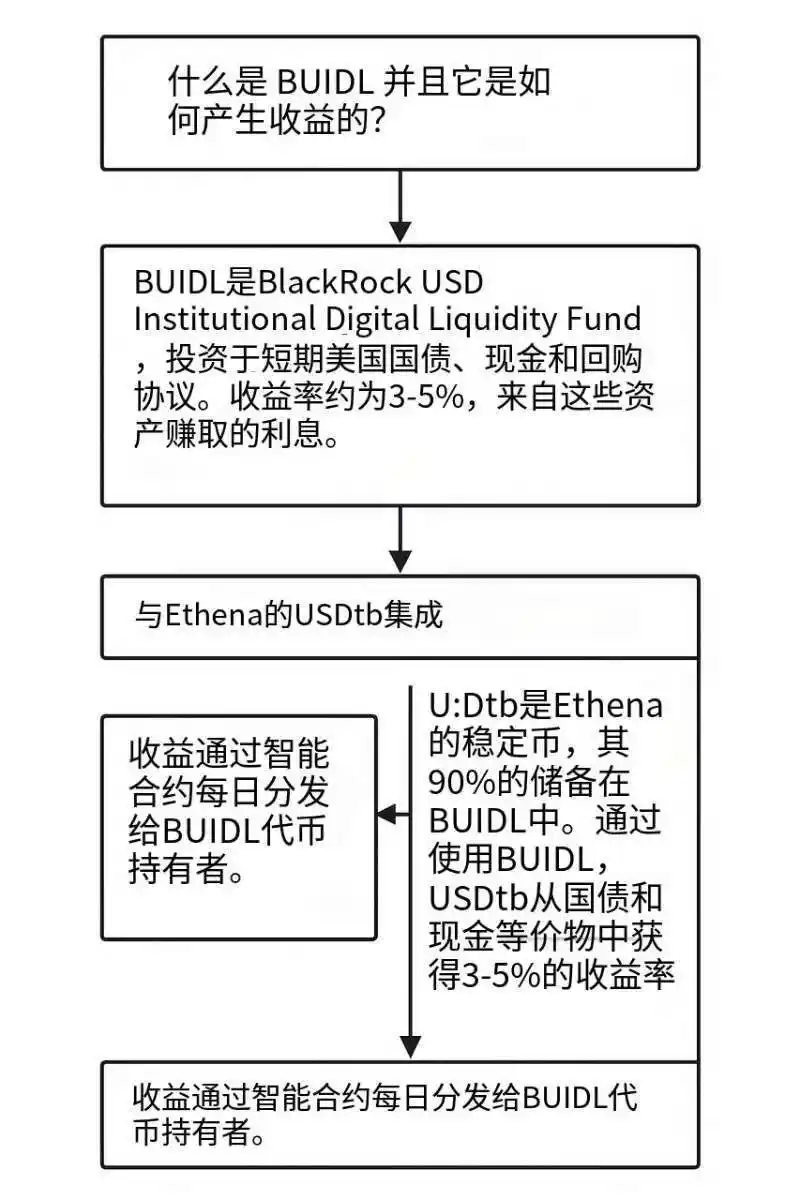

USDtb – Powered

@Ethena_Labs and @BlackRock→ Annual Yield: Approximately 3–5%

→ Strategy: Institutional-grade tokenised fund

• BUIDL is a tokenised fund made up of U.S. Treasuries, cash, and repurchase agreements (repos)

• USDtb uses BUIDL to support 90% of its reserves

• The security of traditional finance combined

is ideal for DAOs and protocols looking for security and yield.

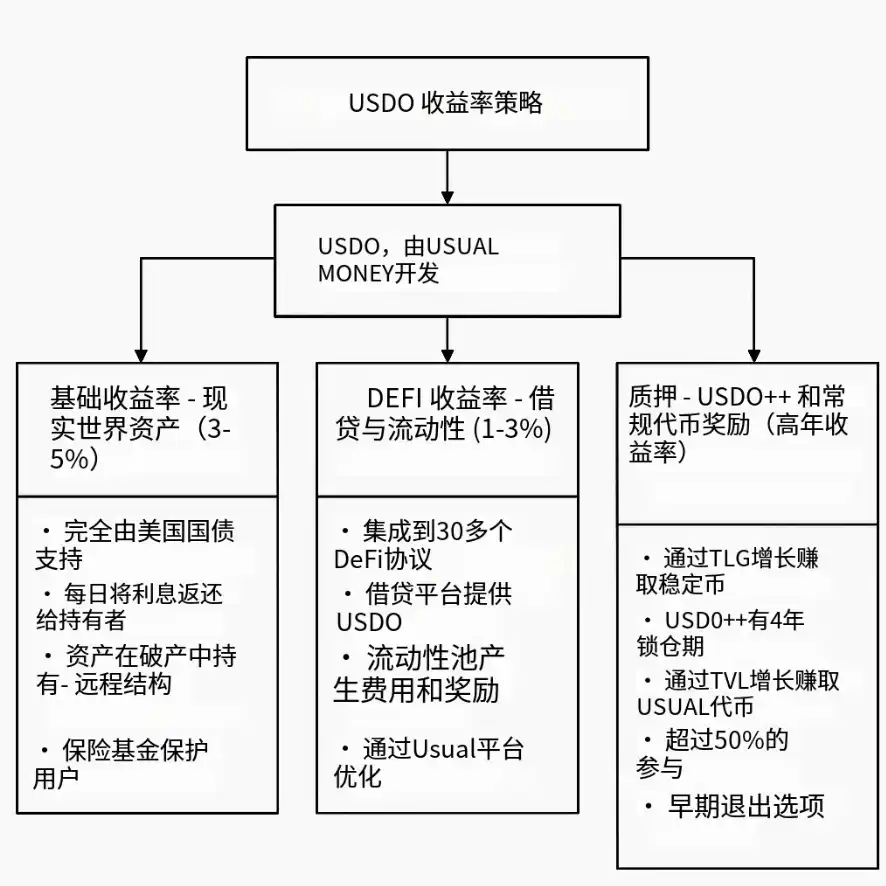

USD0 – Provided by

→ Annual Yield: Approximately 5–7%

→ Strategy: RWA+ DeFi + Staking Rewards

• Base Yield: 3–5% from US Treasuries

• Additional Yield: 1–3% from DeFi Lending and Liquidity Mining

• Stake USD0++ → to get USUAL tokens (up to 60% APY)

Highly composable, deployed on 27 chains and 30+ decentralised applications.

YLDS – Powered by

@FigureMarkets→ Annual Yield: Approximately 3.8%

→ Strategy: Yields

• Anchored SOFR - 0.5%

• Reserve funds held in high-quality money market funds (MMFs) and U.S. Treasuries

• Accumulate daily and pay out monthly

returns• Registered public securities – available for U.S. investors to purchase

stable, regulated, and well-suited on-chain investments.

staking, no lock-up.

"Original link".