Why Robert Kiyosaki Praises Bitcoin Over Crypto ETFs?

Rich Dad Poor Dad author Robert Kiyosaki cautioned investors that paper investments should be handled with care.

Although Kiyosaki indicated that average investors can make investments in exchange-traded funds (ETFs), he preferred physical assets, including Gold, Silver, and Bitcoin.

His comments came as spot Bitcoin ETFs recorded renewed investor interest. After three consecutive days of outflows, the funds saw $226 million in net inflows on Thursday.

Robert Kiyosaki Reveals Crypto ETF Limitations

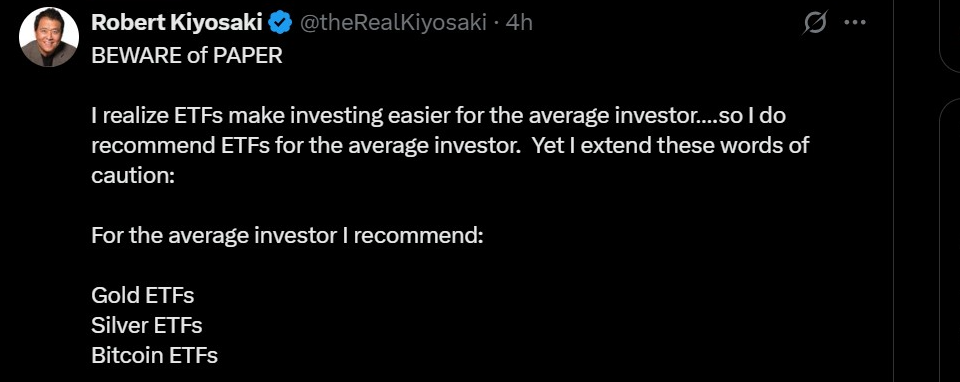

In a post shared on X, Robert Kiyosaki urged investors to “beware of paper.” He has refered to the financial assets that do not involve direct ownership.

He stated that although crypto ETFs are useful for the average investor, they do not replace the value of real, tangible holdings.

To illustrate his point, he compared owning crypto ETFs to possessing a picture of a gun for self-defense.

Robert Kiyosaki stressed that understanding when to hold real assets versus paper-based investments is essential. He acknowledged that crypto ETFs make access easier.

Despite Robert Kiyosaki’s warning, crypto ETFs have continued to expand. Recently, Trump-backed Truth Social filed an S-1 for its own ETF backed by Bitcoin, Ethereum, Solana, XRP, and Cronos.

The fund, structured as a commodity pool, will allocate 70% to Bitcoin and list on NYSE Arca, offering passive exposure to top digital assets.

Kiyosaki Recommends Bitcoin ETFs

However, Robert Kiyosaki listed Gold ETFs, Silver ETFs, and Bitcoin ETFs as suitable for average investors.

The financial author clarified that these instruments should be used with an understanding of their limitations.

He repeated his stance that real Bitcoin and precious metals offer better long-term security. However, he noted that retail investors benefit from the liquidity and convenience of ETFs.

Despite that, he suggested that those who can manage physical or self-custodied assets should consider doing so.

Moreover, the author of Rich Dad Poor Dad warned in recent weeks that the buying power of the U.S. dollar has fallen by almost 95% since the 1970s. He encouraged investors to consider abandoning fiat savings.

Robert Kiyosaki also stressed his choice of Bitcoin, gold, and silver, and confirmed that he recently bought more Bitcoin.

Bitcoin ETFs Regain Momentum After Three-Day Outflow

Robert Kiyosaki’s cautionary remarks came as spot Bitcoin ETFs in the U.S. recorded strong net inflows of $226.6 million on Thursday.

This ended a three-day streak of consistent outflows that had seen over $280 million withdrawn between Monday and Wednesday.

The rebound was spearheaded by Fidelity FBTC, which raised $106.6 million. VanEck, HODL came next with $46.4 million, and BlackRock, IBIT recorded $32.5 million in inflows.

Bitwise, Franklin Templeton, and Grayscale were among the other ETFs with inflows. This increased investor movement indicated that confidence was piling into the crypto ETF industry again.

Meanwhile, Bitcoin price dropped 1.8% to $116,500 at the time of writing. Despite the BTC price dip, institutional players showed no signs of retreating.

A recent report highlighted that the current calm in Bitcoin price marked a significant liquidation risk. If the BTC price slips further, it could trigger forced liquidations, potentially crashing BTC to $103,000.

Ethereum ETFs Maintain Strong Demand

Although Bitcoin ETFs showed a great recovery, Ethereum-related ETFs recorded consecutive five-day inflows.

ETFs listed in the United States alone registered net inflows of $231.2m into Ethereum on Thursday alone.

At the same time, Ethereum price has risen by more than 50% within the past month, rising to approximately $3,721 from a low of $2,420.

The rally surged the market cap of the crypto to $449.25 billion, and the 24-hour trading volume increased to $46.05 billion.

The post Why Robert Kiyosaki Praises Bitcoin Over Crypto ETFs? appeared first on The Coin Republic.