Attracting more than 10 million US dollars in 7 days, can MIRAI detonate the AI idol economy?

Original title: "MIRAI Coin Attracts Over 10 Million US Dollars in 7 Days!" When AI skins are put on the blockchain skeleton, do we still need real stars? Original

author: Lawrence, Mars Finance

In May 2025, a capital experiment across virtual idols, artificial intelligence, and blockchain was quietly launched in Tokyo. The MIRAI project, jointly launched by Aww Inc., a leading virtual human company in Japan, and Holoworld, an ecological AI platform based on Solana, raised more than $12.9 million in just one week with the appeal of the top IP "imma", breaking the fundraising record for Web3 projects in Japan. Is this project, which attempts to deeply bind the two-dimensional culture with decentralized finance, a "new paradigm" of the metaverse narrative, or another footnote to the bubble carnival?

1. Project Background: From Virtual Idols on the Streets of Shibuya to "New Species" of Blockchain

1. Aww Inc.: The creator of the virtual human empire

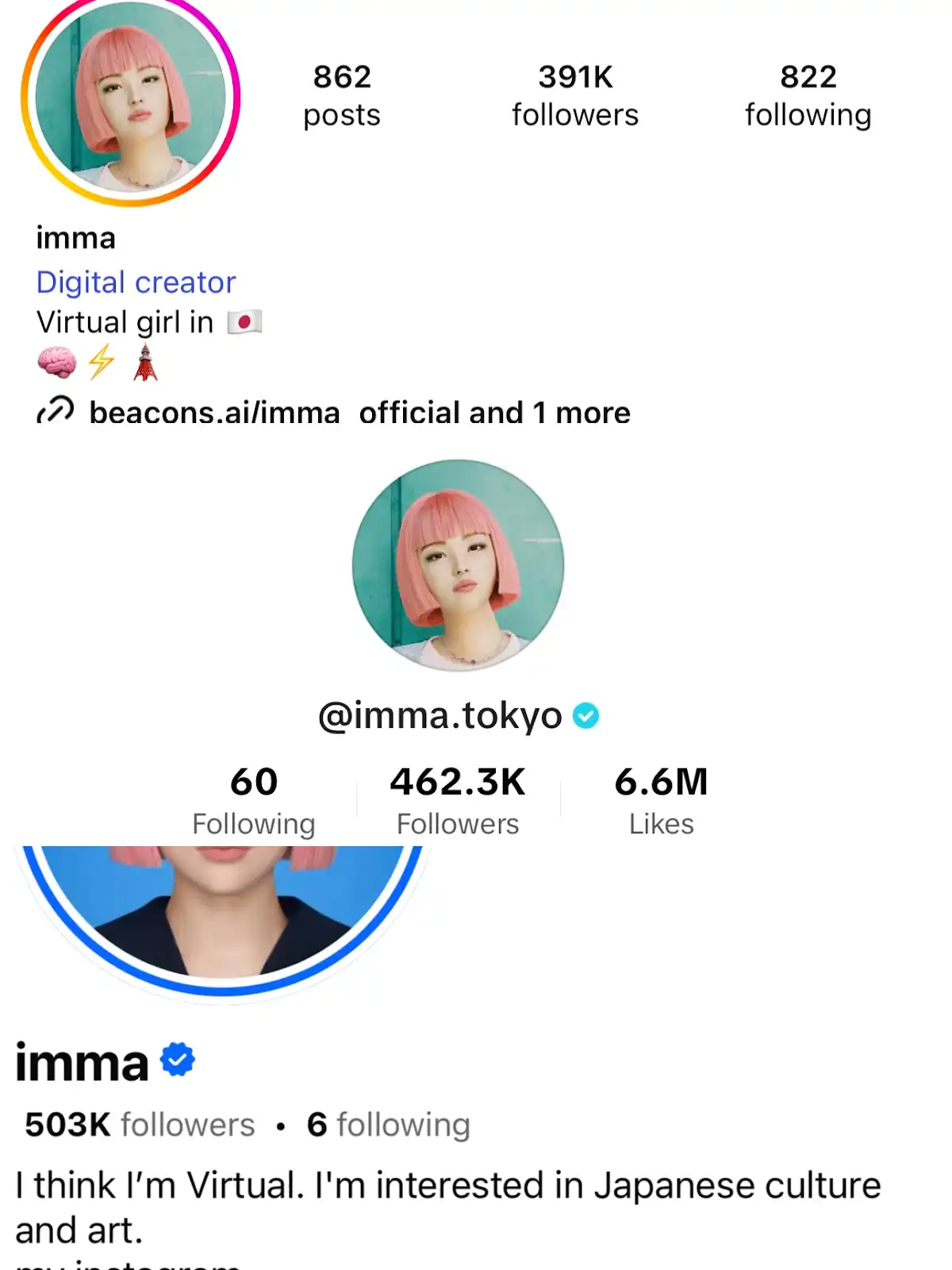

As one of the first companies in Japan to lay out the virtual human track, Aww Inc. has built a matrix covering more than 20 virtual IPs such as Ria and Plusticboy since the launch of the original virtual idol imma in 2018. Its core business model is "Virtual as a Service" (VaaS), which realizes commercial monetization through brand endorsements, trendy brand co-branding, film and television placement, etc.

