Pi Coin Price Prediction: Weak Rebound, No Volume – Is Pi Coin Going to Zero?

Pi (PI) has experienced one of the most dramatic drops among cryptos valued at over $1 billion as its year-to-date losses climbed to 80% recently. Combined with a strong decline in trading volumes, this favors a bearish Pi Coin price prediction.

PI is, by far, the worst-performing asset of the top 40 cryptos in the past 30 days with a 26% loss, while other tokens with similar market caps like Mantle (MNT) and Ondo (ONDO) have delivered gains of 53% and 16% respectively.

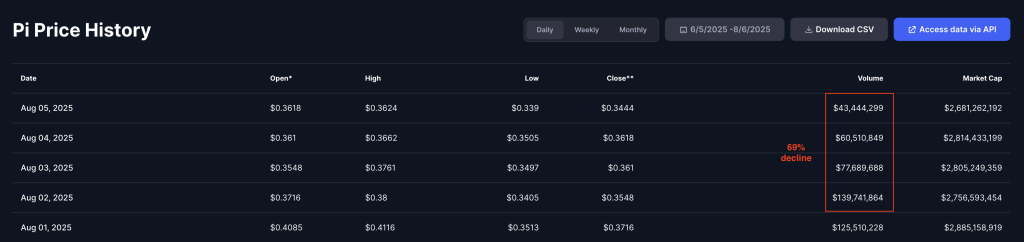

Data from CoinMarketCap shows that trading volumes for Pi have declined severely, moving from a recent peak of $140 million on August 2 to just $43 million yesterday. This 70% drop in trading activity occurred as Pi made a new all-time low of $0.335.

Pi’s negative momentum has accelerated lately at a point when most cryptos are rallying. This antagonist performance is the result of disappointing ecosystem growth initiatives that have led to a disgruntled community.

Delays in token migrations to the public mainnet and failing to secure top CEX listings by the Pi Core Team have undermined the project’s credibility and favor a bearish Pi Coin prediction.

Pi Coin Price Prediction: PI Seems Poised to Retest Its All-Time Low as Willing Buyers are AWOL

The 4-hour chart shows that PI broke below a key trend line support on August 1 with some strong volumes.

During that specific 4-hour period, the price made an all-time low of $0.3220. Although it rapidly bounced off that level, it has been progressively moving toward that area again and could soon retest it.

In the absence of good news, little seems to stand in the way of PI to hit that all-time low again. The Relative Strength Index (RSI) has flat-lined just above the 30 threshold, meaning that negative momentum is at a high point.

Even if the price bounces off $0.3220, low trading volumes indicate little to no interest from buyers to buy the token at these levels. Hence, the price may need to move even lower to find willing buyers.

Only an unexpected listing at a big CEX could save PI from collapsing to $0.10 or even lower at this point.

PI failed to capitalize on the latest wave of positive momentum that cryptos have experienced, but top crypto presales like Bitcoin Hyper (HYPER) have done the opposite. In just a month or so, this project has raised more than $7 million to launch its ambitious Bitcoin L2 chain.

Bitcoin Hyper (HYPER) Could Kickstart a New Era for BTC’s DeFi Ecosystem

Bitcoin Hyper (HYPER) is a Solana-based layer-2 chain that will allow BTC holders to earn passive income on their assets by bridging the two networks.

The Hyper Bridge will act as the gateway to a growing DeFi ecosystem powered by the Bitcoin Hyper L2. A canonical Bitcoin address will be designated to receive BTC tokens so users don’t have to transfer their assets out of this network.

Once the origin transaction is confirmed, the corresponding amount of tokens will be minted on the Hyper L2 with near-instant finality.

As top wallets and exchanges embrace this protocol, the demand for its utility token, $HYPER, will skyrocket.

To buy $HYPER at its discounted presale price and reap the highest returns, head to the Bitcoin Hyper website and connect your wallet (e.g. Best Wallet). You can either swap USDT, SOL, or ETH for this token or use a bank card to invest.

Click Here to Participate in the Presale