The sequel to the Curve conspiracy, the new paradigm of yield yield for stablecoins

Author: Zuo Ye Crooked Neck Mountain

The

Road to Stablecoin Trading Expansion Beyond Ethena

Welcome to @YBSBarker, a guide to the income of the era of stablecoin credit expansion.

After the collapse of Luna-UST, stablecoins completely bid farewell to the era of stability, and the CDP mechanism (DAI, GHO, crvUSD) once became the hope of the whole village, but in the end, it was Ethena and its representatives who broke out of the siege under the encirclement of USDT/USDC, which not only avoided the problem of capital inefficiency caused by over-staking, but also opened up the DeFi market with native income characteristics.

On the other hand, after relying on stablecoin trading to open the DEX market, the Curve series gradually entered the lending market Llama Lend and the stablecoin market crvUSD, but under the light of the Aave system, the issuance of crvUSD has hovered around $100 million for a long time, and it can basically only be used as a background board.

However, after the launch of the Ethena/Aave/Pendle flywheel, Curve's new project Yield Basis also wants to get a share of the stablecoin market, starting with revolving leveraged loans, but this time it is a transaction, hoping to use trading to erase the chronic disease of AMM DEX - impermanent loss (IL).

Unilateralism eliminates gratuitous losses

Curve is the latest masterpiece, now your BTC is mine, take your YB and stand guard.

Yield Basis represents the Renaissance, and in one project, you can see liquidity mining, pre-mining, Curve War, staking, veToken, LP Token, and revolving loans, which can be said to be the culmination of DeFi development.

Curve founder Michael Egorov was an early beneficiary of the development of DEXs, improving on Uniswap's classic AMM algorithm of x*y=k, successively launching stableswap and cryptoswap algorithms to support more "stablecoin transactions" and more efficient general-purpose algorithms.

Large-scale stablecoin transactions have established Curve's "lending" market for early stablecoins such as USDC/USDT/DAI, and Curve has also become the most important stablecoin on-chain infrastructure in the pre-Pendle era, and even the collapse of UST directly stemmed from the Curve liquidity withdrawal moment.

In terms of tokenomics, the veToken model and the subsequent "bribery" mechanism Convex have made veCRV a real asset in one fell swoop, but after the four-year lock-up period, most $CRV holders are suffering and not enough to be humane.

After the rise of Pendle and Ethena, the market position of the Curve system is not guaranteed, and the core is that for USDe, hedging originates from CEX contracts, diversion uses sUSDe to capture returns, and the importance of stablecoin trading itself is no longer important.

The counterattack of the Curve series first came from Resupply, which was launched in 2024 with the two ancient giants Convex and Yearn Fi, and then unexpectedly, the Curve series failed in its first attempt.

Resupply accident, although it is not an official Curve project, but if Curve does not fight back, it will be difficult to buy a ticket to the future in the new era of stablecoins.

Yield Basis is not aiming at stablecoins or the lending market, but at the problem of free losses in AMM DEXs, but first state that the real purpose of Yield Basis has never been to eliminate free losses, but to promote the surge in crvUSD issuance.

For example, in the BTC/crvUSD trading pair, LPs need to provide 1 BTC and 1 crvUSD (assuming 1 BTC = 1 USD), at which point the total value of LPs is 2 USD.

Correspondingly, the price p of 1 BTC can also be expressed as y/x, we agree on p=y/x, at this time, if the price of BTC changes, such as a 100% increase to $2, an arbitrage situation will occur:

Pool A: The arbitrageur will use $1 to buy 1 BTC, at which point the LP needs to sell BTC to get $2

Pool B: Sell in pool B with a value of $2, and the arbitrageur will make a net profit of 2-1=

If youwant to quantify this loss, you can first calculate the value of LP LP after the arbitrage occurs LP(p) = 2√p (x,y is also expressed as p), but if the LP simply holds 1 BTC and 1 crvUSD, it is considered that there is no loss, which can be expressed as LP~hold~(p)= p +1.

