WLFI launch countdown: Justin Sun and other early investors made more than ten times the profit, and the Aave share proposal was controversial

Author: Nancy, PANews

Another king-level project is about to be unveiled, and the crypto project World Liberty Financial (WLFI), backed by the Trump family, is about to be launched on the Ethereum mainnet, and its ultra-high market valuation and astonishing early returns have quickly made it a hot topic in the crypto circle. However, WLFI has also fallen into the whirlpool of public opinion due to the controversy over the cooperation sharing proposal with Aave, and this on-chain governance drama has also stimulated market discussion and thinking.

WLFI is about to be listed on Ethereum, and early investors can earn up to 14x returns

On August 23, WLFI announced that it will be launched on the Ethereum mainnet on September 1, when users can claim and trade. Among them, early supporters ($0.015 and $0.05 rounds) will unlock 20%, and the remaining 80% will be decided by community voting. Tokens for the founding team, advisors, and partners will not be unlocked upon launch.

After the launch news, exchanges such as Binance, OKX, and Hyperliquid announced the launch of WLFI/USDT perpetual contract pre-market trading, and the contract price rose to $0.55 on the same day, corresponding to a full circulation valuation of about $55 billion. But then the price fell rapidly, with the pre-market trading price falling by more than 60% to about $0.2.

– >

– >

WLFI was announced by the Trump family in September 2024 and has publicly raised two rounds so far. The first round of presale opened on October 15, 2024, when WLFI announced the release of 20 billion tokens to whitelisted investors at a price of $0.015 each. However, the market response was mediocre, with about 610 million WLFIs sold on the first day (19.4 billion remaining for sale) and sales of only $9.15 million. Due to the weak market response, WLFI also submitted an application the following month, significantly lowering its funding target by 90%, and only plans to raise $30 million after the adjustment.

However, since Trump won the US election, WLFI token sales began to accelerate, eventually selling out 20 billion tokens by January 20, 2025, with a cumulative revenue of about $300 million. During this period, Tron founder Justin Sun made two rounds of investments of $30 million and $45 million, becoming the largest individual investor in this round of fundraising, and also served as a WLFI consultant.

On January 20, 2025, coinciding with Trump's inauguration, WLFI launched its second round of presale, announcing an additional 5% of the token supply, raising the price to $0.05. Compared with the first round, this round of pre-sale was enthusiastic, selling out on March 14 in just two months, successfully completing the $250 million fundraising target.

According to WLFI tokenomics, the total supply is 100 billion, of which 35% is used for token sales, 32.5% for community growth and incentives, 30% is allocated to initial supporters, and the remaining 2.5% is allocated to the team and advisors. Judging from the current public offering progress, WLFI has completed 25% of the total supply, and 10% is still for sale.

Based on the current pre-market trading price of $0.21, investors with $0.015 have a floating profit of about 14 times, and participants with $0.05 have a floating profit of about 4.2 times. Another on-chain analyst, Aunt Ai, revealed that the participants in the public offering round of WLFI TOP10 addresses have invested a total of US$73.08 million, holding a total of 4.63% of the tokens, totaling 4.64 billion. At current prices, these investors will unlock more than $190 million worth of tokens at TGE.

In addition, WLFI's market makers have also been disclosed. According to Aunt Ai's analysis, there is no suspense that DWF Labs is a WLFI market maker, and there is a high probability that there will be other market makers. According to the data, Web3Port received 200 million WLFI tokens (cost $0.05) in the strategy round, DWF Labs received 250 million tokens (cost $0.1) in the strategy round, and ALT5 Sigma Corporation acquired 7.5 billion tokens (cost $0.2) through equity acquisition.

Notably, DT Marks DEFI LLC, associated with the Trump family, receives a 75% share of the agreement's net revenue distribution without liability. During the public offering, DT Marks DEFI LLC has dropped from 75% to about 40%.

Theimplementation of the 7% token distribution proposal is questionable, WLFI and Aave have their own opinions While

the high returns of early investors in WLFI have sparked heated discussions, a rumor that Aave may receive 7% of WLFI's total tokens has also caused controversy in the community. The WLFI team denied this, but Aave insisted that the agreement was still valid, and both sides had their own opinions.

The event dates back to before the official launch of WLFI. WLFI revealed plans to provide crypto lending services on the Ethereum blockchain at the time, and said on its official Telegram channel that they were working with Aave, emphasizing that this was not a malicious fork, but wanted to create an innovative platform to drive the development of the DeFi industry.

