This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

PT

PowerTrade price

FCkCfi...Pump

$0.00010936

+$0.000064469

(+143.61%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about PT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

PT market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$109.36K

Network

Solana

Circulating supply

999,999,790 PT

Token holders

141

Liquidity

$146.57K

1h volume

$2.70M

4h volume

$2.70M

24h volume

$2.70M

PowerTrade Feed

The following content is sourced from .

KINETIQ — The Kinetic Engine of the Hyperliquid Ecosystem

KM!

So excited to see Kinetiq @kinetiq_xyz becoming the first(maybe) @HyperliquidX ecosystem project to hit $1B TVL — and in just three weeks since launch! What a milestone. Congrats to @0xOmnia ~

This is why I believe Kinetiq deserves deep attention ,and below is my introduction about Kinetiq .

tbh I has been curious why there is so much eyeballs on Kinetiq before it launch haha . And If I am not wrong tons of HYPE (more than 100m HYPE ) unstaked before the launch day of Kinetiq from mainnet for engaging into Kinetiq's liquid staking .

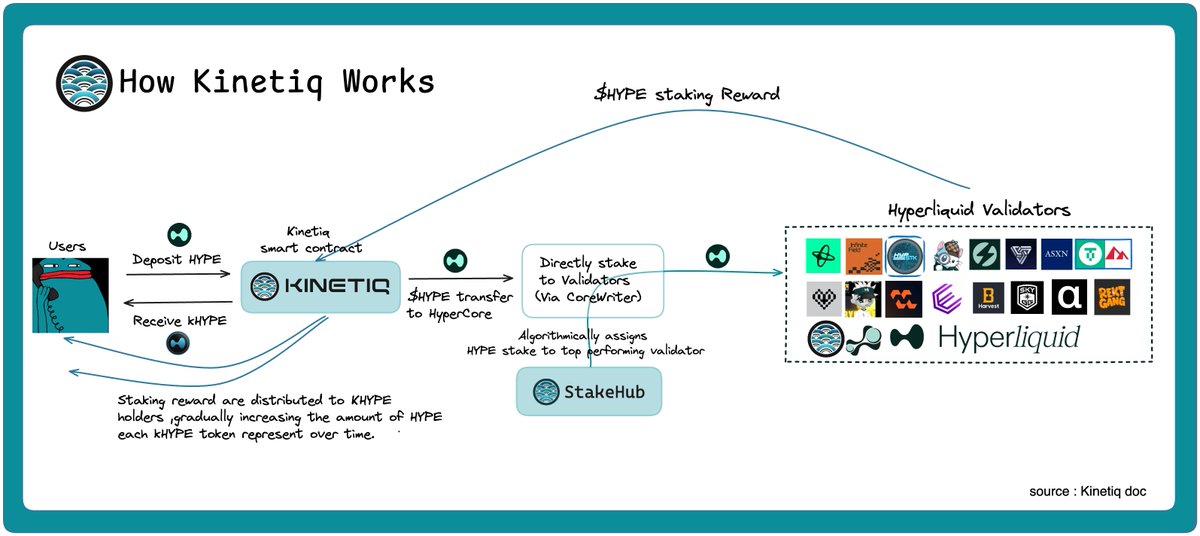

1. How Kinetiq works

Kinetiq is a native Hyperliquid LST protocol designed to fully meet user needs from diff aspects :

Unlike other LST projects, Kinetiq natively integrates with the Hyperliquid PoS network. Users simply stake their HYPE to Kinetiq and receive kHYPE to get the liquidity while earning the reward from POS network .

Besides, Kinetiq’s contract autonomously delegates staked HYPE to the top-performing validator, which ranked by StakeHub based on five key metrics: Reliability, Security, Economics, Governance, and Longevity.

Can go through their validators to know much more about current status of Stakehub 's scoring system :

Even more impressively, staking to HyperCore is powered by CoreWriter — a native Hyperliquid system feature that allows HyperEVM contracts to write directly into HyperCore. This means all validator delegation happens fully on-chain, with no off-chain trust assumptions.

Kinetiq is the one of first HyperEVM protocol to adopt CoreWriter for validator delegation, enabling trustless, automated HYPE staking.