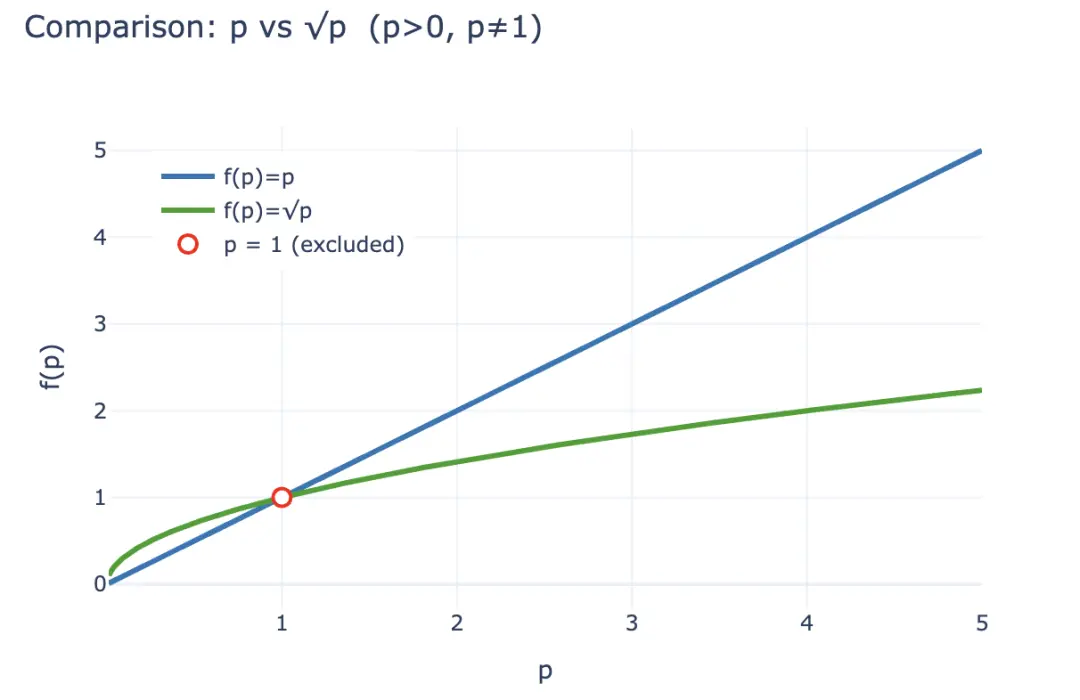

According to the inequality, in the case of p>0 and not 1, you can always get 2√p < p + 1, and the income obtained by arbitrageurs essentially comes from the loss of LPs, so stimulated by economic interests, LPs tend to withdraw liquidity and hold cryptocurrencies, and AMM protocols must retain LPs through higher fee sharing and token stimulation, which is also the fundamental reason why CEXs can maintain their advantages over DEXs in the spot field.

Image caption: Free loss

Image source: @yieldbasis

From the perspective of the entire on-chain economic system, uncompensated losses can be regarded as an "expectation", and LPs can no longer claim the income from holding if they choose to provide liquidity.

Yield Basis does not think so, they do not eliminate the expected loss of LPs by improving liquidity and increasing the proportion of fees, but start from "market-making efficiency", as mentioned above, compared to holding p+1, LP's 2√p can never outperform, but from the perspective of the output ratio of $1 investment, the initial investment is $2√p, the current price is $2p, and the "yield" per dollar is 2√p/2 = √p, remember p is the price of 1 BTC? So if you simply hold, then p is your return on assets.

Assuming an initial investment of $2, then after a 100% increase, the LP earnings change as follows:

-

• Absolute added value: 2 USD = 1 BTC (1 USD) + 1 crvUSD -> 2√2 USD (arbitrageurs take the difference -

). • Relative yield: 2 USD = 1 BTC (1 USD) + 1 crvUSD -> √2 USD

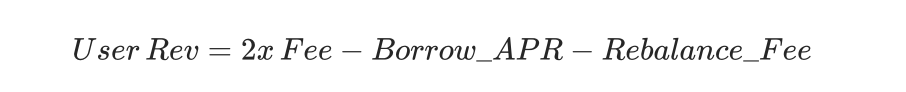

Yield Basis From the perspective of asset yield, let √p become p to ensure LP fees while retaining holding income, this is very simple, √ p², from a financial point of view, it is necessary to have 2x leverage, and it must be a fixed 2x leverage, too high or too low, will cause the economic system to collapse.

Caption: LP Value Scaling Comparison of p and √

Image Source: @zuoyeweb3

That is, let 1 BTC exert twice its own market-making efficiency, and naturally there is no corresponding crvUSD participation fee profit sharing, and BTC only has its own participation rate comparison, that is, it transforms from √ p to p itself.

Believe it or not, anyway, in February, Yield Basis officially announced a $5 million financing, indicating that there was a VC letter.

