Lazy Money Management Strategy|Focus on Berachain, Raise Reslov Airdrop Expectations (March 31)

Original | Odaily (@OdailyChina)

Author|Azuma(@azuma_eth)

column aims to cover the current market with stablecoins (and their derivative tokens) as the main focus of low-risk return strategies (Odaily note: systemic risk can never be ruled out) to help those who wish to pass through U Users who gradually enlarge the amount of funds to find more ideal interest-earning opportunities.

The pace of change in the wealth management market is slower than that of the trading market. In the past few issues, we have basically covered mainstream income markets such as Pendle and Fluid, as well as "dual mining" opportunities such as Sonic, Ethreal, Level, Meteora, Vest, Perena, BackPack, and Echelon.

For the sake of avoiding resonance, we will focus on the latest developments in the wealth management market over the past week.

Previous records

oflazy financial management strategy: BlackRock investment projects have been excavated, and 15% annualized can be obtained at the same time (March 17);

Lazy Money Management Strategy: Ethena and Perena Launched a New Season, and the Stablecoin Track Appeared as a Dark Horse (March 24);

New Opportunity

Berachain Flywheel LaunchLast

Monday, Berachain officially launched the Proof of Liquidity (PoL) mechanism, which means that this Layer 1 with its own Ponzi mechanism has officially turned.

-

Odaily Note: For more information on the specific mechanism of PoL, please refer to "Berachain PoL Mechanism in Detail: A More Radical Bribery Model than Curve".

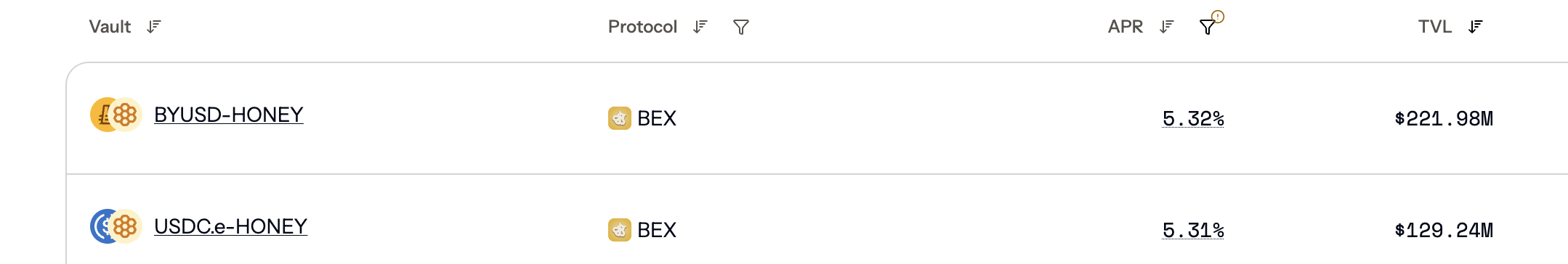

At the beginning of the PoL launch, the APR of BYUSD/HONEY and USDC.e/HONEY, the two main stablecoin pools, once exceeded 20%, but with the expansion of the pool size and the decline of BERA with the broader market, the APR has now shrunk significantly to about 4%.

However, with the help of Infrared, a PoL liquid staking protocol based on the Berachain ecosystem, this APR figure can rise to about 5.3% (because iBGT has a certain premium over BERA), while maintaining long-term interaction with Infrared - Although the APR number is not ideal, I personally recommend mining this mine, because Infrared is likely to be the most imaginative project in the entire Berachain ecosystem by market capitalization, and the potential airdrop is expected.

-

Odaily Note: For details, please refer to "Raising Over $18.75 Million, How to Rake Berachain's Only Leading Infrared".

In addition, since the LP APY of iBGT and iBERA on Pendle is relatively high (132% and 299% for the base, and up to 322% and 543% for full PENDLE staking), the hedging strategy of "spot mining, contract shorting" can also be adoptedAt present, the annualized cost of short BERA on Binance is about 50%, and the yield is enough to cover the cost of the fee, while also maintaining the interaction with Infrared - iBGT has a premium and is relatively uncontrollable, so it is recommended to use iBERA to operate.

addition to these relatively mainstream pools, there are also many small pools with an annualized rate of more than 100% or even 1000% on Berachain (such as USDbr, a start-up stable project), and the others are not listed here (you can view them on the Infrared homepage), you can participate as appropriate based on your own risk appetite.

Reslov's Blueprint

Last Tuesday, IvanKo, the founder of stablecoin project Reslov, posted a lengthy article outlining the two biggest issues facing the current booming "interest-bearing stablecoin" – scalability and risk.

Scalability refers to the fact that the on-chain income space will be rapidly compressed with the expansion of asset scale, even if it is the futures and spot arbitrage market that Ethena (USDe) relies on, the actual actual capacity under the BTC + ETH + SOL hedging strategy is about 20 billion US dollars, so it is necessary to explore all ways to earn interest, including but not limited to spot arbitrage, MEV, high-frequency trading (HFT), etc.

Risk refers to the fact that the more path to return, the more potential risk points will become, so risk isolation should be done - Resolv's current solution is to walk on two legs: USR and RLP, RLP insures USR against unexpected situations, and earns higher returns while taking risks.

Including Ethena, Level, and Reslov, interest-bearing stablecoins are increasingly seen by the market as the biggest opportunity to disrupt the stablecoin landscape (see "The Four Upcoming TGE Yielding Stablecoin Protocols, Who Will Define the New Paradigm of DeFi?"). But few people mention the upper limit of on-chain revenue space, but it is true that the sooner projects within the track are aware of this, the better. On the whole, Resolv's thinking is quite clear, and I personally tend to raise the airdrop expectations for the project.

Resolv's points program has been open for a long time, but there are still many ways to speed up the score accumulation, and you can make up for it before TGE. For example, the four pools in Pendle in the diagram below can provide a minimum of 25x and a maximum of 45x credit rate bonus.