If you want to dive deeper into CoreWriter, check out @djenn’s excellent explainer:

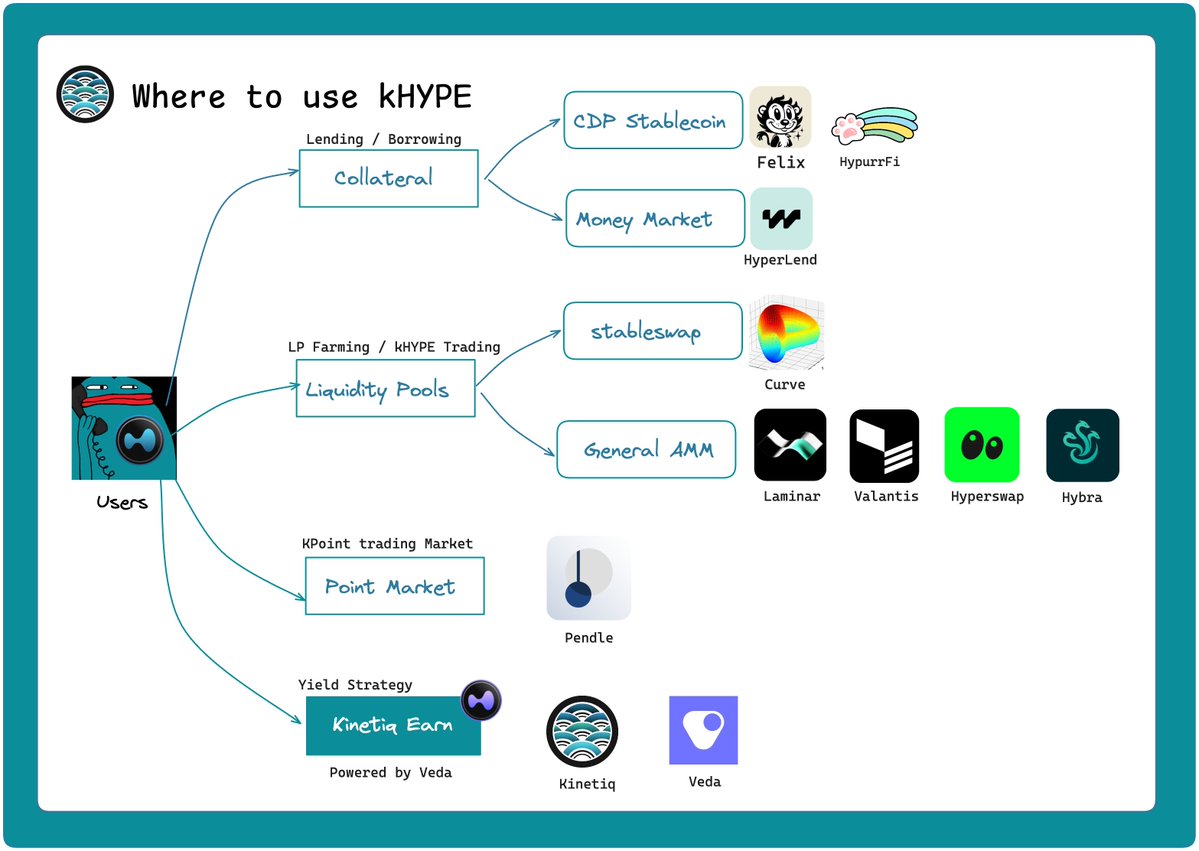

2.The Multiple Usage of kHYPE from the first moment of launch

One of Kinetiq’s strongest moves was launching with deep ecosystem integration. From day one, kHYPE has been usable across the HyperEVM DeFi landscape.

Below is the four sectors which kHYPE already has been acceptable by the HyperEVM ecosystem project .(Pls lemme know if I miss your project here)

A. Collateral

kHYPE can be accepted as collateral on money markets and CDP protocols like @felixprotocol, @HypurrFi, and @hyperlendx which means that you can leverage your asset much more with kHYPE .

B. Liquidity Pools

kHYPE is tradable on stable AMMs like @CurveFinance and on general-purpose AMMs like @laminar_xyz, @ValantisLabs, @HyperSwapX, and @HybraFinance. And you can also pair it with HYPE or USDC to add the liquidity for LP Farming!