imma's breakthrough effect is phenomenal: she appeared with a live model in SK-II's global skincare campaign; When the BMW Tokyo Harajuku Experience Store opened, its holographic projection served as the "digital store manager"; Even in the advertisements for the carriages on Japan's JR Yamanote Line, daily commuters can see her in motion. This kind of immersive marketing of "virtual reality without boundaries" has made Aww Inc. a strategic partner of traditional giants such as Mitsubishi UFJ and Shiseido.

2. Holoworld: The AI infrastructure maniac of the Solana ecosystem

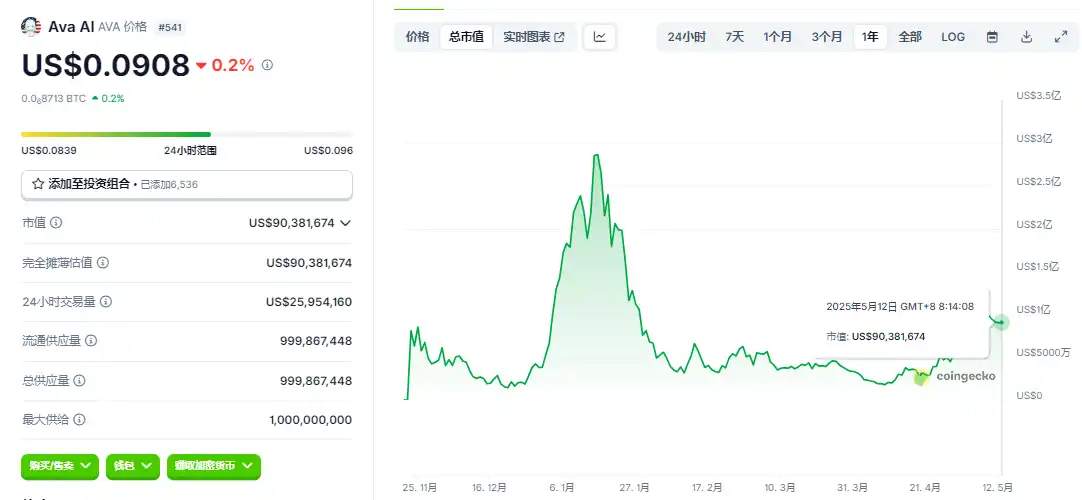

Holoworld is positioned as a "virtual human on-chain infrastructure", and its core product, the AVA AI engine, can map real human movements to avatars in real time through 3D scanning and deep learning.

The previously issued governance token $AVA (with a peak market value of $300 million and a current market value of $90 million) has been connected to more than 50 metaverse platforms, and has provided on-chain identity confirmation services for the South Korean girl group aespa and the European and American virtual influencer Lil Miquela. The essence of this cooperation with Aww Inc. is the vertical integration of "IP resources + technology infrastructure": Aww contributes imma's IP assets and fan traffic, and Holoworld provides AI-generated tools and on-chain interaction protocols to jointly build a virtual human economic ecology.

2. Tokenomics: The Design Logic Behind the $12.9 Million Overraising

On May 10th, less than two days after the on-chain virtual human MIRAI started fundraising, the official announcement announced that the Mirai token pre-sale has now ended early, and the amount raised has far exceeded our initial goal. The team plans to refund the excess funds. On-chain data shows that Mirai's presale address has received 76,423.42 SOL, or about $12.95 million.

