Quarterly revenue expectations have surged 268 times, how high is Galaxy Digital's position in the coin stock boom?

Written by: BUBBLE

There have been two tipping points since the development of cryptocurrency OTC platforms, which are the passage of Bitcoin and Ethereum ETFs in 2024, while regions such as the European Union and Dubai have gradually introduced frameworks (MiCA, VARA) to allow OTC counters to operate legally and on a large scale, and institutions need to quickly procure underlying assets. By 2025, since US President Trump proposed the concept of "cryptocurrency capital", the overall tendency of traditional finance has taken a 360-degree turn, and after the introduction of various new crypto policies, Bitcoin has reached a new high in early 2025, Ethereum has risen strongly, and the institutional asset allocation boom has created an explosive growth in OTC platform transactions.

Generally speaking, OTC trade matching is a direct match between buyers and sellers. They offer a single offer, so there is no slippage and no bidding, and transfers are done through escrow wallets, institutional accounts. Because the order never touches the public limit book, the market will never see your hand. As a dark pool in the "cryptocurrency market", OTC institutions do not disclose the specific transaction rules of their users, but unlike traditional finance, we can query and find clues from the chain.

In July 2025, one of the largest Bitcoin OTC transactions to date occurred, with a total of 80,000 BTC changing hands at a price of about $9 billion, but there was almost no turmoil in the open market.

What role do OTC platforms play in this wave of compliance? How Galaxy Digital uses its resources to flip and move in currency and stock trading. BlockBeats has conducted a series of research on this topic.

Crypto's third largest liquidity pillar

With this round of institutional boom, OTC platforms have become the "third largest liquidity pillar" in the crypto market after centralized trading platforms (CEXs) and decentralized trading platforms (DEXs). For large amounts of funds, it is difficult for CEX/DEX to directly carry hundreds of millions of dollars in buying without causing violent fluctuations, so OTC platforms play the role of "white gloves" for institutions, completing positions or liquidations behind the scenes.

No month of 2024 has had OTC trading volume lower than the same period last year, indicating a growing preference among market participants to trade through private channels rather than placing overt bets in the open market. The crypto industry has gradually changed from edge speculation to an acceptable asset allocation option in their eyes, and Wall Street has changed from a skeptic. And in 2025, this growth will increase exponentially.