C. Pendle Point Market

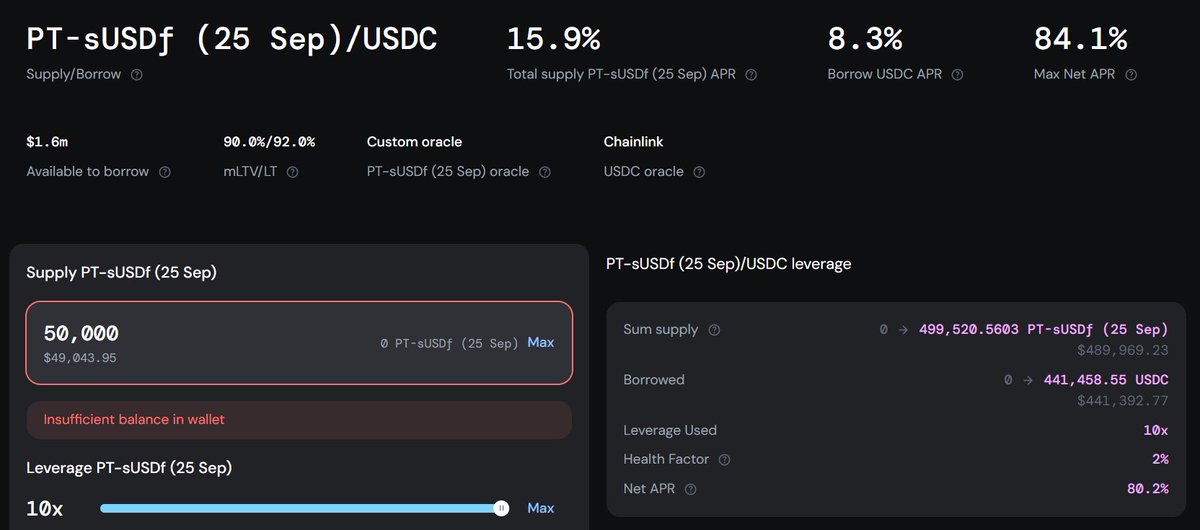

Thanks for king of interest - Pendle ,now kHYPE is also can be used on @pendle_fi’s point market for kPOINT rewards(YT) and fixed income (PT)

- Buy YT tokens with kHYPE to earn points.

- BUY PT tokens of kHYPE also offer a 12% fixed APY.

🔗 Explore the market:

Here pls allow me to say thanks for Pendle @tn_pendle your team is the god for any kind of scenario of interest or yield

D. Kinetiq Earn

Powered by @veda_labs, Kinetiq Earn optimizes kHYPE (and HYPE) yields across top HyperEVM DeFi protocols with their own strategy, targeting the best risk-adjusted returns.

Current TVL is $196M with around 6% estimated APY.