1. Token Distribution: Centralized Governance and Liquidity Game

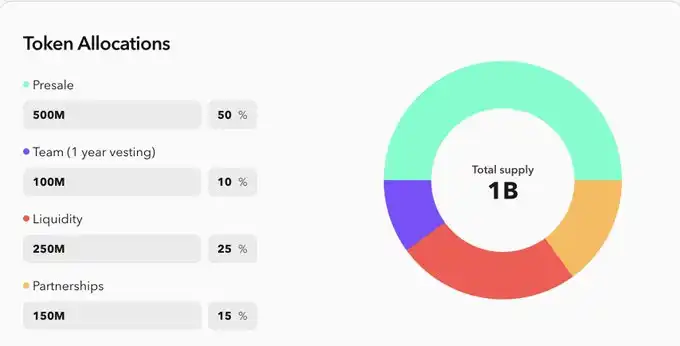

According to the white paper, the total number of MIRAI tokens is 1 billion, and the distribution structure is obviously "resource-oriented":

There are two major controversies implicit in this design:

· Centralization risk: The team and partners hold a total of 25% of the tokens, and the pre-sale share is highly concentrated (the top 100 addresses account for more than 60%), and community governance may become a "rubber stamp".

· Liquidity trap: 25% of liquidity pools are released in phases, which may cause sharp price swings in the early days. Historical data shows that similar model projects, such as SkyAI, generally have amplitudes of more than 300% in the first week of launch.

2. Overfunding and Refund Mechanisms: A Double-edged Sword for Market Sentiment

The original fundraising target of 50,000 SOL ended early with 76,831 SOL (about $12.9 million), which was 153.6% overraised. The project team promised to return the excess funds proportionally, but on-chain data shows that the top 10 addresses contributed 42% of the amount of funds, and the characteristics of "whale control" are significant. While the refund mechanism can provide a short-term confidence boost (see the sharp rebound after the SLERF incident), it can also trigger a "prisoner's dilemma": some investors choose to sell in the secondary market to avoid refund losses, causing a price spiral.

3. Price prediction: trend deduction under multi-dimensional factor game

1. Short-term (1-3 months): Market maker trading and liquidity games

Wintermute's in-depth involvement (the on-chain label shows that its test address participates in the pre-sale, and the largest single transaction is related to Wintermute, and the pre-sale address is nearly 15wu 881sol) has injected a boost into the project. Refer to $AVA's online performance:

· First-day performance: When Q4 2024 launched, $AVA opened at $0.12, surged to $0.87 (up 625%) within 24 hours, and then fell back to $0.35;

· Market-making strategy: Wintermute completed the initial control through "pulse pull up + stepped shipment", and the turnover rate was as high as 580% in the first week.

If MIRAI replicates the path, the following phases may occur:

· Opening high: With the help of imma's social media popularity (more than 860,000 Twitter followers), the price may quickly break through $0.5, equivalent to a market value of about $50 million;

· Profit-taking: About 30% of the pre-sale investors are "new studios", and may withdraw their funds in batches after 2-3 times the return;

· Liquidity siphoning: If 25% of the initial liquidity pool is concentrated in Raydium, it can trigger MEV bot sniping and increase volatility.

2. Medium-term (3-6 months): Ecological implementation and narrative validation

According to the project roadmap, Q3 will be launched in the beta version of Mirai Terminal, which supports three major functions:

· Virtual human minting: Users can generate exclusive images through AVA AI and mint them as NFTs;

· Reward economy: Fans can buy virtual gifts with MIRAI tokens, and imma and other IPs can get a share;

· Brand co-branding pool: Partners (such as Uniqlo, Loft) can launch crowdfunding for limited digital goods.

At this stage, there are two major indicators to pay attention to:

· MAU (Monthly Active Users): If it fails to break the 100,000 threshold, the token may fall into a "priceless market";

· Percentage of IP Share: Whether imma-related transactions account for more than 70% of the ecosystem, reflecting the shortcomings of ecological diversity.

3. Long-term (more than 1 year): "Death Cross" of the virtual human track

The life cycle law of virtual idols shows that the peak popularity of head IPs usually lasts for 18-24 months (such as Hatsune Miku and Luo Tianyi). imma has entered its seventh year since its debut in 2018, and despite the extension of its life cycle through "cross-dimensional marketing", the risk of aesthetic fatigue among Gen Z users has increased. If the team fails to incubate new IPs or expand application scenarios (such as VR concerts and AIGC content platforms), the token may become a "meme-like asset" and rely on community hype to maintain its valuation.

Conclusion: Can the "dimensional wall" between virtual and reality be broken by tokens?

MIRAI's ambition is not only to issue a token, but to try to build a trinity economic system of "virtual people-fans-brands". Its success depends on whether it can convert IMMA's traffic potential energy into on-chain activity, break through the bottleneck of "instrumentalization", and create a true digital identity paradigm.

However, when the capital carnival dissipates, we need to answer an essential question: does blockchain give new value to virtual idols, or is it just a layer of decentralized "emperor's new clothes"? Only time may tell, but until then, investors must fasten their seatbelts – this journey through the dimensional wall is destined to be bumpy.

Link to original article