Dingaling strikes again: Can Boop siphon off Pump?

Woke up to see NFT whale @dingalingts promoting his new meme platform @boopdotfun, so I decided to dig into it. It reminded me of when he spearheaded LooksRare and became famous for launching a vampire attack against OpenSea. I suspect this time, too, has been in the works for a while. The competition among launch platforms is now fierce, but no one has yet shaken Pumpfun's position. This battle is worth watching.

TLDR: For any latecomer to rise to the top, token price is key. Only by pumping the price can they attract token-issuing groups, ignite platform data, and kickstart the flywheel.

Price increase 👉 Attract token issuance, new projects increase 👉 Fee revenue grows, airdrops increase 👉 Incentivize more people to lock tokens for dividends 👉 Price continues to rise.

1. Boop's Launch Mechanism

Boop's launch mechanism is not much different from @pumpdotfun.

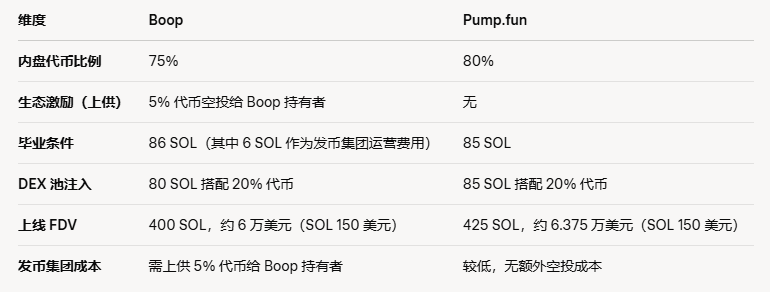

Pump allocates 80% of tokens for internal market users to purchase, requiring 85 SOL to graduate. After deducting Pump's fees, 20% of the tokens are injected into the DEX. Boop, on the other hand, reduces the internal market allocation to 75%, with the 5% difference used as a "tribute"—airdropped to Boop token holders, laying the groundwork for the flywheel.

Additionally, projects launched on Boop need to reach 86 SOL to graduate. The token-issuing group can retain 6 SOL as operating expenses, with the remaining 80 SOL and 20% of the tokens injected into the DEX. At the current SOL price of approximately $150, Boop's graduation market cap is 400 SOL = $65,000.

2. Boop's Cold Start: Token Mining

The core of Boop's cold start is rewarding token-issuing groups and users with Boop tokens, something Pump, which hasn't issued tokens, lacks. To some extent, this can be considered a vampire attack.