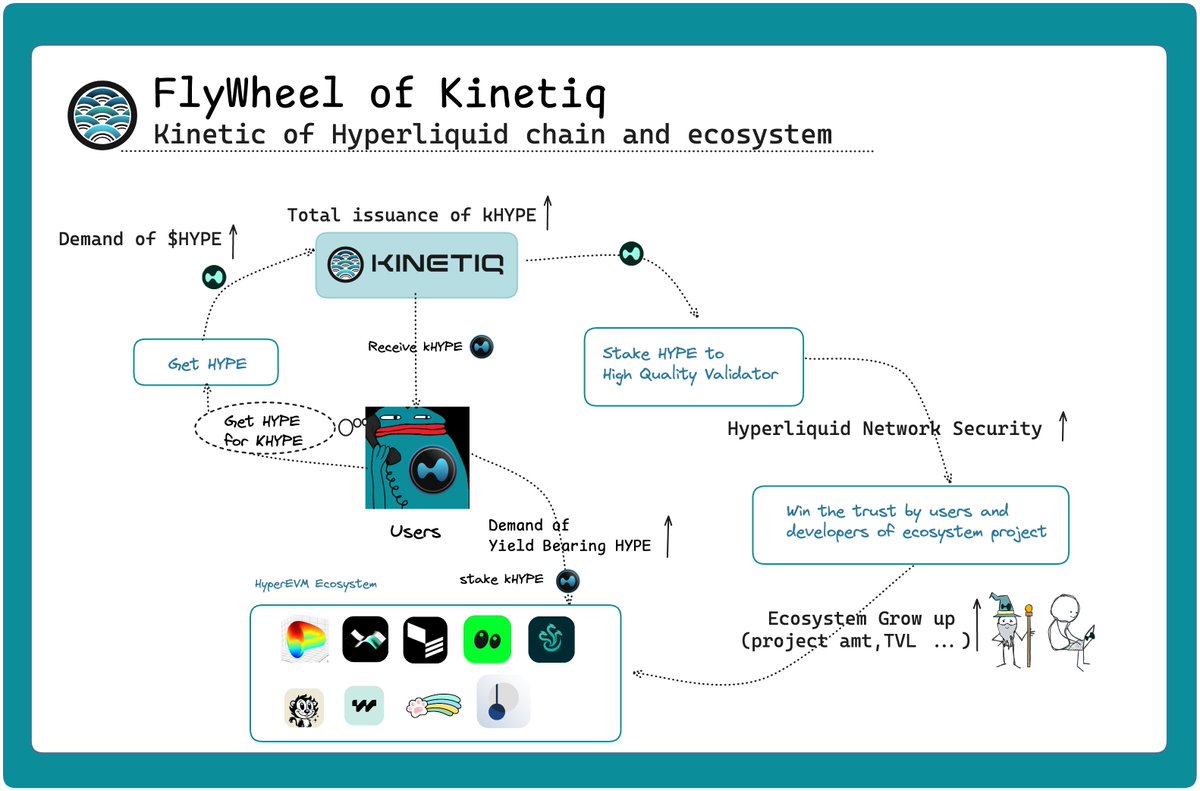

3. The Kinetiq Flywheel — Powering Hyperliquid

Kinetiq creates a self-reinforcing loop that benefits users, validators, and the entire ecosystem.

A. Users (HYPE Holders)

- Yield — Stake HYPE via Kinetiq to top validators and earn rewards.

- Liquidity — Hold kHYPE to keep assets liquid while still earning staking yield.

B. Validators (Network Security)

- Continuous delegation incentives drive validators to maintain top-tier uptime and performance.

- Enhances trust in Hyperliquid’s PoS network, attracting both developers and users.

C. Ecosystem Developers & Projects

- More liquidity in kHYPE fuels DeFi participation.

- Early-stage incentives like kPOINT boost adoption.

- Strong validator performance encourages long-term builder confidence.

By simplifying liquid staking while integrating deeply across DeFi, Kinetiq has become the kinetic engine driving Hyperliquid’s growth.

And the flywheel is just starting — expect more innovation, integrations, and ecosystem impact from Kinetiq soon.

Special thanks to @0xOmnia for the quick responses and insights.

Do let us know if you are running or about to run a project on Hyperliquid (HyperEVM).

Recommended reading

- For kPOINT's value estimation : Well read from @0xlykt 's post.