In

In

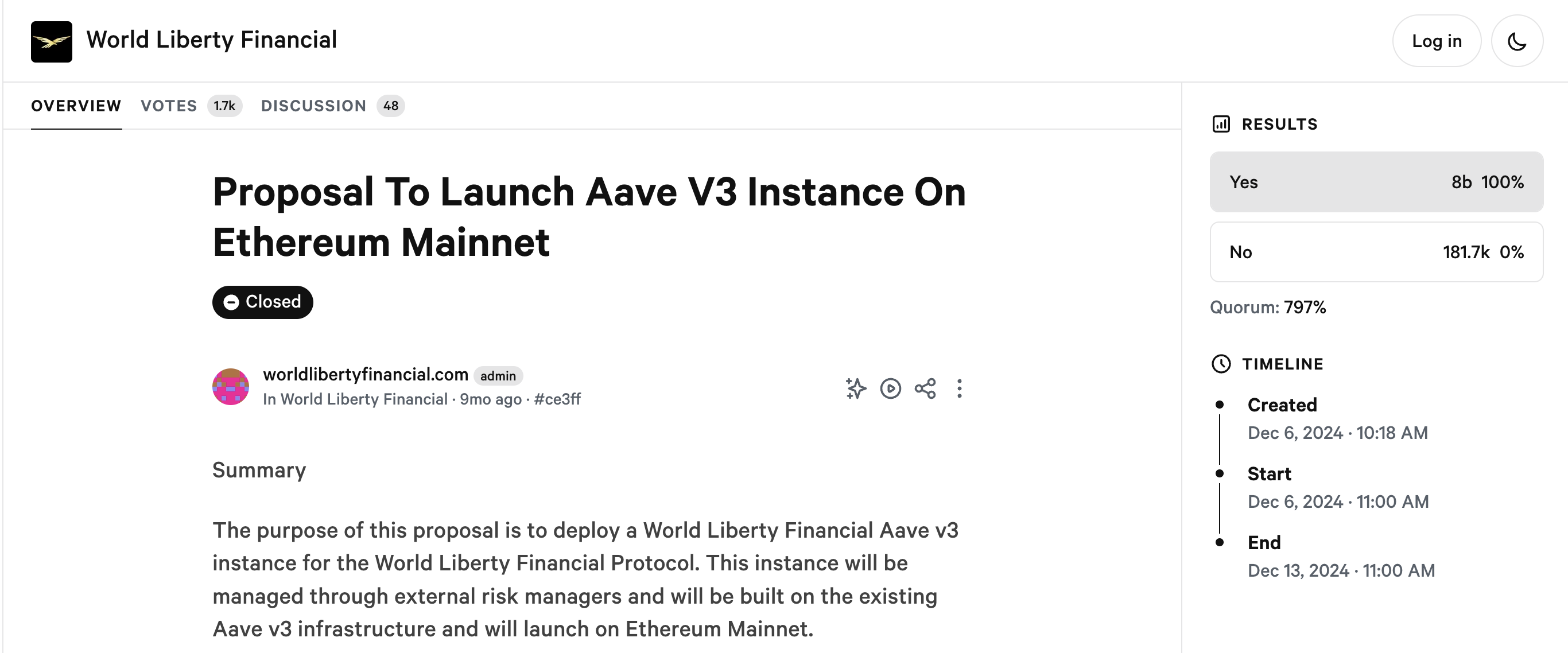

early December 2024, WLFI submitted its first community proposal, planning to deploy the Aave v3 lending instance of the WLFI protocol on the Ethereum mainnet, initially supporting USDC, USDT, ETH, and WBTC, managed by the Aave risk management team. The main goal of the proposal is to attract users who are entering DeFi for the first time and increase awareness of the WLFI and Aave brands. In return, the proposal states that AaveDAO will receive 20% of the protocol fees generated by WLFI Aave v3 instances and will receive approximately 7% of the total WLFI token supply (7 billion tokens) to participate in WLFI future governance, liquidity farming, and promote platform decentralization. The revenue distribution plan is executed through trustless smart contracts and distributed proportionally to AaveDAO and WLFI treasury addresses. The proposal was voted on on December 13, 2024, with a 100% approval rating.

With the upcoming launch of WLFI, this proposal has also been re-mentioned by the community recently, directly driving the price of AAVE up. Based on current market valuations, Aave Treasury may receive billions of dollars worth of WLFI tokens, making it one of the potential largest beneficiaries in this cycle.

However, this good news was denied by a suspected WLFI Wallet team member, who also told Wu that the blockchain was untrue and called it "fake news". In response, Aave founder Stani.eth insisted that the protocol is still valid, emphasizing that the proposal was created by the WLFI team and officially approved.

As the news ferments, the crypto community continues to controversy over this incident, with different opinions from all sides. The crypto KOL@0x_Todd noted that this is WLFI's genesis proposal (Proposal 1), with more votes than the required votes by 7 times and an approval rating above 99%. If even the genesis proposal is not fulfilled in the end, it is very unDeFi. Centralized governance is no longer DeFi, and governance breach should be kicked out of DeFi status.

KOL@Luyaoyuan1 warned that WLFI may be at risk of default, pointing to historical precedents similar to the sharp reduction of promised returns of SPK projects, and Aave has been deceived many times. If the contract is breached, it supports Aave to sue WLFI.

In the view of dForce founder Mindao, the initial design of the "20% revenue share + 7% token distribution" clause was unreasonable and did not match the actual brand and market value of WLFI. He analyzed that the later script is probably WLFI completely abandoning Aave, so that the previous contract will naturally be invalidated. At the same time, WLFI has large-scale reduced its token distribution share, using the allocation to incentivize USD1 lending and minting, and the left hand and right hand will not suffer losses, so it will be used as a targeted stablecoin minting operation subsidy.

"The previous WLFI public sale did not go well, and the outside world questioned its leek cutting, which made Aave on the strong side in cooperation. However, with the high market enthusiasm, the passage of the Stablecoin Genius Act, and Trump's personal financial disclosure of 15.7 billion WLFI, its value position has increased, making WLFI unwilling to give Aave as much cake as before. @wenser2010 analysis pointed out that Aave may need to make concessions to reduce its original share, or WLFI may promote new proposals to redistribute the proportion of revenue. As for the length of time, it depends on the mediation negotiations behind the two sides.

However, Alex Xu, a research partner at Mint Ventures, pointed out that at first, WLFI wanted to create an Aave-based lending market, but later WLFI may have felt that lending was too unsexy (although it had issued a proposal with tokens and profit distribution plans) and turned to stablecoins. In this case, the cooperative relationship between the two sides does not exist, and the golden book officially announced by WLFI has never had Aave's share.

Although the controversy over the cooperation between WLFI and Aave has not yet been settled, this incident once again exposed the limitations of on-chain governance. Although on-chain governance has the advantages of transparency and decentralization, even if the proposal is voted on by the community, the actual implementation still depends on the wishes of all parties and the results of negotiation.