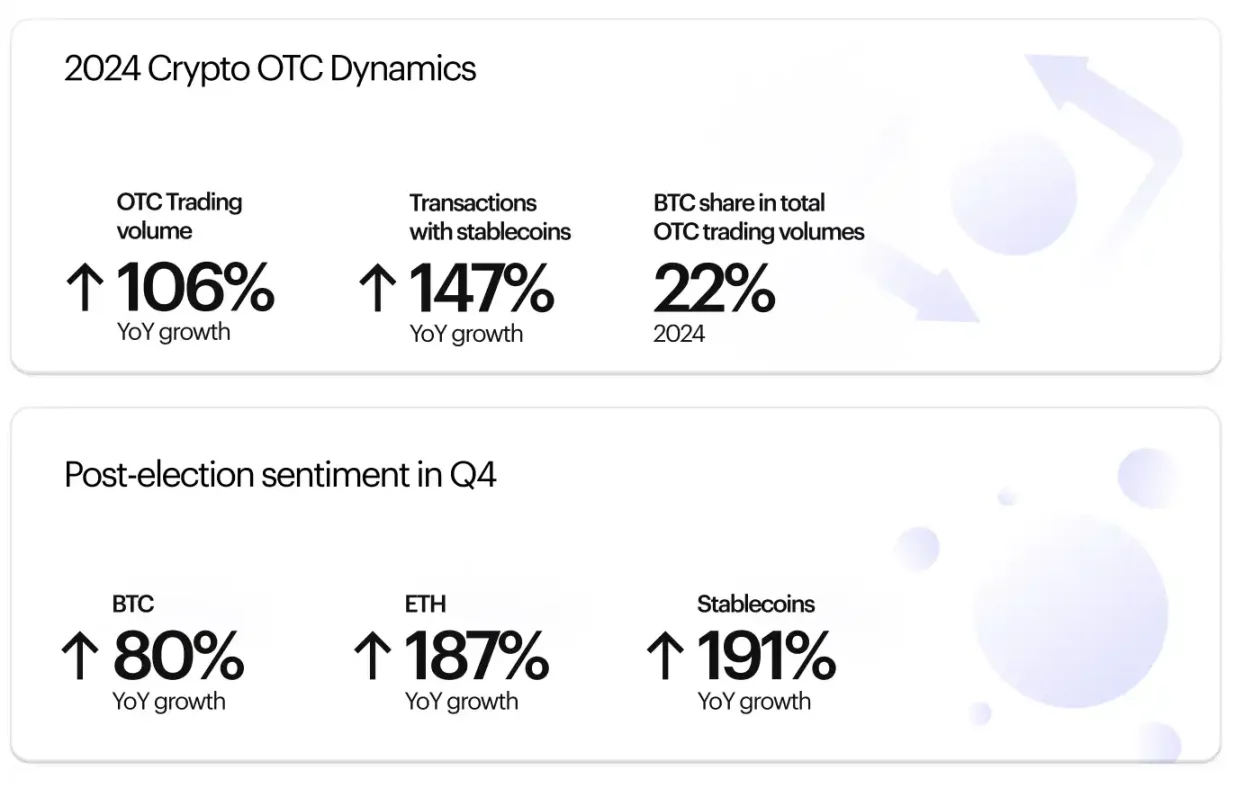

Finery Markets pointed out that more and more traditional financial leaders are moving from "wait-and-see" to neutral or accepting, which is an important reason for the surge in OTC trading volume. When more trades are made in the dark pool, the apparent market volatility may be significantly smoothed out. According to the Q4 2024 report released by Finery Markets, it is mentioned that the overall trading volume of OTC platforms has increased by 106% compared to the previous year, and the OTC spot volume in the first half of 2025 has increased by 112.6% year-on-year compared to the first half of 2024.

It is worth noting that while the compliance environment in Europe and the United States is improving, the OTC market in Asia is also emerging. OSL, a licensed OTC platform in Hong Kong, and emerging platforms in the UAE and Southeast Asia, are attracting global liquidity. At the same time, some traditional block trade market makers such as Flow Traders are also active, using high-frequency and quantitative strategies to provide institutional clients with bilateral quotes for crypto large trades, improving execution efficiency and reducing impact costs. These factors collectively solidify OTC's position as an invisible pool in the crypto market.

Galaxy Digital in the limelight

Among the many OTC players, Galaxy Digital, founded by Mike Novogratz, is undoubtedly the star of this wave of institutional buying frenzy. Galaxy is not only a well-known crypto investment bank, but also operates a high-reach over-the-counter trading business, mainly covering several business lines: trading, investment, asset management, consulting and mining. Its clients include top players such as listed companies and hedge funds. However, the main pillars of profitability are OTC spot trading and investment. Backed by the founder's 20 years of experience on Wall Street and the compliance of the company's listing, more and more institutional funds are pouring in, and Galaxy's platform has staged amazing block trading dramas, covering mainstream assets such as ETH and BTC, as well as popular currencies such as SOL and BNB.

The epic 80,000 BTC transaction landed smoothly

As mentioned earlier, the OTC transaction of 80,000 bitcoins in 4 days, worth up to $9 billion, was one of the largest single transactions in crypto history, and the middleman of this transaction was Galaxy Digital.

Galaxy Digital made an announcement on July 25, disclosing that it was commissioned to complete this huge BTC sale as an early investor in the "Satoshi era". Allegedly part of the investor's estate planning, Galaxy did not disclose the client's identity, only saying the transaction was a step in a broader wealth management strategy. Surprisingly, the liquidation of these 80,000 BTC almost did not impact the market, starting from July 17, the ancient address on the chain changed, transferring Bitcoin to Galaxy Digital's OTC address within a few days, and the liquidation of these 80,000 BTC was not reflected in the price of Bitcoin, although a few days later, the Galaxy news fell nearly 4% in a short time and fell below the $115,000 mark at one point, but the price quickly recovered to about $117,300 within a few hours.

Analyst Jason Williams pointed out that this massive sell-off has been "completely absorbed" by the market, and another analyst, Joe Consorti, also lamented that "80,000 bitcoins (more than $9 billion) were sold at market price, while the BTC price was almost unchanged." On the one hand, this once again tests the OTC depth of the current market, where a competitor can undertake such a large number of sell orders in a short period of time after exchange matching, and on the other hand, it also reflects the importance of "dark pool trading" in today's cryptocurrency space.

ETH coin stock company preference

In Q2 2025, there were multiple unusually large buy orders on the Ethereum chain, causing the community to pay close attention. Since July 9, 14 new wallet addresses have bought a staggering 856,554 ETH, worth about $3.16 billion, through OTC channels such as Galaxy Digital or FalconX.