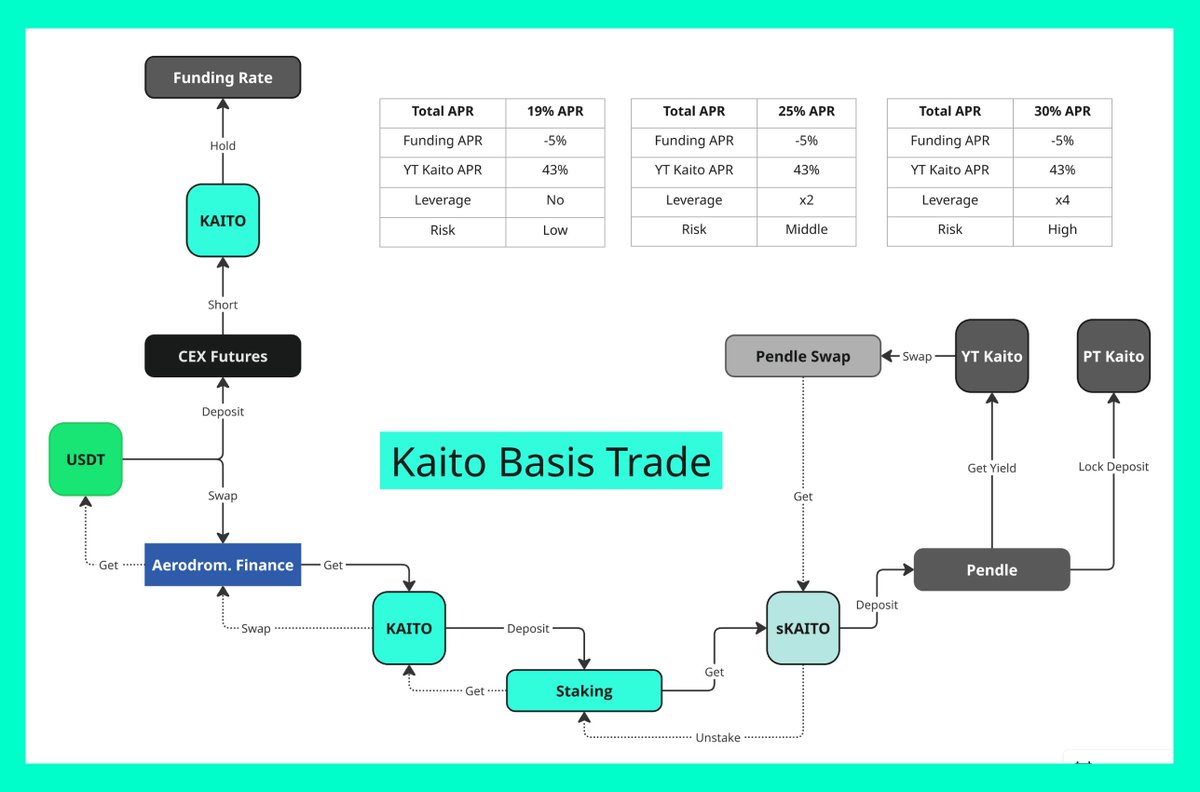

Basis Trade strategy with a yield of up to 30% APR

I choose $KAITO as an asset for this strategy for one reason - the high yield of the YT token on the Pendle platform (43% at the moment). All this will look like this:

1. Buy KAITO for USDT

2. Open short on KAITO for 2 part of USDT

3. Send KAITO to staking and receive sKAITO

4. On Pendle, split sKAITO into YT Kaito and PT Kaito

5. Sell YT Kaito for sKAITO on PendleSwap

6. Unstake sKAITO and receive Kaito (in 7 days)

7. Sell KAITO for USDT

The yield on stables will be 19% APR

You can reduce the amount of liquidity for short by taking leverage x2 - the yield will increase to 25% APR

Leverage x4 will give a yield of 30% APR

In this case, the main risk lies in the Funding Rate area, at the moment it is negative and has stabilized around 3% APR. Funding Rate calculation was based on Binance data.

In case of growth of the FR, partial sale of the PT Kaito token is possible so that the strategy remains profitable.

Theoretically, it is possible to transfer the short to any other exchange, including Hyperliquid. Due to the miscorrelation between these exchanges, funding rate arbitrage is possible, which can mitigate the risks.

DeFi Lego Games: Demystifying Ethena, Pendle, and Aave's Tens of Billions of Growth Flywheels

Written by Shaunda Devens, Analyst at Blockworks Research

Compiled by: Yuliya, PANews

Over the past 20 days, Ethena's decentralized stablecoin USDe supply has increased by approximately $3.7 billion, primarily driven by the Pendle-Aave PT-USDe circular strategy. Currently, Pendle has about $4.3 billion locked (60% of USDe), and Aave has deposited about $3 billion. This article will break down the PT cycle mechanism, growth drivers, and potential risks.

USDe's core mechanics and yield volatility

USDe is a decentralized stablecoin pegged to the US dollar whose price is not anchored by traditional fiat currencies or crypto assets, but by delta-neutral hedging in the perpetual contract market. In short, the protocol hedges against ETH price volatility by holding long spot ETH while shorting the same amount of ETH perpetual contracts. This mechanism allows USDe to algorithmically stabilize its price and capture yield from two sources: staking yield on spot ETH and funding rates on the futures market.

