River's first chain abstract stablecoin system: the third path of stablecoins, using chain abstraction to solve liquidity fragmentation

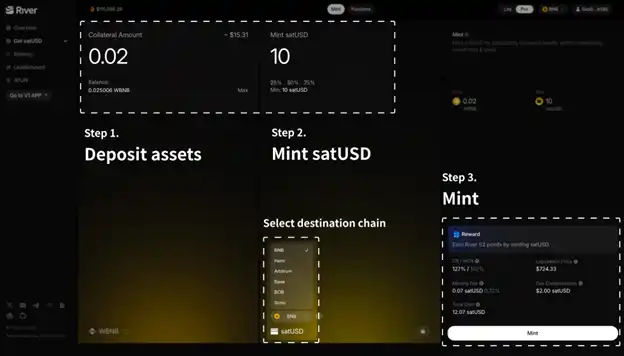

River aims to establish a chain abstract stablecoin system, allowing users to deposit assets on Chain A and mint satUSD stablecoins on Chain B; Establish a stablecoin system that does not require cross-chain and wrapped operations, allowing users to securely obtain income opportunities on various chains without selling assets.

Capital dilemma

the past 2 years, DeFi has accelerated its development, and the ecosystem has entered the multi-chain era:

·300+ Layer2

·30+ stablecoins

·20+ BTC, ETH-BASED LSD/LST

seem to be booming, But capital and liquidity are locked in silos on their respective chains.

For example, if you want to participate in the same strategy, you often need to exchange assets across chains 2-3 times through DEXs, which not only has high fees but also increases cross-chain risks.

Multi-chain brings choice, but does not promote efficient use between assets, and value between ecosystems cannot flow naturally.

River Chain Abstraction Stablecoin System

Traditional stablecoins operate on a single chain and rely on third-party liquidity when cross-chain, so River chose a third path - chain abstraction.

The core is to hide the boundaries between chains, so that users do not need to prepare capital and liquidity for different chains separately.

Behind this is the combination of LayerZero technology and OFT standards:

Deposit BTC, ETH, BNB, LST

on any chain Natively mint satUSD

on another chain No need to cross-chain or wrapped, and safely circulate

ecosystems It's like having a global bank account, you don't have to reopen an account in every country, you can settle, pay, and invest at any time.

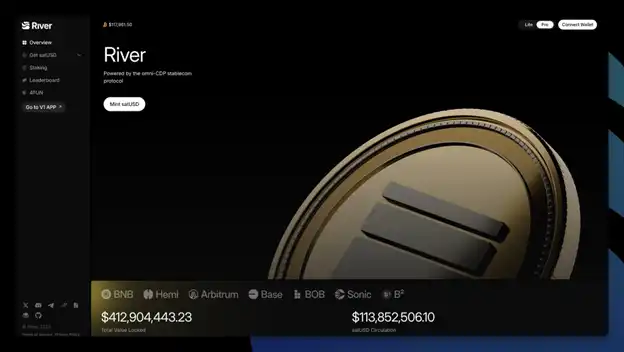

River products have been launched, with a total lock-up

past two months, River's on-chain abstract stablecoin system has accumulated:

More than $400 million in TVL (total locked)

and more than $100 million in satUSD circulation

Support BTC, ETH, BNB, LST deposit as collateral

Integrate more than 30 protocols (Pendle, ListaDAO, Solv...)

CDP stablecoin ranks first in ecosystems such as BNB Chain, Arbitrum, Hemi, and BOB

, which means that no matter which chain your assets are on, your assets can be activated instantly and invested in multi-scenario strategies.

Why do we need River now?

As of today, DeFi TVL has exceeded $150 billion, and the total stablecoin market capitalization has reached $270 billion.

It stands to reason that the growth of market capitalization and TVL should bring about a more vigorous DeFi ecosystem, but the reality is:

· Liquidity is more dispersed

· Asset transfer is difficult

· Income opportunities are concentrated in a few protocols

· The entry barrier for new users is still high

In the context of major DeFi, stablecoin giants, and even listed companies launching chains and building their own ecosystems, River's chain abstract stablecoin system is positioned to solve the problem of liquidity fragmentation in a multi-chain ecosystem, rather than adding new islands.

Chain abstract stablecoin? Connecting multi-chain ecological liquidity and value circulation

River is not just a stablecoin, but uses "full-chain native" technology to overturn the traditional logic of the entire asset flow method.

You can Fork Ethena hedging strategy, Liquidity's liquidation model, Usual Money stablecoin's minting mechanism; But you can't fork the chain abstraction underlying architecture that River creates.

Currently, all stablecoins have not considered "how to solve the integration of cross-chain assets, cross-chain flow, and cross-chain income" on the first day. The River stablecoin satUSD has been targeting the entire chain since Day 1, using the LayerZero structure and natively deploying the satUSD stablecoin in OFT format.

You don't need the silky feeling of cross-chain, you can know the experience gap at a glance, just like when you first use cryptocurrency to make peer-to-peer payments, you realize that bank cross-border wire transfers are obsolete.

What River wants to do is not just issue a stablecoin, but to allow any asset in the world to participate in value creation, distribution, and circulation wherever it is needed.

Let every on-chain asset flow to any user in the world.

Connect with value, flow with River

This article is from a contribution and does not represent the views