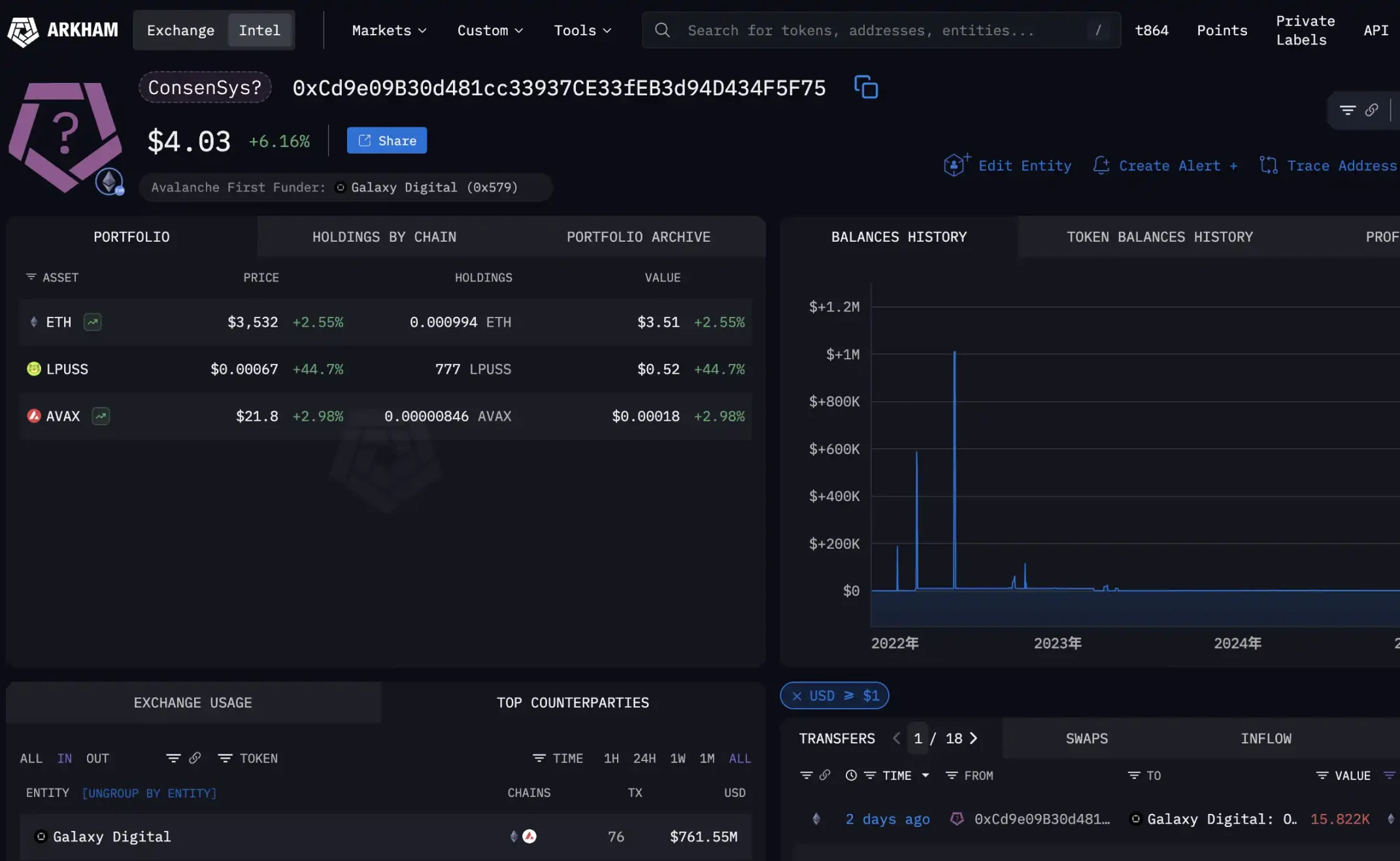

On-chain analytics firm Arkham Intelligence noted that starting in late July, a newly created wallet address (0xdf0A... 2EF3) has accumulated about $300 million worth of ETH through Galaxy Digital's OTC seats in just 3 days. The address once held 79,461 ETH at a cost of about $300 million, and based on its market capitalization of about $282.5 million at the time, it once lost about $26 million (about 8.7% of the drawdown). This shows that the whale's average buying price is relatively high, but it is still firmly increasing its position.

