A picture is worth a thousand words!

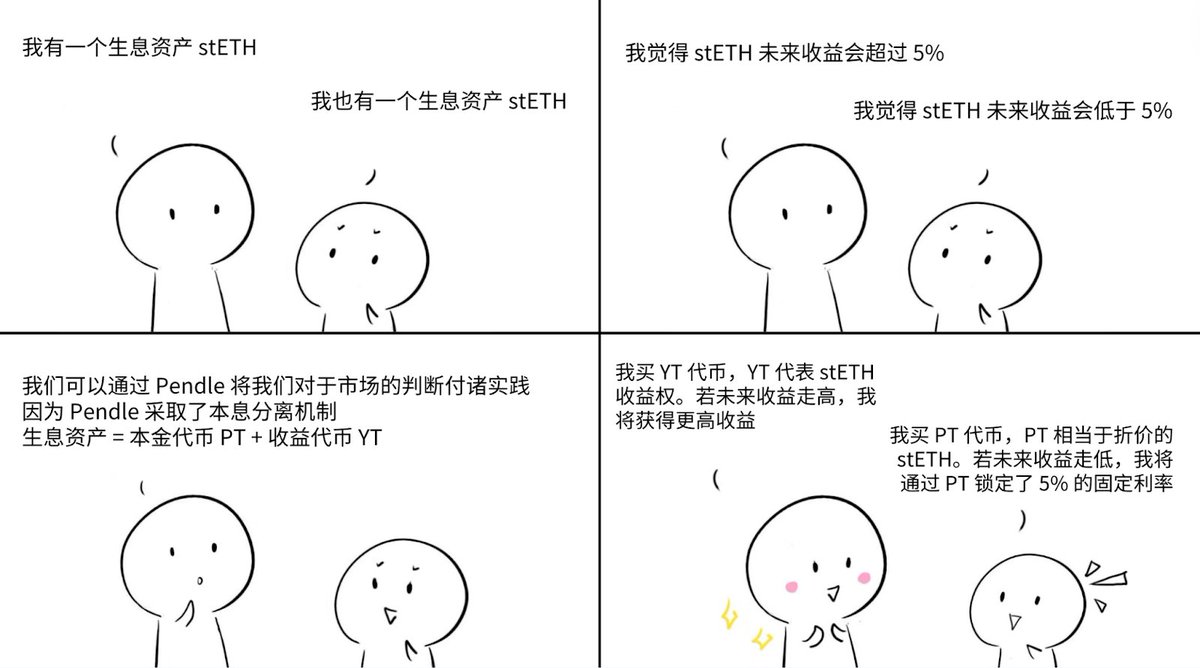

The image vividly explains how Pendle operates, how to make money with Pendle, and what the logic is.

It's clear to see that it's about betting on interest rate fluctuations, and it also fits very well with trading logic!

In the future, CEX/DEX will definitely have this new sector of interest rates, and with Pendle currently being the absolute leader in the Web3 interest rate derivatives track, Pendle will definitely have a place in the future!

Moreover, in the traditional financial sector, the interest rate derivatives track where Pendle is located is already very mature.

Last time, when I thought interest rate trading would give rise to new exchange products, I didn't know Pendle was already planning to launch a product similar to DEX: Boros.

Once formed, leveraging Pendle's existing advantages, it will definitely be a leading product (even if Boros doesn't succeed in the end, other products will need to use the infrastructure provided by Pendle as a supplement).

However, I expect more, that is, in the future, Pendle's split PT/YT tokens can be directly listed on CEX, connecting on-chain and off-chain, forming a new TradFi of DeFi + CeFi + DEX + CEX.

Unlike the hedging mining or stablecoin mining that has been adopted during this period, I have moved many DeFi positions to $PENDLE, I'm betting it can succeed!

______________________

Pendle's core goal is to achieve principal and interest separation, packaging yield-generating assets into SY tokens to standardize these yield-bearing tokens.

Then, SY tokens can be split into two parts: principal token PT and yield token YT. Through Pendle's automated market maker (AMM) mechanism, users can easily trade these tokens, engaging in interest rate speculation.

Principal token PT is like a stable investment tool that helps users withstand market fluctuations and lock in fixed returns.

The price of PT tokens is usually lower than the price of the original asset, and this difference is the fixed return that users can obtain. Users who purchase PT tokens are usually cautious about future returns and hope to lock in the current yield through PT.

Yield token YT, on the other hand, is a leveraged tool full of opportunities and risks.

Users don't need to invest a lot of funds to purchase the complete yield-bearing asset; they only need to hold YT to enjoy the yield rights generated by the principal.

If future yields decline, users may face losses; but if yields rise, users will receive higher returns. Therefore, users can flexibly choose to increase or decrease their holdings of YT tokens based on their predictions of future yields, seizing market opportunities.

The Next Step for Decentralized Exchanges: Spot/Contract Trading of Interest Rates!

This idea was inspired by @pendle_fi. When I first encountered Pendle, I felt it wasn't quite suitable for traditional DeFi users but more for traders.

In simple terms, Pendle splits tokens into Yield Tokens (YT) and Principal Tokens (PT), with Yield Tokens (YT) being tradable.

This means that the price of YT is influenced not only by the yield of the underlying token but also by market factors.

On Pendle, the game is about speculating on the future interest rate of tokens, whereas current trading typically revolves around speculating on the price movement of the underlying token. Isolating Yield Tokens makes them perfectly compatible with the spot/contract trading logic of current exchanges.

Previously, the conditions weren't quite ripe, but recently PT and YT have been appearing more frequently on Twitter and in Web3 articles. Many DeFi protocols are innovating based on Pendle, and even various arbitrage strategies now utilize PT/YT.

For example, @lista_dao's clisBNB was previously launched on Pendle. The latest lending options also allow the use of PT-clisBNB. Additionally, arbitrage strategies for @berachain's BERA/BGT can combine shorting on exchanges with holding PT/YT for mining arbitrage.

The adoption and support of Pendle by these protocols could very well make Pendle the next core protocol in DeFi, which has also led to $PENDLE doubling in value over the past month, though it still has some way to go to reach its peak.

But as the initial idea suggests, the next step for decentralized exchanges is spot/contract trading of interest rates.

Pendle's YT represents the yield portion beyond the principal token. Theoretically, any token that generates interest can be split into YT tokens, making it entirely feasible to create an exchange based on YT.

Moreover, YT originates from DeFi, making it naturally more suitable for on-chain applications and DEXs.

With on-chain exchanges maturing and Pendle's adoption expanding, isn't the future promising?

What are your plans for this, @Aster_DEX @StandX_Official?

@BTW0205 @degens_grandma @ViNc2453 @PendleIntern @0xNing0x

21.68K

91

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.