How far are we from a full-blown copycat season?

Written by: KKK, Rhythm

OnAugust 12, Ethereum broke through $4,700 in one fell swoop, hitting a four-year high, and @CryptoHayes, which took profits early last week, also bought back Ethereum on August 9. Bitcoin also reached a new high, with the total cryptocurrency market capitalization soaring to $4.2 trillion, and market sentiment was completely ignited.

Traditional markets are also in full swing. The S&P 500 and Nasdaq 100 both set new historical records, and global liquidity accelerated to risk assets; The US Dollar Index (DXY) fell below 98, opening the floodgates for capital inflows into the stock market and crypto market. Such a macro environment not only consolidates the upward trend, but also makes investors' confidence in high-risk assets rise.

At the same time, the market is almost certain that the Fed will cut interest rates at the September 17 meeting with a probability close to 100% and bring the benchmark interest rate to a range of 4.00%-4.25%. This anticipation provides additional fuel for markets that rely on high liquidity, particularly cryptocurrencies. Nowadays, the wealth effect of the copycat season has become the focus of heated discussions in the market, and the key is when it will be fully launched.

Next, BlockBeats has compiled traders' views on the upcoming market situation and provided some directional references for everyone's trading this week.

@b66ny

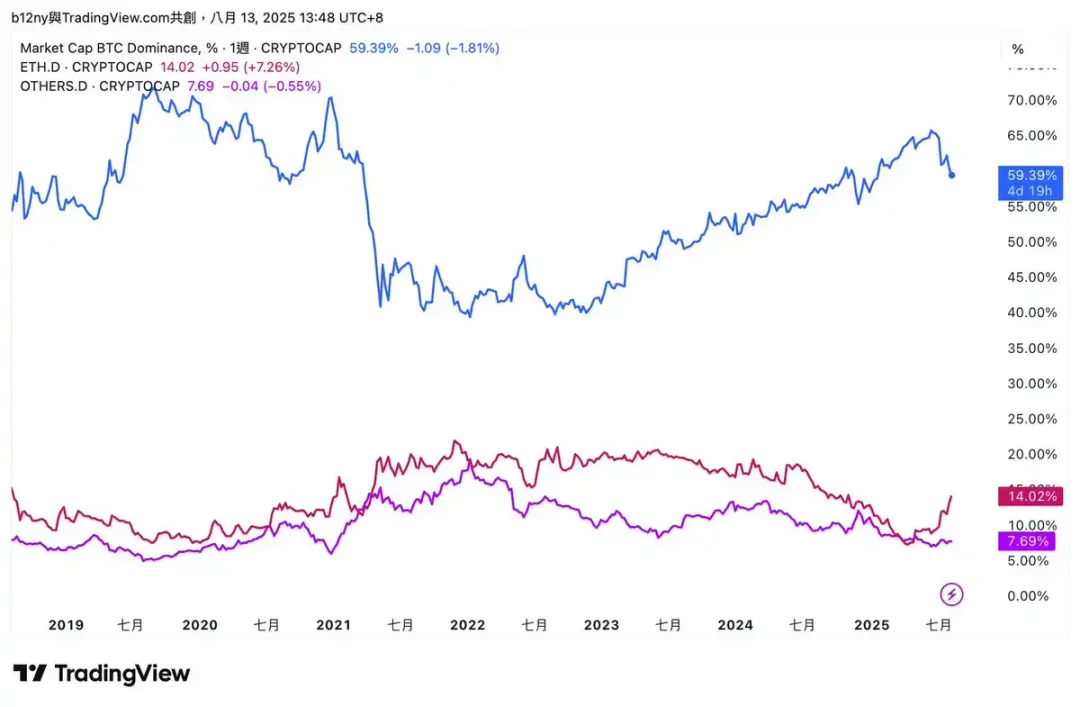

BTC. D has recently shown a clear downward trend, having fallen back from its previous high to about 57.7%. Combined with ETH. D's trend, I think this is a typical capital rotation signal: market funds begin to withdraw from relatively stable assets and pursue higher risk and higher potential returns. Looking back at history, BTC. The continuous decline of D is often one of the necessary conditions for the start of the altcoin season.

ETH. D not only represents the strength of Ethereum itself, but is more often seen as the leader of the entire altcoin market. Currently, ETH. D performed strongly, with its dominance rate rebounding to 14.0%, and with the rapid rise in ETH prices, ETH/BTC rose by more than 4% in 24 hours, showing a clear trend of funds flowing from Bitcoin to Ethereum.

This trend is a classic script for capital rotation: in the first stage, BTC stagnated or even fell, and funds began to flow into ETH; ETH's rise not only boosts market confidence but also creates conditions for more liquidity to be injected into the altcoin market.