And today, August 5 alone, three new addresses have obtained a total of 63,837 ETH through Galaxy and FalconX, worth about $236 million. EyeOnChain has publicized some of these buyer addresses, including 0x55CF... 679、0x8C6b… 60、0x86F9… 446 et se. It is estimated that the cumulative buying power of these addresses has reached tens of millions to hundreds of millions of dollars, and a single wallet once held more than 110,000 ETH (with a market capitalization of more than $400 million).

Who exactly is this buying from? There are signs pointing to SharpLink Gaming, which has made high-profile claims since June 2025 to continue to increase its holdings of Ethereum as a major treasury asset, following the MicroStrategy strategy. According to its announcement and on-chain data, SharpLink frantically swept nearly 500,000 ETH through ATM financing and over-the-counter transactions from June to the end of July, and as of July 27, the company held 438,190 ETH, a surge of 21% from a week ago, and purchased more than 77,000 ETH in a single week, with an average weekly price of about $3,756.

As of the end of July, SharpLink had purchased a total of about 449,000 ETH, and in August, the company continued to hoard the dip, spending another $43.09 million to buy 11,259 ETH on July 31, and another 18,680 ETH from Galaxy on August 4. Some analysts say that SharpLink's total holdings have exceeded 499,000 ETH, with an average cost of about $3,064, and a current market capitalization of about $1.8 billion and a floating profit of about $275 million. Such a large-scale Ethereum buying order is almost entirely completed through OTC counters such as Galaxy and FalconX, and even the founder of Wintermute joked, "It's almost impossible to buy ETH on our OTC platform now, because whales have already swept away the supply. In addition to SharpLink, which is currently the second largest ETH holder, Bitmine, the current largest ETH holder, is also an in-depth partner of Galaxy.

The associated address 0xCd9 has now transferred over $800 million in ETH to SharpLink. $153 million in ETH 0xdf0, 0x286 about $300 million, and other addresses are associated with the two.

Although we can't figure out where such dense large OTC positions come from, in any case, this undercurrent is becoming a key force affecting the supply and demand of ETH. BlockBeats has roughly calculated that OTC transactions in ETH over the past 90 days have reached $5.444 billion, with an average monthly processing of about $1.8 billion in ETH.

According to the four OTC wallets disclosed by Arkham, 0x335, 0x15, 0x46f, 0xb9c four wallets

As a referee and a contestant, MicroStrategy's drama is staged on BNB Chain

If the protagonists of 2024 are BTC and ETH, then starting in the second half of 2025, BNB will also enter the stage of institutional layout. In July, an unexpected news broke: CEA Industries (ticker VAPE, a company originally specializing in agricultural temperature control and e-cigarettes), listed on the Nasdaq, announced that it would completely transform into a "BNB treasury company" and plan to raise up to $1.25 billion to purchase BNB through private financing and exercise, a plan that caused the vape stock price to soar 550% in a single day.

What's even more striking is that the author of the vape crypto pivot is none other than David Namdar, co-founder of Galaxy Digital. He will serve as VAPE's new CEO, with Russell Read, another partner from 10X Capital and former chief investment officer of the California Public Employees Retirement System (CalPERS), serving as CIO. Namdar said it will use this funding of up to $500 million (up to $1.25 billion) to actively build BNB positions over the next 24 months, including open market purchases, strategic trading, and yield through staking and decentralized finance.

This means that BNB will welcome its first institutional buyers in a large open market, and OTC channels will undoubtedly play a key role in this. Due to the high concentration of BNB issuance and circulation, Binance and its founder Changpeng Zhao CZ reportedly control 71% of the circulating BNB, and to absorb hundreds of millions of dollars of BNB without causing sharp market volatility, they can only resort to over-the-counter block transactions or protocol transfers. Galaxy Digital's rich OTC network and liquidity resources will provide strong support for Namdar's "BNB MicroStrategy Action". As the world's third-largest crypto asset by market capitalization, BNB's move marks its official entry into institutional asset allocation vision.

Whether it is Coinbase's main custody, trading, and on-chain ecological integrated trading platform, or the matching of currency-stock relationships such as Galaxy Digital for consulting + OTC trading, or the rapid integration of traditional brokerages and trading platforms, various industries in the cryptocurrency field have begun to move towards compliance and the transfer of resources to the head aggregation. The recent launch of the Crypto Project may be a manifestation of this significant trend, as the era of hegemony of compliance agencies is approaching, and the OTC platform of cryptocurrencies, the "transparent dark pool", may occupy a more important ecological niche in the future.