However, the strategy has high yield volatility because the yield depends on the funding rate. The funding rate is determined by the premium or discount between the price of the perpetual contract and the spot price of the underlying ETH (the "Mark Price").

When market sentiment is bullish, traders will focus on opening high-leverage long orders, pushing the price of the perpetual contract above the mark price, resulting in a positive funding rate. This will attract market makers to hedge by shorting perpetual contracts and going long on spot.

However, funding rates are not always positive.

When market sentiment is bearish, an increase in short positions can push the price of ETH perpetual contracts below the mark price, causing the funding rate to turn negative.

For example, the recent AUCTION-USDT spot premium formed by spot buying and selling perpetual contracts has resulted in an 8-hour funding rate of -2% (approximately 2195% annualized).

Data shows that USDe has an annualized return of about 9.4% so far in 2025, but the standard deviation has also reached 4.4 percentage points. It is this sharp fluctuation in earnings that has given rise to an urgent need for a product with more predictable and stable returns.

Pendle's fixed income conversion and limitations

Pendle is an AMM (automated market maker) protocol that splits yield-bearing assets into two tokens:

Principal Token (PT - Principal Token): Represents the principal amount that can be redeemed at a certain date in the future. It trades at a discount, similar to zero-coupon bonds, and its price gradually reverts to its face value (like 1 USDe) over time.

Yield Token (YT - Yield Token): Represents all future yields generated by the underlying asset before the maturity date.

In the case of PT-USDe expiring on September 16, 2025, PT tokens typically trade below their face value at maturity (1 USDe), similar to zero-coupon bonds. The difference between the current price of PT and its face value to maturity, adjusted for the remaining maturity time, reflects the implied annualized percentage yield (i.e., YT APY).

This structure provides USDe holders with the opportunity to hedge against earnings fluctuations while locking in a fixed APY. During periods of high historical funding rates, the APY of this method can exceed 20%; The current yield is around 10.4%. In addition, PT tokens can also receive up to 25x the SAT bonus of Pendle.

Pendle and Ethena thus form a highly complementary relationship. Pendle currently has a total TVL of $6.6 billion, of which about $4.01 billion (about 60%) comes from Ethena's USDe market. Pendle solves USDe's earnings volatility but still has limited capital efficiency.

YT buyers can efficiently access yield exposure, while PT holders must lock up $1 in collateral for each PT token when shorting floating yield, limiting gains to tight spreads.

Aave Architecture Adjustments: Clearing the way for USDe circular strategies

Aave's two recent structural changes have enabled the rapid development of the USDe circular strategy.

First, after the risk assessment team pointed out that sUSDe lending poses a significant risk of large-scale liquidations due to price de-peg, Aave DAO decided to peg the price of USDe directly to the USDT exchange rate. This decision almost eliminated the previous most important liquidation risk, retaining only the interest rate risk inherent in carry trades.

Second, Aave began accepting Pendle's PT-USDe directly as collateral. This change is even more profound, as it simultaneously addresses two previous limitations: insufficient capital efficiency and volatile returns. Users can leverage PT tokens to establish fixed-rate leveraged positions, significantly enhancing the viability and stability of revolving strategies.

Strategy Shaping: High-leverage PT circular arbitrage

To improve capital efficiency, market participants have begun to adopt leveraged cycle strategies, a common carry trade method that increases returns through repeated borrowing and depositing.

The operation process is usually as follows:

Deposit sUSDe.

Borrow USDC at a loan-to-value ratio (LTV) of 93%.

Exchange borrowed USDC back to sUSDe.

Repeat the above steps to obtain approximately 10x effective leverage.

This leveraged loop strategy has become popular across several lending protocols, especially the USDe market on Ethereum. As long as USDe's annualized yield is higher than the cost of borrowing USDC, the trade remains highly profitable. But once earnings plummet or borrowing rates soar, profits will be quickly eroded.

The key risk was the oracle design. Billion-dollar positions often rely on AMM-based oracles, making them vulnerable in the face of temporary price decoupling. Such events, such as those seen in the ezETH/ETH circular strategy, can trigger chain liquidations, forcing lenders to sell collateral at huge discounts, even if the collateral itself is fully backed.