Next up to watch is OTHERS. D (Proportion of market capitalization of small and medium-sized altcoins except for top currencies such as BTC and ETH). Currently OTHERS. D is still trading sideways at the bottom for a long time, and there is no ETH-like pattern. D's explosive growth means that the popularity of funds is still concentrated in a few leading assets such as ETH. Although SOL has also risen significantly today, and the signs of capital rotation are clearer, it has not yet fully spread to high-risk, small-cap speculative sectors.

Judging from the three major indicators, the market is likely to be in the early stages of rotation:

it has occurred: BTC.D is down, funds are spilling.

Happening: ETH.D rises, and funds pour into ETH.

Not happening yet: OTHERS.D rises, funds spread to small-cap altcoins.

@im_BrokeDoomer

Looking at the altcoin versus Bitcoin market cap from 2017 to date, we are currently at a critical support position at the lower edge of the channel. This position has always been a sensitive area for capital entry, often accompanied by the recovery of market sentiment and the acceleration of rotation. If this support is confirmed, the altcoin sector is expected to usher in a collective explosion, marking the official launch of a new round of altcoin season.

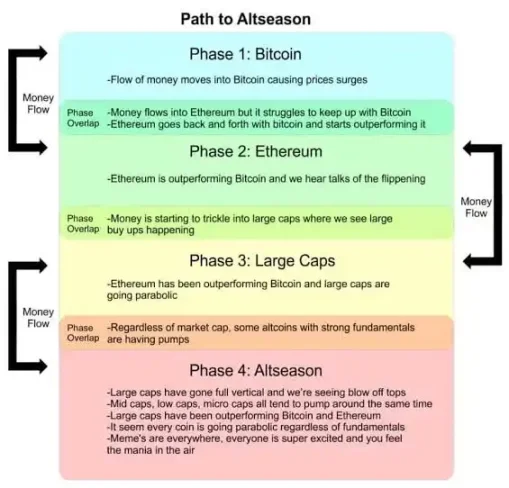

The launch process of the altcoin season is generally as follows: Bitcoin (BTC) started the market→ Ethereum (ETH) followed the rise→ BTC made another effort→ ETH broke through its all-time high (ATH)→ large-cap altcoins rose→ BTC hit new highs→ ETH and large-cap altcoins hit new highs→ Medium-cap altcoins took off→ Small-cap altcoins fully exploded

Currently, we are in the third stage, ETH and large-cap altcoins hit new highs, and the subsequent outbreak of other altcoins can be expected.

@ZssBecker

In the last 2020 bull run, the narrative of most altcoins didn't explode at the beginning, but waited until ETH price broke its all-time high and rose 3x before it was fully launched. At that time, funds flooded into new narratives - such as the gaming sector - driving related tokens to soar by 10, 20, or even 50 times, and at one point the sandbox soared 80 times, and even the holiest and most marginal game projects could achieve a dozenfold increase. This phenomenon does not really occur until the middle and late stages of the bull market, but once it starts, it becomes a period of concentrated explosion of the wealth effect.

I think this scene will be repeated in this round of market. We are still in the first stage of the altcoin season - the dominant period of BTC and ETH. It will take for ETH to break above $5,000 and mainstream altcoins to complete a 2-3x increase before market funds will frantically look for the next narrative. The most likely to take over will be AI, RWA, and gaming, three fields that have been efficiently entered and profitable by the crypto industry in reality, with strong narratives and high potential returns.

The launch of the last round of game narrative has turned countless people from thousands of dollars in principal to millions of dollars in assets; This time, the market capital scale is larger and the risk appetite is higher, and once it is launched, the capital push will only be more violent. For investors, the key is not to chase anxiously now, but to wait patiently and lay out in advance. When the narrative switch signal appears, the climax of the copycat season will really arrive.

@lanhubiji

understand the market structure, you will understand that the altcoin season will definitely come, but the pattern may be completely different from the last two rounds. Previously, the number of altcoins was limited, funds were relatively concentrated, and almost all leading sectors would usher in a general rise; Now there are millions of currencies on the market, and the competition is extremely scattered, and it is impossible for funds to cover all targets.

This means that this round of the market is more likely to be a "local copycat season" - funds will be concentrated in a few sectors or individual tokens with strong narratives, strong communities and strong liquidity to form a local carnival, while most coins will still be ignored by the market. For investors, opportunities still exist, but the probability of winning the target is much lower than in the past, and they are more optimistic about the AI track now.

@joao_wedson

real copycat season is far from beginning. The flow path of smart funds is usually from BTC to ETH, then into the top large-cap coins, and finally to small and medium-sized market capitalization tokens. The current market has just entered the first half, and the real "copycat carnival" is still on the way, and it may continue all the way to November. In other words, the rise we see now is only an "appetizer", and the real "main course" has not yet been served.