XRP News: Expert Reveals Why August Is Important for Ripple Vs SEC Lawsuit

Contrary to the speculation pertaining XRP news, Bill Morgan, a legal expert, confirmed that August 15 is not a resolution deadline in the Ripple vs. SEC case.

Rather, he clarified that it is a procedural requirement after which both parties are to file a joint status with the appellate court.

This Ripple update could involve a range of options, such as requesting additional time or confirming the next steps in the XRP legal process.

XRP News: Bill Morgan Clarifies Ripple vs SEC Appeal Status

In recent XRP news, legal expert Bill Morgan stated that there is no obligation for the U.S. Securities and Exchange Commission (SEC) to withdraw its appeal by August 15.

He explained that the deadline is procedural, not a mandatory requirement for resolution. According to the expert, the US SEC must file a joint status report with Ripple on August 15 to inform the appellate court of the appeal’s progress.

This filing could involve a withdrawal, a request for an extension, or another procedural step. Bill Morgan’s remarks challenged the belief held by many XRP holders that a settlement is due on that date.

Ripple and the SEC previously requested a 60-day pause to discuss a revised settlement. That break ended in June. During this period, both parties agreed to modify some aspects of the judgment issued by Judge Torres in 2024.

However, the court declined their motion. Judge Torres ruled that the changes could not be granted without intervention by a higher court.

Since then, speculation around August 15 has grown, despite it being a deadline for procedural filing rather than a settlement date.

XRP/BTC Chart Shows Historic Breakout Zone

Meanwhile, XRP/BTC trading pair exited a seven-year accumulation range, according to chart analysis shared by Cas Abbé.

This interval had a minimum and a maximum of 0.00001400 BTC and 0.00003800 BTC within 176 weekly candles.

XRP/BTC ended up rising over the 0.00003800 BTC resistance level in the middle of 2025, with direction toward a supply zone between 0.00018000 BTC and 0.00025000 BTC.

This region served as one of the key breakdown levels in 2018, but it is currently considered a significant resistance range.

The sustained buying pressure from the XRP news could initiate a reversal in XRP price structure against Bitcoin.

Analyst Abbé connected this rally with ongoing developments in the Ripple lawsuit and the anticipated launch of an XRP spot ETF.

He added that if the current price action holds, it may resemble XRP’s rapid rise in late 2017.

Key MACD Timeframes for XRP

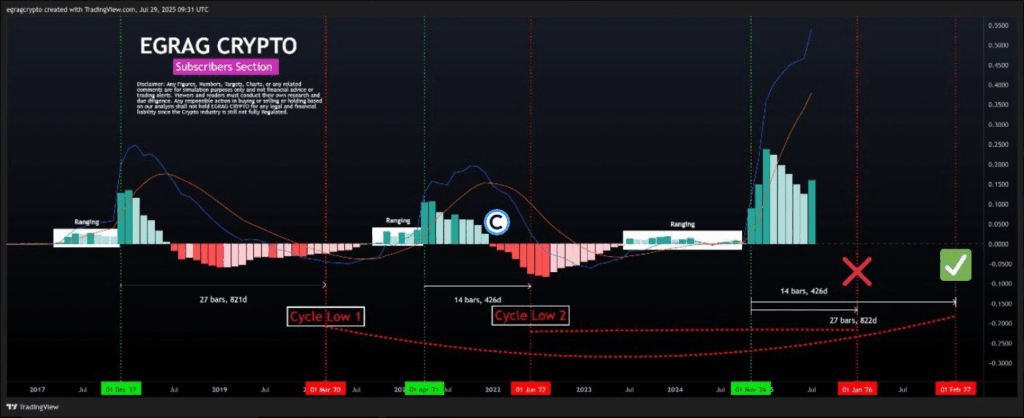

On the other hand, EGRAG Crypto reviewed XRP price historical cycle lows using the MACD indicator.

He identified two key cycle lows, one in March 2020 after the 2017 peak and another in June 2022 following the April 2021 peak. These cycles lasted 821 and 426 days, respectively.

By applying these timeframes to the November 2024 pivot high, EGRAG suggested two potential windows for the next cycle low. The analyst revealed January 2026 (426 days) and February 2027 (822 days).

The XRP news marked the February 2027 target, indicating it may be more aligned with historical cycle duration.

EGRAG believed this phase mirrored the extended consolidation periods seen before past XRP rallies. If this holds, the next parabolic move may take time to develop.

More so, the recent XRP news forecasted that the Ripple vs. SEC suit might last until 2026, according to remarks by market commentator AltcoinBale.

Nevertheless, legal expert Bill Morgan downplayed the possibility of such postponement, noting that Congress will most likely approve the joint motion by Judge Torres.

The post XRP News: Expert Reveals Why August Is Important for Ripple Vs SEC Lawsuit appeared first on The Coin Republic.