There was a time when I didn't understand the significance of projects like Gauntlet Merkl.

In the past, project teams would start mining by randomly picking an integer or following trends with numbers like 69 or 420.

Now, these third parties are helping project teams plan how much mining rewards to give to keep the farmers playing with the least amount of money.

The actuaries have gone to the other side 😂

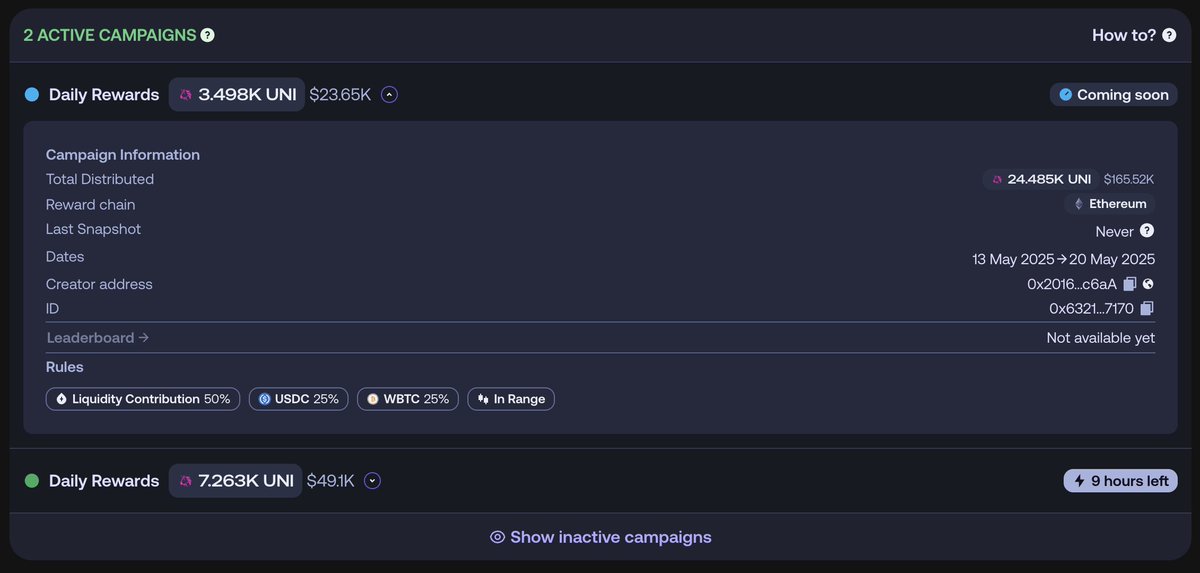

A new round of Uniswap mining, $UNI production has been halved, and the cycle has been adjusted from once every 14 days to once every 7 days. This means:

1. It is believed that the excess production has not brought more TVL.

2. Production adjustments will be more frequent.

Gauntlet is quite sensitive to yield adjustments. As the price of $UNI has risen and the market has warmed up, mining TVL has withdrawn, immediately trying to save money. Let's see the inflow and outflow of funds after the yield is halved.

9.04K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.