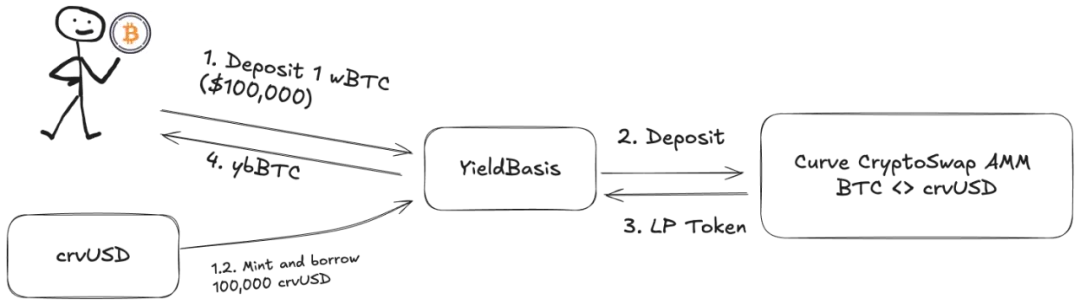

But! LP liquidity added must be the corresponding BTC/crvUSD trading pair, and the pool is full of BTC and cannot run, Llama Lend and crvUSD take advantage of the trend and launch a dual lending mechanism:

-

1. The user deposits (cbBTC/tBTC/wBTC) 500 BTC, and YB (Yield Basis) uses 500 BTC to lend the equivalent of 500 crvUSD -

2. YB deposits 500BTC/500 crvUSD into the BTC/crvUSD trading pool corresponding to Curve and mints it as a $ybBTC representing share -

3. YB uses 1000U worth of LP shares as collateral and then goes to Llama Lend to lend 500 crvUSD through the CDP mechanism and repay the initial equivalent loan -

4. The user receives ybBTC representing 1000U, Llama Lend gets 1000U of collateral and eliminates the first equivalent loan, and the Curve pool gets 500BTC/500 crvUSD liquidity

In the end, 500 BTC "eliminated" its own loan and received 1000 U of LP share, and the 2x leverage effect was achieved. However, please note that the equivalent loan is lent by YB and acts as the most critical intermediary, essentially YB assumes the remaining 500U borrowing share from Llama Lend, so Curve's handling fee YB also has to be shared.

If users think that 500U of BTC can generate 1000U of fee profits, then it is right, but it is a bit rude to think that it is all given to themselves.

Let's calculate the original income:

where 2x Fee means that users can generate 1000 U fee profit by investing 500U equivalent BTC, Borrow_APR represents the Llama_Lend fee, and Rebalance_Fee represents the fee for arbitrageurs to maintain 2x leverage.

Now there is good news and bad news:

-

• Good news: All Llama Lend's borrowing income goes back to the Curve pool, which is equivalent to a passive increase in LP earnings -

• Bad news: The Curve pool's fees are fixed 50% to the pool itself, that is, both LP and YB have to split the remaining 50% of the fees