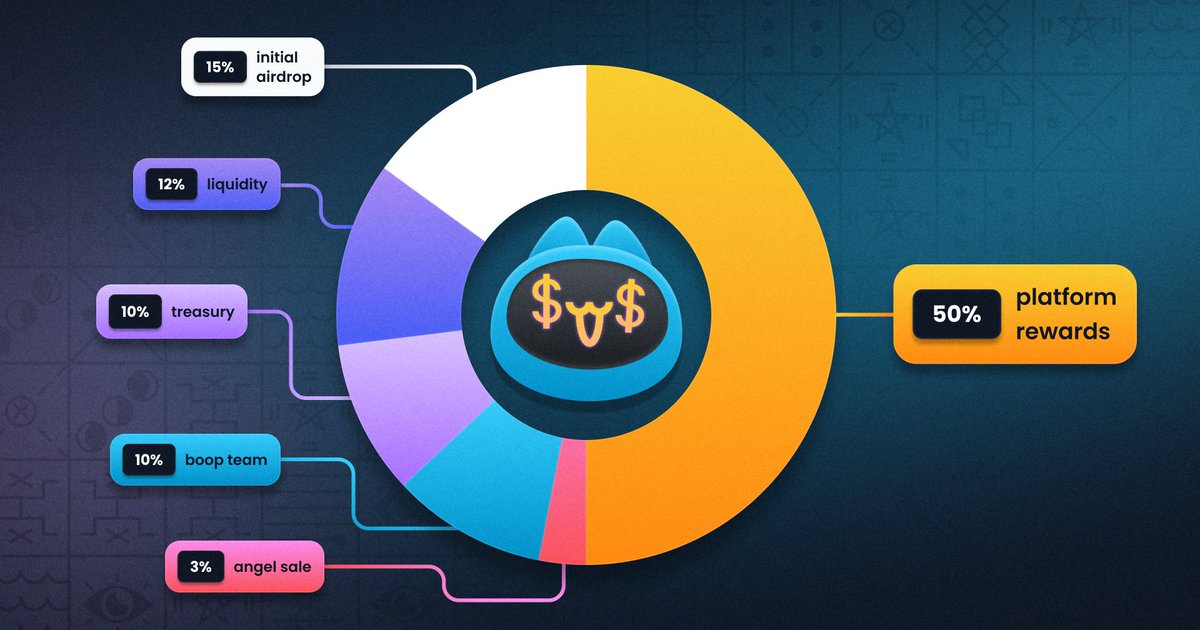

In Boop's token distribution, 50% of the total supply is used as token issuance incentives. Initially, 1 million Boop tokens are distributed daily to graduated projects. Assuming 5 projects graduate daily, each project would receive an average of 200,000 tokens. However, this portion of Boop tokens is not entirely given to the token-issuing group; 90% goes to internal market snapshot token holders, and 10% to the token-issuing group.

To some extent, Boop's launch mechanism resembles "token mining." If a token-issuing group fills the internal market themselves, it's akin to "mining" Boop tokens with an 80 SOL cost. In exchange, 5% of the new token's total supply is given as tribute to Boop token holders, creating a mutually beneficial arrangement.

If there aren't many new projects daily, this could even turn into arbitrage—after all, if the 80 SOL cost yields higher-value Boop tokens, the number of projects might have an "invisible" floor.

3. How to Evaluate Boop's Token Value

I always enjoy analyzing platform projects with cash flow and revenue sources. Boop's design is very clear in this regard:

- 5% of the total supply of graduated project tokens is airdropped.

- Transaction fees (both pre- and post-graduation): 60% dividends + 30% buybacks.

Thus, in a long-term stable state, Boop's valuation (FDV) should be:

"(Average daily market cap of new projects * number of graduated projects * 5% + platform project transaction fees * 90%) * 365 * P/E ratio."

Why use the average daily market cap? Because I believe most airdrops will be sold on the graduation day, so the first wave of average market cap for on-chain projects is a reasonable reference for this cash flow.

Transaction fees follow another logic: they have little impact early on but will become a major revenue source as more projects survive. Conversely, early on, new project airdrops carry more weight, especially when a few "golden projects" emerge, significantly impacting the platform.

Therefore, while the valuation formula for a long-term stable state is fixed, in the early stages, especially when most Boop tokens are locked, Boop's price volatility is likely to be high. The emergence of 1-2 "golden projects" could allow Boop token holders to break even. Thus, Boop's logic varies at different stages:

- Early stage: Dividend recovery, high FDV, low circulation.

- Long term: Cash flow valuation, reliant on transaction fees from surviving projects.

4. Boop's Growth Flywheel: Price-Driven

For Boop's system to work, it heavily relies on Boop's token price, ultimately forming a typical self-reinforcing flywheel:

Price increases, attracting more projects to issue tokens, new projects increase, fee revenue grows, airdrops increase, incentivizing more people to lock tokens for dividends, and the price continues to rise.

In my view, Boop's early-stage playbook must be:

Early-stage price pumping + simultaneous emergence of "golden projects" to set a template, thereby attracting more token-issuing groups and igniting platform data.

However, Pump's success today isn't due to incentives but because it became "the most standardized speculative track," firmly occupying the mental high ground of Solana's hot money. Whether Boop can break through and whether such a breakthrough is sustainable remains to be seen.

.@boopdotfun launches this week!

spent a long time designing a model that aligns traders, creators and holders, while keeping everything in the ecosystem in a positive feedback loop

and yes, there will be an airdrop at launch. fuck points systems, we'll reward you degens and trench warriors in real time

more details coming soon (๑>◡<๑)

2.93K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.