PT collateral pricing and arbitrage space

When pricing PT collateral, Aave employs a linear discount based on PT implied APY and is based on USDT anchored pricing. Similar to traditional zero-coupon bonds, Pendle's PT token gradually approaches its face value as its maturity date approaches. For example, in the PT token expiring on July 30, this pricing model clearly reflects its price approaching 1 USDe over time.

While PT prices don't exactly correspond to face value 1:1, and market discount fluctuations can still affect pricing, their returns become increasingly predictable as maturity approaches. This is highly similar to the stable value appreciation model of zero-coupon bonds before maturity.

Historical data shows that the appreciation of the PT token price relative to the cost of borrowing USDC creates a clear arbitrage space. The introduction of leveraged cycles has further amplified this profit margin, yielding approximately $0.374 per $1 deposited since September last year, with an annualized yield of approximately 40%.

This begs a critical question: does this circular strategy equate to risk-free returns?

Risks, linkages and future prospects

Historically, Pendle's returns have been significantly higher than borrowing costs over time, with an average unleveraged spread of about 8.8%. Under Aave's PT oracle mechanism, the risk of liquidation is further reduced. The mechanism has a floor price and a kill switch. Once triggered, the LTV (loan-to-value ratio) will immediately drop to 0 and freeze the market to prevent bad debts from accumulating.

In the case of Pendle's PT-USDe September expiration symbol, the risk team sets an initial discount rate of 7.6% per year for its oracle and allows a maximum discount of 31.1% (circuit breaker threshold) under extreme market pressure.

The graph below shows the LTV of various safes (calculated by the fact that liquidation is virtually impossible once the discount reaches the lower limit of the kill switch, so the PT collateral remains above the liquidation threshold at all times).

The interconnectedness of ecosystems

Since Aave underwrites USDe and its derivatives at the same value as USDT, market participants can execute circular strategies on a large scale, but it also makes Aave more closely linked to the risks of Pendle and Ethena. Whenever the collateral supply limit is increased, the pool is quickly filled up by circular strategy users.

Currently, Aave's USDC supply is increasingly backed by PT-USDe collateral, and circular strategy users borrow USDC and then stake PT tokens, making USDC structurally similar to senior tranche: its holders receive higher APRs due to high utilization and are protected from bad debt risk in most cases, except in the event of extreme bad debt events.

Scalability and ecological revenue distribution

Whether the strategy can continue to expand in the future depends on Aave's willingness to continue to increase the collateral limit of PT-USDe. Risk teams currently tend to raise the cap frequently, such as proposing an additional $1.1 billion, but due to policy regulations, each increase in the cap must not exceed twice the previous cap and must be more than three days apart.

From an ecological perspective, this circular strategy brings benefits to multiple participants:

Pendle: 5% fee from the YT side.

Aave: Takes 10% of the reserve from USDC borrowing interest.

Ethena: Plans to take about 10% of the share after the fee switch is launched in the future.

Overall, Aave provides underwriting support for Pendle PT-USDe by using USDT as an anchor and setting a discount cap, allowing the circulation strategy to operate efficiently and maintain high profits. However, this high-leverage structure also brings systemic risks, and problems on either side may have a linkage impact between Aave, Pendle, and Ethena.

PT price performance in USD

The current price of powertrade is $0.00010936. Over the last 24 hours, powertrade has increased by +143.61%. It currently has a circulating supply of 999,999,790 PT and a maximum supply of 999,999,790 PT, giving it a fully diluted market cap of $109.36K. The powertrade/USD price is updated in real-time.

5m

+49.59%

1h

+143.61%

4h

+143.61%

24h

+143.61%

About PowerTrade (PT)

PT FAQ

What’s the current price of PowerTrade?

The current price of 1 PT is $0.00010936, experiencing a +143.61% change in the past 24 hours.

Can I buy PT on OKX?

No, currently PT is unavailable on OKX. To stay updated on when PT becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of PT fluctuate?

The price of PT fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 PowerTrade worth today?

Currently, one PowerTrade is worth $0.00010936. For answers and insight into PowerTrade's price action, you're in the right place. Explore the latest PowerTrade charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as PowerTrade, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as PowerTrade have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.