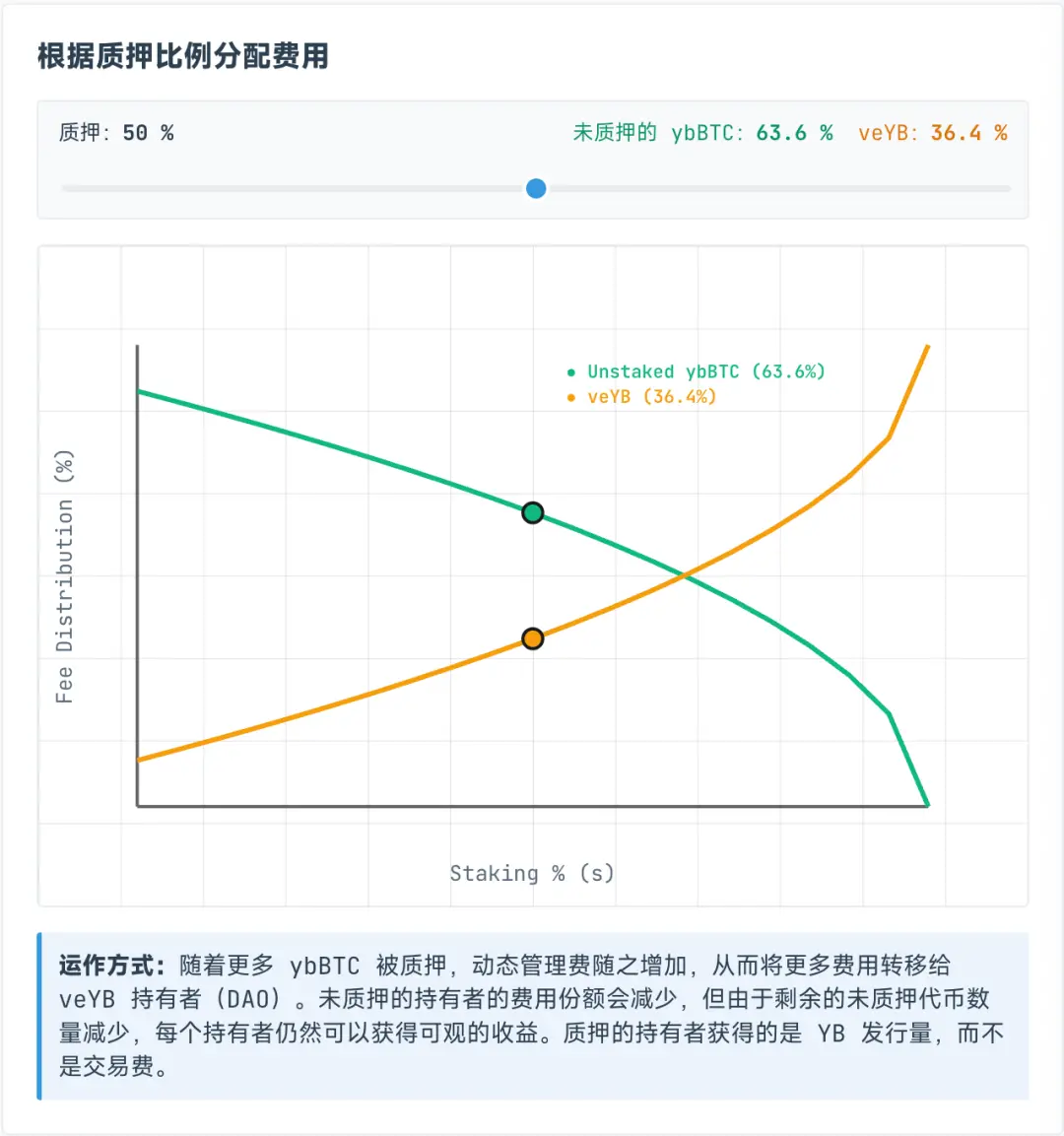

However, the fees allocated to veYB are dynamic, and they are actually dynamically divided between ybBTC and veYB holders, with veYB fixing a minimum 10% guaranteed share, which means that even if everyone does not stake ybBTC, they can only receive 45% of the original total income, while veYB itself can receive 5% of the total income.

Themagic result is that even if users do not stake ybBTC to YB, they can only get 45% of the handling fee, if they choose to stake ybBTC, they can get YB Token, but if they want to give up the handling fee, then they can continue to stake YB for veYB, and they can get the handling fee.

Image caption: ybBTC and veYB revenue share

Image source: @yieldbasis

Unpaid losses will never disappear, they will just transfer.

You think you can use 500U equivalent BTC to exert 1000U of market-making effect, but YB doesn't say that all the market-making income will be given to you, and after you stake veYB, unstake twice, veYB->YB, ybBTC->wBTC to get back the original funds and income.

But if you want to get the full voting rights of veYB, that is, the bribery mechanism, then congratulations, you have obtained a four-year lock-up period, otherwise the voting rights and income will gradually decrease with the staking period, so whether the income from locking up for four years and giving up BTC liquidity to obtain YB is worth it depends on personal considerations.

As mentioned earlier, gratuitous loss is a kind of bookkeeping loss, as long as liquidity is not withdrawn, it is a floating loss, and now YB's elimination plan is essentially "accounting income", giving you a floating profit that anchors the income you hold, and then cultivates your own economic system.

You want to leverage 1000U of fee income with 500U, and YB wants to "lock" your BTC and sell your YB to you.

Multi-party negotiation embraces the growth flywheel

In the era of great income, you will come if you have a dream.

Based on Curve, using crvUSD will empower $CRV, but it will also open a new Yield Basis protocol and token $YB, so can YB maintain and increase its value in four years? I'm afraid....

In addition to the complex economics of Yield Basis, the focus is on crvUSD's path to market expansion.

Llama Lend is essentially part of Curve, but the founder of Curve actually proposed to issue an additional $60 million in crvUSD to provide YB's initial liquidity, which is a bit bold.

YB will give benefits to Curve and $veCRV holders as planned, but the core is the pricing and appreciation of YB Token.

Not to mention another ReSupply event, which affects the Curve itself.

Therefore, this article does not analyze the token linkage and profit-sharing plan between YB and Curve, $CRV that the lesson is not far off, $YB is destined to be worthless, and wasting bytes is meaningless.

