"Why do you say Spark will issue coins next month?"

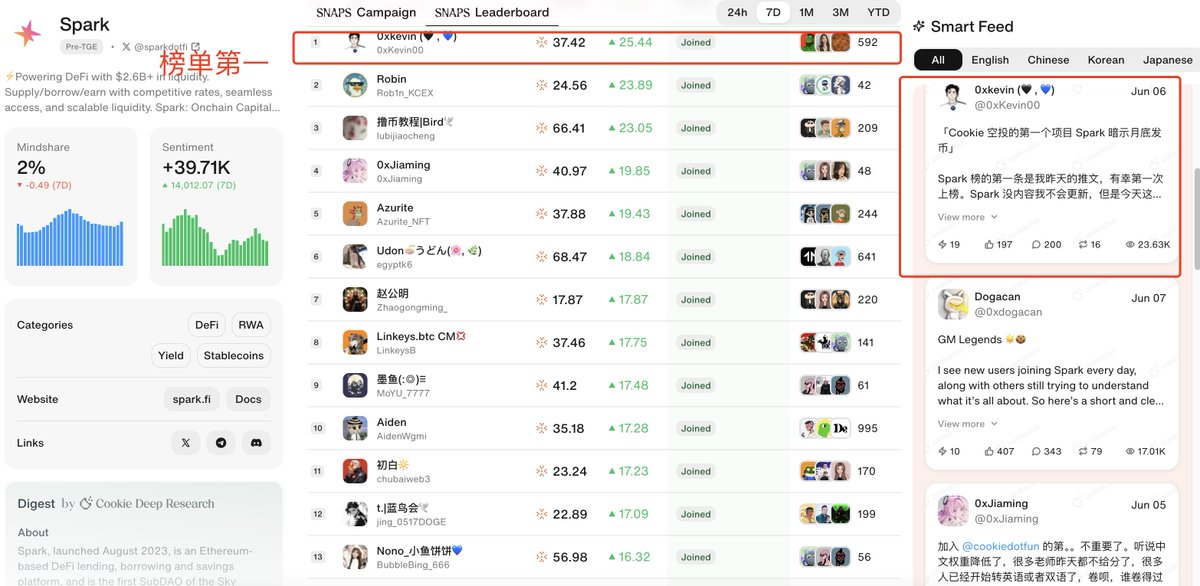

I'm finally in the first place at Spark, and I thank my family 😭

I think there's a big chance that I've written about Saprk from different angles, and today I'm talking about why Spark will be issuing coins next month from a political perspective! The old rule, I'm the first on the list, you comment#spark I'll give you extra points for interaction, and 1 point for white prostitution is 100U!

› ••••••••• ‹

@sparkdotfi the issue of coins excludes #cookie influence, and I think it is more important to have a political dimension

This year, Trump took office, and the entire DeFi track began to enter the policy premium window

Just this month, the SEC threw out an innovation exemption framework to the effect that American-style compliant DeFi will become a new testing ground for policy support

Don't think that the U.S. government has figured it out, I think it's likely that Trump's prince needs to pave the way for USD1, because USD1 is a stablecoin, which also belongs to the defi track, so the regulations issued in advance have also benefited the entire defi track

For the first time, Defi has been allowed to grow bigger and stronger under the regulatory vision from on-chain finance, which has been in the grey area for many years. With this relaxation, the long-established DeFi project Uni Aave Lido has been able to see the light of day

In the past few years, Uniswap has been subject to policy pressure because of the design of dividend tokens, even though the liquidity is far ahead, but the coin price has been flat for a long time. As the largest lending pool on the chain, Aave's TVL broke a record high yesterday, but the price of the coin still can't break the ceiling. But now it's different, once the policy is implemented, these old items will usher in a second spring

While the old projects are breaking free from the shackles and exerting their strengths, don't forget our new star, Spark, represented by the rising deFi talents

Spark is in the right place at the right time, and driven by strong policies, Spark's innovation has been fully unleashed

The biggest regulatory dead hole in traditional DeFi is credit expansion and black box risk, and Spark completely bypasses these two red lines: the credit layer stays in Sky, and Spark is just a pure execution on-chain fund allocation engine

Funds can only be circulated in the whitelist, all positions are closed and transparent, and the risk control model is extremely strict - allocation quota, daily injection rate, risk reserve, and the bottom layer of Junior Capital is sealed. This architecture, in essence, has completely on-chain the fiduciary asset management model of traditional finance, and has become a new species that is most in line with the logic of "American-style compliant DeFi".

What's more, Spark has the Sky system behind it as a credit endorsement. Sky currently has an annualised revenue of $320 million, a market capitalisation of $2.5 billion, and a P/S of only 7-8 times, which is the cheapest cash flow business 😂 in the industry

Sky's high-intensity repurchase and pledge closed capital pools continue to compress systemic risks, and the entire ecosystem is being made into an on-chain version of the quasi-sovereign wealth management system. Sky is the pool of funds, and Spark is the execution arm – logically infinitely close to the model that will be most needed for future institutional entry

Therefore, this round of Spark issuance, on the surface, is the launch of Sky's sub-project, but in essence, it is stepping on the window period of regulatory dividends and system migration in the United States, and directly rehearsing the mainstream paradigm of the next round of on-chain asset management

› ••••••••• ‹

Spark is so awesome, can we masturbate? Of course! 👇

1⃣️Spark can currently deposit stablecoin USDS to get interest and get airdrop points at the same time

2⃣️ Spark has made its first list in Cookie with a prize of $5 million! Even if 10,000 people have 500u, the threshold is low and the reward is high

> Go to the @cookiedotfun website and link your Twitter account

> Comment on Twitter #spark related tweets, and get a reply to get extra points

> tweet about Spark and write from a variety of angles

If you haven't registered for #cookie yet, hurry up, @cookiedotfuncn you don't need any funds, you can get the airdrop!

It's less than a month old now, and the link below can only be used once ⬇️

The big guys on the list can be followed

@lubijiaocheng @0xjiaming @egyptk6 @rob1in_kcex @cryptolisa @bubblebing_666 @moyu_777 @captain_kent @jing_0517doge @0xdogacan @chubaiweb3 @Zhaogongming_ @jiao_newlife

Show original

280

40.98K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.