However, in the defense of his additional issuance, we can get a glimpse of Michael's whimsical idea, the BTC deposited by users will "increase" the equivalent amount of crvUSD, the advantage is to increase the supply of crvUSD, and each crvUSD will be put into the pool to earn fees, which is a real transaction scenario.

But in essence, this part of the crvUSD reserve is equivalent rather than excessive, if the reserve ratio cannot be increased, then increasing the crvUSD money-making effect is also a way, remember the relative return on funds?

According to Michael's vision, the lent crvUSD will efficiently synergize with existing trading pools, such as wBTC/crvUSD will be linked to crvUSD/USDC to promote the trading volume of the former and increase the trading volume of the latter.

The handling fee of the crvUSD/USDC trading pair will be distributed 50% to $veCRV holders and the remaining 50% to LPs.

Itcan be said that this is a very dangerous assumption, the crvUSD lent by Llama Lend to YB mentioned above is exclusively for the use of a single pool, but pools such as crvUSD/USDC are not admitted, and crvUSD at this time is essentially insufficient reserves Ecology.

It is important to note that crvUSD and YB are tied, 50% of the new liquidity must enter the YB ecosystem, and the crvUSD used by YB is isolated, but there is no isolation for use, which is the biggest potential thunderstorm point.

Image caption: Curve profit sharing plan

Image source: @newmichwill

Michael's plan is to bribe the stablecoin pool with 25% of the issuance of YB Token to maintain depth, which is close to the level of a joke, asset security: BTC>crvUSD> CRV>YB, when the crisis comes, YB can't even protect itself, so what can it protect?

YB's own issuance is the product of the fee sharing of the crvUSD/BTC trading pair, recall, the same is true for Luna-UST, UST is the equivalent mint of Luna burning, and the two rely on each other, as is YB Token

crvUSD.

It can also be more like, according to Michael's calculations, based on the BTC/USD trading volume and price performance over the past six years, he calculated that he can guarantee an APR of 20%, and can also achieve a 10% yield in a bear market, and the bull market high in 2021 can reach 60%.

Because the amount of data is too large, I didn't backtest the data to verify his calculation ability, but don't forget, UST has also guaranteed a 20% return, and the Anchor + Abracadabra model has also been running for quite a long time.

At least, UST frantically bought BTC as a reserve before the collapse, and YB directly based BTC as a leveraged reserve, which can be regarded as a huge improvement.

Forgetting equals betrayal.

Starting with Ethena, on-chain projects began to look for real returns, not just looking at the market dream rate.

Ethena uses CEX to hedge ETH for yield capture, distributes income through sUSDe, and uses $ENA treasury strategy to maintain the trust of large investors and institutions.

YB wants to find real trading income, there is no problem in itself, but arbitrage and lending are different, the transaction is more instantaneous, each crvUSD is a common liability of YB and Curve, and the collateral itself is also borrowed from users, and its own funds are highly close to zero.

The current issuance of crvUSD is small, and it is not difficult to maintain a growth flywheel and a 20% return in the early stage, but once the scale expands, YB price growth, BTC price movements, and crvUSD's value capture ability will all cause significant selling pressure.

The US dollar is an unanchored currency, and crvUSD is coming soon.

However, the nested risk of DeFi has been priced into the overall systemic risk on the chain, so if it is a risk for everyone, it is not a risk, but those who do not participate will passively share the loss of the crash.

Conclusion

TheTheworld will give a person a chance to shine, and he is a hero if he can grasp it.

yield basis of traditional finance is the yield of U.S. Treasury bonds, will the yield basis on the chain be BTC/crvUSD?

The YB logic can be established if the on-chain transactions are large enough, especially the huge transaction volume of Curve itself, in this case, it makes sense to eliminate uncompensated losses, which can be analogized:

-

• Power generation is equal to electricity consumption, there is no static "electricity", which is immediately issued -

• Trading volume is equal to market capitalization, and every token is in circulation, buying and selling

Only in continuous and sufficient trading can the price of BTC be discovered, and the value logic of crvUSD can be closed, and additional issuance from BTC lending and profiting from BTC transactions can I have confidence in BTC's long-term rise.

Since the financial explosion in '08, as long as mankind does not want to restart the world order in the form of revolution or nuclear war, the overall trend of BTC will rise, not because there is more consensus on the value of BTC, but because of confidence in the inflation of the US dollar and all fiat currencies.

However, I have moderate trust in the technical strength of the Curve team, and I am deeply skeptical about their moral level after ReSupply, but it is difficult for other teams to dare to try in this direction.

UST frantically bought BTC on the eve of its demise, exchanged for USDC during USDe reserve fluctuations, and Sky embraced Treasury bonds like crazy.